Kevin Crowley and David Wethe

Mon, July 24, 2023

(Bloomberg) -- Chevron Corp.’s board is waiving the mandatory retirement age for Chief Executive Officer Mike Wirth, giving the company more time to find a successor as it notches record production from the world’s most prolific shale basin.

The oil giant, which typically requires CEOs to step down at age 65, made the announcement Sunday as Chevron posted better-than-expected earnings driven by surging output from the Permian Basin of West Texas and New Mexico. Though Wirth turns 63 later this year, he’ll now be able to stay at the company beyond 2025.

As Chevron’s top boss for the past five years, Wirth has overseen its push into shale production and helped the company narrow its valuation gap with rival Exxon Mobil Corp. While Chevron’s earnings have declined from an all-time high last year, its net income is still more than double the average from 2015 to 2019.

The man who joined Chevron as a design engineer in 1982 plans to grow its Permian output to more than 1 million barrels a day by the middle of this decade and hold it steady through at least 2040. While its recent acquisition of PDC Energy Inc. will allow Chevron to expand in Colorado, Wirth rejected the suggestion that the Permian has become too expensive.

“The Permian is a tremendous asset for our company and for our country,” Wirth said Monday on CNBC. “It is the best place for us to be investing our dollars. It’s the largest single destination for investment.”

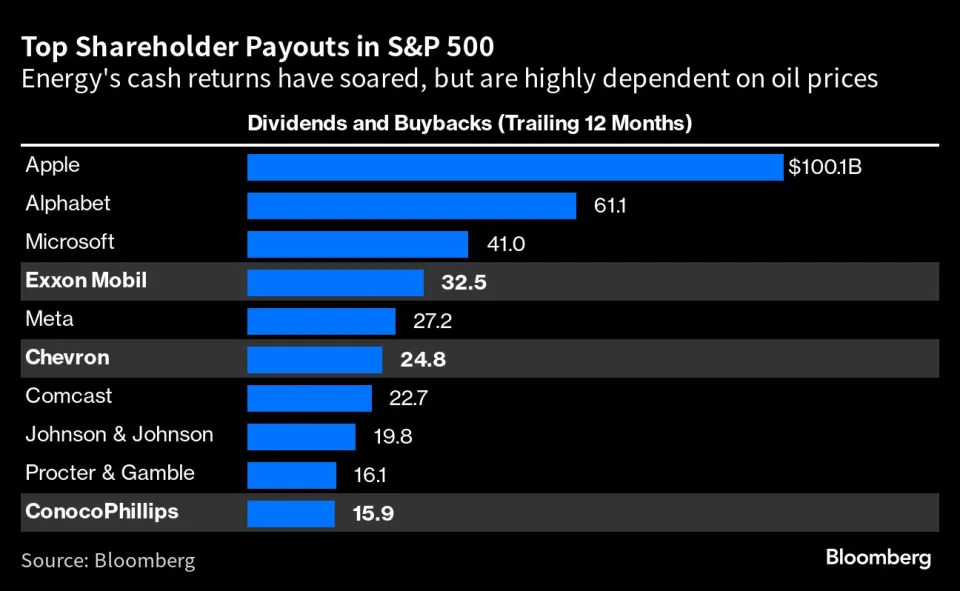

Chevron’s second-quarter earnings, originally set to be posted July 28, come as the company heads for record shareholder returns this year. Other management changes in the surprise announcement included the retirement next year of Chief Financial Officer Pierre Breber.

Chevron shares rose 2.2% to $162.14 at 10:40 a.m. in New York.

Though adjusted earnings of $3.08 per share were higher than the Bloomberg consensus, net income dropped to $6 billion, according to a statement Sunday. It’s the fourth straight quarter of lower results for Chevron, which have fallen to almost half the level of a year earlier when oil prices surged after Russia invaded Ukraine.

Chevron maintained its elevated share buyback despite lower commodity prices. At a rate of $17.5 billion a year, Chevron’s buyback — which it’s boosted several times over the past 18 months — is equal to that of Exxon Mobil Corp., which has a 40% bigger market value.

Still, Chevron stock has languished this year, down 12% through Friday compared with a 4% decline in the S&P 500 Energy Index. Wirth has struggled to persuade investors that Chevron has enough fossil-fuel projects in its locker to maintain targeted annual production growth rates of about 3%. Further, the company was forced to redraw its drilling plan in the Permian Basin earlier this year as wells under-performed expectations. By contrast, rival Exxon has a plethora of growth opportunities.

Wirth attempted to ease some of these concerns by agreeing to buy Colorado-based PDC for $6.3 billion in stock in May. The goal is to expand Chevron’s operations in the DJ Basin, which Wirth believes can offer high returns with low risk.

Breber, who was 58 as of February, will retire March 1, 2024, and be succeeded as CFO by Eimear Bonner, 49, currently the vice president and chief technology officer, the company said.

In an interview with Bloomberg News on Sunday, With said the board asked him to stay during a “turbulent time” in the markets. There’s “more that I want to do,” he said, adding that he’s “excited to continue.”

Chevron produced the equivalent of 772,000 barrels of oil per day in the Permian, it said Sunday, registering a new quarterly record for the company in the world’s busiest shale patch.

Most Read from Bloomberg Businessweek

No comments:

Post a Comment