The wind energy industry is struggling

Jeronimo Gonzalez

Thu, July 27, 2023

The News

The wind energy sector has been blighted by rising financing and materials costs, fierce competition, and expensive technical problems that have led to heavy losses despite demand for energy soaring. Plummeting prices for other forms of renewable energy have also piled on to the industry’s problems.

We’ve gathered reporting and analysis on why the industry is struggling and where it’s succeeding.

Insights

Soaring temperatures across Europe and the continent’s efforts to wean its economies from dependance on Russian oil and gas have underscored the need for wind energy. However the combination of plummeting prices for renewable energy coupled with soaring costs on debt have made large offshore wind projects inviable. “This means that price of renewable energy regrettably must come up temporarily after years of steep decline,” the head of Danish energy giant Ørsted said.

Wind turbine producers have struggled with rising steel prices, inflation, and low quality production. Shares of Siemens Energy plunged by close to 30% last month after the company announced technical faults in its turbine business, affecting some of the world’s biggest wind developers. “Turbine prices fell sharply in 2017, which was then followed by the industry introducing new technology and turning to emerging markets for suppliers to keep costs down,” an analyst at JPMorgan said. “Some of the quality and design issues in the industry now are the result of that.”

Earlier this year, the White House announced plans to deploy 30 gigawatts of offshore wind energy capacity by 2030, enough to power roughly 10 millions homes. Reaching the goal will be a tough task: As of July, there are just two operational wind projects in the U.S. which combined produce 0.14% of the government’s 2030 goal. Earlier this month, two major projects were scrapped because of a lack of bids and cost issues. Developers “look at projects and the agreed upon price and are not seeing a path to profitability,” an expert at the Centre for Strategic and International Studies said.

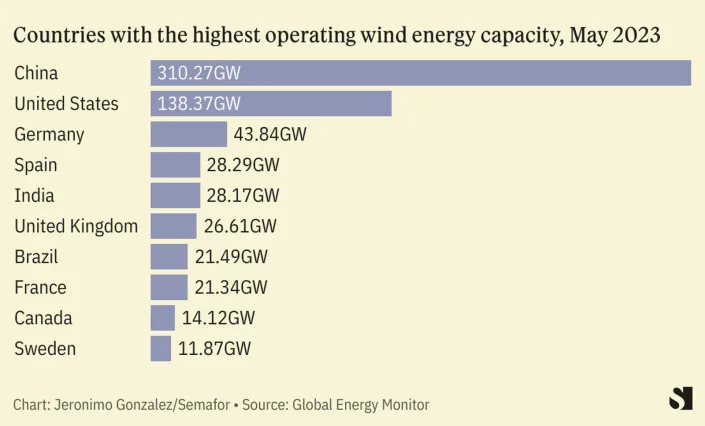

Meanwhile, China’s wind industry is buoyant. The country’s total wind capacity — both onshore and offshore — now surpasses 310 gigawatts, double its 2017 level and roughly equivalent to the next seven highest producing countries combined. Its capacity is set to double again before 2025 as it seeks to add another 371 GW by then. “This new data provides unrivalled granularity about China’s jaw-dropping surge” in wind capacity, Dorothy Mei, a project manager at Global Energy Monitor said, referring to data published last month.

Vattenfall Stops UK Offshore Wind Project Citing Costs and Lower Profits

Vattenfall has become the latest developer of wind farms to report that rising costs are undermining the economics of offshore projects. The Swedish energy company announced that it has decided to shelve a late-stage development project in the UK saying the market for offshore wind power is “challenging.” The company’s decision also raised broader concerns for the UK’s offshore wind energy sector which is a key component of the government’s future energy plans.

“We have decided to stop the development of Norfolk Boreas in its current form,” Vattenfall President and CEO Anna Borg announced in the company’s mid-year financial report. “We will examine the best way forward for the entire Norfolk Zone, which in addition to Boreas also includes Vanguard East and West.”

The project was planned for an area about 30 miles off the south east coast of Britain. Boreas was to have an installed capacity of 1.4 GW and was due to deliver its first power in 2027. The zone with the three wind farms was to consist of between 180 and 312 turbines with a total capacity of 3.6 GW.

“Higher inflation and capital costs are affecting the entire energy sector, but the geopolitical

situation has made offshore wind and its supply chain particularly vulnerable,” Borg said in explaining the decision to suspend the development project. She told investors that the company has seen cost increases of up to 40 percent, saying that this affects the future profitability of the project. They are citing soaring material and project costs along with the impact of inflation and interest rates on the projects’ economics.

The company, which has grown its wind portfolio in the past year from 4.2 GW to 5.6 GW, said it is still convinced that offshore wind power is “crucial for energy security.” Nonetheless, based on the changing economics, they are recording a more than $500 million impairment charge against earnings to stop the development of these UK projects.

Vattenfall had previously said the Boreas project and its advancement was “great news” for the UK. They received planning consent for the project in December 2021 and won Contracts for Difference a year ago. The company reported the contract provided for a 15-year fixed revenue stream with Reuters estimating the guaranteed minimum price at nearly $58 per MW hour. The company signed grid contracts with Siemens Energy and Aker Solutions last October and was expected to make a final investment decision later this year for Boreas.

The decision to suspend the development is raising broader questions about the UK’s industry. The government has highlighted that it plans to have 50 GW of offshore wind energy as part of its energy plan. The UK currently has around 14 GW of installed capacity. The Boreas project was seen as among the most advanced of the UK’s future projects.

Addressing investors, Borg said that they now believe that the UK does not currently have the investment environment needed to meet its offshore wind targets. The company hopes that the contract prices might improve to make it possible to go forward with projects. They said the incentives currently available no longer reflect market conditions while noting that other developers including Ørsted have also called for target support of the industry.

No comments:

Post a Comment