Vince Golle and Molly Smith

Sat, August 26, 2023

(Bloomberg) -- The contraction in euro area business activity deepened this month, most notably in Germany where the decline was the steepest since the pandemic brought the economy to a screeching halt in May 2020.

France reported a third monthly drop in output, while the rest of the region contracted more moderately, according to a survey of purchasing managers. Sweden’s economic prospects dimmed, while a decline in UK retail sales underscored greater consumer caution.

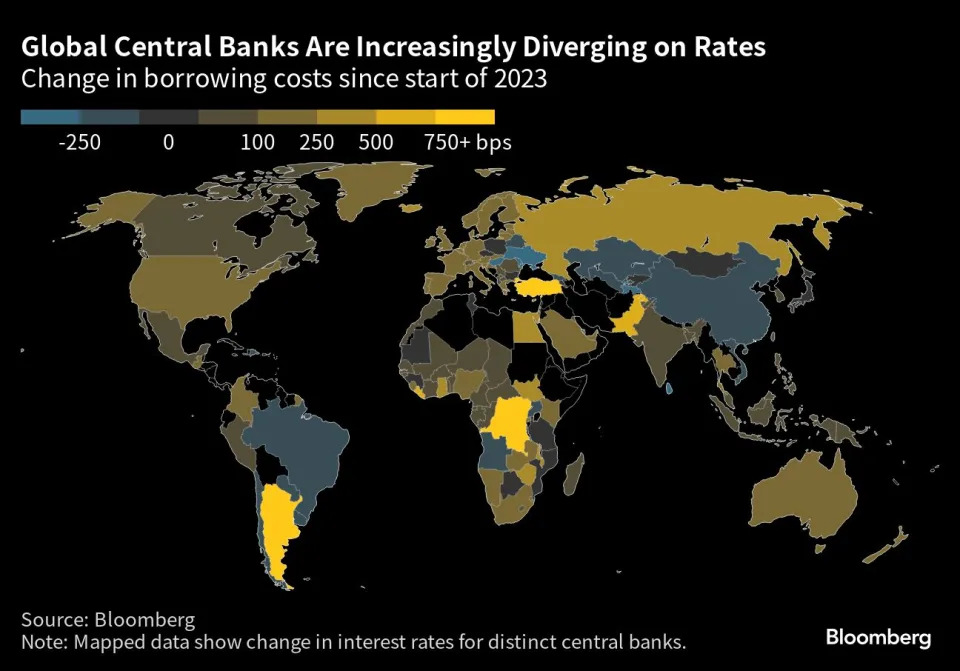

In Turkey, central bankers, including newly appointed officials led by Governor Hafize Gaye Erkan, surprised markets with the steepest interest-rate increase since 2018. The move sparked a rally in Turkish lira and banking shares.

Here are some of the charts that appeared on Bloomberg this week on the latest developments in the global economy:

Europe

The contraction of private-sector activity in the euro area intensified, leading investors to bet that the European Central Bank will pause its campaign of interest-rate hikes next month. Services in August ceased being a bright spot and followed the industrial sector into a downturn in the region’s top two economies.

Sweden’s government shrugged off the potential for a contraction next year, while projecting meager growth for the economy as consumers remain under pressure from higher costs.

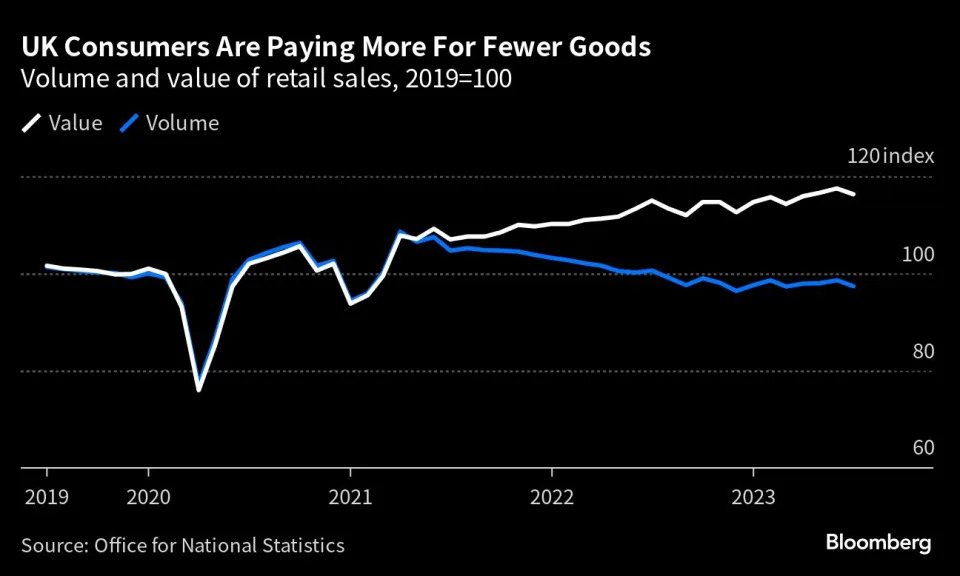

UK retail sales fell more than expected in July after a spell of cool and rainy weather kept people out of shops at a moment consumers are becoming more cautious with spending.

Record pay raises and the slide in property prices caused the biggest improvement in UK housing affordability in more than a decade, a glimmer of hope for young buyers who have been priced out by stretched valuations.

US

US mortgage applications for home purchases slid last week to an almost three-decade low, indicating residential real estate is reeling from the recent spike in borrowing costs. The contract rate on a 30-year fixed mortgage increased 15 basis points to 7.31% in the week ended Aug. 18 — the highest since late 2000.

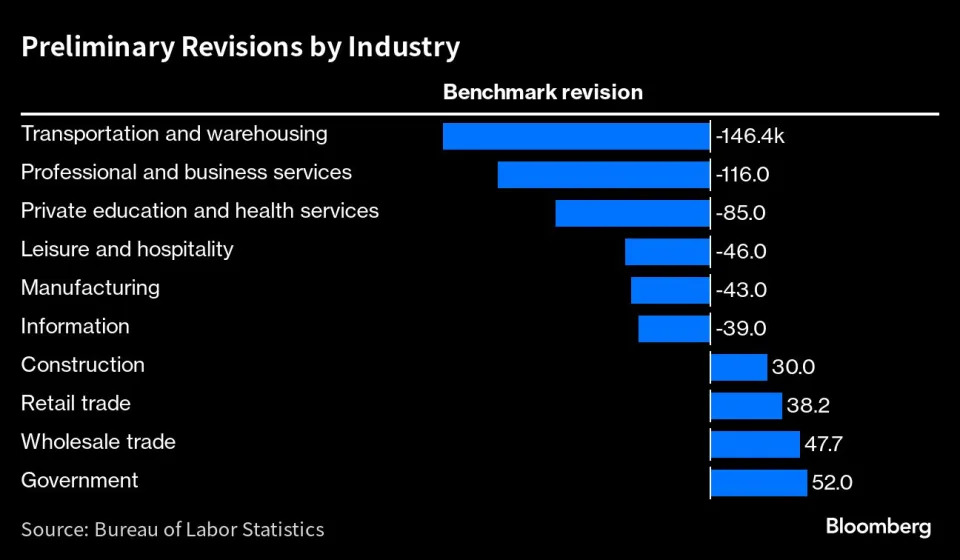

US job growth was probably less robust in the year through March than previously reported. While the government’s preliminary estimate suggests that strength was somewhat overstated, it doesn’t fundamentally alter the picture of a resilient and robust labor market that’s gradually cooling.

American politicians are keener than ever to juice the economy with government cash, a shift that’s already helping to drive up borrowing costs and looks likely to keep them high long after the inflation emergency is over. The outlook for the federal budget right now is essentially unprecedented—crisis-size deficits as far as the eye can see. That prospect is making investors uneasy.

Asia

South Korea’s early exports kept declining in August in the latest sign of lackluster global trade weighing on economic growth. Daily shipments decreased 10.7% on average in the first 20 days of the month compared with a year earlier.

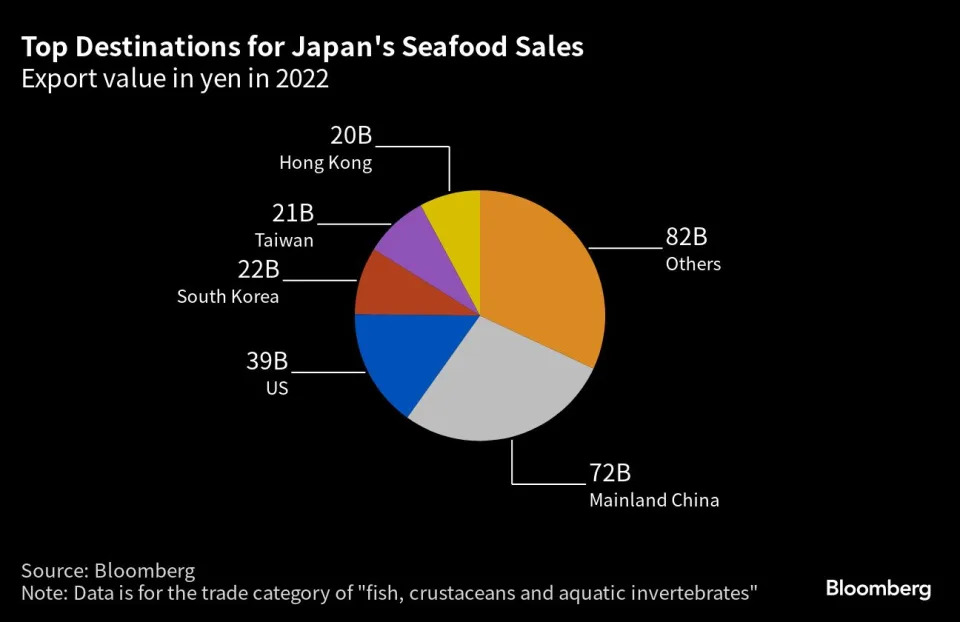

China will stop all seafood imports from Japan, escalating tensions between the two nations as Japan begins a contentious release of treated wastewater from the wrecked Fukushima nuclear power plant.

Emerging Markets

Turkey’s central bank’s jumbo interest-rate increase triggered a major rally in the country’s assets on hopes that it augurs the unwinding of policies that have sent foreign investors fleeing the $900 billion economy. The Turkish lira, long one of the world’s worst-performing currencies, surged the most in almost two years following the Thursday announcement.

World

One of the world’s most potent symbols of global trade — the Panama Canal — is falling victim to climate change as shrinking water levels force ships to part-load in order to navigate the vital waterway. If lower container loads continue, there is a chance that business will suffer delays in restocking inventories ahead of Christmas, according to Container xChange, a container logistics platform.

Iceland’s central bank raised western Europe’s highest interest rate by more than expected. Officials in Turkey boosted rates far more than expected, while Zambia also hiked. Korea, Sri Lanka and Indonesia held rates unchanged.

--With assistance from Beril Akman, Christopher Condon, Eamon Akil Farhat, Sam Kim, Alex Longley, James Mayger, Liz Capo McCormick, Colum Murphy, Reade Pickert, Tom Rees, Niclas Rolander, Augusta Saraiva, Zoe Schneeweiss, Alex Tanzi, Naomi Tajitsu, Erik Wasson, Alexander Weber and Lucy White.

Sat, August 26, 2023

(Bloomberg) -- The contraction in euro area business activity deepened this month, most notably in Germany where the decline was the steepest since the pandemic brought the economy to a screeching halt in May 2020.

France reported a third monthly drop in output, while the rest of the region contracted more moderately, according to a survey of purchasing managers. Sweden’s economic prospects dimmed, while a decline in UK retail sales underscored greater consumer caution.

In Turkey, central bankers, including newly appointed officials led by Governor Hafize Gaye Erkan, surprised markets with the steepest interest-rate increase since 2018. The move sparked a rally in Turkish lira and banking shares.

Here are some of the charts that appeared on Bloomberg this week on the latest developments in the global economy:

Europe

The contraction of private-sector activity in the euro area intensified, leading investors to bet that the European Central Bank will pause its campaign of interest-rate hikes next month. Services in August ceased being a bright spot and followed the industrial sector into a downturn in the region’s top two economies.

Sweden’s government shrugged off the potential for a contraction next year, while projecting meager growth for the economy as consumers remain under pressure from higher costs.

UK retail sales fell more than expected in July after a spell of cool and rainy weather kept people out of shops at a moment consumers are becoming more cautious with spending.

Record pay raises and the slide in property prices caused the biggest improvement in UK housing affordability in more than a decade, a glimmer of hope for young buyers who have been priced out by stretched valuations.

US

US mortgage applications for home purchases slid last week to an almost three-decade low, indicating residential real estate is reeling from the recent spike in borrowing costs. The contract rate on a 30-year fixed mortgage increased 15 basis points to 7.31% in the week ended Aug. 18 — the highest since late 2000.

US job growth was probably less robust in the year through March than previously reported. While the government’s preliminary estimate suggests that strength was somewhat overstated, it doesn’t fundamentally alter the picture of a resilient and robust labor market that’s gradually cooling.

American politicians are keener than ever to juice the economy with government cash, a shift that’s already helping to drive up borrowing costs and looks likely to keep them high long after the inflation emergency is over. The outlook for the federal budget right now is essentially unprecedented—crisis-size deficits as far as the eye can see. That prospect is making investors uneasy.

Asia

South Korea’s early exports kept declining in August in the latest sign of lackluster global trade weighing on economic growth. Daily shipments decreased 10.7% on average in the first 20 days of the month compared with a year earlier.

China will stop all seafood imports from Japan, escalating tensions between the two nations as Japan begins a contentious release of treated wastewater from the wrecked Fukushima nuclear power plant.

Emerging Markets

Turkey’s central bank’s jumbo interest-rate increase triggered a major rally in the country’s assets on hopes that it augurs the unwinding of policies that have sent foreign investors fleeing the $900 billion economy. The Turkish lira, long one of the world’s worst-performing currencies, surged the most in almost two years following the Thursday announcement.

World

One of the world’s most potent symbols of global trade — the Panama Canal — is falling victim to climate change as shrinking water levels force ships to part-load in order to navigate the vital waterway. If lower container loads continue, there is a chance that business will suffer delays in restocking inventories ahead of Christmas, according to Container xChange, a container logistics platform.

Iceland’s central bank raised western Europe’s highest interest rate by more than expected. Officials in Turkey boosted rates far more than expected, while Zambia also hiked. Korea, Sri Lanka and Indonesia held rates unchanged.

--With assistance from Beril Akman, Christopher Condon, Eamon Akil Farhat, Sam Kim, Alex Longley, James Mayger, Liz Capo McCormick, Colum Murphy, Reade Pickert, Tom Rees, Niclas Rolander, Augusta Saraiva, Zoe Schneeweiss, Alex Tanzi, Naomi Tajitsu, Erik Wasson, Alexander Weber and Lucy White.

No comments:

Post a Comment