INDIA 1%

Global clean energy shift won't hit Reliance's oil business- Ambani

Mon, August 28, 2023

Mukesh Ambani, Chairman and Managing Director of Reliance Industries, arrives to address the company's annual general meeting in Mumbai

By Nidhi Verma

NEW DELHI (Reuters) - Reliance Industries Ltd will continue to operate its refineries and petrochemical projects profitably, even as fossil fuel demand wanes due to a gradual global shift to clean energy, Chairman Mukesh Ambani said on Friday.

"We have already put in place a comprehensive strategy to ensure that all our investments and all our assets remain not just safe, but actually become profitable even as fossil fuel demand wanes," Ambani said at the group's annual shareholder meeting.

He said Reliance will switch to 100% green energy for captive consumption to cut energy costs, and upgrade the output of its refineries into value added chemicals.

Billionaire Ambani on Monday also announced the appointment of his three children as board directors at the oil-to-chemicals conglomerate, as he prepares to eventually hand over the reins.

Reliance, the operator of the world's biggest refining complex at Jamnagar in western India, is investing 750 billion rupees ($9.08 billion) in clean energy and technologies as it seeks to become net carbon zero by 2035.

The company is building four giga factories at Jamnagar to produce solar cells and modules, energy storage batteries, fuel cells and green hydrogen.

"..let me assure you that both during and after energy transition, our Jamnagar refining complex and all other petrochemical complexes will continue to operate profitably," he said.

Reliance aims to start commissioning facilities at its solar cell and module factory in phases from end-2025 and to set up a battery giga factory by 2026, he said, adding the plan is to install at least 100 gigawatts of renewable energy generation capacity by 2030.

Ambani said Reliance's Jamnagar refining complex, which has the capability to process 1.4 million barrels of oil per day, will be progressively operated as a chemicals and materials feedstock production engine.

Indian Billionaire Mukesh Ambani's Firm Will Explore Blockchain Platforms and CBDCs

Amitoj Singh

Mon, August 28, 2023

Reliance Industries Ltd. is entering the world of blockchain and central bank digital currencies (CBDCs), its Chairman and Asia's richest man, Mukesh Ambani, announced on Monday.

Ambani's Reliance ventured into the financial sector through its new financial services entity, Jio Financial Services (JFS), launched earlier this month. The development received further momentum with the announcement that BlackRock (BLK) would be a partner. Ambani's Reliance has been one of the most important players in India's digital growth story and its latest foray into CBDCs and Blockchain was declared during the company's biggest event of the year – the annual general meeting.

"JFS will consolidate its payment infrastructure, with a ubiquitous offering for both consumers and merchants further driving digital adoption for India," Ambani said. "JFS products will not just compete with current industry benchmarks but also explore pathbreaking features such as blockchain-based platforms and CBDC. They will adhere to the highest standards of security, regulatory norms and ensure protection of customer transaction data at all times."

While another Reliance entity, Reliance Retail, the nation's largest retail chain had started accepting India's digital rupee or CBDC during its pilot phase in February 2023, the announcement on Monday reflects greater intrigue in the space.

India has already made significant progress towards a wholesale and retail CBDC even though a full-scale launch is awaited.

Read More: Unpacking India's CBDC Pilots as Country Prepares for Digital Rupee

Global investors show new interest in Reliance Retail, Ambani says

M. Sriram

Mon, August 28, 2023

Reliance's Yeah! and Coca-Cola Co. soft drinks are seen on a shelf inside a Reliance supermarket in Mumbai, India

By M. Sriram

MUMBAI (Reuters) - Reliance Industries' retail unit is attracting "strong interest" from other top investors after raising $1 billion from Qatar Investment Authority, its billionaire chairman Mukesh Ambani said on Monday.

Reliance Retail, which aims to list on the stock market, raised $1 billion from Qatar Investment Authority at a $100 billion valuation last week, three years after a wave of fundraising where the unit attracted investors such as KKR, Silver Lake and TPG.

"In less than three years, the valuation of Retail has almost doubled, notwithstanding the intervening COVID-19 pandemic," Ambani, Asia's richest person, said during the company's annual general meeting.

"Several marquee global strategic and financial investors have shown strong interest in Reliance Retail," he said, adding he would share progress about them "in due course".

Ambani said in 2019 that the group planned to list the retail business in five years.

Led by Ambani's daughter Isha, the retail arm includes e-commerce operations and outlets selling electronics, clothing and food products, a consumer goods business and international partnerships with brands like Burberry, Pret A Manger and Tiffany.

Reliance also said on Monday that Ambani's three children, including Isha Ambani, will join the board of parent Reliance Industries.

Reliance Retail has invested more than $10 billion in the last two years and opened 3,300 new stores last year, Isha Ambani said.

Since last year, Reliance has been expanding its consumer business by acquiring dozens of small grocery and non-food brands as it targets building a consumer business generating annual sales of $6.5 billion with five years to challenge foreign giants like Unilever.

It also revived a local cola brand with plans to use its vast retail network, slash prices and tap nationalist sentiment to challenge U.S. beverage giants Coca-Cola and PepsiCo in a key market.

Talking about its consumer brand, Isha Ambani said the company was scaling it up "further in India, and has also started work to take it global, starting with Asia and Africa."

(Reporting by M. Sriram; Editing by Aditya Kalra and Susan Fenton)

View comments

Factbox-The three Ambani children joining the board of India's Reliance

By M. Sriram

MUMBAI (Reuters) - Reliance Industries' retail unit is attracting "strong interest" from other top investors after raising $1 billion from Qatar Investment Authority, its billionaire chairman Mukesh Ambani said on Monday.

Reliance Retail, which aims to list on the stock market, raised $1 billion from Qatar Investment Authority at a $100 billion valuation last week, three years after a wave of fundraising where the unit attracted investors such as KKR, Silver Lake and TPG.

"In less than three years, the valuation of Retail has almost doubled, notwithstanding the intervening COVID-19 pandemic," Ambani, Asia's richest person, said during the company's annual general meeting.

"Several marquee global strategic and financial investors have shown strong interest in Reliance Retail," he said, adding he would share progress about them "in due course".

Ambani said in 2019 that the group planned to list the retail business in five years.

Led by Ambani's daughter Isha, the retail arm includes e-commerce operations and outlets selling electronics, clothing and food products, a consumer goods business and international partnerships with brands like Burberry, Pret A Manger and Tiffany.

Reliance also said on Monday that Ambani's three children, including Isha Ambani, will join the board of parent Reliance Industries.

Reliance Retail has invested more than $10 billion in the last two years and opened 3,300 new stores last year, Isha Ambani said.

Since last year, Reliance has been expanding its consumer business by acquiring dozens of small grocery and non-food brands as it targets building a consumer business generating annual sales of $6.5 billion with five years to challenge foreign giants like Unilever.

It also revived a local cola brand with plans to use its vast retail network, slash prices and tap nationalist sentiment to challenge U.S. beverage giants Coca-Cola and PepsiCo in a key market.

Talking about its consumer brand, Isha Ambani said the company was scaling it up "further in India, and has also started work to take it global, starting with Asia and Africa."

(Reporting by M. Sriram; Editing by Aditya Kalra and Susan Fenton)

View comments

Factbox-The three Ambani children joining the board of India's Reliance

Reuters

Mon, August 28,23

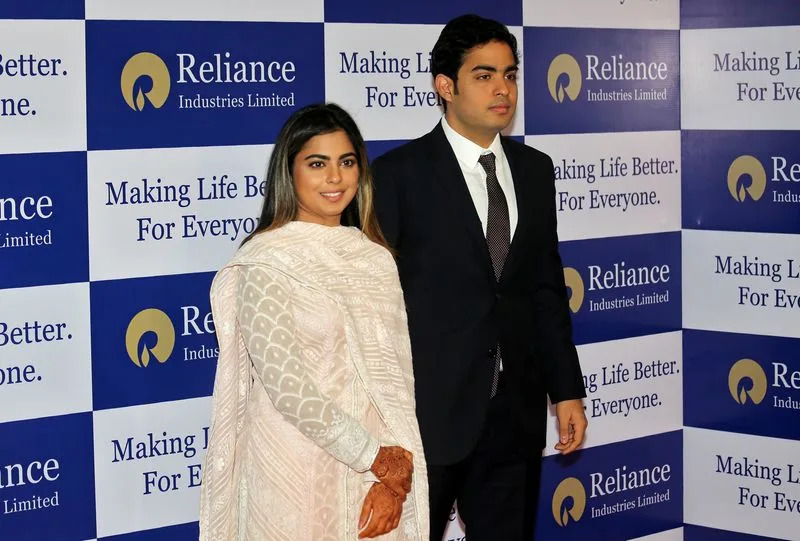

Isha Ambani and Akash Ambani, children of Mukesh Ambani, Chairman and Managing Director of Reliance Industries, pose for a photograph as they arrive to attend the company's annual general meeting in Mumbai

MUMBAI (Reuters) - India's Reliance Industries Ltd on Monday appointed the three children of chairman Mukesh Ambani - Isha, Akash and Anant - as board directors at the oil-to-telecoms conglomerate, as the billionaire prepares to eventually hand over the reins.

Ambani, Asia's richest person, in recent years has said the children would have significant roles at Reliance, India's biggest conglomerate, which is valued at around $200 billion. Eldest son Akash is already chairman of the telecom unit.

Here are some key details about the three:

AKASH AMBANI, 31

Eldest son Akash has been chairman of Reliance's telecoms unit, Jio Infocomm, since June 2022 after joining the unit in 2014.

An economics graduate from Brown University, he was part of a team that brokered a $5.7 billion investment in 2020 by Meta Platforms in digital unit Jio Platforms. He also helped broker deals with global investors such as KKR and TPG.

In 2019, Akash married Shloka Mehta, the daughter of a wealthy diamond merchant. They have a son and a daughter.

ISHA AMBANI, 31

Akash's twin sister Isha drives the company's retail, ecommerce and luxury businesses. Reliance says its retail unit is India's largest retailer by revenue and profits.

She was also involved in the launch of the Nita Mukesh Ambani Cultural Centre, a Broadway-style theater and arts centre launched in Mumbai earlier this year.

She has a management degree from Stanford and a double major in Psychology and South Asian Studies from Yale.

ANANT AMBANI, 28

Ambani's youngest son Anant has been a director on the board of Jio Platforms since March 2020, Reliance Retail since May 2022 and the group's new energy and solar energy businesses since June 2021.

A graduate of Brown University, Anant oversees the group's new energy businesses, where Reliance aims to become a net-zero carbon company by 2035. Anant has also been on the board of Reliance Foundation, the group's philanthropic arm, since September 2022.

(Reporting by M. Sriram; Editing by Aditya Kalra and Conor Humphries)

MUMBAI (Reuters) - India's Reliance Industries Ltd on Monday appointed the three children of chairman Mukesh Ambani - Isha, Akash and Anant - as board directors at the oil-to-telecoms conglomerate, as the billionaire prepares to eventually hand over the reins.

Ambani, Asia's richest person, in recent years has said the children would have significant roles at Reliance, India's biggest conglomerate, which is valued at around $200 billion. Eldest son Akash is already chairman of the telecom unit.

Here are some key details about the three:

AKASH AMBANI, 31

Eldest son Akash has been chairman of Reliance's telecoms unit, Jio Infocomm, since June 2022 after joining the unit in 2014.

An economics graduate from Brown University, he was part of a team that brokered a $5.7 billion investment in 2020 by Meta Platforms in digital unit Jio Platforms. He also helped broker deals with global investors such as KKR and TPG.

In 2019, Akash married Shloka Mehta, the daughter of a wealthy diamond merchant. They have a son and a daughter.

ISHA AMBANI, 31

Akash's twin sister Isha drives the company's retail, ecommerce and luxury businesses. Reliance says its retail unit is India's largest retailer by revenue and profits.

She was also involved in the launch of the Nita Mukesh Ambani Cultural Centre, a Broadway-style theater and arts centre launched in Mumbai earlier this year.

She has a management degree from Stanford and a double major in Psychology and South Asian Studies from Yale.

ANANT AMBANI, 28

Ambani's youngest son Anant has been a director on the board of Jio Platforms since March 2020, Reliance Retail since May 2022 and the group's new energy and solar energy businesses since June 2021.

A graduate of Brown University, Anant oversees the group's new energy businesses, where Reliance aims to become a net-zero carbon company by 2035. Anant has also been on the board of Reliance Foundation, the group's philanthropic arm, since September 2022.

(Reporting by M. Sriram; Editing by Aditya Kalra and Conor Humphries)

Mukesh Ambani poses with wife Nita Ambani, children Isha Ambani, Anant Ambani, and Akash Ambani before addressing the company's annual general meeting in Mumbai

In this article:

By Munsif Vengattil and Dhanya Skariachan

Mon, August 28, 2023

BENGALURU (Reuters) -India's Reliance Industries Ltd on Monday appointed the three children of Chairman Mukesh Ambani as board directors at the oil-to-telecoms conglomerate, as the billionaire prepares to eventually hand over the reins.

Ambani, Asia's richest person, has previously said his children Isha, Akash and Anant would have significant roles in the business and that Reliance was "in the process of effecting a momentous leadership transition". Mukesh Ambani was re-appointed as chairman of the company for another five years in July.

Ambani, 66, said his three children will work as one single team and will collaborate with other directors "to provide leadership to the Reliance group as a whole and guide the growth of all our diverse businesses."

With a market value of more than $200 billion, Ambani's business empire spans telecoms, retail, oil and gas and new energy.

With Mukesh Ambani in his late 60s, "the time is probably right ... If not now, when?," said Arun Dasmahapatra, a partner at executive search firm Heidrick & Struggles’ Mumbai office.

"This is also an attempt by Mukesh Ambani to ensure the next generation of Ambani siblings stay close to one another and do not have any discord."

Mukesh's father Dhirubhai Ambani, a well-known industrialist, died without a will, sparking a long-running and public feud for control of assets between Mukesh and his younger brother Anil.

Ambani has positioned experienced executives and long-time friends and family to steer his children through the transition, and they have taken larger roles at annual general meetings and led some company announcements.

Reliance also said Ambani's wife Nita had stepped down from the board to focus more on strengthening Reliance's charity arm.

Akash Ambani, who attended Brown University, was part of a team that brokered a $5.7 billion investment in 2020 by Meta Platforms in Jio Platforms, a Reliance unit. He is already the chairman of Reliance Jio Infocomm Limited, the telecom arm of Reliance.

Akash's twin sister Isha is driving the expansion of Reliance Retail into new categories and geographies, and is already a director on the boards of the retail unit, Reliance Retail Ventures, which houses the conglomerate's bets in India's brick-and-mortar and e-commerce industries.

The youngest of the siblings, Anant, is a director at Reliance's new energy business, retail unit as well as Jio platforms and its energy, and oil and chemical units.

The appointments are to be finalised after approval from shareholders.

RETAIL, AIRFIBER

Speaking at the annual general meeting with shareholders, Mukesh Ambani said the retail unit had doubled its valuation to $100 billion after a recent $1 billion investment from the Qatar Investment Authority in exchange for a 1% stake, adding that it was seeing interest from several top global and financial investors.

The company will launch Jio AirFiber, a wireless indoor device for offices and homes that provides broadband-like speeds, on Sept. 19. The device, which uses the Jio 5G telecom network for connectivity, will help Reliance target more than 200 million homes in the next three years.

Reliance shares closed down 1% on Monday and were among the top losers in the benchmark Nifty 50 index. Analysts attributed the decline to the absence of any new details at the shareholder meeting on the IPOs of telecom and retail arms of the company.

Reliance in 2019 had said the units will be listed publicly in five years. Investors were expecting an update on the timeline after Ambani last year said more details would be shared at this year's meeting.

Ambani also announced plans to manufacture wind energy equipment in India under Reliance's new energy business, and a plan to set up a battery giga factory by 2026.

(Reporting by Munsif Vengattil, Aditya Kalra and Dhanya Skariachan in Bengaluru; Editing by Tom Hogue, Mark Potter and Louise Heavens)

BENGALURU (Reuters) -India's Reliance Industries Ltd on Monday appointed the three children of Chairman Mukesh Ambani as board directors at the oil-to-telecoms conglomerate, as the billionaire prepares to eventually hand over the reins.

Ambani, Asia's richest person, has previously said his children Isha, Akash and Anant would have significant roles in the business and that Reliance was "in the process of effecting a momentous leadership transition". Mukesh Ambani was re-appointed as chairman of the company for another five years in July.

Ambani, 66, said his three children will work as one single team and will collaborate with other directors "to provide leadership to the Reliance group as a whole and guide the growth of all our diverse businesses."

With a market value of more than $200 billion, Ambani's business empire spans telecoms, retail, oil and gas and new energy.

With Mukesh Ambani in his late 60s, "the time is probably right ... If not now, when?," said Arun Dasmahapatra, a partner at executive search firm Heidrick & Struggles’ Mumbai office.

"This is also an attempt by Mukesh Ambani to ensure the next generation of Ambani siblings stay close to one another and do not have any discord."

Mukesh's father Dhirubhai Ambani, a well-known industrialist, died without a will, sparking a long-running and public feud for control of assets between Mukesh and his younger brother Anil.

Ambani has positioned experienced executives and long-time friends and family to steer his children through the transition, and they have taken larger roles at annual general meetings and led some company announcements.

Reliance also said Ambani's wife Nita had stepped down from the board to focus more on strengthening Reliance's charity arm.

Akash Ambani, who attended Brown University, was part of a team that brokered a $5.7 billion investment in 2020 by Meta Platforms in Jio Platforms, a Reliance unit. He is already the chairman of Reliance Jio Infocomm Limited, the telecom arm of Reliance.

Akash's twin sister Isha is driving the expansion of Reliance Retail into new categories and geographies, and is already a director on the boards of the retail unit, Reliance Retail Ventures, which houses the conglomerate's bets in India's brick-and-mortar and e-commerce industries.

The youngest of the siblings, Anant, is a director at Reliance's new energy business, retail unit as well as Jio platforms and its energy, and oil and chemical units.

The appointments are to be finalised after approval from shareholders.

RETAIL, AIRFIBER

Speaking at the annual general meeting with shareholders, Mukesh Ambani said the retail unit had doubled its valuation to $100 billion after a recent $1 billion investment from the Qatar Investment Authority in exchange for a 1% stake, adding that it was seeing interest from several top global and financial investors.

The company will launch Jio AirFiber, a wireless indoor device for offices and homes that provides broadband-like speeds, on Sept. 19. The device, which uses the Jio 5G telecom network for connectivity, will help Reliance target more than 200 million homes in the next three years.

Reliance shares closed down 1% on Monday and were among the top losers in the benchmark Nifty 50 index. Analysts attributed the decline to the absence of any new details at the shareholder meeting on the IPOs of telecom and retail arms of the company.

Reliance in 2019 had said the units will be listed publicly in five years. Investors were expecting an update on the timeline after Ambani last year said more details would be shared at this year's meeting.

Ambani also announced plans to manufacture wind energy equipment in India under Reliance's new energy business, and a plan to set up a battery giga factory by 2026.

(Reporting by Munsif Vengattil, Aditya Kalra and Dhanya Skariachan in Bengaluru; Editing by Tom Hogue, Mark Potter and Louise Heavens)

No comments:

Post a Comment