Evergrande Tycoon Crossed a Red Line When Wealth Funds Ran Dry

Bloomberg News

Fri, September 29, 2023

(Bloomberg) -- China Evergrande Group wiped out international investors, roiled financial markets and left thousands of suppliers in the lurch. Yet it was the developer’s failure to pay households who invested in its wealth management products that may have provided the last straw for Chinese authorities.

Almost two years after Evergrande defaulted on its debt, its billionaire founder and chairman, Hui Ka Yan, is under police control on suspicion of committing unspecified crimes. Staff at the group’s wealth management business have been detained. Hui’s son Peter Xu, who once ran the firm’s wealth unit, was also taken into custody, local media reported.

The actions came after the company’s money management arm said it was unable to make payments in August on investments held by retail clients. Evergrande, like many other Chinese developers, sold high-yielding wealth management products to individual investors to help fund their operations when other financing avenues were becoming tougher to tap.

The detentions are consistent with the Chinese government’s priority to look after citizens rather than other stakeholders such as foreign bondholders, in line with President Xi Jinping’s desire to avoid social unrest and achieve “common prosperity.” They also send a signal to other debt-laden developers to focus on finishing apartments and paying consumers who are owed money.

“As the property sector is unlikely to provide an engine of growth, a prominent property tycoon makes a politically effective target,” said Rana Mitter, a professor of Chinese politics at Oxford University. “The Communist Party wants to demonstrate that what it views as anti-social business behavior will be penalized.”

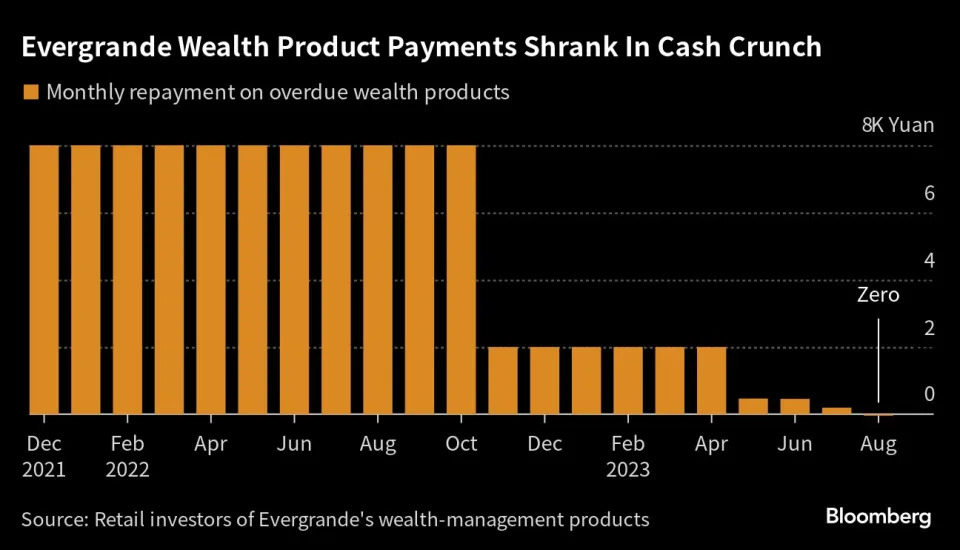

Evergrande’s wealth unit ran into problems two years ago when a cash crunch meant it couldn’t make overdue payments on about 40 billion yuan ($5.5 billion) of investment products, sparking protests and prompting the company to offer reduced amounts of cash or discounted real estate instead.

Zhao was one of those investors. In the past two years she had waited for trickling repayments. After urging the police to investigate dozens of times without success, her luck finally turned this month when she received notice that her complaint was acknowledged.

To her bigger surprise, police and related authorities in the southern city of Shenzhen said they will work overtime through an eight-day national holiday, which starts Friday, to deal with leads from tens of thousands of retail investors. She quickly spread the word.

“It’s been two years, and I’ve almost been driven crazy,” said Zhao, who asked to be identified only by her surname for security reasons.

For those who chose to get repaid in cash, Evergrande’s wealth division initially promised to return 10% installments toward their principal on a quarterly basis. Three months later, the plan shrank to a monthly payment of 8,000 yuan. Almost a year after that, it was dialed back to 2,000 yuan a month, and then to around 500 yuan. For a 100,000 yuan investment, a full repayment at that pace would take almost 17 years.

When the latest installment was due on Aug. 31, nothing appeared in consumers’ accounts. That day, the money management arm said it couldn’t make payments due to a liquidity crunch and setbacks in disposing of assets.

Over the past two years, retail investors got the cold shoulder when seeking legal redress. Some were told by local police that their complaints couldn’t be submitted in a legal manner without consent from higher authorities, according to multiple individual investors who asked not to be identified.

Now they are being told that they can file complaints in various ways, ranging from in person to online. The easiest method is sending a formatted text message. Many quickly received notices that their cases were received. Police in Shenzhen, where Evergrande was based during its heyday, in mid-September publicly called on investors to provide leads to the authorities.

That’s also when a raft of headlines flashed on actions taken against Evergrande executives. On Sept. 18, police said they recently detained some staff at its wealth management unit. A week later, Caixin reported that former Chief Executive Officer Xia Haijun and former Chief Financial Officer Pan Darong, who both oversaw financing businesses, were also being held. On Sept. 28, Evergrande acknowledged that Hui is suspected of crimes.

Hui’s second son Xu was taken along with him, Yicai reported. Xu oversaw Shenzhen-based Evergrande Financial Wealth Management Co. for a while, according to Yicai. Earlier, Shenzhen police identified one of the detainees from the wealth division by the last name of Du. The unit’s general manager is Du Liang.

The involvement of off-balance sheet, unregulated wealth products has been a lightning rod for Evergrande, which has $327 billion in liabilities. Such offerings provided annualized interest rates of as much as 13%, and proceeds were to replenish working capital, Bloomberg reported earlier. The company even encouraged staff to purchase the products.

Regulators have been tightening rules on wealth management products and other parts of China’s shadow banking system for years. This month, China started a campaign against illegal fundraising to protect households. Li Yunze, who became head of China’s new National Administration of Financial Regulation in May, vowed in a September speech to deal with a number of major cases to protect the rights and interests of consumers.

How Wealth Products Helped Inflate China Real Estate: QuickTake

In addition to wealth products issued by developers, stress has emerged in similar offerings sold by trust companies.

Non-bank lenders that package investments for institutions and wealthy individuals are estimated to have sold more than 2 trillion yuan of products tied to property companies. In August, Zhongrong International Trust Co. missed payments, triggering protests and signaling that real estate risks are spreading to the country’s $60 trillion financial system.

For Evergrande’s wealth clients — along with everyone else owed billions by the fallen property giant — it’s likely to be a long road to recovery. Yet Zhao is optimistic.

“I hope there’s an end to all this soon and I can get my money back,” she said.

Bloomberg Businessweek

Factbox-Evergrande founder joins list of Chinese tycoons investigated, arrested

Reuters

Fri, September 29, 2023

China Evergrande Group Chairman Hui Ka Yan attends a news conference on the property developer's annual results in Hong Kong

(Reuters) - The founder of China Evergrande, the world's most indebted property developer, is being investigated for "illegal crimes", a fresh challenge for the tycoon and his embattled company as it struggles to stay afloat.

Hui Ka Yan, 64, who founded Evergrande in 1996 in the southern Chinese province of Guangdong, is the latest tycoon to come under scrutiny since Chinese President Xi Jinping took power in 2012.

Following is a list of some other high-profile Chinese executives who have been investigated or arrested under Xi's leadership.

ZHAO WEIGUO, FORMER CHAIRMAN OF TSINGHUA UNIGROUP

In March, the former chairman of the chip conglomerate was charged with crimes including corruption and illegally earning profits for his friends and family.

Originating as a branch of China's prestigious Tsinghua University, state-backed Tsinghua Unigroup emerged in the previous decade as a would-be domestic champion for China’s laggard chip industry.

But the company racked up debt under Zhao. It spent billions on chip-related acquisitions but also unrelated, unprofitable businesses ranging from real estate to online gambling that eventually led it to default on bond payments in late 2020 and face bankruptcy.

BAO FAN, FOUNDER OF CHINA RENAISSANCE

The founder of China Renaissance Holdings was detained in February and the investment bank said in August he was co-operating with authorities as investigations continued.

It was unclear what the investigation was related to. Bao, who previously worked at Credit Suisse Group and Morgan Stanley, has been hailed as one of China's best-connected bankers, involved with major technology mergers including the tie-up of ride-hailing firms Didi and Kuaidi, food delivery giants Meituan and Dianping.

His whereabouts are unknown.

XIAO JIANHUA, FOUNDER OF TOMORROW HOLDINGS

Xiao has not been seen in public since 2017. In 2022, he was sentenced to 13 years in jail and his Tomorrow conglomerate was fined 55.03 billion yuan ($8.1 billion) by a Shanghai court.

The Chinese-Canadian billionaire, known to have links to China's Communist Party elite, was whisked away in a wheelchair from a luxury Hong Kong hotel in the early hours with his head covered, a source close to the tycoon told Reuters at the time.

The Shanghai court said at sentencing that Xiao and Tomorrow gave shares, real estate, cash and other assets to government officials totalling more than 680 million yuan for two decades from 2001 to 2021, to evade financial supervision and seek illegitimate benefits.

CHEN FENG, CHAIRMAN, AND TAN XIANGDONG, CEO, HNA GROUP

Chen and Tan of HNA Group were taken away by Chinese police due to suspected criminal offences in 2021 when HNA Group, once one of China's most acquisitive overseas buyers, was placed under bankruptcy administration.

In the 2010s, HNA Group, whose flagship business is Hainan Airlines, had used a $50 billion global acquisition spree, mainly fuelled by debt, to build an empire with stakes in businesses from Deutsche Bank to Hilton Worldwide.

WU XIAOHUI, CHAIRMAN OF ANBANG INSURANCE GROUP

Wu was prosecuted for economic crimes in early 2018 after China's insurance regulators found Anbang, an insurance-to-property conglomerate, had violated laws and regulations which "may seriously endanger the solvency of the company."

Prosecutors also seized control of the group.

Wu was arrested in June 2017 amid Beijing’s campaign to curtail big-spending conglomerates as it cracked down on financial risk. He was sentenced to 18 years in prison in May 2018 for fraud and embezzlement.

YE JIANMING, FOUNDER OF CEFC CHINA ENERGY

In 2017, Ye's CEFC agreed to buy a nearly $9.1 billion stake in Russian oil major Rosneft. A year later, he was investigated for suspected economic crimes and disappeared from public view in March 2018. A source familiar with the matter told Reuters at the time he had been taken in for questioning.

His conglomerate has now been dismantled under a mountain of debt in a remarkable fall from grace for the businessman who ranked second in Fortune magazine's "40 Under 40" list of the world’s most influential young people in 2016.

(Reporting By Kane Wu and Selena Li in Hong Kong, compiled by Anne Marie Roantree; editing by Miyoung Kim and Lincoln Feast)

Reuters

Fri, September 29, 2023

China Evergrande Group Chairman Hui Ka Yan attends a news conference on the property developer's annual results in Hong Kong

(Reuters) - The founder of China Evergrande, the world's most indebted property developer, is being investigated for "illegal crimes", a fresh challenge for the tycoon and his embattled company as it struggles to stay afloat.

Hui Ka Yan, 64, who founded Evergrande in 1996 in the southern Chinese province of Guangdong, is the latest tycoon to come under scrutiny since Chinese President Xi Jinping took power in 2012.

Following is a list of some other high-profile Chinese executives who have been investigated or arrested under Xi's leadership.

ZHAO WEIGUO, FORMER CHAIRMAN OF TSINGHUA UNIGROUP

In March, the former chairman of the chip conglomerate was charged with crimes including corruption and illegally earning profits for his friends and family.

Originating as a branch of China's prestigious Tsinghua University, state-backed Tsinghua Unigroup emerged in the previous decade as a would-be domestic champion for China’s laggard chip industry.

But the company racked up debt under Zhao. It spent billions on chip-related acquisitions but also unrelated, unprofitable businesses ranging from real estate to online gambling that eventually led it to default on bond payments in late 2020 and face bankruptcy.

BAO FAN, FOUNDER OF CHINA RENAISSANCE

The founder of China Renaissance Holdings was detained in February and the investment bank said in August he was co-operating with authorities as investigations continued.

It was unclear what the investigation was related to. Bao, who previously worked at Credit Suisse Group and Morgan Stanley, has been hailed as one of China's best-connected bankers, involved with major technology mergers including the tie-up of ride-hailing firms Didi and Kuaidi, food delivery giants Meituan and Dianping.

His whereabouts are unknown.

XIAO JIANHUA, FOUNDER OF TOMORROW HOLDINGS

Xiao has not been seen in public since 2017. In 2022, he was sentenced to 13 years in jail and his Tomorrow conglomerate was fined 55.03 billion yuan ($8.1 billion) by a Shanghai court.

The Chinese-Canadian billionaire, known to have links to China's Communist Party elite, was whisked away in a wheelchair from a luxury Hong Kong hotel in the early hours with his head covered, a source close to the tycoon told Reuters at the time.

The Shanghai court said at sentencing that Xiao and Tomorrow gave shares, real estate, cash and other assets to government officials totalling more than 680 million yuan for two decades from 2001 to 2021, to evade financial supervision and seek illegitimate benefits.

CHEN FENG, CHAIRMAN, AND TAN XIANGDONG, CEO, HNA GROUP

Chen and Tan of HNA Group were taken away by Chinese police due to suspected criminal offences in 2021 when HNA Group, once one of China's most acquisitive overseas buyers, was placed under bankruptcy administration.

In the 2010s, HNA Group, whose flagship business is Hainan Airlines, had used a $50 billion global acquisition spree, mainly fuelled by debt, to build an empire with stakes in businesses from Deutsche Bank to Hilton Worldwide.

WU XIAOHUI, CHAIRMAN OF ANBANG INSURANCE GROUP

Wu was prosecuted for economic crimes in early 2018 after China's insurance regulators found Anbang, an insurance-to-property conglomerate, had violated laws and regulations which "may seriously endanger the solvency of the company."

Prosecutors also seized control of the group.

Wu was arrested in June 2017 amid Beijing’s campaign to curtail big-spending conglomerates as it cracked down on financial risk. He was sentenced to 18 years in prison in May 2018 for fraud and embezzlement.

YE JIANMING, FOUNDER OF CEFC CHINA ENERGY

In 2017, Ye's CEFC agreed to buy a nearly $9.1 billion stake in Russian oil major Rosneft. A year later, he was investigated for suspected economic crimes and disappeared from public view in March 2018. A source familiar with the matter told Reuters at the time he had been taken in for questioning.

His conglomerate has now been dismantled under a mountain of debt in a remarkable fall from grace for the businessman who ranked second in Fortune magazine's "40 Under 40" list of the world’s most influential young people in 2016.

(Reporting By Kane Wu and Selena Li in Hong Kong, compiled by Anne Marie Roantree; editing by Miyoung Kim and Lincoln Feast)

No comments:

Post a Comment