Reuters | September 10, 2023 |

US President Joe Biden and Saudi Crown Prince Mohammed bin Salman bin Abdulaziz. (Image by the Saudi Press Agency, Wikimedia Commons.)

The United States and Saudi Arabia are in talks to secure metals in Africa needed to help them with their energy transitions, the Wall Street Journal reported on Sunday, citing people with knowledge of the talks.

A state-backed Saudi venture would buy stakes in mining assets worth $15 billion in African countries such as the Democratic Republic of Congo, Guinea and Namibia, which will permit US companies to have rights to buy some of the production, the report added.

The US is in a race to catch up with China for supplies of cobalt, lithium and other metals that are used in electric car batteries, laptops and smartphones.

In a similar arrangement in July, Saudi Arabian Mining Co (Ma’aden) and the Saudi Public Investment Fund (PIF) acquired 10% of Brazilian Vale’s base metal unit, while US investment firm Engine No. 1 acquired 3%.

The newspaper said the PIF approached Congo in June about investing in cobalt, copper and tantalum in the country via its $3 billion joint venture with Ma’aden called Manara Minerals

Manara is also focusing on iron ore, nickel and lithium.

The White House is seeking the financial backing of other sovereign-wealth funds in the region, but talks with Saudi Arabia have progressed the farthest, the Journal added.

The Saudi government and The White House did not immediately respond to a request for comment.

(By Urvi Dugar; Editing by Cynthia Osterman)

Saudi Arabia’s crown prince looks to metals as new source of wealth

Bloomberg News | September 7, 2023 | \

Saudi Arabian Crown Prince Mohammed bin Salman is the Chairman of the Public Investment Fund (Image: Wikimedia Commons)

In scorching summer heat, Renier Swiegers marches through the desert toward a drilling rig. He’s not looking for oil, the dynamo of Saudi Arabia’s economy the past 80 years, though. It’s another potential source of wealth and influence the kingdom now has its eye on.

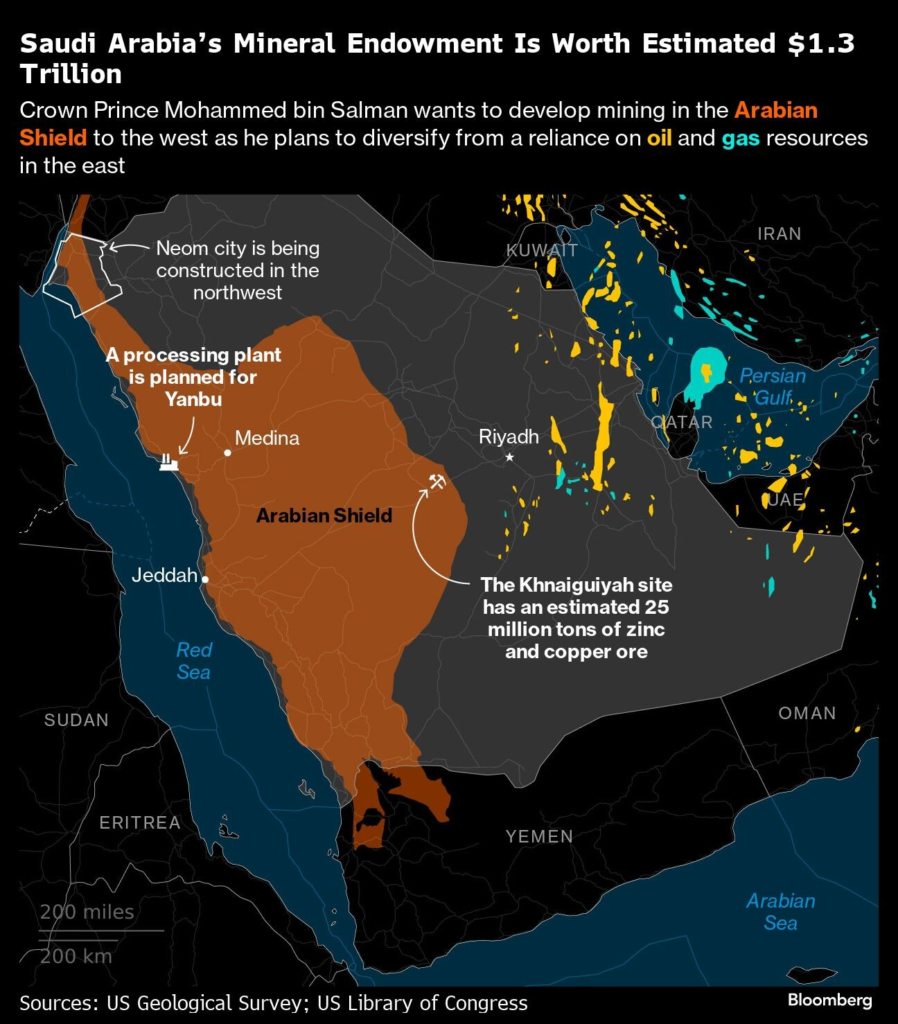

Having already used its energy riches to upend the worlds of sports, tourism and movies, Saudi Arabia’s Crown Prince Mohammed bin Salman is prepared to pour billions of dollars into tapping the more than $1.3 trillion of metals his government says is buried in places like this.

The plan may be among the less glamorous components of his grand Vision 2030 to transform the Saudi economy. The prospect of turning the country into a metals hub that can make a dent in a global industry also has no shortage of skeptics. But Saudi Arabia’s 38-year-old de-facto leader has no shortage of wealth or ambition. Key will be convincing international mining companies it’s worth their while.

If only partially successful, the dream would have implications beyond the Middle East, not just for metals mining but also Saudi Arabia’s relations with the US, China and the emerging markets the kingdom is inching closer to.

Swiegers, a Namibian who works for British mining firm Moxico Resources Plc, is a believer. He’s helping establish a new zinc and copper open pit mine about 200 kilometers (125 miles) west of the Saudi capital, Riyadh.

“I’ve done projects all over Africa, and I know the geology and where is good to mine,” said Swiegers, extracting earth samples from the rig from as deep as 200 meters and pointing to copper deposits glittering in the sun. “This site is just like those.”

If everything comes to fruition, by 2025 the Khnaiguiyah site he’s working on will be producing metals including 100,000 tons a year of zinc and 10,000 tons of copper in its first phase. That’s miniscule by global standards — equivalent to Chile’s copper output in about 18 hours — but the aim is to double the volume. It’s one of several projects in the kingdom.

As well as developing local mines, there’s also another element to the plan that industry insiders say is less speculative and quicker to get up and running. Saudi Arabia wants to buy up resources from elsewhere to be refined and processed at new facilities inside the kingdom.

In July, the country announced its first big push into international mining. It took part in a $3.4 billion deal in Brazil, buying a stake in Vale SA’s base metals unit alongside investment fund Engine No. 1.

The transaction was the first by Manara Minerals, a vehicle established by Saudi Arabia’s powerful sovereign wealth fund — the Public Investment Fund, or PIF — and Saudi Mining Co., also known as Maaden. The agreement gives the kingdom, which beat off competition from Japan and Qatar, a 10% slice in one of the world’s crucial suppliers of nickel and copper — essential metals needed to decarbonize.

There will be more. Manara’s two shareholders will initially provide about $3 billion for two or three international deals a year, and more funding will be provided if needed, people familiar with the strategy said. It’s part of Maaden’s aim to ramp up its role in domestic production, while also buying access to global resources.

Pillar of the new Saudi economy

Using government subsidies and lending by state-controlled funds, the overarching goal is to position Saudi Arabia as an alternative supplier to China for the metals and minerals vital to the global energy transition, such as batteries for electric cars. In short, dirty old mining is one of the pillars of the clean new future.

“Saudi Arabia needs more than one engine to achieve its vision,” Khalid Al Mudaifer, vice minister of mining affairs, said in an interview. The kingdom’s plan is to transform itself into an economic and industrial powerhouse, he said. “For that we need minerals.”

The main metal of interest to companies is copper, but Saudi Arabia also wants to mine uranium and phosphates for its nascent nuclear program. That’s drawn the attention of Western powers and the United Nations, who are wary of nuclear proliferation in the Middle East.

Saudi Arabia has repeatedly pledged that its atomic program is strictly for peaceful purposes, but Prince Mohammed has said the kingdom would develop a bomb if the other big Middle Eastern power, Iran, did so.

Some executives and advisers at the world’s biggest miners, though, have doubts about the kingdom’s domestic mining plans and point first to its geology. Its uranium reserves have been called “severely uneconomic.” The copper deposits — the most desirable metal for most miners — were mainly formed by volcanic activity.

That means they will likely only be found in small to medium-sized areas. It makes them less attractive to mine than the deposits that stretch down the through the Andes in Latin America and provide the bulk of the world’s supplies or the sedimentary-rock formations in places like Central Africa.

These jurisdictions — and even the largely undeveloped copper crescent that runs through Iran and Pakistan — are seen as much more prospective for the large, long-life mines many of the major global companies are looking to develop.

There’s also the problem of water, something in scarce supply in Saudi Arabia, which is around 95% desert. “There is also the challenge of availability of infrastructure, particularly for deposits located in remote desert areas,” said Carole Nakhle, founder and chief executive officer of London-based consultancy Crystol Energy.

Much of the Saudi plan will hinge on how successful projects like the one at Khnaiguiyah are at getting from identifying specific locations of mineral deposits to commercial production. Ajlan & Bros, the local investor developing Khnaiguiyah along with UK-based Moxico Resources, has earmarked $14 billion to invest in developing mines and processing facilities by 2030.

The firm, controlled by a wealthy Saudi family that built its fortune on selling traditional Arab headdresses, is betting that “Saudi Arabia can become a new source of minerals and rare earths away from China,” said Fahad Alenezi, CEO for the metals and mining group at Ajlan & Bros. As China and the US compete for access to resources “this is healthy for us,” he said.

Ajlan is planning to develop the largest zinc and copper processing plant in the Middle East at Yanbu on Saudi Arabia’s west coast. Most of the focus will be domestic demand, but the firm is already getting offers from Chinese and European trading houses to take any commodities it can produce.

Saudi Arabia is partnering with the Chinese Geological Survey on a $207 million contract to help identify minerals in the so-called Arabian Shield area of the kingdom where most deposits are, officials said at a Saudi-China business conference in June. The government in Beijing has also led efforts to identify the kingdom’s uranium deposits.

“The bottom line is that Saudi is exceptionally prospective,” Mark Bristow, CEO of Barrick Gold Corp, said in an interview during a visit to Riyadh in January. As for the estimate of more than $1 trillion of metals in the ground, “Whatever that number is, it’s worth an investment,” said Bristow, whose company took a risk on Mali more than 25 years ago and helped to turn it into a top African gold producer.

Canada’s Barrick operates a copper mine on Saudi Arabia’s southwestern coast near the Red Sea. It’s also been in talks with the PIF about a potential stake in a copper project in Pakistan, which would bring in Saudi money and political influence, people familiar with the matter said recently.

Vision 2030 eyes $75 billion

The government is offering big incentives for companies to start mining. The Saudi Industrial Development Fund will offer financing for up to 75% of a project. There’s a five year grace period on royalty payments, a cap on taxation levels, and a commitment not to levy windfall taxes. All government income from mining will go into a special fund to be reinvested in the industry.

Mining is the so-called “third pillar” of the economy in Vision 2030. The others are petroleum and petrochemicals, meaning mining would become the biggest part of the economy after oil and gas. The industry would eventually employ more than 250,000 people and contribute some $75 billion to Saudi gross domestic product by 2030, according to the targets.

A metals refining and processing industry could have potential to draw interest from international partners looking to provide more competition with China, which currently dominates minerals processing and battery manufacturing. That, of course, is if it all goes to plan.

So far, Saudi auctions for exploration licenses in the country have attracted only smaller players. The kingdom in August announced another bid round for investment and development of eight mining areas across the country.

Doubts among the big miners, though, don’t mean they aren’t closely following the Saudi efforts. Under the crown prince, Saudi Arabia is willing to take the kind of commercial risks other countries with mining ambitions might balk at, and his futuristic new city in the desert, called Neom, and the recent lavish spending on football shows the kingdom’s belief in its aims.

“Others in the industry were telling me that this is real and it’s something you need to get closer to,” Mike Henry, CEO of BHP Group Ltd., the world’s biggest mining company, said during a trip to Saudi Arabia. “It’s definitely the real deal.” That was in January when he attended the country’s annual mining conference. Whether giants like BHP get involved remains to be seen.

(By Matthew Martin, Fahad Abuljadayel and Thomas Biesheuvel, with assistance from Anthony Di Paola, Tiffany Tsoi, Paul Wallace, Jonathan Tirone and Samuel Dodge)

The government is offering big incentives for companies to start mining. The Saudi Industrial Development Fund will offer financing for up to 75% of a project. There’s a five year grace period on royalty payments, a cap on taxation levels, and a commitment not to levy windfall taxes. All government income from mining will go into a special fund to be reinvested in the industry.

Mining is the so-called “third pillar” of the economy in Vision 2030. The others are petroleum and petrochemicals, meaning mining would become the biggest part of the economy after oil and gas. The industry would eventually employ more than 250,000 people and contribute some $75 billion to Saudi gross domestic product by 2030, according to the targets.

A metals refining and processing industry could have potential to draw interest from international partners looking to provide more competition with China, which currently dominates minerals processing and battery manufacturing. That, of course, is if it all goes to plan.

So far, Saudi auctions for exploration licenses in the country have attracted only smaller players. The kingdom in August announced another bid round for investment and development of eight mining areas across the country.

Doubts among the big miners, though, don’t mean they aren’t closely following the Saudi efforts. Under the crown prince, Saudi Arabia is willing to take the kind of commercial risks other countries with mining ambitions might balk at, and his futuristic new city in the desert, called Neom, and the recent lavish spending on football shows the kingdom’s belief in its aims.

“Others in the industry were telling me that this is real and it’s something you need to get closer to,” Mike Henry, CEO of BHP Group Ltd., the world’s biggest mining company, said during a trip to Saudi Arabia. “It’s definitely the real deal.” That was in January when he attended the country’s annual mining conference. Whether giants like BHP get involved remains to be seen.

(By Matthew Martin, Fahad Abuljadayel and Thomas Biesheuvel, with assistance from Anthony Di Paola, Tiffany Tsoi, Paul Wallace, Jonathan Tirone and Samuel Dodge)

No comments:

Post a Comment