Matthew Malinowski

Fri, September 1, 2023 at 10:00 AM MDT·5 min read

(Bloomberg) -- In Santiago, real estate sales are surging, stocks recently hit record highs and investors are betting big on corporate bonds. Forecasts show Chile’s economic growth next year will top mighty regional peers like Brazil and Mexico.

That optimism is being driven by expectations for the world’s biggest interest rate easing cycle, the payoff for the central bank’s early and aggressive fight to save an overheated economy from surging prices and unsustainable growth that approached a red-hot 12% two years ago.

That rescue wasn’t painless — quickly raising interest rates to a two-decade high caused a mild recession, and data out just this week showed continued doldrums in retail and industry — but the economy is now much better positioned to benefit from lower rates than some of its developed-world peers, which were slower to boost borrowing costs.

“Inflation expectations have been anchored, and that speaks to the central bank’s credibility,” said Andres Perez, the chief economist for Latin America at Banco Itau in Santiago. “The hiking cycle started well before other countries, especially developed economies.”

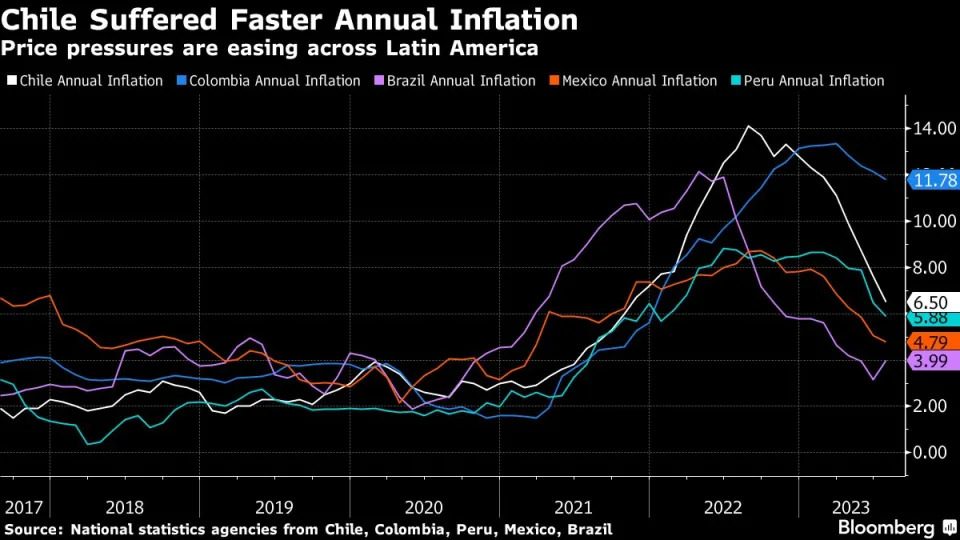

The bank’s easing cycle — including a 1 percentage-point cut in July and what’s forecast to be a 75 or 100 basis point reduction Sept. 5 — will total at least 625 basis points over the next 12 months, the biggest in the world according to market implied policy rates tracked by Bloomberg. Just a year ago, the benchmark rate peaked at 11.25% as price increases topped 14%, the highest since 1992 and the steepest among regional peers.

Chile and other Latin American nations, with more recent memories of out-of-control inflation, were much more aggressive about interest rate hikes than developed-market peers as consumer prices surged globally in 2021. Brazil, for example, raised rates as early as March 2021, while the Federal Reserve didn’t increase borrowing costs until a year later.

Now the Fed and European Central Bank are still playing catch-up, weighing more tightening. Last month, Goldman Sachs Group Inc. predicted the Fed won’t cut rates until the second quarter of 2024.

Chile faced the same cost-of-living pressures from global supply bottlenecks and Russia’s invasion of Ukraine that other countries encountered, but on top of that, the country also grappled with the aftermath of stimulus totaling more than 25% of gross domestic product injected into the economy during the pandemic.

Government transfers under former President Sebastian Pinera reached 90% of households, and three rounds of early pension fund withdrawals approved by Congress pumped roughly $50 billion in additional cash into a red-hot economy.

Turnaround

A linchpin of the bank’s response was consistent communication. After taking over as central bank governor in February 2022, Rosanna Costa repeatedly emphasized economic growth was slowing too gradually and inflation running too hot. She sent real rates, adjusted for consumer-price increases, to the highest since 2002, according to Bloomberg Economics.

Inflation projections quickly tumbled, and economists and traders now see it slowing to the 3% target within two years. By contrast, cost-of-living estimates in Brazil, which is also cutting rates, remain above target through 2026.

Peso Risks

Of course Chile’s aggressive cuts pose risks. Some economists are warning inflation could be revived by a weakening peso, which has tumbled 6.4% since the start of July even as the Finance Ministry doubles dollar sales, a move which supports the currency.

A weaker currency makes imports more expensive, and Chile is particularly vulnerable because it imports the majority of its fuel. Wage growth and rising commodity costs have also been flagged as potential vulnerabilities.

Central bank Vice President Pablo Garcia downplayed the peso’s effect on the monetary policy outlook, saying in an Aug. 26 interview from Jackson Hole, Wyoming, that board members still intend to lower rates to 7.75%-8% at year’s end from 10.25% now.

“The news that we’ve had, both on the international scenario and domestic data, inflation, gyrations of the exchange rate, they don’t seem to paint a picture dramatically different from what we had in mind when we started the cuts in July,” Garcia said.

2024 Outlook

For now, Chilean financial markets are positioning for better times. Local stocks smashed records in July and early August on bets that lower rates will help demand, setting off a rally across sectors that was led by retailers like Plaza SA and Ripley Corp.

Economic activity expanded in July, defying analysts’ forecasts for a dip, according to the central bank’s latest GDP proxy published Friday. Growth is gaining momentum, according to Bloomberg Economics’ Felipe Hernandez.

Meanwhile, investors are hurrying back to the corporate debt market on prospects of a return to stronger economic growth after months of stagnation, according to a monthly Bloomberg News survey published in August. UBS upgraded Chilean stocks Thursday to most preferred in emerging markets, prompted by the rapid monetary policy pivot and a more stable political backdrop.

Real estate sales jumped 33% in Santiago in the first half of this year from the previous six months. Rene Castro Leal, a University of California-trained executive who is selling apartments at a new residential building in the capital, said he’s seen an inflection point in demand.

Fresh in his mind is a client who had fallen in love with an apartment a year ago, but was hesitant to buy because of the rough economic outlook. That buyer finally agreed to purchase the property after the central bank delivered its first interest rate cut in July and said inflation was coming down faster than initially thought.

“Clients react to the central bank,” Leal said. “We’re going to have better months ahead.”

--With assistance from Matthew Boesler.

Bloomberg Businessweek

No comments:

Post a Comment