$10 Trillion in Added US Debt Since 2001 Shows 'Bush and Trump Tax Cuts Broke Our Modern Tax Structure'

AUSTERITY FOR THEE, TAX CUTS FOR ME

"In their blind loyalty to their mega-donors, Republicans' fixation on giant tax cuts for billionaires has created a revenue problem that is driving up our national debt," said Sen. Sheldon Whitehouse in response to new Treasury Department figures.

President Donald Trump jokes with Senate Majority Leader Mitch McConnell (R-Ky.), Sen. Mike Enzi (R-Wy.), Vice President Mike Pence, Speaker of the House Paul Ryan (R-Wis.) and Sen. Tim Scott (R-S.C.) during an event celebrating the passage of the Tax Cuts and Jobs Act on the South Lawn of the White House December 20, 2017 in Washington, DC.

(Photo: Chip Somodevilla/Getty Images)

JON QUEALLY

Oct 21, 2023

The U.S. Treasury Department on Friday released new figures related to the 2023 budget that showed a troubling drop in the nation's tax revenue compared to GDP—a measure which fell to 16.5% despite a growing economy—and an annual deficit increase that essentially doubled from the previous year.

"After record U.S. government spending in 2020 and 2021" due to programs related to the economic fallout from the Covid-19 crisis, the Washington Postreports, "the deficit dropped from close to $3 trillion to close to $1 trillion in 2022. But rather than continue to fall to its pre-pandemic levels, the deficit unexpectedly jumped this year to roughly $2 trillion."

While much of the reporting on the Treasury figures painted a picture of various and overlapping dynamics to explain the surge in the deficit—including higher payments on debt due to interest rates, tax filing waivers related to extreme weather events, the impact of a student loan forgiveness program that was later rescinded, or a dip in capital gains receipts—progressive tax experts say none of those complexities should act to shield what's at the heart of a budget that brings in less than it spends: tax giveaways to the rich.

Bobby Kogan, senior director for federal budget policy at the Center for American Progress, has argued repeatedly that growing deficits in recent years have a clear and singular chief cause: Republican tax cuts that benefit mostly the wealthy and profitable corporations.

In response to the Treasury figures released Friday, Kogan said that "roughly 75%" of the surge in the deficit and the debt ratio, the amount of federal debt relative to the overall size of the economy, was due to revenue decreases resulting from GOP-approved tax cuts over recent decades. "Of the remaining 25%," he said, "more than half" was higher interest payments on the debt related to Federal Reserve policy.

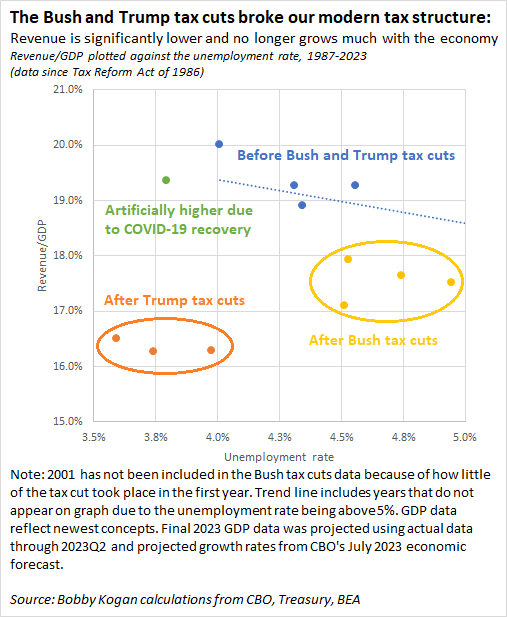

"We have a revenue problem, due to tax cuts," said Kogan, pointing to the major tax laws enacted under the administrations of George W. Bush and Donald Trump. "The Bush and Trump tax cuts broke our modern tax structure. Revenue is significantly lower and no longer grows much with the economy." And he offered this visualization about a growing debt ratio:

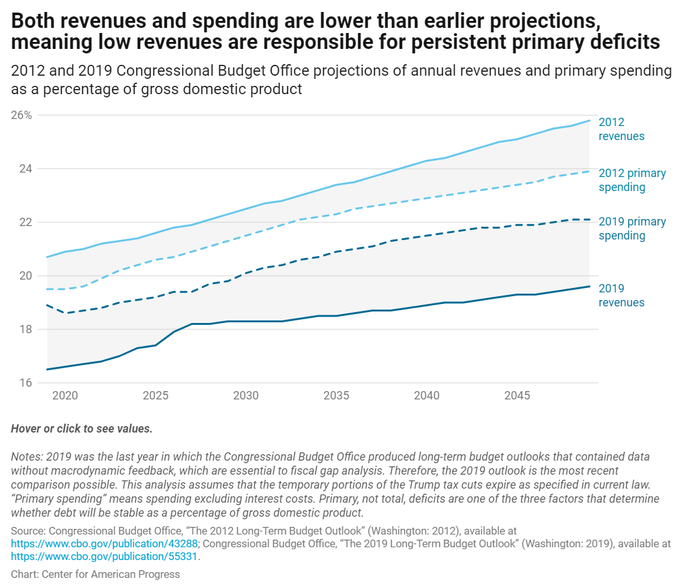

"The point I want to make again and again and again is that, relative to the last time CBO was projecting stable debt/GDP, spending is down, not up," Kogan said in a tweet Friday night. "It's lower revenue that's 100% responsible for the change in debt projections. If you take away nothing else, leave with this point."

In his tweet, Kogan offered the following chart to show recent and projected levels of both federal revenue and spending relative to gross domestic product (GDP):

In a detailed analysis produced in March, Kogan explained that, "If not for the Bush tax cuts and their extensions—as well as the Trump tax cuts—revenues would be on track to keep pace with spending indefinitely, and the debt ratio (debt as a percentage of the economy) would be declining. Instead, these tax cuts have added $10 trillion to the debt since their enactment and are responsible for 57 percent of the increase in the debt ratio since 2001, and more than 90 percent of the increase in the debt ratio if the one-time costs of bills responding to COVID-19 and the Great Recession are excluded."

On Friday, the office of Sen. Sheldon Whitehouse (D-R.I.) cited those same numbers in a press release responding to the Treasury's new report.

"Tax giveaways for the wealthy are continuing to starve the federal government of needed revenue: those passed by former Presidents Trump and Bush have added $10 trillion to the debt and account for 57 percent of the increase in the debt-to-GDP ratio since 2001," read the statement. "If not for those tax cuts, U.S. debt would be declining as a share of the economy."

Whitehouse, who chairs the Senate Budget Committee, said the dip in federal revenue and growth in the overall deficit both have the same primary cause: GOP fealty to the wealthy individuals and powerful corporations that bankroll their campaigns.

"In their blind loyalty to their mega-donors, Republicans' fixation on giant tax cuts for billionaires has created a revenue problem that is driving up our national debt," Whitehouse said Friday night. "Even as federal spending fell over the last year relative to the size of the economy, the deficit increased because Republicans have rigged the tax code so that big corporations and the wealthy can avoid paying their fair share."

Offering a solution, Whitehouse said, "Fixing our corrupted tax code and cracking down on wealthy tax cheats would help bring down the deficit. It would also ensure teachers and firefighters don't pay higher tax rates than billionaires, level the playing field for small businesses, and promote a stronger economy for all."

None of the latest figures—those showing that tax cuts have injured revenues and therefore spiked deficits and increased debt—should be a surprise.

In 2018, shortly after the Trump tax cuts were signed into law, a Congressional Budget Office (CBo) report predicted precisely this result: that revenues would plummet; annual deficits would grow; and not even the promise of economic growth made by Republicans to justify the giveaway would be enough to make up the difference in the budget.

"The CBO's latest report exposes the scam behind the rosy rhetoric from Republicans that their tax bill would pay for itself," Sen. Chuck Schumer (D-N.Y.), and now Senate Majority Leader, said at the time.

"Republicans racked up the national debt by giving tax breaks to their billionaire buddies, and now they want everyone else to pay for them."

In its 2018 report, the CBO predicted the deficit would rise to $804 billion by the end of that fiscal year. Now, for all the empty promises and howling from the GOP and their allied deficit hawks, the economic prescription they forced through Congress has resulted in an annual deficit of more than double that, all while demanding the nation's poorest and most vulnerable pay the price by demanding key social programs—including food aid, education budgets, unemployment benefits, and housing assistance—be slashed.

Meanwhile, the GOP majority in the U.S. House—with or without a Speaker currently holding the gavel—still has plans to extend the Trump tax cuts if given half a chance. In May, a CBO analysis of that pending legislation found that such an extension would add an additional $3.5 trillion to the national debt.

"Republicans racked up the national debt by giving tax breaks to their billionaire buddies, and now they want everyone else to pay for them," Sen. Whitehouse said at the time. "It is one of life's great enigmas that Republicans can keep a straight face while they simultaneously cite the deficit to extort massive spending cuts to critical programs and support a bill that would blow up deficits to extend trillions in tax cuts for the people who need them the least."

Our work is licensed under Creative Commons (CC BY-NC-ND 3.0).

Feel free to republish and share widely.

JON QUEALLY

Jon Queally is managing editor of Common Dreams.

Full Bio >

JON QUEALLY

Jon Queally is managing editor of Common Dreams.

Full Bio >

No comments:

Post a Comment