China is Bringing Aquaculture to Deep Offshore Waters

[By Yingxin Feng]

Over 100 nautical miles off the coast of China in the Yellow Sea, a huge octagonal structure rests in the water. This is no new-look oil rig. It’s Deep Blue 1, China’s first offshore aquaculture base for farming salmon.

At its corners, the yellow octagon has steel columns extending 30 metres into the water. Enclosed by black mesh, they form a cage with a volume of 50,000 cubic metres, and room for 300,000 salmon. The yield is nearly 1,500 tonnes of fish per year.

Deep Blue 1 is merely a taster for future developments in Chinese offshore aquaculture. The Guoxin 1 aquaculture vessel is designed to produce 3,700 tonnes of fish annually. The ship cruises between the Yellow and South China seas, avoiding typhoons and “red tide” algal blooms, and keeping to waters in the 22C to 26C range suitable for the fish. This factory-type aquaculture vessel contains 15 tanks with a total volume of nearly 90,000 cubic metres. Stock density is four to six times that of traditional net pens.

The Guoxin 1 is a floating fish farm the size of an aircraft carrier. It has 15 fish tanks in its hold and aims to produce 3,700 tonnes of fish annually. In its first trial phase, the vessel produced more than 1,200 tonnes of large yellow croaker.

Following successful trials of the initial project, upgraded versions of the vessel, in the form of Guoxin 2 and Guoxin 3 are due for delivery in March 2024.

China is developing various forms of offshore aquaculture. According to data released in June by the Ministry of Agriculture and Rural Affairs, coastal provinces have already brought into use more than 20,000 “gravity cages” – each formed of a net and a floating collar – 40 steel-framed sea cages, like Deep Blue 1, and four aquaculture vessels. China’s offshore aquaculture currently spans nearly 44 million cubic metres of water, yielding almost 400,000 tonnes of seafood – more than 20% of national mariculture, or marine farming, output.

The ministry says: “With another five years, we aim to increase the scale of offshore aquaculture nationally by 16 million cubic metres, to more than 60 million cubic metres, and achieve annual offshore aquaculture output of more than 600,000 tonnes – more than 25% of sea-farmed fish products.”

Offshore aquaculture: known for its large scale

In the policy paper “The opinions on accelerating the development of offshore aquaculture”, jointly released in June by the Ministry of Agriculture and Rural Affairs and eight other Chinese government departments, offshore aquaculture is defined in a way that stresses the use of large-scale installations such as gravity cages, steel-framed cages, aquaculture platforms and aquaculture vessels, supported with mechanisation, automation and smart technology. They should all enable aquaculture to be undertaken at scale and efficiently in deep offshore waters, the paper states.

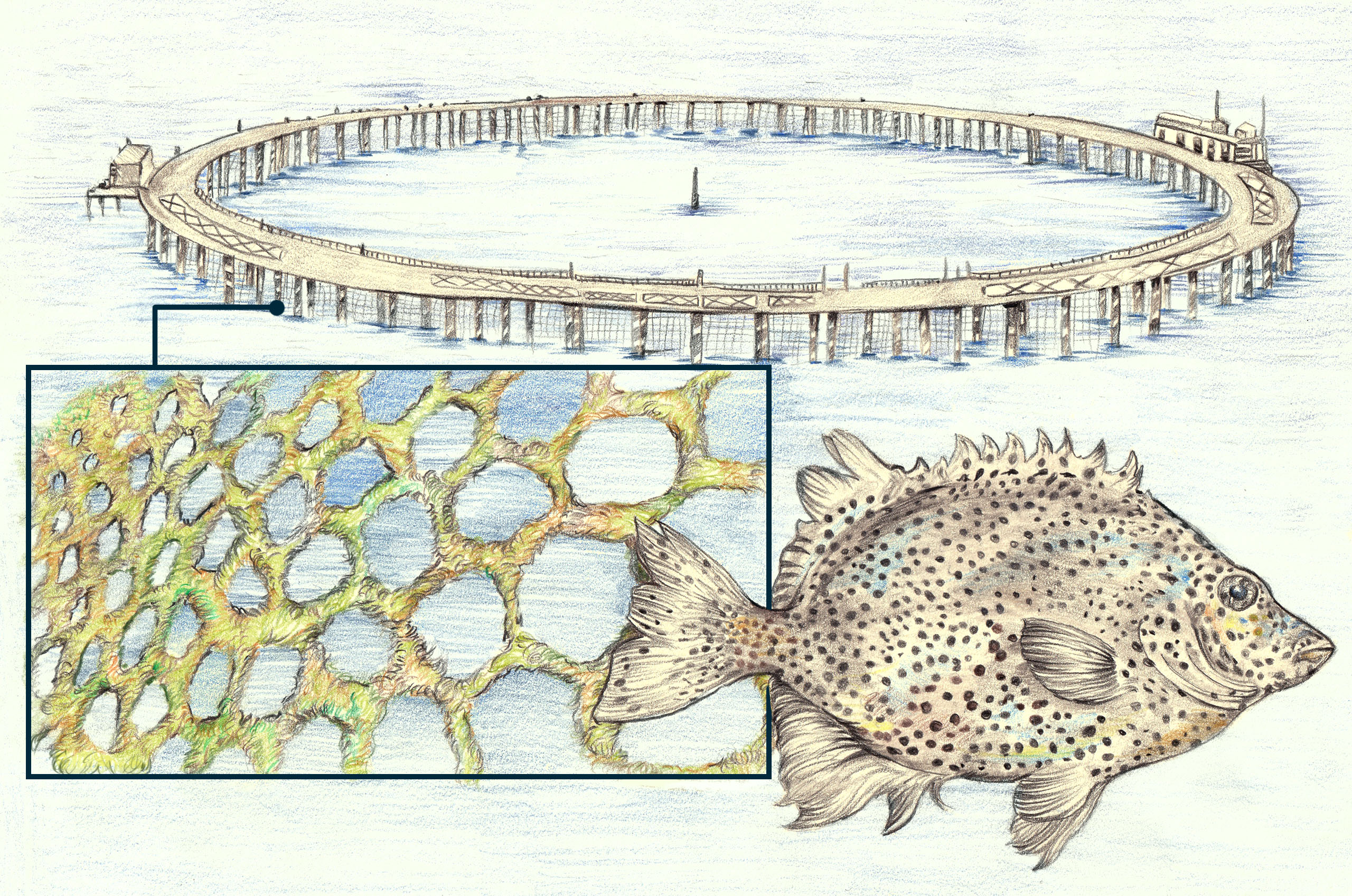

Another of China’s large-scale offshore fish farms is the Blue Diamond 1. Positioned 10km off the coast of Shandong province’s Laizhou Bay, this fenced sea-cage boasts a volume of 160,000 cubic metres, and is currently farming spotted knifejaw (Oplegnathus punctatus), a high-value sushi-grade species. The facility was built to withstand typhoon-strength winds and nine-metre waves. (Illustration: Ricardo Macía Lalinde / China Dialogue Ocean)

Another of China’s large-scale offshore fish farms is the Blue Diamond 1. Positioned 10km off the coast of Shandong province’s Laizhou Bay, this fenced sea-cage boasts a volume of 160,000 cubic metres, and is currently farming spotted knifejaw (Oplegnathus punctatus), a high-value sushi-grade species. The facility was built to withstand typhoon-strength winds and nine-metre waves. (Illustration: Ricardo Macía Lalinde / China Dialogue Ocean)

Offshore aquaculture operations are often large-scale in order to achieve cost reductions. This is necessary because they are situated far from land supplies, meaning it costs a lot to deliver feed, supply energy and transport catches. Increases in production capacity and centralising of operations are also needed to reduce costs.

Lin Ming, of the Chinese Academy of Engineering (CAE), explains in a paper that the greater the volume of a sea cage, the lower its per-unit operating costs and the higher its cost-effectiveness. Larger volumes of water also create conditions more like those in which wild fish grow, and generate a higher-quality yield. Cui Mingchao, an associate researcher at China’s Fishery Machinery and Instrument Research Institute (FMIRI), sums up the thinking behind the Guoxin 1 design as “big in capacity, with costs spread out”.

Similarly, experts advise selecting large fish species for farming. Guan Changtao points out that the scale of offshore aquaculture farms means they have high per-cage yields, with centralised harvesting and delivery to market. So, it is necessary to ensure that there is a market for the fully grown fish. Guan wants the industry to reach a consensus on jointly developing a setup based around five staple species: large yellow croaker, golden pompano, grouper, sea bass and flounder, along with fish such as cobia, brown croaker, seabream, and amberjack.

It is difficult to gauge market response as offshore fish farming is still being trialled. To date, only limited quantities of fish have been harvested and brought into the distribution chain. A senior figure in the fisheries media, who wishes to remain anonymous, tells China Dialogue that compared to catches of wild fish, yields from offshore aquaculture are currently more stable, and the model is more sustainable. Moreover, the quality of fish farmed far offshore is better than that of fish from near-shore operations, due to an obvious difference in water quality.

Offshore aquaculture products largely sit in the upper-middle price range. In the case of salmon, for example, the domestically produced offshore aquaculture product beats imports in terms of price and freshness.

Zhao Xiaoxia, deputy chief engineer of Guoxin 1, said in an interview that the vessel’s large yellow croaker currently sell for around twice the price of fish farmed inshore. Being quasi-wild is a distinct quality advantage, too, given that a wild individual could easily be sold for more than 1,000 yuan. As the industry develops and upgrades, it can be expected that there will more affordable, good-quality fish on the market, he added.

An urgent need for sustainable blue transformation

Rich in micronutrients and high-quality protein, aquatic products are becoming increasingly popular as a sustainable and healthy dietary choice. A report by the UN Food and Agriculture Organization (FAO) on the state of world fisheries indicates that global seafood consumption is now more than five times what it was 60 years ago, and as world population and income rise, the consumption of seafood will continue to grow.

Overfishing has long been a source of concern, so the spread of sustainable fisheries in recent years is a positive development. However, the FAO report states that the proportion of fish stocks at biologically sustainable levels decreased from 90% in 1974 to 64.6% in 2019, meaning that overfishing persists. Aside from the impact on biodiversity and ecosystems, this threatens fishery yields.

Overreliance on near-shore aquaculture is also problematic. China is the world’s largest producer and processor of aquatic products, with fish farms dotted all along its coastline. Previously dominant and cruder forms of fish farming have left a legacy of environmental pollution and ecological problems in the country’s near-shore waters. Direct discharge of fish farm effluents, accumulations of faecal matter and the uncontrolled use of fishery drugs – in particular, antibiotics – have all contributed to the degradation of coastal mangroves and the increasing occurrence of red tides. Research has shown that the increase in red tides correlates with the increase in shrimp farming.

Fortunately, conditions have eased for the near-shore ecology thanks to the pace of green development in recent years. In 2016, the Ministry of Agriculture and Rural Affairs required local authorities to delineate areas where aquaculture was prohibited, restricted or permitted by law, bringing structure to aquaculture distribution. The media reported that China removed 300,000 near-shore net pens and 2.4 million mu (160,000 hectares) of fish farms in 2018 alone. Guangdong, China’s leading fisheries province, has also demonstrated its commitment to curtailing near-shore aquaculture and shifting towards more environmentally friendly development further offshore, by mandating an “orderly withdrawal” of fish farming from waters shallower than 10 metres.

Another concern is the impact of climate change. The FAO report found that freshwater aquaculture was becoming more vulnerable in China due to the changing climate. It also noted that the country’s near-shore aquaculture operations are now being impacted by typhoon-related weather every two or three years, and that typhoons are becoming more frequent.

The UN group on nutrition states that moderate consumption of seafood does not necessarily increase the negative environmental impacts of production activities if their recommended supply and consumption protocols are followed. Organisations such as the FAO, The Nature Conservancy and WWF are unanimous in encouraging responsible marine aquaculture, which they regard as a solution to food problems and a way of developing a sustainable blue economy.

Findings from academia have also boosted confidence in marine aquaculture. A 2019 study analysing water samples collected near net pens off the coast of Panama found that coastal fish farms can have a relatively small pollution footprint if properly located. Research has also found that the feed-conversion ratio and carbon emissions for salmon farming are much lower than those for several other protein products such as pork and beef. Another study shows that a wide variety of fauna can often be found in or around mariculture farms, which may benefit localised ecological restoration.

It is against this backdrop that China has set its sights on the ocean expanses, where the water is cleaner, and begun exploring offshore aquaculture. As technology matures and is increasingly applied, offshore aquaculture can be expected to simulate wild environments and produce “blue” food – caught and cultivated in freshwater and marine environments – and to do so with precision and efficiency.

According to the FAO fisheries report, China’s total mariculture yield now far exceeds its catch from ocean fisheries. The “Opinions”, released in June this year by the nine government departments, are being viewed in the industry as a policy foundation that will last for years to come. There has been speculation in the industry that this may prompt a new wave of aquaculture in China headed by high-tech farms.

Offshore aquaculture’s marine ecology controversy

While some experts in the sector applaud the environmental positives associated with the development of offshore aquaculture, there has also been scepticism about the mariculture approach. Doubters say aquaculture systems of this kind simply shift the negative impacts out of sight while exacerbating them, as exemplified by the bigger carbon footprint that results from running facilities far offshore.

Hu Zhenyu, director of the Centre for Sustainable Development and Marine Economy, expressed this and other concerns in an article about the high carbon production, energy consumption and expense of aquaculture vessels. Guoxin 1, for example, extracts water from dozens of metres deep, around the clock, to ensure the water in its tanks is replaced 16 times a day. This relies on traditional diesel power, requiring fuel that is costly and difficult to resupply, while also generating exhaust gas, effluents, noise and other pollution.

As we shall see, Deep Blue 1 is even more controversial in terms of its ecological impact.

Sea temperatures in the middle of the Yellow Sea are lower than in surrounding areas. This particularly suits the valuable coldwater fish of the salmonid family being raised in Deep Blue 1. The low-temperature zone, which at 130,000 sq km is equivalent in size to Shandong province, is called the “Yellow Sea cold water mass”.

Since 2014, a team led by Professor Dong Shuanglin at Ocean University of China (OUC) has been working with the Shandong-based fisheries firm Wanzefeng Group to trial localised farming of Atlantic salmon in the area of the cold water mass. Having successfully regularised fish harvesting by Deep Blue 1, Wanzefeng Group are reported to be proposing an ambitious plan, called “12+1”. This entails developing an offshore aquaculture park, consisting of 12 upgraded Deep Blue 1 farms and a central integrated management platform, in the cold water mass zone.

China Dialogue spoke to a concerned marine ecologist who prefers to remain anonymous. They explained that the Yellow Sea cold water mass is sharply stratified by temperature, due to stable currents in the sea basin. These keep temperatures at the bottom low all year round, harbouring many cold-water species. The idea of using the cold water mass for aquaculture before establishing a marine protected area policy there, is inherently problematic, the ecologist continued.

Furthermore, the operation and development of projects such as Deep Blue 1 are constrained by ecological conditions in that area of the sea, said the ecologist. Deep Blue 1 is currently farming Atlantic salmon of Norwegian origin – a cold-water species suited to growing 13–15C waters. The ecologist points out that, firstly, the movement of throngs of fish inside sea cages churns water from the upper and lower layers, raising the temperature beyond what is suited to Atlantic salmon. And secondly, the area’s stable currents are not helpful for dispersing fishery pollutants.

The window of time suitable for fish farming in the area is also rather limited, according to the ecologist. In the winter, when temperatures in the cold water mass are lower, the farmed fish become lethargic and grow more slowly. Higher temperatures in summer, on the other hand, are not ideal for growth, and submersing the cage further into the low-temperature layer would risk wiping out the stock due to limited amounts of dissolved oxygen at the bottom. Deep Blue 1’s actual aquaculture production cycle is therefore relatively constrained. As publicly reported, the facility’s previous two harvests were carried out before summer, and the farmed fish had a growing period of only about six months in the cage.

The technology for operating Deep Blue 1 in cold water mass waters is not yet mature. It requires high levels of investment, due to the cost of the operations, and its long-term ecological impact needs to be further evaluated, says the ecologist.

In Deep Blue 1’s early days, it was struck by sharks which wrecked the cage, resulting in a number of fish breaking free

Regarding developing and exploiting the resources of the Yellow Sea cold water mass area, the ecologist suggested that the special habitat should be managed through the establishment of marine protected areas (MPAs) and no-trawl zones. Then the unique biodiversity and the high value fishery resources would be supported. Only at this point, could offshore farming models that are ecologically friendly and have high socio-economic benefits, be carried out in the area to secure blue food supply, the ecologist concluded.

Subsequent risks that cannot be ignored

The problem of fish escaping from deep-sea fish farms has long been a matter of concern, in China and elsewhere. When farmed fish enter the wild, they disrupt local food chains. They tend to grow fast but are ill-adapted to the natural environment. And by interbreeding, they alter the genetic makeup of wild populations, reducing survival rates for the young and affecting genetic diversity. Moreover, they are more likely to carry diseases, and can spread contagion to other communities of fish.

A study of Norwegian fish farms found that 92% of escapes involved marine fish farms. In Deep Blue 1’s early days, it was struck by sharks which wrecked the cage, resulting in a number of fish breaking free. Chile, which is number two in the world for salmon farming, is also a major source of fugitive salmonids, on account of storms, other extreme weather events, and sabotage by competitors. For this reason, it introduced new regulations earlier this year imposing fines for unrecovered catches of escaped fish, and operational bans of between one and four years. Aquaculture operators are also required to fund two years of marine monitoring to determine the derivative effects of any escapes.

The collapsed pens of an open-water farm rearing non-native Atlantic salmon off Cypress Island in the US state of Washington. When the pens collapsed in August 2017, over 200,000 fish escaped (Image: Washington State Department of Natural Resources / Flickr, CC BY-NC-ND)

The collapsed pens of an open-water farm rearing non-native Atlantic salmon off Cypress Island in the US state of Washington. When the pens collapsed in August 2017, over 200,000 fish escaped (Image: Washington State Department of Natural Resources / Flickr, CC BY-NC-ND)

Unlike in Norway and Chile, where there are fjords free of waves, China’s offshore aquaculture environment is heavily subject to oceanic wind and waves. In fact, the excessive safety risks associated with offshore aquaculture are a significant deterrent for aquaculture firms. In 2014, the fisheries sector in Hainan province suffered more than 2.7 billion yuan in direct losses as a result of super typhoon Rammasun. Extreme weather occurrences will become increasingly difficult to manage under climate change.

Records show that extreme waves along the coast of the South China Sea can be as high as 16 metres and exert 50,000 tonnes of force per 100 metres of wave front. The destructive power of the sea under such conditions is far worse than can be imagined. Take the example of HDPE (high-density polyethylene) deep-water sea cages, which are common in China’s offshore aquaculture industry. Analysis by Lin Ming of the Chinese Academy of Engineering indicates that cages of this kind would deform under catastrophic sea conditions, rendering their structure and anchoring system unsafe, and very likely resulting in the death or escape of farmed fish.

As a solution, Lin Ming’s team has proposed the construction of wave-dissipation installations close to aquaculture areas, cutting them off from the roughest of sea conditions behind gigantic “walls”. Earlier studies indicate that such installations can reduce a 16-metre wave to about 2 metres. Constructing offshore defences of this kind may in future mitigate the risks to offshore aquaculture posed by climate change and its impacts.

Yingxin Feng is a freelance writer and former environmental editor, with an MSc in Environmental Policy and Management from the University of Bristol.

This article appears courtesy of China DIalogue Ocean and may be found in its original form here.

No comments:

Post a Comment