Toronto councillor wants city staff to study office conversions

, BNN Bloomberg Oct 19, 2023

A Toronto city councillor has put forward a motion asking city staff to explore possible ways to convert office space into residential housing.

Brad Bradford introduced the motion at the city’s Planning and Housing Committee on Thursday. It asked staff to look at office conversion possibilities and consider what regulatory changes might be needed to make them happen.

Bradford’s motion highlighted that the city needs to remove barriers that impede the creation of new housing “at every opportunity.”

“I don't think, given the housing challenges that are in front of us today, we as a council or local government should be writing off any opportunities to deliver more housing supply in a market that desperately needs it,” Bradford told BNNBloomberg.ca in a Thursday interview.

Office conversions could be “one of many tools we need to put in our housing tool kit,” Bradford said, though they would not be an all-encompassing solution.

He noted that not all office floorplates can be easily converted into residential space, but argued that there is a need to remove barriers where possible.

In his motion, Bradford said the process of converting of older office buildings into housing units where possible should be simplified.

“This will require that we ensure relief from guidelines and other rules that make it difficult to convert office floor plates into housing,” his motion read. “This will also mean modernizing office replacement policies to unlock new housing supply and identify opportunities to secure affordable housing.”

Specifically, the study would look at potential zoning, regulatory or policy relief that might be needed to allow for economically viable office conversions.

The motion said it would also evaluate the possibility of “requiring the provision of affordable housing” instead of replacing office space, as is currently required when office space is removed in downtown Toronto neighbourhoods.

The motion asked that city staff report back to the committee with recommendations in the third quarter of 2024 “as part of the ongoing Office Space Needs Study.”

Bradford’s motion also highlighted that as of September 2023, downtown core occupancy rates were just 50 per cent of pre-pandemic levels. While some workplaces mandate a return to office others are continuing hybrid work policies, the motion notice.

“Given the changing nature of work and the ongoing housing crisis, it is time to revaluate the need for office space,” Bradford’s motion read.

City council has not yet voted on the motion.

Thursday’s motion stems from a letter to the council from Bradford earlier this month. The item will be considered by the Planning and Housing Committee later this month and will be subsequently considered by the City Council in November.

Veronica Green, vice president of Slate Asset Management, said in a statement to BNNBloomberg.ca that the city should consider the current and future supply and demand dynamics of office market conditions.

“Softening or dismantling” the language in Toronto’s official plans as it rates to office or non-residential space would be a step forward, she said.

“This will let the market react to current conditions to make effective decisions about where and how much office space Toronto needs,” Green said Thursday.

“Allowing office to residential conversions is one small step to support Toronto's housing supply problem; this can also support the city’s path to net zero by encouraging adaptive reuse of existing assets.”

OFFICE SPACE DEMAND

Bradford told BNNBloomberg.ca that within Toronto’s office market, the market for Class A space remains strong, because companies have been moving into those buildings from Class B and C office spaces after the COVID-19 pandemic.

Class A buildings are often new buildings in locations considered more desirable.

This trend presents a challenge, according to Bradford, who argued that higher vacancies in Class B and C buildings means as those buildings sit vacant, they are “further and further diminished” over time.

“From a policy perspective, we need to ask the question, do our office policies around conversion still make sense in today's context?” he said.

“If we could forecast five or 10 years from now, do we think we are going to have a huge sort of shortage of office space? Or do we think we're going to have a huge shortage of housing?”

Bradford said that the vast majority of the time, the city is not willing to engage in discussions around the conversion of office space, and as a result, the city rarely sees applications of that type come forth.

In June, Bradford ran as a mayoral candidate with the promise of changing zoning rules to simplify the process of converting offices into residential units.

At the time, he said he would eliminate the rule dictating office space be replaced on a foot-for-foot basis, if the development includes 20 per cent affordable housing.

Bradford ultimately lost the election to current Toronto Mayor Olivia Chow, but he has remained on city council.

CBRE report says office vacancy rate in Q2 rose to highest level since 1994

The national office vacancy rate in Canada climbed in the second quarter to its highest level since 1994, according to a report by commercial real estate firm CBRE

The firm said Tuesday that the national office vacancy rate rose to 18.1 per cent in the second quarter, up from 17.8 per cent in the first quarter.

It was the highest level since the first quarter of 1994 when it was 18.6 per cent.

"Canadian office markets are grappling with a perfect storm of a recession threat, interest rate hikes, tech sector weakness, tenants rightsizing and new supply of office space," CBRE said in a news release.

"All of this is compounded by the continued uncertainty around remote work."

The increase in the overall rate came as the downtown office vacancy rate in the second quarter rose to 18.9 per cent compared with 18.5 per cent in the first quarter. The suburban office vacancy rate was 17.1 per cent, up from 16.9 per cent.

CBRE said downtown vacancies in the second quarter inched higher in all major centres across the country except for Calgary and the Waterloo region in Ontario.

The downtown vacancy rate in Vancouver was 11.5 per cent in the second quarter, up from 10.4 per cent, while the rate in Toronto was 15.8 per cent, up from 15.3 per cent in the first quarter. Montreal saw its downtown rate rise to 17.0 per cent from 16.5 per cent.

Meanwhile, the downtown vacancy rate in Calgary was 31.5 per cent, down from 32.0 per cent in the first quarter. Waterloo Region's downtown rate was 21.5 per cent compared with 22.0 per cent in the first three months of the year.

CBRE said Calgary has benefited from the expansion of the engineering, construction and education sectors.

"Calgary is also working its way through several office building conversion projects, which will reduce inventory," the firm said.

CBRE said that before the pandemic, Canada claimed the two lowest-vacancy office markets in North America in Toronto and Vancouver, where downtown vacancy hovered around two per cent for several years.

The company said there is 11.5 million square feet of office space under construction including 6.2 million in Toronto, 2.7 million in Vancouver and 1.9 million in Montreal.

This report by The Canadian Press was first published July 4, 2023.

This is a corrected story. An earlier version incorrectly stated the national overall, downtown and suburban office vacancy figures for the first quarter.

Toronto developers keen to convert offices to

housing say city rules are a barrier

, BNN Bloomberg

Real estate developers say regulations are holding back efforts to convert empty Toronto office buildings into much-needed housing – but some candidates in the ongoing mayoral election, as well as the city itself, appear open to discussing policy changes.

The idea of converting office spaces into residential units picked up steam since the pandemic-induced shift to hybrid work. Recent reports suggest office occupancy rates in Canada may not bounce back to pre-2020 levels given the rise of hybrid work, and RE/MAX Canada has suggested cities take a hard look at converting offices into housing.

Some cities like Calgary are moving ahead with turning empty offices into apartments. But as it stands, office space in downtown Toronto neighbourhoods must be replaced if it is removed, creating a major barrier for such projects to move ahead in Canada’s largest city.

Jeff Hull, president of Hullmark, a real estate and development company, said his firm is keen to move into office-to-residential conversions. He considers it a way to boost affordable housing supply in a city that desperately needs it, and sees the appeal of sustainability arguments for the practice – that it’s more climate-friendly from an emissions point of view to reuse a building, rather than tear it down and construct a new one.

“We're very much interested in seeing how we can play a part in creating more housing supply through the conversion of office,” Hull told BNNBloomberg.ca in a telephone interview. “The main challenge is changing the regulatory framework.”

Hullmark already has several office properties, themselves conversions from old industrial buildings, which Hull said might work as residential buildings. The company has also looked at buying some other office properties to convert, Hull said, but regulations such as the office replacement rule have stopped them from taking the plunge.

CONVERSION CHALLENGES

Architect Duanne Render, whose firm Gensler has worked extensively on office conversions, said mainstream discussion of the office-to-residential idea has been a noteworthy change from three years ago, when he and colleagues would have been “laughed out of people’s offices bringing it up.”

Despite growing interest in making it work, the process is not without challenges, he said, and not all office buildings are good candidates.

Purpose-built offices have different floorplan and layout needs than apartment buildings, making some conversions less feasible. The projects are also costly, and generally need some kind of financial assistance to incentivize developers, like in Calgary where the city offered subsidies to support conversions in its waning downtown core.

Market dynamics can also help make the economic case for conversions, Render noted. In Toronto, where rents are particularly high, he said the math might work out for more developers to jump in to the space.

“Toronto is quite ripe to be able to support quite a few candidates,” he said.

Still, rules barring the removal of commercial office space are a major barrier, Render noted. But with housing a major mayoral election issue and growing developer interest, he predicts conversions will eventually take off in the city.

CITY CONSULTATIONS AND ONGOING PROJECTS

Gregg Lintern, chief planner at the City of Toronto, told BNNBloomberg.ca in an email that “increasing office vacancies resulting from the adoption of hybrid work models is an issue impacting cities across North America, including Toronto.”

The city is running a study on office market conditions that will look at the “benefits and risks” of converting office space for other purposes, and look at policy options “that balance office needs in the short and long term and ensure the City’s economic role remains competitive and resilient,” Lintern said.

In the meantime, there is an application before the city that would convert and build onto an exiting 15-storey heritage office building, turning it into a mixed-use retail and residential tower with more than 100 apartment units.

Matthew Kingston, executive vice-president of development and construction at H&R REIT, the company behind the proposed project, said talks are ongoing with the city to “find common ground” when it comes to the office retention policy.

“The challenge for us, is that the heritage retention and enhancement are so costly, that we are unable to make financial sense of our project if we replace the office fully,” Kingston said in an email to BNNBloomberg.ca

“That being said, city staff have been very open in dialogue with us and have proposed numerous options for us to consider. We are hopeful that we can work with them to find a mutually acceptable resolution.”

WHAT DO THE MAYORAL CANDIDATES SAY?

Some frontrunners in the upcoming mayoral vote set for June 26 have also weighed in on the issue, and promised to loosen regulations if elected.

Candidate Brad Bradford has promised to change zoning rules to make it easier to convert offices into homes. If elected, Bradford said he would eliminate the rule requiring office spaces be replaced foot-for-foot if the proposed development includes 20 per cent affordable housing.

He also promised to “ensure relief from guidelines and other rules that make it difficult to convert office floor plates into housing,” and as-of-right approvals for conversions that wouldn’t add on to a building, in a bid to speed up the zoning process.

Ana Bailão’s campaign said in an email that if elected, she would “reduce office replacement requirements when buildings are demolished or converted in exchange for affordable housing” as part of her plan to build 285,000 new homes.

Olivia Chow’s campaign said she is “open to exploring how we can animate unused office buildings, including converting some to housing and other uses, but it should be part of the broader conversation on how best the city can support recovery in Toronto’s downtown core,” among other models.

Anthony Furey said he would “100 per cent support” making it easier to flip offices to residential units with zoning rule changes, though he doesn’t consider it a primary solution for the city’s housing shortage.

Hullmark developer Hull said he’d like to see flexibility and a “really permissive policy environment” when it comes to office conversions, “acknowledging the fact that these are going to be hard and cost a lot of money” – but he’s not deterred by the roadblocks currently in his way.

“I like solving complex problems that end up being, I think, potentially really positive things for the future of the city,” he said.

Vacant offices can help fix the housing crisis, former deputy PM argues

BNN Bloomberg

Former deputy prime minister Sheila Copps says Canada needs to convert empty offices into housing units if it plans to fix the ongoing affordability and supply crisis.

Copps, who served as Liberal deputy prime minister under Jean Chrétien between 1993 and 1997, said Prime Minister Justin Trudeau’s Thursday announcement concerning removing GST from rental builds is a good step – but she thinks the measure should be extended to cover other kinds of housing developments.

“I think it needs to go further, and not just no GST for new builds – for rentals – but also for conversions and including conversion renovations,” she told BNN Bloomberg in a television interview on Friday.

“If you’re looking at high-density opportunities in downtown cores, it can’t just be new builds on new lots, it should also be for restorations and renovations, and that piece was missing from yesterday’s announcement.”

EMPTY OFFICES

The commercial real estate firm CBRE recently reported an 18.1 national office vacancy rate, the highest level since 1994. When it comes to downtown offices, the vacancy rate climbed to 18.9 per cent.

“All of the office space that is sitting vacant in malls and downtown cores across the country, why not have an office conversion attached to that, so you’re actually thinking outside the box (and) you’re fixing two problems for the price of one,” Copps said.

Office-to-housing conversions are not a new concept, but the idea has picked up steam in the pandemic as housing prices skyrocketed and more occupations embraced work from home.

In June, RE/MAX Canada suggested cities are taking a look at conversions though zoning rules and red tape make these projects difficult to get off the ground.

Meanwhile, the City of Calgary began subsidizing these conversions in 2021, with at least 10 such projects in the works. Calgary is one of two cities – along with Waterloo – without a declining office vacancy rate, according to the CBRE.

In Toronto, developers are keen to begin these conversions, but the city requires all removed office space to be replaced. The city is currently studying the market conditions to allow more office conversions.

With files from BNN Bloomberg’s Holly McKenzie-Sutter and The Canadian Press

What is it like to live in a converted office

building?

, BNN Bloomberg

As Canada grapples with a housing shortage, there has been growing interest in the idea of converting underused offices into apartment units.

While there are challenges to such conversion projects, some developers have pulled it off, with projects underway or completed in major Canadian cities.

Here is a look at one building in Winnipeg that was successfully converted from an office into a residential space, with perspective from tenants on what it is like to live there, and from the developer on how they made it work.

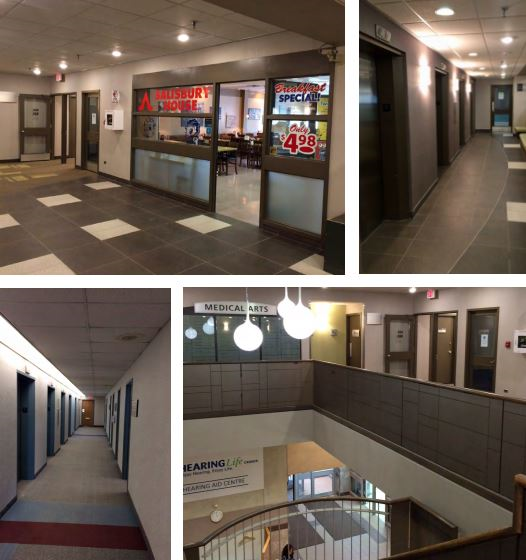

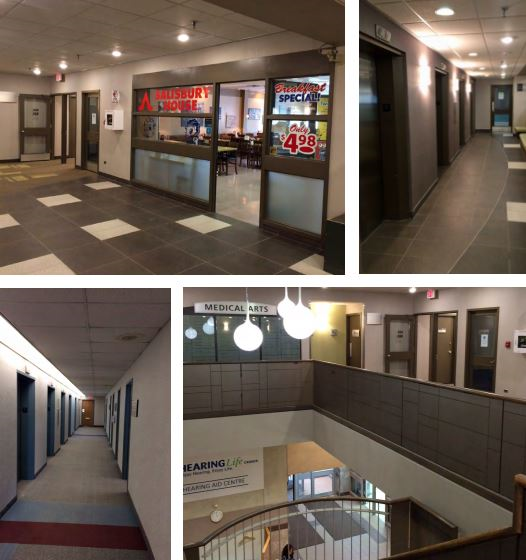

Hallways in the Medical Arts Building in Winnipeg before it was converted into apartments. (HAZELVIEW INVESTMENTS)

HOW DID IT HAPPEN?

Development company Hazelview Investments has converted two office buildings into residential apartments.

One of them, the Medical Arts Building in Winnipeg, added about 104 new rental units to the city’s downtown real estate market, opening its doors to residents in 2021.

Mike Williams, a managing partner and head of real estate development at Hazelview Investments, said the project was the result of office market conditions that had “deteriorated,” with high vacancy levels in Winnipeg.

Former office tenants in the building were able to sublease elsewhere, he explained, allowing the project to go ahead.

“We were left with a vacant office building that worked in our eyes for conversion to residential,” Williams told BNNBloomberg.ca in a telephone interview last month.

It took a few years for the conversion to begin because of the duration of some office lease contracts, Williams said. But after that, the project proceeded quickly and was completed in under two years – quicker than building a new residential tower from scratch, Williams added.

“We're able to move a little bit faster than probably traditional build,” he said.

A room in the Medical Arts Building in Winnipeg before it was converted into apartments. (HAZELVIEW INVESTMENTS)

CONVERSION INCENTIVES

Labour shortages, construction delays and can present roadblocks for conversions in Canada, Williams said. These challenges have arisen amid growing interest in the idea with office vacancies on the rise after the COVID-19 pandemic prompted more hybrid and remote working arrangements.

Regulatory hurdles can also pose challenges. For example, city rules in Toronto dictate that office space removed from the city’s downtown must be replaced, creating barriers for office-to-residential conversions.

Williams said there are generally more opportunities for these types of projects in western Canada, specifically in Calgary, where the city has offered incentives to developers for office conversion projects in response to high office vacancy rates.

Calgary was the location for Hazelview’s other office conversion project.

“They’re trying to find ways to continue to activate their downtown core and make it vibrant with more people living there if they're not going to be working there,” Williams said of Calgary’s initiative.

CONVERSION CHALLENGES

Developers have to consider many factors before converting an office building to residential use, Williams said, and not all offices are the right fit.

“Office buildings are meant to be used differently than residential buildings,” he said. In a residential building, “you're going have significantly more toilets and sinks and dishwashers and washing machines,” he explained.

“A traditional office building wasn't designed to have that same sort of building systems operational throughout the day,” he said.

A room in the Medical Arts Building in Winnipeg after it was converted into apartments. (HAZELVIEW INVESTMENTS)

Other changes need to be made during the conversion process, Williams said, including things like changing stair locations and upgrading HVAC systems that are not suitable for residential use.

Williams said many office buildings are not suitable to be converted because of these differences.

TENANTS’ PERSPECTIVE

Shey Rizi, a tenant of the Medical Arts Building, told BNNBloomberg.ca she was not initially aware of the building's previous use. When she went to see the place, she was “pleasantly surprised.”

“The space was bigger, the ceilings were higher,” she recalled in a telephone interview. “It was interesting. I liked it.”

A room in the Medical Arts Building in Winnipeg after it was converted into apartments. (HAZELVIEW INVESTMENTS)

On the inside of her rental unit, Rizi said there are high, industrial-style ceilings that are “quite spacious” and that the unit is a “bigger space with more flow to it.”

She said there are “pros and cons” to living in the space.

“I really like that they're using previously commercial buildings as residential buildings, in terms of using the space for making more homes. I thought that was a great idea," she said, adding that she appreciates how converting underutilized office space is environmentally conscious.

As for the downsides, Rizi has noticed “some minor details” missing because the building’s previous use, such as a lack of cupboards and spaces for appliances.

Hannah Gibbens, another rental tenant in the building, had been looking for a place to live in mid-March before moving in on July 1.

She told BNNBloomberg.ca she could “hardly tell” the building was formerly an office building, but there are some noticeable features, like concrete walls and ceilings.

Overall, Gibbens said she supports the conversion of underutilized office space to residential purposes, referencing an “incredible amount” of empty buildings or underutilized buildings in Winnipeg.

“We're also really, really hurting for affordable housing,” she said. “We have the space. Why are we not just converting it into housing for people?”

, BNN Bloomberg

As Canada grapples with a housing shortage, there has been growing interest in the idea of converting underused offices into apartment units.

While there are challenges to such conversion projects, some developers have pulled it off, with projects underway or completed in major Canadian cities.

Here is a look at one building in Winnipeg that was successfully converted from an office into a residential space, with perspective from tenants on what it is like to live there, and from the developer on how they made it work.

Hallways in the Medical Arts Building in Winnipeg before it was converted into apartments. (HAZELVIEW INVESTMENTS)

HOW DID IT HAPPEN?

Development company Hazelview Investments has converted two office buildings into residential apartments.

One of them, the Medical Arts Building in Winnipeg, added about 104 new rental units to the city’s downtown real estate market, opening its doors to residents in 2021.

Mike Williams, a managing partner and head of real estate development at Hazelview Investments, said the project was the result of office market conditions that had “deteriorated,” with high vacancy levels in Winnipeg.

Former office tenants in the building were able to sublease elsewhere, he explained, allowing the project to go ahead.

“We were left with a vacant office building that worked in our eyes for conversion to residential,” Williams told BNNBloomberg.ca in a telephone interview last month.

It took a few years for the conversion to begin because of the duration of some office lease contracts, Williams said. But after that, the project proceeded quickly and was completed in under two years – quicker than building a new residential tower from scratch, Williams added.

“We're able to move a little bit faster than probably traditional build,” he said.

A room in the Medical Arts Building in Winnipeg before it was converted into apartments. (HAZELVIEW INVESTMENTS)

CONVERSION INCENTIVES

Labour shortages, construction delays and can present roadblocks for conversions in Canada, Williams said. These challenges have arisen amid growing interest in the idea with office vacancies on the rise after the COVID-19 pandemic prompted more hybrid and remote working arrangements.

Regulatory hurdles can also pose challenges. For example, city rules in Toronto dictate that office space removed from the city’s downtown must be replaced, creating barriers for office-to-residential conversions.

Williams said there are generally more opportunities for these types of projects in western Canada, specifically in Calgary, where the city has offered incentives to developers for office conversion projects in response to high office vacancy rates.

Calgary was the location for Hazelview’s other office conversion project.

“They’re trying to find ways to continue to activate their downtown core and make it vibrant with more people living there if they're not going to be working there,” Williams said of Calgary’s initiative.

CONVERSION CHALLENGES

Developers have to consider many factors before converting an office building to residential use, Williams said, and not all offices are the right fit.

“Office buildings are meant to be used differently than residential buildings,” he said. In a residential building, “you're going have significantly more toilets and sinks and dishwashers and washing machines,” he explained.

“A traditional office building wasn't designed to have that same sort of building systems operational throughout the day,” he said.

A room in the Medical Arts Building in Winnipeg after it was converted into apartments. (HAZELVIEW INVESTMENTS)

Other changes need to be made during the conversion process, Williams said, including things like changing stair locations and upgrading HVAC systems that are not suitable for residential use.

Williams said many office buildings are not suitable to be converted because of these differences.

TENANTS’ PERSPECTIVE

Shey Rizi, a tenant of the Medical Arts Building, told BNNBloomberg.ca she was not initially aware of the building's previous use. When she went to see the place, she was “pleasantly surprised.”

“The space was bigger, the ceilings were higher,” she recalled in a telephone interview. “It was interesting. I liked it.”

A room in the Medical Arts Building in Winnipeg after it was converted into apartments. (HAZELVIEW INVESTMENTS)

On the inside of her rental unit, Rizi said there are high, industrial-style ceilings that are “quite spacious” and that the unit is a “bigger space with more flow to it.”

She said there are “pros and cons” to living in the space.

“I really like that they're using previously commercial buildings as residential buildings, in terms of using the space for making more homes. I thought that was a great idea," she said, adding that she appreciates how converting underutilized office space is environmentally conscious.

As for the downsides, Rizi has noticed “some minor details” missing because the building’s previous use, such as a lack of cupboards and spaces for appliances.

Hannah Gibbens, another rental tenant in the building, had been looking for a place to live in mid-March before moving in on July 1.

She told BNNBloomberg.ca she could “hardly tell” the building was formerly an office building, but there are some noticeable features, like concrete walls and ceilings.

Overall, Gibbens said she supports the conversion of underutilized office space to residential purposes, referencing an “incredible amount” of empty buildings or underutilized buildings in Winnipeg.

“We're also really, really hurting for affordable housing,” she said. “We have the space. Why are we not just converting it into housing for people?”

No comments:

Post a Comment