Yale Environment 360

Wed, November 1, 2023

A liquefied natural gas import terminal near Porto Levante, Italy.

MARCO SABADIN / AFP VIA GETTY IMAGES

As part of its efforts to wean itself off Russian energy, Europe has sought to import more natural gas from overseas, erecting new terminals for processing deliveries of liquefied natural gas. But this new capacity is set to far exceed demand, an analysis finds.

With war roiling energy markets, Europe has aimed to swap gas delivered by Russian pipeline for liquefied natural gas (LNG) delivered by ship, largely from the U.S. and Qatar. From the beginning of last year, Europe has added six new LNG terminals, expanded an existing terminal, and restored a dormant terminal.

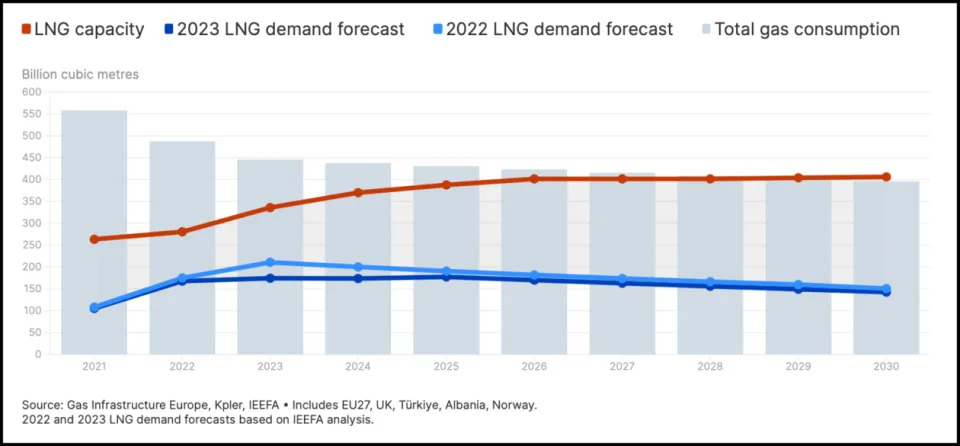

But much of that new infrastructure may prove unnecessary as European gas consumption declines, according to the Institute for Energy Economics and Financial Analysis. Europe’s recent efforts to build out renewables and curb gas consumption are paying off. After a surge in imported LNG in 2022, it has seen imports flatten out this year.

As part of its efforts to wean itself off Russian energy, Europe has sought to import more natural gas from overseas, erecting new terminals for processing deliveries of liquefied natural gas. But this new capacity is set to far exceed demand, an analysis finds.

With war roiling energy markets, Europe has aimed to swap gas delivered by Russian pipeline for liquefied natural gas (LNG) delivered by ship, largely from the U.S. and Qatar. From the beginning of last year, Europe has added six new LNG terminals, expanded an existing terminal, and restored a dormant terminal.

But much of that new infrastructure may prove unnecessary as European gas consumption declines, according to the Institute for Energy Economics and Financial Analysis. Europe’s recent efforts to build out renewables and curb gas consumption are paying off. After a surge in imported LNG in 2022, it has seen imports flatten out this year.

IEEFA

With new LNG infrastructure still coming online, the analysis found, Europe will be able to import 406 billion cubic meters of natural gas by 2030, slightly more than the 400 billion cubic meters of natural gas it is projected to consume in total.

“The decline in gas demand is challenging the narrative that Europe needs more LNG infrastructure to reach its energy security goals,” said analyst Ana Maria Jaller-Makarewicz. “The data is showing that we don’t.”

Experts have warned that new LNG infrastructure could incentivize future consumption of natural gas even as countries must cut fossil fuel use to avert dangerous climate change. A new report from the International Energy Agency finds that the global buildout of LNG infrastructure threatens to create a supply glut, which could cause prices to crater later this decade.

Chevron in talks on 15-year LNG supply contracts into Europe

Thu, November 2, 2023

FILE PHOTO: Illustration shows Chevron logo and natural gas pipeline

By Ron Bousso

LONDON (Reuters) - Chevron is negotiating contracts to supply liquefied natural gas (LNG) into Europe for up to 15 years as buyers expect the region to rely on imports for longer than previously thought, an executive at the U.S. oil and gas company said.

The new willingness by buyers to agree on long-term supply deals comes after several European governments rolled back some green policies citing higher costs and economic concerns.

European imports of the super-chilled fuel surged after Russia halted pipeline gas exports in the wake of Moscow's invasion of Ukraine last year.

Buyers initially sought short-term LNG supply of up to 5 years due to the uncertainty in the market and countries' ambitions to reduce their reliance on fossil fuels.

But that has changed as the focus on securing energy supplies grew, Colin Parfitt, head of Chevron's trading, shipping and pipeline operations, told Reuters on Wednesday.

"There's been an evolution over the past 18 months from short-term and spot supply deals to longer term commitment," Parfitt said.

"After Russia-Ukraine, the initial thoughts we were getting out of Europe were 'we only want LNG for a short period of time because of the energy transition'. What I've seen happening in the last year is that lengths of contracts customers are willing to sign have been extended," Parfitt said.

"European customers want medium-term deals in the up to 15 years space and we're working on some commercial deals."

Last month, Shell and TotalEnergies agreed on two separate 27-year LNG supply deals into Europe with Qatar, one of the world's top producers.

Chevron will supply most of the LNG from the United States, which has become a major LNG exporter following the shale boom in recent years.

U.S. LNG exports hit their second highest level on record in October, with Europe remaining the principal buyer.

In the short term, Parfitt said the European market looked well supplied ahead of winter.

"In the short term European gas looks well supplied, softer than last year but with risk of volatility if you get a cold winter in Europe, cold winter in Asia, risks to supply as well as geopolitics."

(Reporting by Ron Bousso; Editing by Emelia Sithole-Matarise)

New Fortress Energy may need to reapply for Mexico LNG permit -US

Wed, November 1, 2023

By Curtis Williams

HOUSTON (Reuters) - The U.S. Department of Energy (DOE) has warned New Fortress Energy if any portion of its Altamira floating liquefied natural gas (LNG) project is located onshore Mexico, the company will have to resubmit its application for an export permit.

New Fortress's $1.3 billion Altamira LNG project was expected to start shipping the superchilled gas this month under an export permit issued in June. If the company must reapply for a U.S. export permit, it could further delay the two-phase project.

New Fortress did not immediately reply to a request for comment submitted through its website.

The company has received a U.S. license to export Altamira's LNG to Free Trade Agreement (FTA) countries, but not the larger set of non-FTA countries. New Fortress has proposed many LNG projects that use converted offshore oil production rigs to support LNG processing.

Altamira was originally designed with two facilities - Fast LNG1 on converted oil platforms and Fast LNG2 on three fixed platforms. The entire project is set to be Mexico's first producing and exporting LNG facility. It would use U.S.-sourced gas, the DOE wrote.

"If the project site and design have been modified such that FLNG2 will be located onshore in Mexico instead of offshore, NFE Altamira is required ...to request an amendment of its FTA order," the department wrote on Oct. 30.

The DOE's letter pointed to a corporate press release and an Oct. 16 securities filing that suggested the project was a hybrid, with FLNG1 located offshore and FLNG2 set onshore.

The configuration requires clarification, the DOE added, since it might not meet the terms of the export license that governs both parts.

In June, Mexico's government granted NFE a permit to export up to 7.8 million metric tons through April 2028.

Its existing U.S. FTA authorization allowed it to supply LNG to Mexico and other countries with free trade pacts. The project awaits a decision on its application for a non-FTA export permit.

(Reporting by Curtis Williams in Houston; Editing by Josie Kao)

No comments:

Post a Comment