Martin Fornusek

Wed, December 20, 2023

Six vessels carrying almost 5 million barrels of Russian oil failed to reach their destinations in India, some idling kilometers off the coast for weeks without providing a reason, Bloomberg reported on Dec. 20.

Recent U.S. sanctions targeting the violators of the $60-per-barrel price cap could partially be the reason, the news outlet speculated.

The U.S. Treasury Department sanctioned the NS Century ship, belonging to the Russian Sovcomflot shipping company, on Nov. 16 for violating the price cap.

Two days later, the vessel halted south of Sri Lanka while carrying Russian oil to the Indian port of Vadinar, Bloomberg wrote.

In the past week, NS Century was later reportedly joined by two other Sovcomflot-owned tankers carrying oil to Vadinar.

Two more tankers heading to another Indian port, Paradip, also came to a sudden stop before reaching their destinations, and another ship may soon join them, according to Bloomberg.

Five of the listed vessels belong to Sovcomflot.

Both the U.S. and the EU began ramping up sanctions to enforce the price cap on Russian seaborne crude. The measure was imposed last year to limit Moscow's oil revenue without destabilizing global markets.

Although Russia managed to largely avoid the cap in recent months by using a fleet of uninsured "ghost" tankers, Russian oil and gas profits dropped by 41% in 2023 amid tightening sanctions.

With the West weaning itself off Russian oil, Moscow turned to new markets like China and India, offering discount prices.

India is an especially important customer for Russia, as it has been buying more than 60% of Russia's seaborne oil, making it the second buyer of Russian seaborne crude after China.

5 million barrels of Russian oil on the way to India never arrived

Phil Rosen

Wed, December 20, 2023

Millions of barrels of Russian oil heading to India never reached their destination, per Bloomberg.

The tankers holding the cargoes are now idling at sea.

US sanctions on Russia may be part of why the ships never completed their deliveries.

Roughly five million barrels of Russian oil that was on the way to India never reached their destination, according to a Bloomberg report.

The cargoes of Russia's Sokol grade crude were supposed to arrive over the past four weeks, but instead the relevant tankers are idling at sea, miles out from their intended ports.

It's unclear why the ships haven't arrived, per the report, but sanctions on sellers moving Russian crude above the $60 price cap set by G7 nations may be part of the explanation.

The US Treasury has sanctioned eight ships tied to the crude cargoes since October, with six of them owned by Russia's Sovcomflot PJSC.

One vessel, which was headed to the port Vadinar in India, has been idle since November 16 near Sri Lanka, Bloomberg reported. Two more Sovcomflot ships heading to the same place have joined it in the past week.

Meanwhile, three other ships heading to the Paradip port in east India should have arrived by now but have not.

The issue comes as Russia's weekly oil flows rose to the highest level in five months in the seven days up to December 10, Bloomberg shipping data showed. Exports in that stretch hit 3.76 million barrels a day.

That increase comes as OPEC+ have committed to reducing crude production to help stabilize prices. The group plans to cut production by a total of 2.2 million barrels a day through the first quarter of 2024, with some of that coming from Russia.

Oil prices have softened over recent weeks amid a US production boom and an uncertain demand outlook. On Wednesday, West Texas Intermediate moved 1.69% higher to $75.18 a barrel. Brent crude, the international benchmark, climbed 1.51% to $80.46 a barrel.

Russia’s Crude Flows Stay Strong Despite Baltic Port Stoppage

Julian Lee

BLOOMBERG

Tue, December 19, 2023

Tue, December 19, 2023

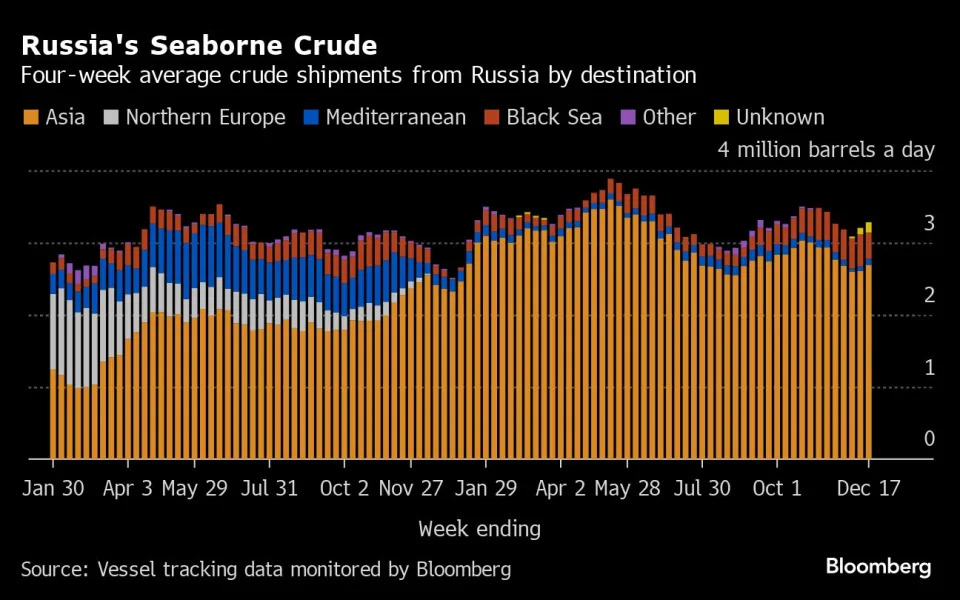

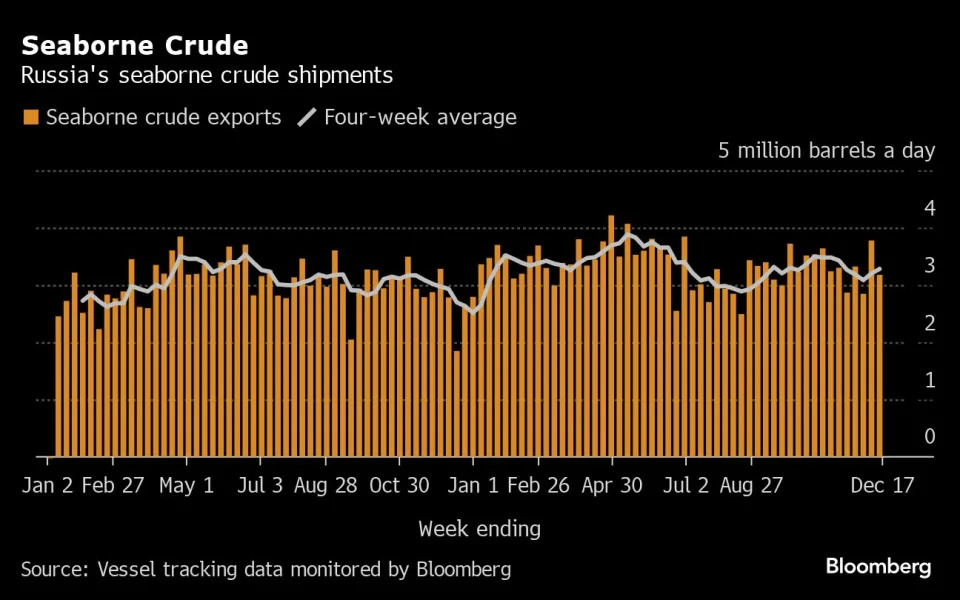

(Bloomberg) -- Russia’s seaborne crude exports climbed again on a four-week average basis, despite a dip in weekly flows driven by a brief pause in shipments from the Baltic port of Primorsk.

About 3.28 million barrels a day of crude were shipped from Russian ports in the four weeks to Dec. 17, tanker-tracking data monitored by Bloomberg show. That was up by 80,000 barrels a day from the revised figure for the period to Dec. 10. The more volatile weekly average gave up about two-thirds of the previous week’s increase, with a four-day gap in loading schedules at Primorsk suggesting planned work affecting the port.

About 1.7 million barrels a day of Russia’s crude exports pass through the Red Sea, where merchant vessels are increasingly coming under attack from Houthi rebels in Yemen. Tankers carrying Moscow’s oil are unlikely to be targeted, but that doesn’t rule out the risk of a ship carrying Russian supplies being hit by mistake.

The figure for weekly flows fell sharply, driven in part by the work at Primorsk. Using this measure, shipments fell to 3.18 million barrels a day, down by about 600,000 barrels a day from the revised figure for the period to Dec. 10.

Four-week average crude shipments were about 300,000 barrels a day below their May-June level — the baseline used by Moscow for the reduction in combined crude and product exports it has pledged to its partners in the OPEC+ group.

Russia will deepen its oil export cuts to 500,000 barrels a day below the May-June average during the first quarter of next year, after Saudi Arabia said it would prolong its unilateral one-million-barrel-a-day supply reduction and several other members of the OPEC+ group agreed to make further output curbs. The Russian cut will be shared between crude shipments, which will be reduced by 300,000 barrels a day, and refined products, according to Deputy Prime Minister Alexander Novak.

For the rest of 2023, the reduction is set at 300,000 barrels a day, spread across both crude and refined products in undefined proportions. That complicates assessments of whether Russia is meeting its commitment to its OPEC+ partners.

Russia’s oil processing climbed to the highest since early April, making up for a recent decline caused by logistical constraints resulting from storms in the Black Sea. The Kremlin’s weekly revenues from oil export duties slipped after the previous week’s jump to the highest level for the year. From January, Russia’s oil producers are set to pay a higher output tax to fund increased downstream subsidies, which were reinstated in October after being halved the previous month.

Flows by Destination

Russia’s seaborne crude flows in the four weeks to Dec. 17 rose to 3.28 million barrels a day. That was up from a revised 3.2 million barrels a day in the period to Dec. 10. Shipments were about 300,000 barrels a day below the average seen in volumes in May and June.

All figures exclude cargoes identified as Kazakhstan’s KEBCO grade. Those are shipments made by KazTransoil JSC that transit Russia for export through Novorossiysk and the Baltic port of Ust-Luga and are not subject to European Union sanctions or a price cap.

The Kazakh barrels are blended with crude of Russian origin to create a uniform export grade. Since Russia’s invasion of Ukraine, Kazakhstan has rebranded its cargoes to distinguish them from those shipped by Russian companies.

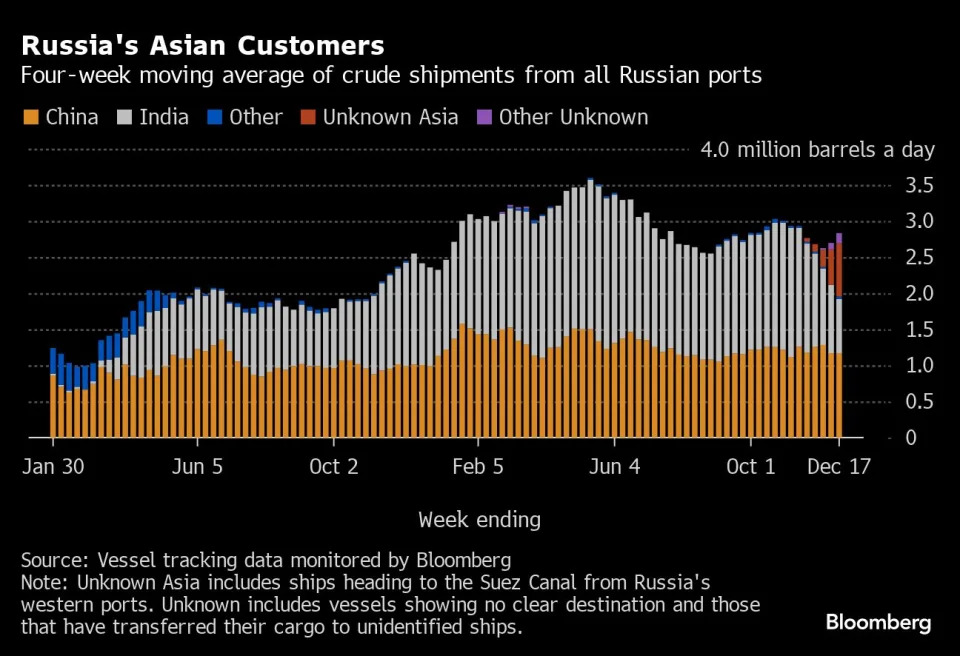

Asia

Observed shipments to Russia’s Asian customers, including those showing no final destination, rose to 2.83 million barrels a day in the four weeks to Dec. 17, up from a revised 2.7 million barrels a day in the period to Dec. 10.

About 1.17 million barrels a day of crude was loaded onto tankers heading to China in the four weeks to Dec. 17. China’s seaborne imports are supplemented by about 800,000 barrels a day of crude delivered directly from Russia by pipeline, either directly, or via Kazakhstan.

Flows on ships signaling destinations in India averaged about 750,000 barrels a day in the four weeks to Dec. 17.

Both the Chinese and Indian figures will rise as the discharge ports become clear for vessels that are not currently showing final destinations.

The equivalent of about 740,000 barrels a day was on vessels signaling Port Said or Suez in Egypt, or are expected to be transferred from one ship to another off the South Korean port of Yeosu. Those voyages typically end at ports in India or China and show up in the chart below as “Unknown Asia” until a final destination becomes apparent.

The “Other Unknown” volumes, running at about 140,000 barrels a day in the four weeks to Dec. 10, are those on tankers showing no clear destination. Most of those cargoes originate from Russia’s western ports and go on to transit the Suez Canal, but some could end up in Turkey. Others could be moved from one vessel to another, with most such transfers now taking place in the Mediterranean, off the coast of Greece.

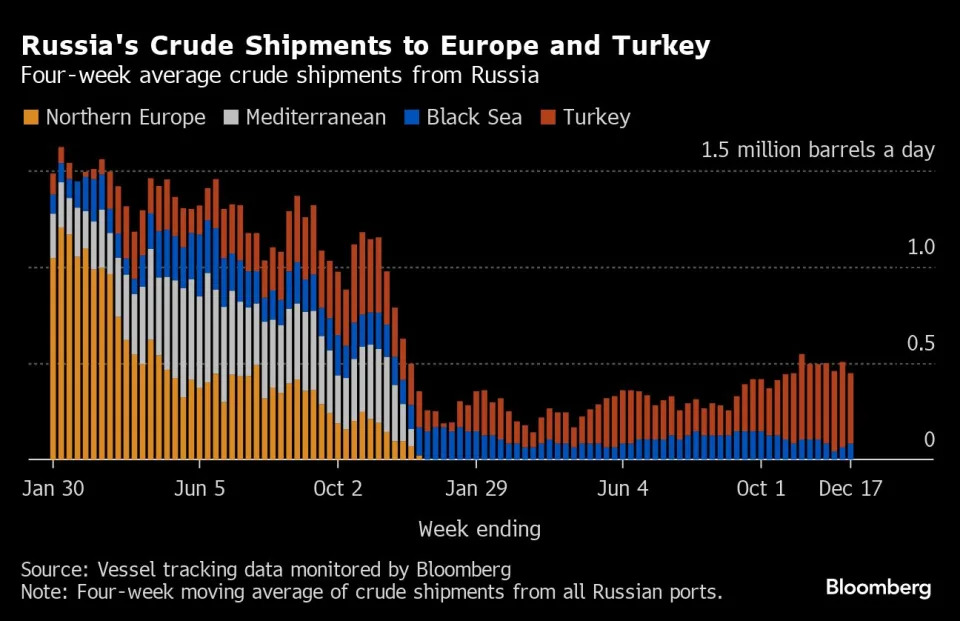

Europe and Turkey

Russia’s seaborne crude exports to European countries have collapsed since Moscow’s troops invaded Ukraine in February 2022. A market that consumed about 1.5 million barrels a day of short-haul seaborne crude, coming from export terminals in the Baltic, Black Sea and Arctic has been lost almost completely, to be replaced by long-haul destinations in Asia that are much more costly and time-consuming to serve.

Combined flows to Turkey and Bulgaria, Russia’s only two remaining buyers close to its western ports, have stabilized between about 450,000 and 500,000 barrels a day, tanker-tracking data show.

Exports to Turkey slipped to a seven-week low of about 365,000 barrels a day in the four weeks to Dec. 17. They are still close to three times as high as the lows they hit in July and August.

Flows to Bulgaria, now Russia’s only European market for crude, edged up to about 83,000 barrels a day in the most recent four-week period. Flows are recovering from earlier disruption at Novorossiysk, though the halt to shipments from the Black Sea port will continue to affect the average until year-end. Bulgaria’s parliament on Monday approved a measure that will end imports of Russian oil from March, nine months earlier than permitted under an exemption to EU sanctions on purchases of Moscow's oil.

No Russian crude was shipped to northern European countries, or those in the Mediterranean in the four weeks to Dec. 17.

Vessel-tracking data are cross-checked against port agent reports as well as flows and ship movements reported by other information providers including Kpler and Vortexa Ltd.

Export Revenue

Inflows to the Kremlin's war chest from its crude-export duty fell back to $75 million in the seven days to Dec. 17. Meanwhile four-week average income rose, increasing by $1 million to a five-week high of $79 million.

The rate for December is $3.37 a barrel, based on an average Urals price of $79.23 during the calculation period between Oct. 15 and Nov. 14. That was about $9.39 a barrel below Brent over the same period.

Export duty is set to be abolished at the end of this year as part of Russia’s long-running tax reform plans.

Origin-to-Location Flows

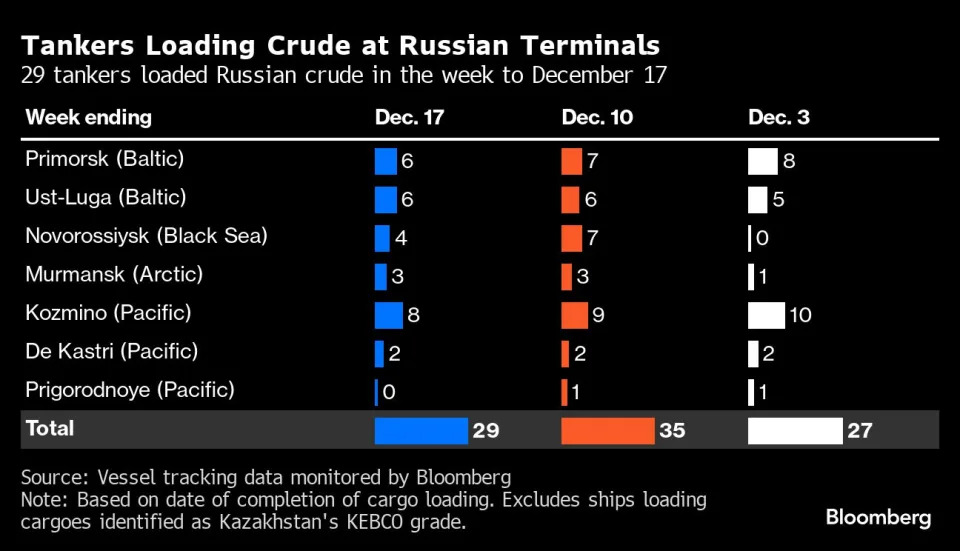

The following table shows the number of ships leaving each export terminal.

A total of 29 tankers loaded 22.2 million barrels of Russian crude in the week to Dec. 17, vessel-tracking data and port agent reports show. That’s down by about 4.2 million barrels from the revised figure for the previous week.

A four-day gap in the loading program for Primorsk suggests that planned work at the port, or the pipeline serving it, may have impacted flows last week.

All figures exclude cargoes identified as Kazakhstan’s KEBCO grade. One cargo of KEBCO were loaded at Novorossiysk and one at Ust-Luga during the week.

NOTES

Note: This story forms part of a weekly series tracking shipments of crude from Russian export terminals and the export duty revenues earned from them by the Russian government. Weeks run from Monday to Sunday. The next update will be on Tuesday, Jan. 2.

Note: All figures exclude cargoes owned by Kazakhstan’s KazTransOil JSC, which transit Russia and are shipped from Novorossiysk and Ust-Luga as KEBCO grade crude.

If you are reading this story on the Bloomberg terminal, click here for a link to a PDF file of four-week average flows from Russia to key destinations.

--With assistance from Sherry Su.

©2023 Bloomberg L.P.

U.S. imposes more Russian oil price cap sanctions and issues new compliance rules for shippers

FATIMA HUSSEIN

Wed, December 20, 2023

The U.S. has imposed new sanctions on alleged violators of the price cap on Russian oil and tightened compliance rules for insurance firms and shippers that move Russian oil. Firms from the United Arab Emirates and Hong Kong have been identified for economic sanctions.

(AP Photo/Patrick Semansky, File)

WASHINGTON (AP) — The U.S. imposed new sanctions on alleged violators of a $60 per barrel price cap on Russian oil and tightened compliance rules for insurance firms and shippers, Wednesday.

Firms across the United Arab Emirates and Hong Kong were identified for economic sanctions, including UAE-based Sun Ship Management D Ltd., which Russian state-owned fleet operator Joint Stock Company Sovcomflot owns. Also sanctioned were Hong Kong-based Covart Energy, which has increased its share of the trade of Russian oil since the price cap policy was implemented, and Hong Kong-based Bellatrix Energy.

Firm administrators were not available for comment to The Associated Press. The sanctions, which follow others imposed this year on shippers of Russian oil priced above the cap, block their access to their U.S.-owned property and prevent U.S. individuals and firms from doing business with the groups.

The price cap coalition also announced Wednesday that it will soon require service providers, including shippers and movers of Russian oil, to receive attestations from their purchasers and sellers each time they lift or load Russian oil.

The coalition will also require insurance and freight firms to share these documents upon request with entities further down the supply chain, a Treasury news release states.

Deputy Treasury Secretary Wally Adeyemo said the sanctions “demonstrate our commitment to upholding the principles of the price cap policy, which advance the goals of supporting stable energy markets while reducing Russian revenues to fund its war against Ukraine.”

“Participants in the maritime transport of Russian oil," he said, “must adhere to the compliance guidelines agreed upon by the Price Cap Coalition or face the consequences.”

The United States, European Union, countries in the Group of Seven and Australia, imposed a $60 a barrel limit last year on Russian oil.

Any purchases above the cap would violate the agreed-upon policy. The cap was designed to deprive the Kremlin of revenue to fund its war in Ukraine, forcing the Russian government either to sell its oil at a discount or divert money for a costly alternative shipping network.

The price cap was rolled out to equal parts skepticism and hopefulness that the policy would stave off Russian President Vladimir Putin’s invasion of Ukraine.

In addition to the price cap, the allied nations have hit Russia with thousands of sanctions over the course of the nearly three-year war. The sanctions are aimed at bank and financial transactions, technology imports, manufacturing and Russians with government connections.

WASHINGTON (AP) — The U.S. imposed new sanctions on alleged violators of a $60 per barrel price cap on Russian oil and tightened compliance rules for insurance firms and shippers, Wednesday.

Firms across the United Arab Emirates and Hong Kong were identified for economic sanctions, including UAE-based Sun Ship Management D Ltd., which Russian state-owned fleet operator Joint Stock Company Sovcomflot owns. Also sanctioned were Hong Kong-based Covart Energy, which has increased its share of the trade of Russian oil since the price cap policy was implemented, and Hong Kong-based Bellatrix Energy.

Firm administrators were not available for comment to The Associated Press. The sanctions, which follow others imposed this year on shippers of Russian oil priced above the cap, block their access to their U.S.-owned property and prevent U.S. individuals and firms from doing business with the groups.

The price cap coalition also announced Wednesday that it will soon require service providers, including shippers and movers of Russian oil, to receive attestations from their purchasers and sellers each time they lift or load Russian oil.

The coalition will also require insurance and freight firms to share these documents upon request with entities further down the supply chain, a Treasury news release states.

Deputy Treasury Secretary Wally Adeyemo said the sanctions “demonstrate our commitment to upholding the principles of the price cap policy, which advance the goals of supporting stable energy markets while reducing Russian revenues to fund its war against Ukraine.”

“Participants in the maritime transport of Russian oil," he said, “must adhere to the compliance guidelines agreed upon by the Price Cap Coalition or face the consequences.”

The United States, European Union, countries in the Group of Seven and Australia, imposed a $60 a barrel limit last year on Russian oil.

Any purchases above the cap would violate the agreed-upon policy. The cap was designed to deprive the Kremlin of revenue to fund its war in Ukraine, forcing the Russian government either to sell its oil at a discount or divert money for a costly alternative shipping network.

The price cap was rolled out to equal parts skepticism and hopefulness that the policy would stave off Russian President Vladimir Putin’s invasion of Ukraine.

In addition to the price cap, the allied nations have hit Russia with thousands of sanctions over the course of the nearly three-year war. The sanctions are aimed at bank and financial transactions, technology imports, manufacturing and Russians with government connections.

No comments:

Post a Comment