Gildan's deposed CEO Chamandy wins over big investors in fight with board

, Bloomberg News

Gildan Activewear Inc.’s former chief executive officer lashed out at the clothing manufacturer’s board, saying it fumbled when it failed to consult investors about the CEO succession process — and major shareholders are backing him up.

Five investment firms that hold stakes in the Canadian company have now denounced the board’s decision to fire CEO Glenn Chamandy and name former Fruit of the Loom executive Vincent Tyra as his replacement.

The unhappy investors include major holders Jarislowsky Fraser Ltd., Pzena Investment Management Inc. and Cooke & Bieler LP. Collectively, the five firms own about 25 per cent of Gildan’s shares, according to data compiled by Bloomberg.

“Shareholders should decide the future if they’re not happy with the CEO,” Chamandy, 62, said in a phone interview. “The process was flawed, and they didn’t really have a very good plan.” He added that he wasn’t ready to retire and was “excluded completely” from the board’s process.

Representatives for the company didn’t respond to requests for comment.

Gildan’s board on Monday announced Chamandy’s departure and the appointment of Tyra, sending the stock plunging. “He has no manufacturing experience, and he has been out of the industry for 20 years,” Chamandy said about Tyra. “His track record is not the greatest.”

Jarislowsky Fraser, a unit of Bank of Nova Scotia, said Gildan Chairman Donald Berg should resign and heaped criticism on the board for its handling of the CEO change. Charles Nadim, Jarislowsky’s head of research, said the abrupt management shuffle was “concerning.” He accused directors of misleading the market with its announcement and failing to perform proper due diligence when it chose Tyra.

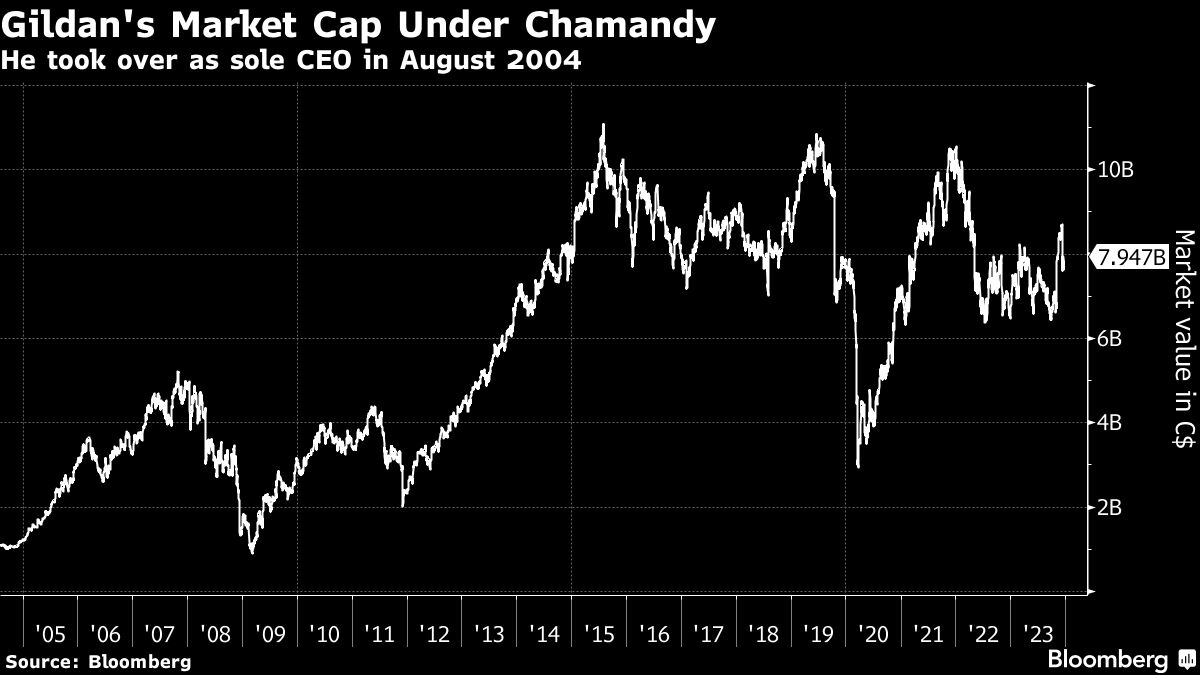

Gildan shares jumped Friday on Bloomberg’s report about Jarislowsky’s comments, closing at $46.15 in Toronto, up 4.1 per cent from the previous day. Still, the stock fell 7 per cent for the week, shrinking the company’s market capitalization to about $8 billion (US$6 billion).

The company’s fourth-largest investor, with 5.8 per cent stake, Cooke & Bieler LP, also came to Chamandy’s cause.

“We enthusiastically support Mr. Chamandy’s reinstatement as CEO, and we do not see that tenable with Mr. Berg on the board,” portfolio manager William Weber said in a phone interview.

Gildan says it’s one of the world’s largest vertically-integrated makers of t-shirts, underwear, and socks. The Montreal-based company made headlines in 2017 when it bought American Apparel for US$88 million in a bankruptcy auction. It also holds an exclusive distribution of Under Armour socks in the US and Canada.

The Chamandy family has been in the clothing sector since the 1940s. In 1984, Glenn Chamandy and his brother, Greg, turned the family firm into an integrated company with a knitting manufacturing business called Gildan Textiles.

In 2004, Greg stepped down as co-CEO, leaving Glenn to run it until the latest management shuffle.

Chamandy acknowledged “it’s been a tough week” and that he can’t do more to win back his seat.

“I’m on the sidelines,” he said. “It’s up to the shareholders to decide ultimately what they want.”

Gildan shareholders seek CEO reinstatement, allege 'grievous error' by board

The Canadian Press

Two of Gildan Activewear Inc.'s shareholders are demanding its former chief executive be reappointed to the company's top post.

In letters sent to Gildan's board of directors, Browning West LP and Turtle Creek Asset Management Inc. called for the Montreal-based apparel maker to reinstate Glenn Chamandy to the board and his prior CEO post.

Earlier this month, Gildan co-founder Chamandy said he was terminated without cause after four decades with the company. He is due to be replaced by Vince Tyra.

Browning West LP, an investment partnership with a 3.9 per cent stake in Gildan, said it believes the company's share price was poised to grow by at least 80 per cent over the next two years under Chamandy's leadership.

Turtle Creek said the board's abrupt termination of Chamandy, which it called a "grievous error," appeared to have been done in haste without meaningful shareholder engagement or consideration of the impact it would have on Gildan.

Gildan did not immediately respond to requests for comment. An autoreply from Chamandy's email said no further statements would be given at this time.

https://plawiuk.blogspot.com/2023/12/caricom-sweat-shops-vince-tyra-to.html

LA REVUE GAUCHE - Left Comment: Search results for GILDAN

LA REVUE GAUCHE - Left Comment: Search results for SWEATSHOP

No comments:

Post a Comment