The Public Company Accounting Oversight Board Thursday fined three Chinese accounting firms $7.9 million for allegedly violating U,S, securities laws.

Dec. 1 (UPI) -- The U.S. Public Company Accounting Oversight Board fined three Chinese firms and four people affiliated with them $7.9 million Thursday for allegedly violating U.S. securities laws and other misconduct.

Public accounting companies PwC China and PwC Hong Kong, were fined $7 million for allowing more than 1,000 people from PwC Hong Kong and hundreds more from PwC China to share answers to tests for mandatory internal training.

Two unauthorized software applications were used to share answers to the tests.

PCAOB said they violated quality control standards related to integrity and personnel management.

PwC China and PwC Hong Kong agreed to pay the fines without admitting or denying the board's findings.

Accounting firm Shandong Haoxin was fined $750,000 and four people associated with it were fined $190,000 for violating securities laws.

Haoxin was also censured and cannot accept new PCAOB accounting clients. An independent monitor was also assigned to improve practices at the company and to ensure future compliance.

PCAOB said the company made false statements on an audit report and violated "independence requirements and/or PCAOB auditing, ethics, and/or quality control rules and standards."

Haoxin and the individuals sanctioned agreed to the penalties without admitting or denying the board's findings.

The sanctioned individuals were Liu Kun. Ma Yao, Sun Penghuan and Zhu Dawei. They are also barred from being "associated persons of a registered public accounting firm."

According to PCAOB, these are the first enforcement settlements with Chinese and Hong Kong companies since the oversight board gained powers to inspect and investigate Chinese firms.

It said they are also the largest civil financial penalties the board has levied against a China-based company.

"The days of China-based firms evading accountability are over. The PCAOB will take action to protect investors on U.S. markets and impose tough sanctions against anyone who violates PCAOB rules and standards, no matter where they are located," said PCAOB Chair Erica Y. Williams in a statement.

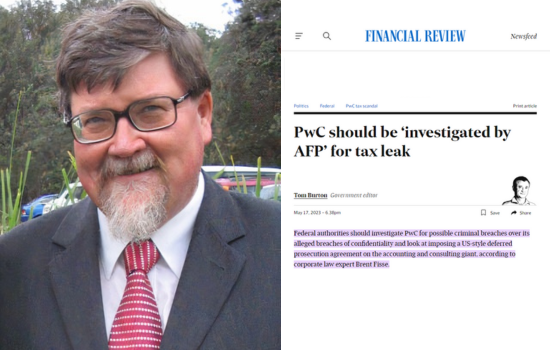

PwC should be ‘investigated by AFP’ for tax leak

A recent piece in the Australian Financial Review cites new CLARS Affiliate, Honorary Professor Brent Fisse.

Anyone who thought Australia's organisational culture problems might have come to an end with the 2019 Banking Royal Commission will be sadly disappointed by the escalating PwC international tax scandal.

The excellent recent piece by Tom Burton in the Australian Financial Review (see extract below), cites new CLARS Affiliate, Honorary Professor Brent Fisse, describing the scandal as PwC's 'Enron moment'.

In the full article, Professor Fisse dissects the possible legal offences and penalties (both in Australia and the United States) that could be relevant further down the line. A must read for anyone interested in accountability for flawed organisational culture!

PwC should be ‘investigated by AFP’ for tax leak

17 May 2023

Federal authorities should investigate PwC for possible criminal breaches over its alleged breaches of confidentiality and look at imposing a US-style deferred prosecution agreement on the accounting and consulting giant, according to corporate law expert Brent Fisse. A former partner with Gilbert+Tobin, Mr Fisse has lectured and written extensively about corporate law, responsibility and accountability and warned PwC to take seriously its situation.

PwC has been warned it faces an “Enron” moment, similar to that faced by US accounting giant Arthur Anderson after an accounting scandal engulfed the energy giant.

“PwC wouldn’t want to underestimate what they’re up against,” Mr Fisse said. “We’re all familiar with the Enron moment that sent Arthur Andersen out of business, and this is starting to look a lot like that.”

This article was published on the Monash Lens. Read the original article (Paywall).

Review of PwC tax leaks scandal will not stop conflicts of interest engulfing consulting firms

By business reporter Nassim Khadem

Posted Tue 26 Sep 2023

Former Telstra CEO Ziggy Switkowski's internal review into PwC following the tax leaks scandal is unlikely to stop further scrutiny of the big four accounting giant and other consulting firms.

The embattled firm had tapped Switkowski to lead an "independent" internal inquiry, but its limited terms of reference mean that important details about the tax leaks scandal aren't the focus of the review.

Switkowski was not specifically asked to investigate the tax leaks or past conduct at the firm, but to instead focus on how PwC could reform its governance structure, the culture of the firm and how leaders were held to account.

PwC knows this is an important PR exercise – and it's one that it's been closely managing.

Ziggy Switkowski has led the internal review into PwC. (Mark Nolan: Getty Images)

The firm was hoping that its review would draw a line in the sand over the damaging revelations that some of its senior partners misused confidential Australian government information to help big multinational companies avoid paying more tax.

Since the scandal erupted, the company's Australian CEO has quit, nine senior partners have been stood down, and the man at the centre of the scandal, Peter Collins, is being investigated by the Australian Federal Police.

In a recent call with former partners, PwC chief executive Kevin Burrowes — who was brought in by PwC's global leadership after the scandal to run the Australian arm — said the international investigation was likely to find a "reasonably clean bill of health". He had also said there were "one or two small instances" where international partners were involved.

PwC Australia's senior management was handed a draft of a report weeks ago but decided to wait for another round of parliamentary hearings into the use of consultants before publicly releasing the review.

But it's unlikely this is the end of an intense probe into PwC and the way other firms manage conflicts of interest

Former PwC partner Peter Collins appears before Senate estimates in Canberra.(ABC News)

The review is unlikely to satisfy those calling for much bigger changes, including federal politicians who want to see PwC partners implicated in the scandal jailed.

The PwC controversy has also reignited a global debate about whether accounting firms need to split their lucrative consulting services from their audit functions.

For decades, the big four — Deloitte, PwC, KPMG and EY — have had an inherent conflict of interest whereby they get paid to both advise the nation's largest corporations as well as audit them.

It's no secret that the big four firms help companies minimise tax, and their ability to push the boundaries has been the subject of a previous Senate inquiry into corporate tax avoidance.

Operating in almost every country, the big four collectively employ more than 1 million people, and most of their revenue growth is from their consulting side.

In 2021, the global consulting services market was valued at between $US700 billion ($1.09 trillion) and $US900 billion (1.4 trillion).

The review is unlikely to satisfy those calling for much bigger changes, including federal politicians who want to see PwC partners implicated in the tax leaks scandal jailed.(AAP: Joel Carrett)

Regulators further probe PwC, questions rise over ATO settlement

The release of the review into PwC comes after an array of investigations and inquiries, including a probe by the Australian Taxation Office (ATO), as well as a new round of investigations by the Tax Practitioners Board (TPB), which is the agency that regulates tax agents.

On Tuesday the TPB told a Senate inquiry into consulting services that it was conducting preliminary investigations into several former partners at PwC — beyond the nine who have already left because of the tax scandal.

TPB chairman Peter de Cure told the inquiry his organisation had "started a formal investigation focused on one person" who used to be a partner at PwC.

And the body's chief executive, Michael O'Neill, said the TPB was continuing with preliminary inquiries into other current and former PwC partners and into PwC itself.

The ATO was later probed about how much knowledge former PwC chief executive Luke Sayers knew about the tax leak scandal before leaving the firm.

ATO second commissioner Jeremy Hirschhorn said he had personally asked Sayers at two meetings in 2019 and 2020 to investigate the PwC emails obtained by the ATO.

Jeremy Hirschhorn has defended the ATO's use of settlements with big companies, arguing it does not do "sweetheart deals". (AAP Image: Mick Tsikas)

Senator Barbara Pocock, questioning Hirschhorn during the committee hearing, said it was "absolutely implausible" that Sayers had no knowledge of confidentiality breaches.

The ATO was also criticised by Pocock at the inquiry for reaching a settlement with a 50 per cent reduction in penalty for PwC in March 2023.

The settlement came after what the ATO claims were false claims for legal professional privilege over 150 documents that related to tax advice PwC gave to a multinational client.

It also came after the TPB in November made findings that the firm used information provided by Peter Collins in breach of the confidentiality agreement signed with the Treasury to market tax avoidance schemes to PwC clients in 2016 and 2017.

The ATO then concealed the deal with PwC from the TPB, only disclosing it to the Senate Committee on Finance and Public Administration References Committee in late July.

The inquiry heard how Tax Commissioner Chris Jordan tried to prevent the TPB from accessing information on that settlement.

The inquiry heard how Tax Commissioner Chris Jordan tried to prevent the TPB from accessing information on a settlement with a PwC client.(ABC News: Mark Moore)

Evidence was given that Jordan wrote to the TPB saying that its release would damage the trust and confidence that taxpayers had in dealing with the ATO and would threaten tax administration.

"What damage is made to tax administration by revealing the level of discount or payment by a large multinational in its tax avoidance strategies? Where's the damage?" Pocock asked.

Hirschhorn defended the ATO's settlement saying, "Large businesses do not get sweetheart deals," and: "We put rigorous controls around the settlements."

Boston Consulting Group (BCG) and McKinsey Australia fronted the inquiry after initially declining to appear.

McKinsey and BCG, which have entered contracts worth more than $120 million in fees from the federal government in the past two years, were questioned over the level of executive pay for individual government contracts as well as their relationship with senior bureaucrats in winning lucrative contracts.

Pocock said McKinsey was paid $660,000 for one week's worth of work — consulting on the COVID-19 vaccine rollout.

But at the inquiry, the firm refused to give details on executive salaries, and questions were raised about whether taxpayers were getting good value for money.

On Wednesday the Senate will continue its probe, calling the Department of Finance and KPMG to give evidence.

Greens senator Barbara Pocock has been questioning regulators involved in the PwC tax leaks.(ABC news: Ian Cutmore)

Should big four accounting firms' functions be split?

As more firms front the inquiry, global regulators have already made clear they don't think big four firms can manage conflicts of interest with dual roles of audit and advisory.

Following a string of high-profile accounting scandals, several countries have already slapped restrictions around firms doing consulting work for companies they audit.

In addition, the UK's auditing and accounting regulator, the Financial Reporting Council (FRC), in 2020 established a June 2024 deadline for the big four firms to split their audit and consulting businesses to improve corporate reporting.

The FRC noted at the time that between 2012 and 2018 combined consulting and advisory revenue for the big four grew 44 per cent, compared to just 3 per cent growth in their auditing businesses.

It said the move to split the functions would help ensure that audit practices were focused on the "delivery of high-quality audits in the public interest".

Ernst & Young in the UK had toyed with breaking up its audit and consulting functions, but in April the firm called off its plan code-named "Project Everest" after facing resistance from some its partners.

The company said its US executive committee decided not to move forward with the split.

Had it gone through, it would have been the biggest overhaul in the accounting sector since the 2002 collapse of Arthur Andersen, the auditor that was embroiled in the Enron scandal and whose downfall reduced the big five to the big four.

Arthur Andersen was the auditor that was embroiled in the Enron scandal and whose downfall reduced the big five to the big four.(Getty Images)

There are also worries that in Australia, billions of dollars of taxpayers' money continues to be spent annually on consulting services, with little or no accountability.

Former ACCC chairman Allan Fels is among those who are worried and who think the audit and advisory functions of big four firms should be split.

Jason Ward, principal analyst at CICTAR, also thinks that should happen.

He points to one example of where audit and advisory functions could potentially create a conflict of interest, noting that big four firm KPMG does both the audit and consulting work for the head Australian entity DP World — one of the largest port operators in Australia and globally.

According to filing lodged with the corporate regulator, KPMG Australia was paid $455,862 for audit services and additionally paid $394,525 for "income tax compliance/advice" in 2022 by DP World Australia.

"In many countries, it would be against the law to have the same firm providing both audit services and tax advice to corporate clients. This is a clear conflict of interest," Ward says.

"Australia needs to end this practice and catch up to global standards."

It's a message that no doubt will be considered in the months to come as regulators and politicians further probe the big consulting firms.

Posted 26 Sep 2023

No comments:

Post a Comment