Ignacio Olivera Doll and Kevin Simauchi

Thu, January 4, 2024

(Bloomberg) -- The Argentine Central Bank’s second auction to pay down importers’ debts owed to suppliers abroad saw another batch of disappointing results on Thursday.

The bank said it sold just $57 million out of a maximum of $750 million of notes available. The fresh setback for the government of Javier Milei — reported by Bloomberg earlier on Thursday — follows a similar flop last week, when the auction saw sales of just $68 million of the $750 million offered.

The bonds — which importers can buy and resell in the secondary market to other investors in exchange for US dollars — are key to helping importers settle some $30 billion owed to suppliers abroad and improving the central bank’s balance sheet. The sales are also meant to help Milei wrestle a chronic dollar shortage and strict capital controls, both of which have bottlenecked trade.

Since taking office in December, Milei has announced a swath of measures to pull Argentina’s economy back from the brink of its sixth recession in a decade. The “shock therapy” package included devaluing the peso by more than 50%, along with massive cuts to government spending.

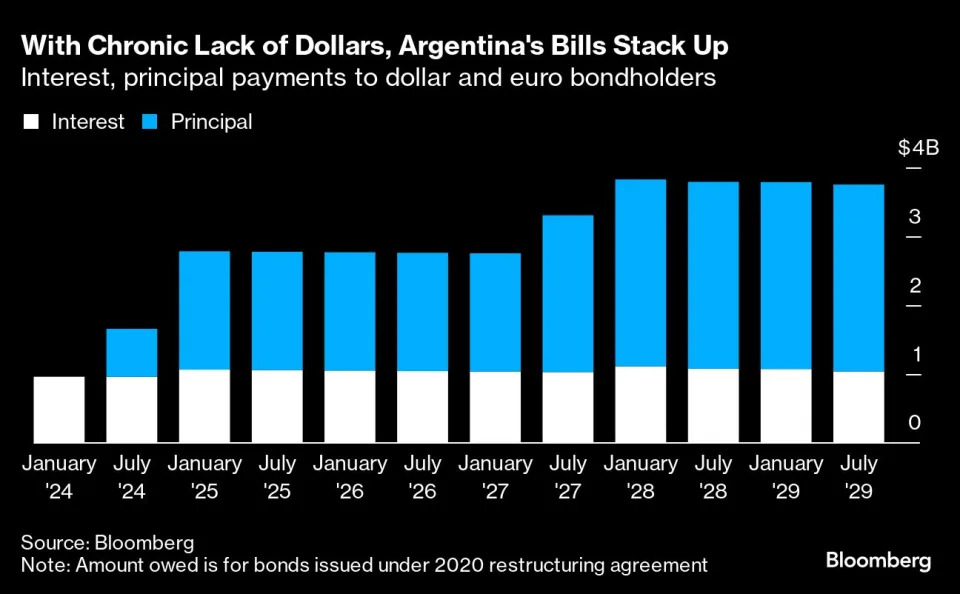

The sales — which are seen as key for Argentina to eventually unify its different exchange rates — also come as the government has about $1 billion in interest payments to bondholders due next week.

The dollar-denominated importer notes are called “Bopreal” — which stands for “bonds for the reconstruction of a free Argentina” — and offer a 5% annual interest rate. They can be bought in local currency, which in turn would help the central bank absorb some pesos in the economy in a bid to ease annual inflation expected to exceed 220% in December.

Bloomberg Businessweek

No comments:

Post a Comment