Felipe Saturnino, Barbara Nascimento and Maria Eloisa Capurro

Fri, January 5, 2024

(Bloomberg) -- Brazil’s exports proved so strong in 2023 that they are rekindling memories of the commodities bonanza that briefly catapulted Latin America’s largest economy to unusually fast growth rates in the early 2000s.

The nation’s trade surplus hit $9.4 billion in December, more than all estimates in a Bloomberg survey of economists that had a median forecast of $7.7 billion. For 2023 as a whole, Brazil posted a trade surplus of $98.8 billion, well above the $61.5 billion recorded in 2022 and the widest in more than 30 years.

Vice President Geraldo Alckmin, who also heads the trade ministry, said the surplus was “significant” and added the government expects exports to increase even more in 2024, to $348 billion. Last year’s result “helps the country’s international reserves and our economy,” he told reporters Friday after the figures were published.

The news couldn’t come at a better time for President Luiz Inacio Lula da Silva. The leftist leader is facing the prospect of a slowing economy and falling tax revenue in 2024, when he will need money to support his ambitious investment plans without jeopardizing the country’s fiscal targets.

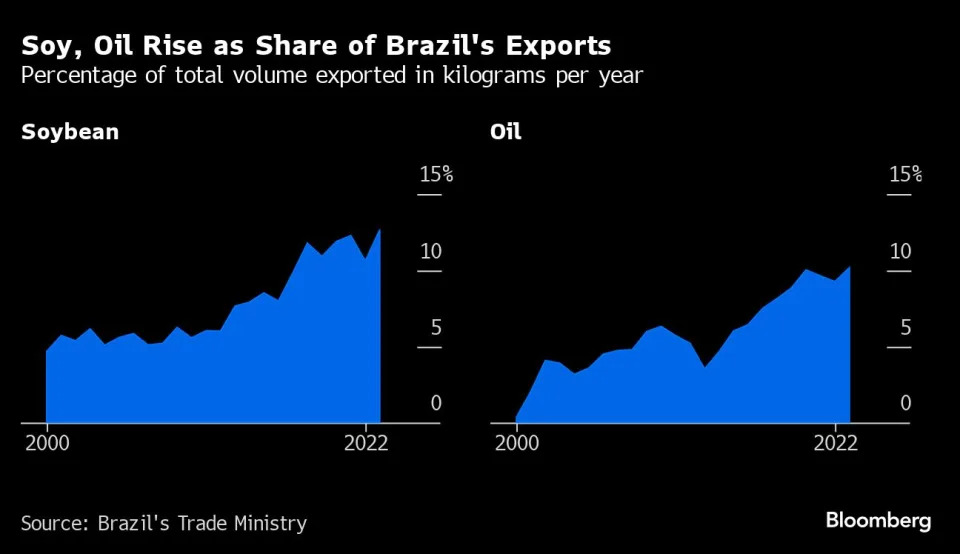

Brazil’s economic success during Lula’s first two terms as president — from 2003 to 2010 — resulted in part from a commodities boom coupled with wealth distribution policies his government implemented. Now, even with commodities prices below those levels, the country’s overall export volume has surged, with oil, soybeans and other agricultural products leading the way.

“Are we going through a second period of external bonanza?” economists at Bradesco bank asked in a note to clients. “Besides oil, exports of agricultural products have increased nearly 30% in volume in 12 months through October.”

SPX Capital, a Brazilian investment firm with $12.5 billion under management, called it a structural change that will ensure robust trade surpluses for years to come.

Other hedge funds have a similar analysis.

Verde Asset Management last month started betting the real will strengthen against the dollar, saying that yearly trade surpluses of $100 billion or above will likely become Brazil’s “new normal.” The Sao Paulo-based firm justified its call by citing growing volumes of oil and soy exports — products that account for the largest value of Brazil’s foreign sales.

XP Inc. also expects the real to strengthen going forward. Just this week the investment firm revised its end-2024 estimate for the Brazilian currency to 4.70 reais per dollar, from 4.85 — based on prospects of Brazil’s strong trade performance coupled with expectations of rate cuts by the Federal Reserve.

“There has been a change of level in Brazil’s trade balance,” and surpluses are likely to remain above the nearly $62 billion recorded in 2022, said Rodolfo Margato, XP’s vice president of economic research. He forecasts a $86 billion surplus in 2024.

Oil and Agriculture

Brazil is reaping the benefits of recent investments made in oil production, together with productivity gains in agribusiness. Although some cyclical factors contributed to the performance of Brazil’s trade balance in 2023, “there are permanent and structural elements favoring the production of oil, soybeans and corn,” Margato said.

Soy exports rose 14.4% in value between January and December, according to government statistics. Soy sales represented 15.7% of total export revenue in 2023, up from 13.9% for 2022.

Oil exports have jumped by nearly 50% in volume over the past five years, despite Lula’s ambitions to turn Brazil into a global leader in green energy. In November, the country was invited to join the OPEC+ alliance in a sign of its growing relevance as an oil supplier.

As exports soar, Brazil’s external accounts have also improved. Its current account deficit has held roughly steady at $1.5 billion in November compared with a year ago, thanks to a trade surplus that was the widest ever for the month.

--With assistance from Giovanna Serafim, Vinícius Andrade, Matthew Malinowski and Beatriz Reis.

No comments:

Post a Comment