SCI: green locomotive fleet in Europe slow and expensive

Initial optimism about a green locomotive fleet in Europe is giving way to the realisation that the transition will be slow and expensive, according to a new study on diesel and alternative drive locomotives by SCI Verkehr.

In 2023, the global market for new diesel and alternative drive locomotives will be small, with a value of around EUR 2.62 billion. For many years, the market for new diesel locomotives has been under enormous pressure for a variety of reasons. In countries with large fleets, such as China (rapidly increasing electrification of the network - no deliveries from 2019) and the USA (the new operating concept of rail freight operators allows for fleet reductions - recently the focus has been on modernising existing fleets), deliveries of new locomotives have collapsed.

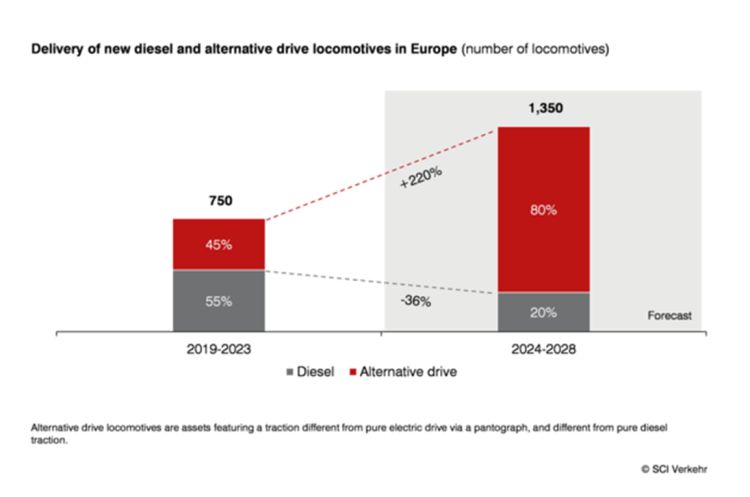

However, starting from the current low level, SCI Verkehr expects a significant increase in new vehicle business to EUR 3.97 billion in 2028. Many alternative drive locomotive types have come out of the testing phase and will gain significant market share. The regions under the greatest pressure to reduce fleet emissions are also the regions with the largest volumes of new vehicles: Europe and North America.

In Europe, the last major deliveries of diesel locomotive fleets are taking place and alternative drive locomotives are already driving the new vehicle business. It is mainly national railways and leasing companies that are making major investments in alternative drive locomotives. At the same time, the first high-performance battery locomotives are being launched in the USA. In combination with diesel locomotives, these are expected to reduce emissions in rail freight transport. Overall, however, there is no discernible shift away from diesel traction in rail freight in most of the world's market regions. In many regions with low levels of electrification, such as Australia/Pacific and Africa, rail freight operators are opting for diesel traction with modern (or more modern) technology. With a global electrification rate of only 33%, catenary independent traction will remain essential for rail freight in many regions for the long term.

Between 2019 and 2023, around 4,100 diesel locomotives and almost 500 alternative drive locomotives will be delivered worldwide. The North American manufacturer Wabtec is the market leader with a 28% share, followed by Russia's TMH (27%). SCI Verkehr is currently observing high price levels in many regions, driven by high inflation rates and stricter emission standards.

No comments:

Post a Comment