Why Aren't the Red Sea Attacks Affecting the Oil Market?

[By David Uren]

Attacks on shipping in the Red Sea have had almost no impact on the oil price, despite the volume of oil shipped through the waterway surging 80% over the last two years because of the war in Ukraine.

Markets more worried about a soft global economy and rising US and Brazilian oil production than by the prospect of interrupted oil flows, having already seen the global oil market adjust to the massive disruption caused by Russia’s invasion of its neighbor.

The oil market has fragmented over the last two years, with Russia now primarily supplying China and India while the Middle East and the United States have replaced Russia in Europe.

Flows of Russian oil traveling south through the Suez Canal rose from about 700,000 barrels a day in 2020 to 3.6 million in the first half of 2023. Flows of Middle East oil traveling north through the Suez Canal rose from 2 million to 3.5 million barrels a day in the same period, according to the US Department of Energy.

In total, oil tankers were ferrying about 9.2 million barrels a day up and down the Red Sea in the first half of 2023, up from 5.1 million barrels a day in 2021.

That translates to a lot more ‘oil-miles’, but there’s been little movement in the price. The Brent oil benchmark was at US81.63 a barrel at the beginning of November but has been below US$80 for most of the last two months.

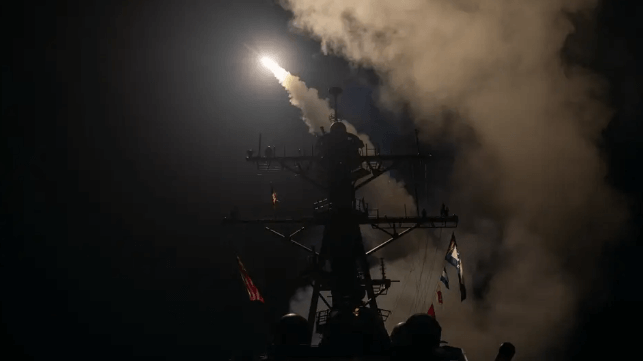

There’s been some diversion of oil tankers since November, when Houthi militias based in Yemen started attacking ships traversing the Bab el-Mandeb Strait, the 25km-wide southern entrance to the Red Sea. BP announced that it was diverting its ships around the south of Africa, while the world’s fourth-largest tanker group, Frontline, said it would avoid the Suez Canal where possible.

However, the oil tanker business is ferociously competitive with a huge number of operators. The top 30 companies control less than half of total capacity, so tanker operators will continue to run the risk of sailing through the Bab el-Mandeb Strait, weighing both the relative costs of insurance versus sailing around the south of Africa and the importance of timely delivery. Diverting large oil tankers bound for Asia around the south of Africa adds 30 to 40 days to the voyage.

An assessment by the ship-tracking service, Mari-Trace, detected an average of 76 oil tankers a day in the south Red Sea and Gulf of Aden in December, only three fewer than the average for the first 11 months of the year.

The oil industry has seen off many previous attacks in the Persian Gulf, which is much more critical to global supplies than the Red Sea. While the Red Sea is mainly a transit channel, the Persian Gulf is the source of about 21 million barrels of oil a day, with ships having to traverse the vulnerable 40km-wide Strait of Hormuz.

Between 1984 and 1988, the war that had been raging between Iraq and Iran embroiled tankers traveling to each country. An assessment by the University of Texas Strauss Center found that although 239 ships were attacked of which 55 were sunk, the disruption to oil supplies to world markets from the Persian Gulf was less than 2%.

Oil tankers were harder to damage or sink than general cargo ships or dry bulk carriers. During the so-called ‘tanker war’, 23% of the oil tankers that were attacked were sunk, compared with 34% of general cargo ships and 39% of bulk carriers. Since the big oil tankers are many times larger than navy vessels, even anti-ship missiles like the French Exocet caused relatively little damage.

There was another spate of attacks on oil tankers in the Strait of Hormuz in 2019, with responsibility variously attributed to Houthi militias, who were fighting Saudi Arabia at the time, or Iran, which was facing severe sanctions from the US on its oil shipments.

An analysis of those attacks by insurer, Allianz, helps explain why tanker operators are prepared to continue running the risk of missile attack. A very large crude carrier could be carrying 2 million barrels of oil, which in 2019 would have been worth US$135 million.

A five-year-old ship was worth about $70 million. Additional war insurance was between 0.2% and 0.5% of hull value, translating to between $140,000 and $350,000. That amounts to only 0.1% to 0.25% of the cargo’s value, a sum that could readily be absorbed by suppliers or customers.

According to Mari-Trace, insurance premiums for ships in the Bab el-Mandeb Strait and the Southern Red Sea have risen from 0.07% of hull value in early December to between 0.5% and 0.7% by early January.

The oil market’s reputation as a geopolitical bell-weather dates from the 1973 Yom Kippur war when OPEC put an embargo on oil deliveries to nations supporting Israel over about six months which led to oil prices tripling to US$60 a barrel and fuelling global inflation (although deficit funding of the Vietnam war also contributed).

The 1979 Iranian revolution sent oil prices rocketing to US$150 in 1979, but they then spent the next six years slowly declining, despite the ‘tanker war’. Since then, geopolitics have lost much of their bite in the oil market.

There was a very brief spike, lasting a few months, when Iraq invaded Kuwait in 1990, but no reaction at all to the September 11 attacks in 2001 or to the attacks on shipping in the Strait of Hormuz in 2019.

The oil price did react to Russia’s invasion of Ukraine in 2022, briefly reaching US$129 a barrel in March but were back below US$100 by August last year and have averaged about US$83 since then.

The declining sensitivity of the oil market to geopolitical events partly reflects the massive growth of US oil production, which rose from 5 million barrels a day in 2010 to 13 million barrels a day by the end of last year. This has almost eliminated the US dependence on Middle East oil and instead turned it into a significant exporter.

The US both imports and exports oil (reflecting the fact that many US refineries were built to accommodate imported crude), but the US ability to be a swing supplier helped minimize the impact of Europe slashing its purchases of Russian oil. It also means the US economy no longer reacts to passing instability in the Middle East.

The global economy has also become less dependent on oil. Oil’s share of total energy supply has dropped from about 50% in 1973 to 30% now. In 1973, the world consumed a barrel of oil for every US$1000 of GDP. By 2019, it was only consuming 0.4 of a barrel for the same (inflation-adjusted) level of output.

Still, you can’t be an economist if you don’t hedge your bets. For the moment, the rocket attacks on shipping are having negligible effect on the market. If the Gaza conflict escalates into regional war involving Iran and threatening the Persian Gulf, governments could be left revisiting their management of the 1973 crisis.

David Uren is an ASPI senior fellow. This article appears courtesy of ASPI and may be found in its original form here.

The opinions expressed herein are the author's and not necessarily those of The Maritime Executive.

No comments:

Post a Comment