Bloomberg News | February 9, 2024 |

Credit: Minerals Security Partnership

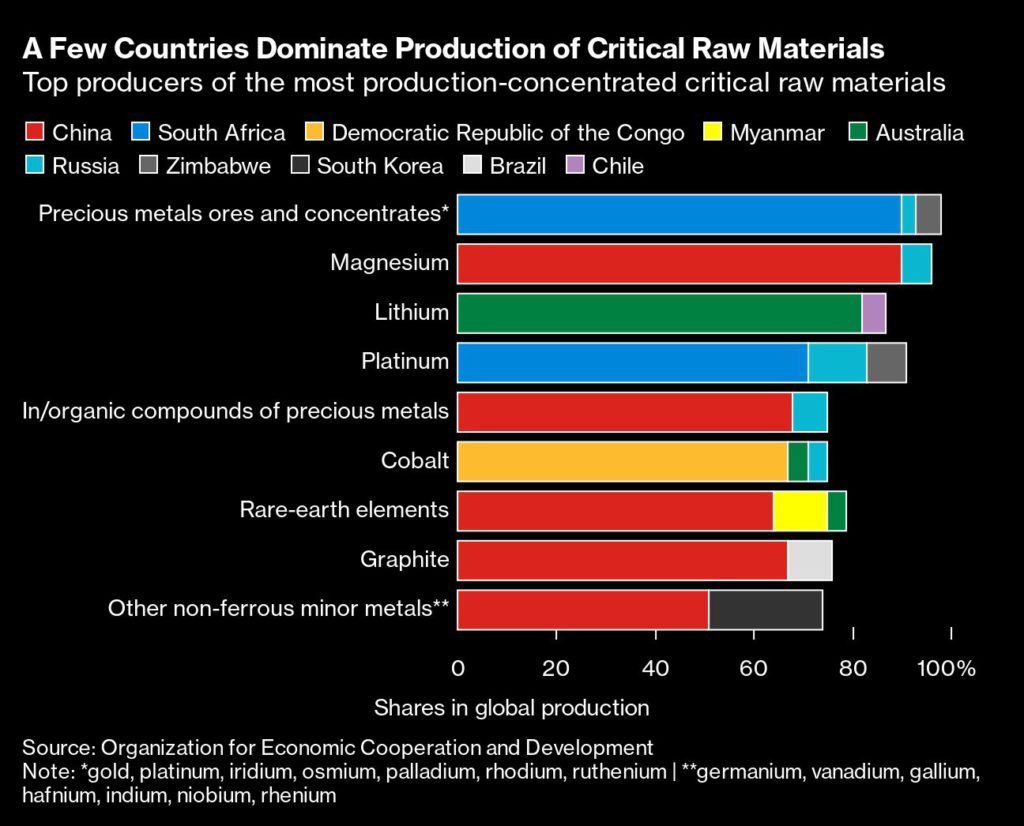

The US and the European Union are in talks to merge a core area of their efforts to engage suppliers of critical minerals in resource-rich nations, seeking to streamline their push against China’s dominance in materials key for future technologies.

The aim is to combine the EU’s high-level policy approach with the US focus on specific projects, according to people familiar with the discussions.

Specifically, the move would merge the EU’s critical raw materials club concept with the Biden administration’s flagship Minerals Security Partnership. It comes after the EU delayed plans to launch its own program in Dubai last year at the COP 28 climate summit, said the people, who asked not to be identified describing internal policy discussions.

The new initiative, known broadly as a “minerals security partnership forum,” would align outreach efforts to buyers in developed countries and resource-rich nations to cooperate on projects and policies, said the people.

As part of their broader economic security strategies, Washington and Brussels are seeking to counter China’s domination of the supply chain for so-called critical minerals, a broad term that includes inputs for electrical vehicles and other green energy technologies.

Key to their combined efforts is working with resource-rich nations to develop standards on investment, trade, research and environmental issues that the US and EU see as an alternative to working with China.

The allies, who’ve identified more than a dozen potential projects, have taken on a daunting challenge. The lengthy and expensive process of developing mining or refining projects means Beijing’s dominance will likely continue for decades. And US officials have conceded it’s impossible to fully replace China.

US and EU officials aim to reach an agreement later this month and officially launch the project in March, according to one of the people. They will discuss the plan at the Munich Security Conference in Germany next week, said a separate person.

The EU and the US are discussing how to optimize their efforts in fostering international cooperation on critical raw materials, Olof Gill, a spokesperson for the European Commission, said in a response to questions, adding that an important aspect of these talks is to find “the best synergies” between the EU’s critical raw materials club and other international activities.

A US State Department official, who asked not to be identified discussing internal matters, said the two sides believe separate outreach plans to resource-rich nations duplicated efforts and risked creating confusion. They also want to ensure alignment on the broader goal of reducing the West’s dependence on China for the production and processing of many critical minerals like lithium, manganese and cobalt, and properly coordinate mobilizing state finances and private companies, the official said.

The EU was already a part of the US-led minerals security partnership alongside Australia, Canada, Finland, France, Germany, India, Italy, Japan, South Korea, the UK and others, which aims to funnel foreign investment into the green energy sector.

The EU has also signed its own minerals pacts with several countries, including the Democratic Republic of Congo, which supplies about 70% of the world’s supply of cobalt, and Zambia.

As well, Central Asian members of the C5+1 group — which includes Kazakhstan, the Kyrgyz Republic, Tajikistan, Turkmenistan, and Uzbekistan — have also expressed interest in the minerals security partnership, the US State Department official said.

Separate EU-US talks on a bilateral critical minerals agreement remain stalled over labor rights and concerns over the feasibility of adopting a trade pact in an election year.

US officials, who have already struck a bilateral deal with Japan, have wanted to kick-start new mining and processing projects by acting as a bridge between private companies seeking raw materials and developing nations that have relied in recent years mainly on China for resource investments.

(By Alberto Nardelli and Iain Marlow)

Syrah starts active anode material production in Louisiana

This makes the graphite miner the first commercial-scale vertically integrated natural graphite AAM supplier outside China

Staff Writer | February 9, 2024 |

Syrah’s Vidalia facility in Louisiana. Credit: Syrah Resources

Syrah Resources announced on Friday the start of active anode material (AAM) production at its Vidalia facility in Louisiana.

This makes the graphite miner the first commercial-scale vertically integrated natural graphite AAM supplier outside China, said CEO Shaun Verner.

Vidalia processes natural graphite from Syrah’s Balama graphite operations in Mozambique.

Syrah is expected to supply 8 kilotonnes per annum (kpta) of AAM from Vidalia to Tesla under an existing offtake agreement, subject to production ramp-up and finalizing qualification.

The miner is progressing the expansion of Vidalia to 45 ktpa capacity, inclusive of 11.25 ktpa, to readiness for a final investment decision.

The company said it has produced unpurified spherical graphite from the front-end milling area since October 2023 to build inventory of precursor value-added material in preparation for the commissioning of the purification and furnace areas in January 2024.

The first purified spherical graphite material was produced in late January 2024.

The heating cycle for the first furnace line commenced in early January 2024, and carbonization of Syrah’s first pitch-coated purified spherical graphite is now complete.

Syrah has applied to the US Department of Energy (DOE) for an additional loan of $350 million under DOE’s Advanced Technology Vehicles Manufacturing loan program to support funding of the Vidalia expansion project, and DOE is progressing due diligence.

Shares of Syrah were down 3.3% by 12:10 p.m. EDT. The company has a market capitalization of $238 million.

Syrah’s Vidalia facility in Louisiana. Credit: Syrah Resources

Syrah Resources announced on Friday the start of active anode material (AAM) production at its Vidalia facility in Louisiana.

This makes the graphite miner the first commercial-scale vertically integrated natural graphite AAM supplier outside China, said CEO Shaun Verner.

Vidalia processes natural graphite from Syrah’s Balama graphite operations in Mozambique.

Syrah is expected to supply 8 kilotonnes per annum (kpta) of AAM from Vidalia to Tesla under an existing offtake agreement, subject to production ramp-up and finalizing qualification.

The miner is progressing the expansion of Vidalia to 45 ktpa capacity, inclusive of 11.25 ktpa, to readiness for a final investment decision.

The company said it has produced unpurified spherical graphite from the front-end milling area since October 2023 to build inventory of precursor value-added material in preparation for the commissioning of the purification and furnace areas in January 2024.

The first purified spherical graphite material was produced in late January 2024.

The heating cycle for the first furnace line commenced in early January 2024, and carbonization of Syrah’s first pitch-coated purified spherical graphite is now complete.

Syrah has applied to the US Department of Energy (DOE) for an additional loan of $350 million under DOE’s Advanced Technology Vehicles Manufacturing loan program to support funding of the Vidalia expansion project, and DOE is progressing due diligence.

Shares of Syrah were down 3.3% by 12:10 p.m. EDT. The company has a market capitalization of $238 million.

Canada Nickel plans to raise $1 billion for processing plant

Reuters | February 8, 2024 |

Crawford nickel-cobalt sulphide project. (Image courtesy of Canada Nickel Company.)

Canada Nickel Co on Thursday said it is looking to raise $1 billion to build a nickel processing plant, as it seeks to position itself as an alternative supplier of the metal used in car and electric battery vehicles.

The processing plant in Ontario is expected to begin production in 2027 and process 80,000 tonnes of nickel annually. Nickel production is currently concentrated in Asia, and the company hopes that the new plant will help increase supplies from cleaner sources.

The company is in discussions with the Canadian government, the United States Department of Defense and other partners in the battery manufacturing sector to raise the funding, CEO Mark Selby told Reuters.

The miner, which counts Samsung SDI and Agnico Eagle Mines as shareholders, is also building a nickel mine in Ontario and hopes to integrate the battery supply chain with the proposed processing plant, according to Selby.

The company’s stock rose 3.6% to C$1.42. The Toronto Stock Exchange Venture-listed miner has a market value of C$194 million.

The announcement by NetZero Metals, a unit of Canada Nickel, comes as large global nickel producers cut costs and reduce production after prices dropped 40% in the last year.

But Selby expects demand for the metal to grow.

“The car companies and battery supply chain know that the amount of nickel needed in North America is going to double and triple over the next decade,” Selby said, adding that what these buyers want is responsibly produced, clean, green nickel in North America.

(By Divya Rajagopal; Editing by Mark Porter)

Reuters | February 8, 2024 |

Crawford nickel-cobalt sulphide project. (Image courtesy of Canada Nickel Company.)

Canada Nickel Co on Thursday said it is looking to raise $1 billion to build a nickel processing plant, as it seeks to position itself as an alternative supplier of the metal used in car and electric battery vehicles.

The processing plant in Ontario is expected to begin production in 2027 and process 80,000 tonnes of nickel annually. Nickel production is currently concentrated in Asia, and the company hopes that the new plant will help increase supplies from cleaner sources.

The company is in discussions with the Canadian government, the United States Department of Defense and other partners in the battery manufacturing sector to raise the funding, CEO Mark Selby told Reuters.

The miner, which counts Samsung SDI and Agnico Eagle Mines as shareholders, is also building a nickel mine in Ontario and hopes to integrate the battery supply chain with the proposed processing plant, according to Selby.

The company’s stock rose 3.6% to C$1.42. The Toronto Stock Exchange Venture-listed miner has a market value of C$194 million.

The announcement by NetZero Metals, a unit of Canada Nickel, comes as large global nickel producers cut costs and reduce production after prices dropped 40% in the last year.

But Selby expects demand for the metal to grow.

“The car companies and battery supply chain know that the amount of nickel needed in North America is going to double and triple over the next decade,” Selby said, adding that what these buyers want is responsibly produced, clean, green nickel in North America.

(By Divya Rajagopal; Editing by Mark Porter)

No comments:

Post a Comment