Exxon and Chevron Announce Record Shareholder Returns in Hottest Year on Record

CEO Mike Wirth boasted that in 2023 Chevron “produced more oil and natural gas than any year in the company’s history.”

By Olivia Rosane ,

CEO Mike Wirth boasted that in 2023 Chevron “produced more oil and natural gas than any year in the company’s history.”

By Olivia Rosane ,

COMMONDREAMS

U.S. oil companies ExxonMobil and Chevron announced their second-highest profits in a decade on Friday, with both companies paying out a record amount to shareholders in 2023, which was the hottest year on record due largely to the burning of fossil fuels.

“In 2023, we returned more cash to shareholders and produced more oil and natural gas than any year in the company’s history,” Chevron chief executive Mike Wirth boasted in a statement.

Exxon also said it processed a record amount of oil and gas through its refineries. While profits for both companies have declined relative to their record hauls in 2022, Exxon CEO Darren Woods told CNBC’s “Squawk Box” Friday that “we’ve more than doubled our earnings power from 2019 to 2023.”

Exxon reported a total of $36 billion in profits with $32.4 billion paid to shareholders, while Chevron took home $21.4 billion and paid out $26.3 billion, putting them behind only Apple, Microsoft, and Google parent Alphabet for total payouts from a U.S. company, according to a Wall Street Journal analysis. The shareholder payouts far surpassed what either company had planned to spend on climate solutions, the Journal said.

“While millions of Americans suffered in extreme weather events in 2023, Exxon and Chevron raked in huge profits from the fossil fuels driving those disasters,” Global Witness strategy lead Alice Harrison said in a statement. “They’re now choosing to reward their shareholders instead of investing in clean energy in a brazen wealth transfer from energy consumers to Big Oil shareholders.”

Global Witness said that the combined nearly $59 billion that the two companies paid to shareholders was equal to what every household in California and Texas paid in energy bills last year and would be enough to pay for nearly two-thirds of the damages from the year’s worst weather disasters in the U.S.

Both companies also have major mergers planned for 2024: Chevron with Hess and Exxon with Pioneer Natural Resources. If these mergers go through, the two companies’ greenhouse gas emissions will spike by more than 20% this year, Global Witness calculated based on Rystad Energy data. The two companies would therefore release more climate pollution in 2024 than Australia, Brazil, and Spain combined.

“These companies are in open rebellion against scientists, energy consumers, and life on planet earth, with their emissions set to rise sharply by 20% in 2024,” Harrison said. “This means more catastrophic weather events, more deaths worldwide, more hardship, and more suffering.”

Greenpeace USA focused on the harm that Chevron has caused to communities in California, where it is headquartered.

“This greedy company drains our wallets, drills in our neighborhoods, and poisons our air, all while locking us into a future filled with climate-driven disasters,” Greenpeace USA’s California climate campaign director Zachary Norris said in a statement.

In California, Norris said, fossil fuels drive both local pollution and increased climate disasters like floods and wildfires. Chevron is one of three companies that holds two-thirds of the state’s orphaned oil wells, which release both greenhouse gases and carcinogens and would cost $10 billion to cap and clean, according to a Sierra Club analysis. Often these wells are positioned near low-income communities of color.

“Chevron needs to face its destructive legacy: stop drilling, start paying to clean up their mess, and fund the transition to a clean energy economy,” Norris said.

Published February 3, 2024

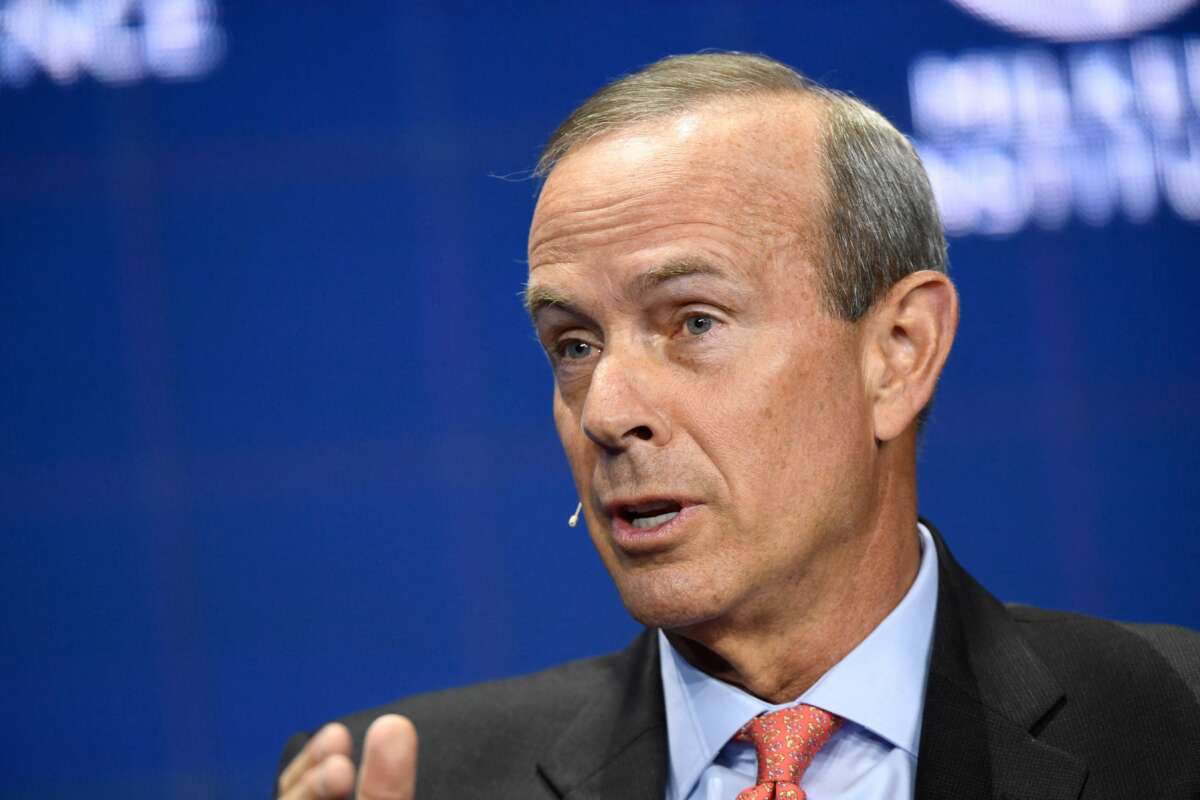

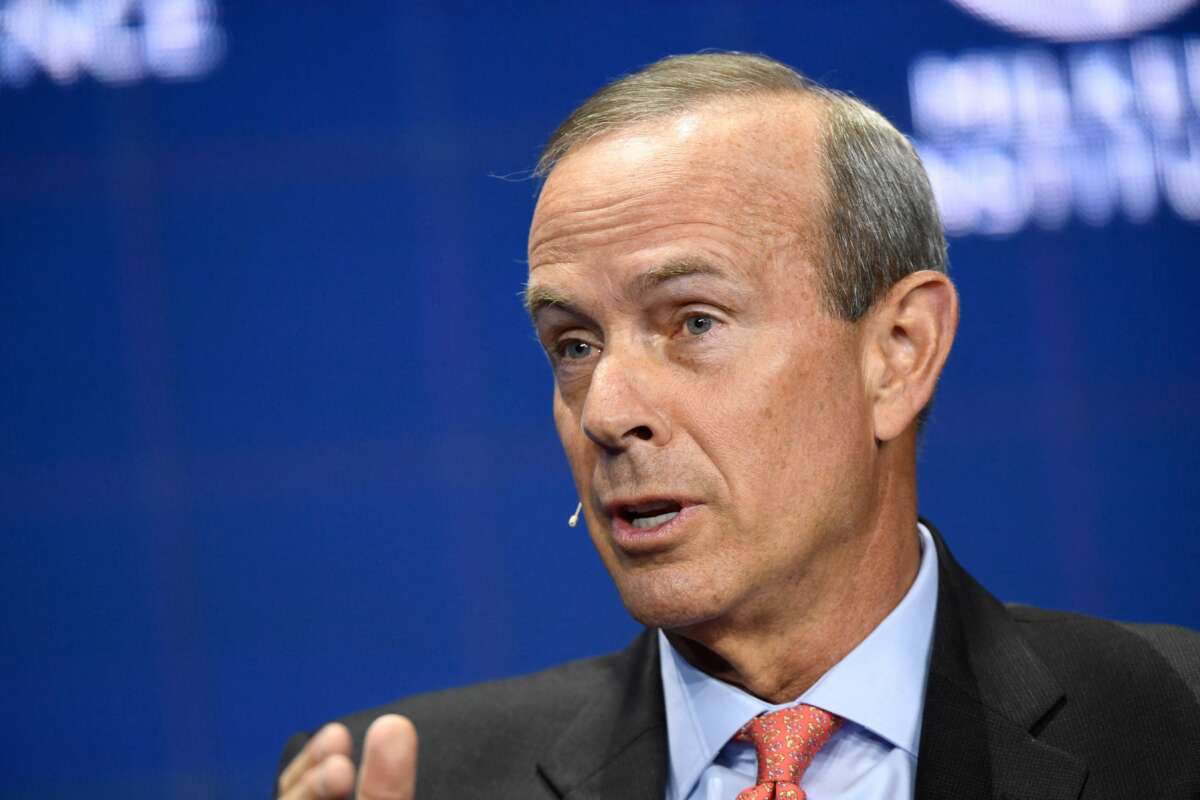

Michael Wirth, Chairman and CEO of the Chevron Corporation, during the Milken Institute Global Conference on October 18, 2021, in Beverly Hills, California.

PATRICK T. FALLON / AFP VIA GETTY IMAGES

U.S. oil companies ExxonMobil and Chevron announced their second-highest profits in a decade on Friday, with both companies paying out a record amount to shareholders in 2023, which was the hottest year on record due largely to the burning of fossil fuels.

“In 2023, we returned more cash to shareholders and produced more oil and natural gas than any year in the company’s history,” Chevron chief executive Mike Wirth boasted in a statement.

Exxon also said it processed a record amount of oil and gas through its refineries. While profits for both companies have declined relative to their record hauls in 2022, Exxon CEO Darren Woods told CNBC’s “Squawk Box” Friday that “we’ve more than doubled our earnings power from 2019 to 2023.”

Exxon reported a total of $36 billion in profits with $32.4 billion paid to shareholders, while Chevron took home $21.4 billion and paid out $26.3 billion, putting them behind only Apple, Microsoft, and Google parent Alphabet for total payouts from a U.S. company, according to a Wall Street Journal analysis. The shareholder payouts far surpassed what either company had planned to spend on climate solutions, the Journal said.

“While millions of Americans suffered in extreme weather events in 2023, Exxon and Chevron raked in huge profits from the fossil fuels driving those disasters,” Global Witness strategy lead Alice Harrison said in a statement. “They’re now choosing to reward their shareholders instead of investing in clean energy in a brazen wealth transfer from energy consumers to Big Oil shareholders.”

Global Witness said that the combined nearly $59 billion that the two companies paid to shareholders was equal to what every household in California and Texas paid in energy bills last year and would be enough to pay for nearly two-thirds of the damages from the year’s worst weather disasters in the U.S.

Both companies also have major mergers planned for 2024: Chevron with Hess and Exxon with Pioneer Natural Resources. If these mergers go through, the two companies’ greenhouse gas emissions will spike by more than 20% this year, Global Witness calculated based on Rystad Energy data. The two companies would therefore release more climate pollution in 2024 than Australia, Brazil, and Spain combined.

“These companies are in open rebellion against scientists, energy consumers, and life on planet earth, with their emissions set to rise sharply by 20% in 2024,” Harrison said. “This means more catastrophic weather events, more deaths worldwide, more hardship, and more suffering.”

Greenpeace USA focused on the harm that Chevron has caused to communities in California, where it is headquartered.

“This greedy company drains our wallets, drills in our neighborhoods, and poisons our air, all while locking us into a future filled with climate-driven disasters,” Greenpeace USA’s California climate campaign director Zachary Norris said in a statement.

In California, Norris said, fossil fuels drive both local pollution and increased climate disasters like floods and wildfires. Chevron is one of three companies that holds two-thirds of the state’s orphaned oil wells, which release both greenhouse gases and carcinogens and would cost $10 billion to cap and clean, according to a Sierra Club analysis. Often these wells are positioned near low-income communities of color.

“Chevron needs to face its destructive legacy: stop drilling, start paying to clean up their mess, and fund the transition to a clean energy economy,” Norris said.

The company paid nine times more to shareholders than it invested in "Renewables and Energy Solutions."

A protester pretends to celebrate outside Shell's London headquarters.

(Photo: Greenpeace U.K./X)

OLIVIA ROSANE

Feb 01, 2024

COMMON DREAMS

Oil major Shell paid nine times more to shareholders in 2023 than it invested in its "Renewables and Energy Solutions" program, according to a Global Witness analysis released Thursday.

The analysis comes as Shell announced its total profits both for the fourth quarter of 2023 and for the entirety of the year. The company took home $28.25 billion in adjusted earnings and paid out $23 billion to shareholders. It also raised dividends by 4%.

"Shell chooses shareholders over climate, once again," Sjoukje van Oosterhout, the head researcher for Climate Case Shell at Friends of the Earth Netherlands, said in a statement. "In the last year, $23 billion went to shareholders, and Shell is now adding to that by increasing the dividend by 4%. Without considering the cost to the climate and human lives."

"Time is running out, but Shell refuses to change course and is racing full speed towards the destruction of the Earth."

When accounting for its "Renewables and Energy Solutions (RES)" investments, Shell combines both real climate solutions like wind and solar with investments in gas, hydrogen, and carbon capture and storage, leading Global Witness to file a greenwashing complaint against the company with the Securities and Exchange Commission last year.

Shell spent a total of $2.681 billion on all of these efforts, which was nearly a quarter less than the $3.469 billion it invested in 2022. At the same time, its greenhouse emissions increased by 4%, based on data from Rystad Energy, and will likely climb by another 5% this year.

"Shell's shareholders remain some of the biggest winners of ongoing global instability and reliance on fossil fuels," Global Witness senior campaigner Jonathan Noronha-Gant said in a statement. "The turmoil in fossil fuel markets, caused by war in Europe and the Middle East, has helped Shell rake in enormous profits—but instead of investing in clean energy, the company has doubled down on oil, and gas, choosing climate-wrecking U-turns and shareholder pay-outs."

Shell, like several oil and gas companies, raked in record profits in 2022 following the spike in energy prices precipitated by Russia's invasion of Ukraine. While 2023's payout is less than 2022's nearly $40 billion, it is still Shell's second-highest since 2011, the Financial Times reported. The company also reported its second-highest cash flow in its history at $54.2 billion.

"Profits seem halved, but apart from last year, they have never been higher since 2011," van Oosterhout said. "While people all around, but also in the Netherlands, are struggling to make ends meet, Shell, Exxon, and Total are still benefiting from causing the climate crisis."

Global Witness calculated that the amount Shell paid to shareholders last year would be almost enough to pay off the average 2023 gas and electric bills for all Florida households. Greenpeace U.K. pointed out on social media that the average British worker would need to work for 640,000 years to match Shell's 2023 profits.

2023 was also the hottest year on record, and likely the hottest in 100,000 years, mostly due to climate change from the burning of fossil fuels.

"They are burning our planet and laughing all the way to the bank," Greenpeace U.K. said on social media. "How on Earth is this fair?"

Van Oosterhout argued that Shell's plans went against a 2021 Dutch court ruling ordering the company to comply with the Paris agreement, as well as the COP28 agreement to transition away from fossil fuels.

Van Oosterhout said that Shell CEO Wael Sawan "is still pressing on the brakes when it comes to sustainable investments and in the meantime is still launching major new fossil projects e.g. in Brazil and the Gulf of Mexico. Time is running out, but Shell refuses to change course and is racing full speed towards the destruction of the Earth."

Noronha-Gant, meanwhile, argued that shareholders could not expect to keep profiting from Shell's actions into the future.

"Shareholders be warned that this unstable and short-termist business outlook will ultimately make your investments worthless in the future," Noronha-Gand said. "When the history books are written, Shell and its shareholders will be held accountable for their devastating impacts on global temperatures, displacement of millions, support for dictators, and disruption of food supplies."

The analysis comes as Shell announced its total profits both for the fourth quarter of 2023 and for the entirety of the year. The company took home $28.25 billion in adjusted earnings and paid out $23 billion to shareholders. It also raised dividends by 4%.

"Shell chooses shareholders over climate, once again," Sjoukje van Oosterhout, the head researcher for Climate Case Shell at Friends of the Earth Netherlands, said in a statement. "In the last year, $23 billion went to shareholders, and Shell is now adding to that by increasing the dividend by 4%. Without considering the cost to the climate and human lives."

"Time is running out, but Shell refuses to change course and is racing full speed towards the destruction of the Earth."

When accounting for its "Renewables and Energy Solutions (RES)" investments, Shell combines both real climate solutions like wind and solar with investments in gas, hydrogen, and carbon capture and storage, leading Global Witness to file a greenwashing complaint against the company with the Securities and Exchange Commission last year.

Shell spent a total of $2.681 billion on all of these efforts, which was nearly a quarter less than the $3.469 billion it invested in 2022. At the same time, its greenhouse emissions increased by 4%, based on data from Rystad Energy, and will likely climb by another 5% this year.

"Shell's shareholders remain some of the biggest winners of ongoing global instability and reliance on fossil fuels," Global Witness senior campaigner Jonathan Noronha-Gant said in a statement. "The turmoil in fossil fuel markets, caused by war in Europe and the Middle East, has helped Shell rake in enormous profits—but instead of investing in clean energy, the company has doubled down on oil, and gas, choosing climate-wrecking U-turns and shareholder pay-outs."

Shell, like several oil and gas companies, raked in record profits in 2022 following the spike in energy prices precipitated by Russia's invasion of Ukraine. While 2023's payout is less than 2022's nearly $40 billion, it is still Shell's second-highest since 2011, the Financial Times reported. The company also reported its second-highest cash flow in its history at $54.2 billion.

"Profits seem halved, but apart from last year, they have never been higher since 2011," van Oosterhout said. "While people all around, but also in the Netherlands, are struggling to make ends meet, Shell, Exxon, and Total are still benefiting from causing the climate crisis."

Global Witness calculated that the amount Shell paid to shareholders last year would be almost enough to pay off the average 2023 gas and electric bills for all Florida households. Greenpeace U.K. pointed out on social media that the average British worker would need to work for 640,000 years to match Shell's 2023 profits.

2023 was also the hottest year on record, and likely the hottest in 100,000 years, mostly due to climate change from the burning of fossil fuels.

"They are burning our planet and laughing all the way to the bank," Greenpeace U.K. said on social media. "How on Earth is this fair?"

Van Oosterhout argued that Shell's plans went against a 2021 Dutch court ruling ordering the company to comply with the Paris agreement, as well as the COP28 agreement to transition away from fossil fuels.

Van Oosterhout said that Shell CEO Wael Sawan "is still pressing on the brakes when it comes to sustainable investments and in the meantime is still launching major new fossil projects e.g. in Brazil and the Gulf of Mexico. Time is running out, but Shell refuses to change course and is racing full speed towards the destruction of the Earth."

Noronha-Gant, meanwhile, argued that shareholders could not expect to keep profiting from Shell's actions into the future.

"Shareholders be warned that this unstable and short-termist business outlook will ultimately make your investments worthless in the future," Noronha-Gand said. "When the history books are written, Shell and its shareholders will be held accountable for their devastating impacts on global temperatures, displacement of millions, support for dictators, and disruption of food supplies."

No comments:

Post a Comment