Colin McClelland | April 22, 2024 |

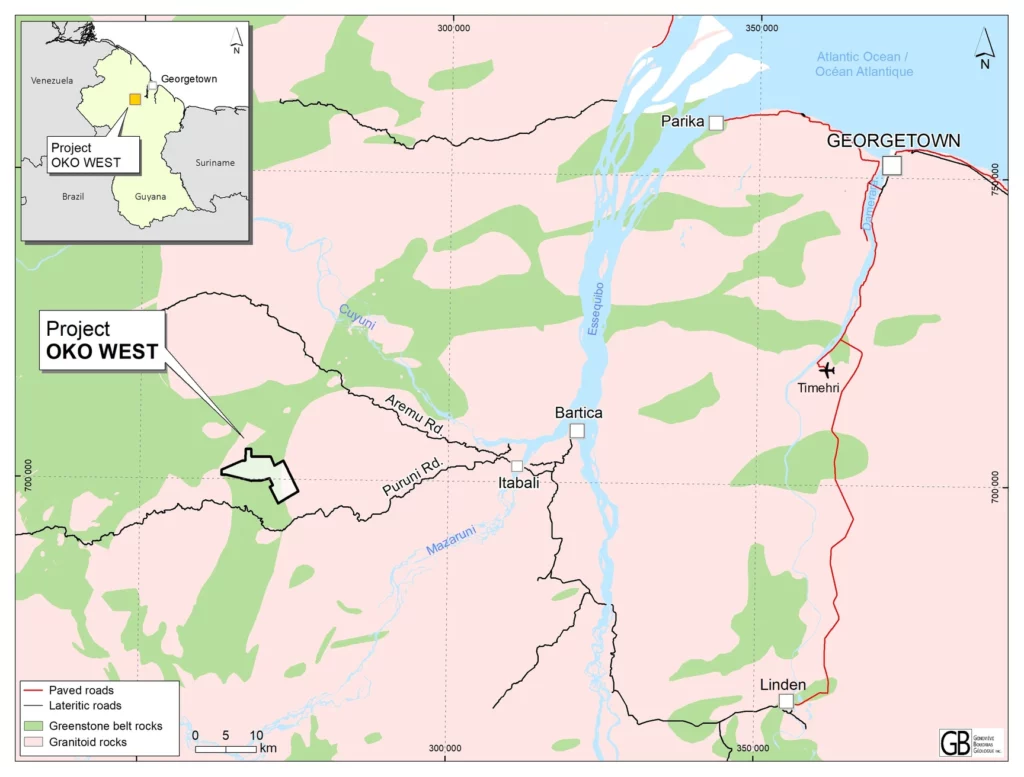

The Oko West project is located in the Cuyuni mining district, some 95 km west of Georgetown. Credit: Reunion Gold

Montreal-based G Mining Ventures (TSX: GMIN) is expanding its South American holdings by taking over Reunion Gold’s (TSXV: RGD) Oko West gold project in Guyana in an all-share deal valued at C$875 million ($638m).

The deal is a 29% premium to Friday’s closing share prices. G Mining shareholders will hold 57% of the new entity, leaving Reunion with 43%, the firms said on Monday. The new shares issued will amount to a 4-to-1 share consolidation of the combined companies.

G Mining plans to use $480 million in near-term free cash flowfrom the permitted and construction-ready Tocantinzinho gold project in Para state, Brazil, to advance Oko West through technical studies to a construction decision. Tocantinzinho is to start annual commercial production of about 200,000 oz. in this year’s second half, the company said. It also announced $50 million in equity financing for the new G Mining.

“We are well-positioned to accelerate value creation at Oko West leveraging our unique expertise in building and operating mines on schedule and on budget in the Guiana Shield,” G Mining CEO Louis-Pierre Gignac said in a release. “We look forward to continuing to advance our ‘Buy, build, operate strategy.”

G Mining bought Tocantinzinho in late 2021 from Eldorado Gold (TSX: ELD; NYSE: EGO) for $115 million after Eldorado had invested $90 million in the project.

Map of Oko West project courtesy of Reunion Gold.

Spinoff

G Mining and Reunion will also spin off Reunion’s assets besides Oko West into a new company. Ownership will be split 19.9% to G Mining for C$15 million and 80.1% for Reunion under the deal.

The spinoff’s focus will be on acquiring and exploring gold mineral properties in Guyana outside of a 20-km area of interest surrounding Oko West, and in Suriname, the companies said. The Marowijne belt in Suriname holds Iamgold’s (TSX: IMG; NYSE: IAG) Rosebel and Newmont’s (NYSE: NEM; TSX: NGT) Merian gold mines. Other deposits including Saramacca, Overman, Benzdorp and Lely are being evaluated, Reunion says.

An updated resource in February at Oko West, about 95 km southwest of the capital, Georgetown, showed 64.6 million indicated tonnes grading 2.05 grams gold per tonne for 4.3 million oz. and 19.2 million inferred tonnes grading 2.59 grams gold for 1.6 million ounces.

At Oko West, Reunion has been working on its environmental and social impact assessment and expected to complete a preliminary economic assessment by June, it said last month, adding that a feasibility study and environmental permit applications would precede a construction decision by next year’s second quarter.

“The transaction significantly de-risks the advancement of Oko West given the financial strength, free cash flow and development capabilities that G Mining brings to the table,” Reunion CEO Rick Howes said in the release. “This is a great outcome for the country of Guyana.”

Spinoff

G Mining and Reunion will also spin off Reunion’s assets besides Oko West into a new company. Ownership will be split 19.9% to G Mining for C$15 million and 80.1% for Reunion under the deal.

The spinoff’s focus will be on acquiring and exploring gold mineral properties in Guyana outside of a 20-km area of interest surrounding Oko West, and in Suriname, the companies said. The Marowijne belt in Suriname holds Iamgold’s (TSX: IMG; NYSE: IAG) Rosebel and Newmont’s (NYSE: NEM; TSX: NGT) Merian gold mines. Other deposits including Saramacca, Overman, Benzdorp and Lely are being evaluated, Reunion says.

An updated resource in February at Oko West, about 95 km southwest of the capital, Georgetown, showed 64.6 million indicated tonnes grading 2.05 grams gold per tonne for 4.3 million oz. and 19.2 million inferred tonnes grading 2.59 grams gold for 1.6 million ounces.

At Oko West, Reunion has been working on its environmental and social impact assessment and expected to complete a preliminary economic assessment by June, it said last month, adding that a feasibility study and environmental permit applications would precede a construction decision by next year’s second quarter.

“The transaction significantly de-risks the advancement of Oko West given the financial strength, free cash flow and development capabilities that G Mining brings to the table,” Reunion CEO Rick Howes said in the release. “This is a great outcome for the country of Guyana.”

Gignac family

G Mining, founded by the Gignac family, has a history in the region. Louis Gignac-led Cambior (taken over by Iamgold in 2006) to build its first South American operation in Guyana in the early 1990s. The family’s G Mining Services built Newmont’s Merian gold mine in Suriname ahead of schedule and under budget, it said.

London-based resources investment adviser La Mancha Investments plans to put as much as $45 million into the new G Mining to hold an 18.7% stake, the companies said.

Royalty and streaming company Franco-Nevada (TSX: FNV; NYSE: FNV) is buying $25 million of shares in G Mining, although its holding will fall to 7.2% from 9.9%.

The deal requires two-thirds of approval from both sets of shareholders. Some 29% of Reunion shareholders pledged support for the deal including directors, senior management, La Mancha, and Toronto-based mining investor Dundee (TSX: DC.A). A group of 60% of G Mining shareholders agreed to support, including its three largest shareholders, La Mancha, Eldorado Gold and Franco-Nevada.

Reunion’s stock rose 8% on Monday afternoon in Toronto to C$0.54 apiece, valuing the company at C$663.9 million. They’ve traded in a 52-week range of C$0.32 to C$0.61.

Shares in G Mining fell nearly 14% to C$1.96 apiece, valuing the company at C$874.2 million ($638.3m). They’ve traded in a 52-week range of C$1.67 to C$2.34.

No comments:

Post a Comment