Bloomberg News | April 19, 2024 |

LME warehouse. Credit: Steinweg Group

The world’s two biggest metals traders are moving to withdraw large volumes of aluminum from the London Metal Exchange in a complex trade made possible by new UK sanctions on Russian metal, raising questions about unintended consequences from the new rules.

Trafigura Group and Glencore Plc plan to withdraw the metal to profit from a new multi-tiered system created by the sanctions, according to people familiar with the matter. The trade involves ordering out Russian metal and then re-registering it on the LME under a new, less-desirable category, while striking profit-sharing deals with warehouses to receive a sliver of the rent paid by future owners for as long as it sits there. (The longer it sits, the more money they stand to make.)

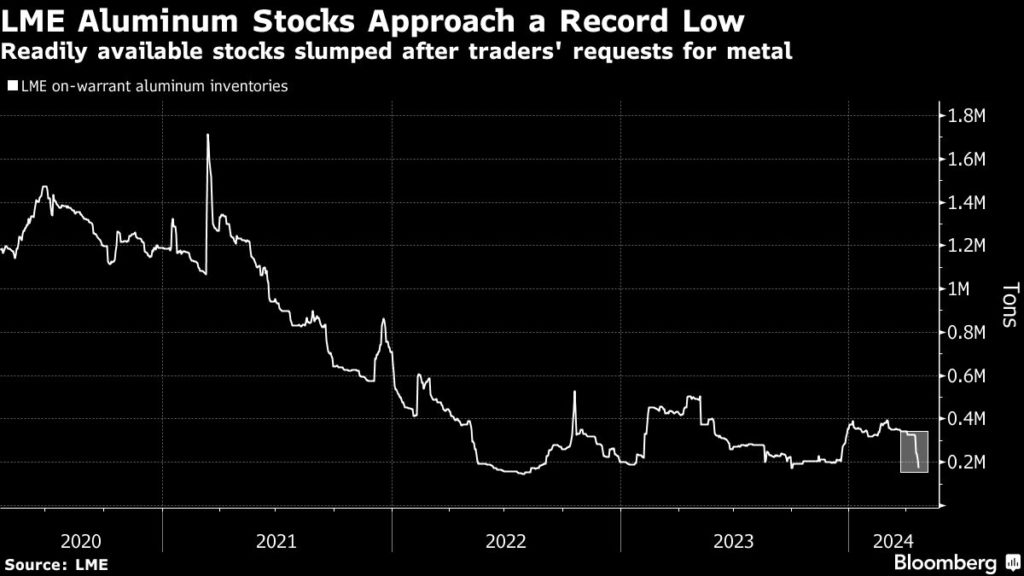

Nearly $400 million of aluminum was requested for withdrawal this week from warehouses in South Korea and Malaysia, according to LME data, driving live inventories in the warehouse system close to a record low. Trafigura and Glencore have both been behind orders for withdrawal of aluminum this week, according to people familiar with the matter.

The play, which has captured the attention of the global metals world, raises questions about whether the UK government was aware of the opportunities it was creating for traders to game a complex set of rules imposed by the sanctions last week.

The nature of the trade means that the metal will ultimately be placed back on the LME. But the restrictions have added new layers of paperwork and approvals as traders must prove the provenance of the metal they are registering, which is likely to slow down the process and keep LME inventories lower for longer.

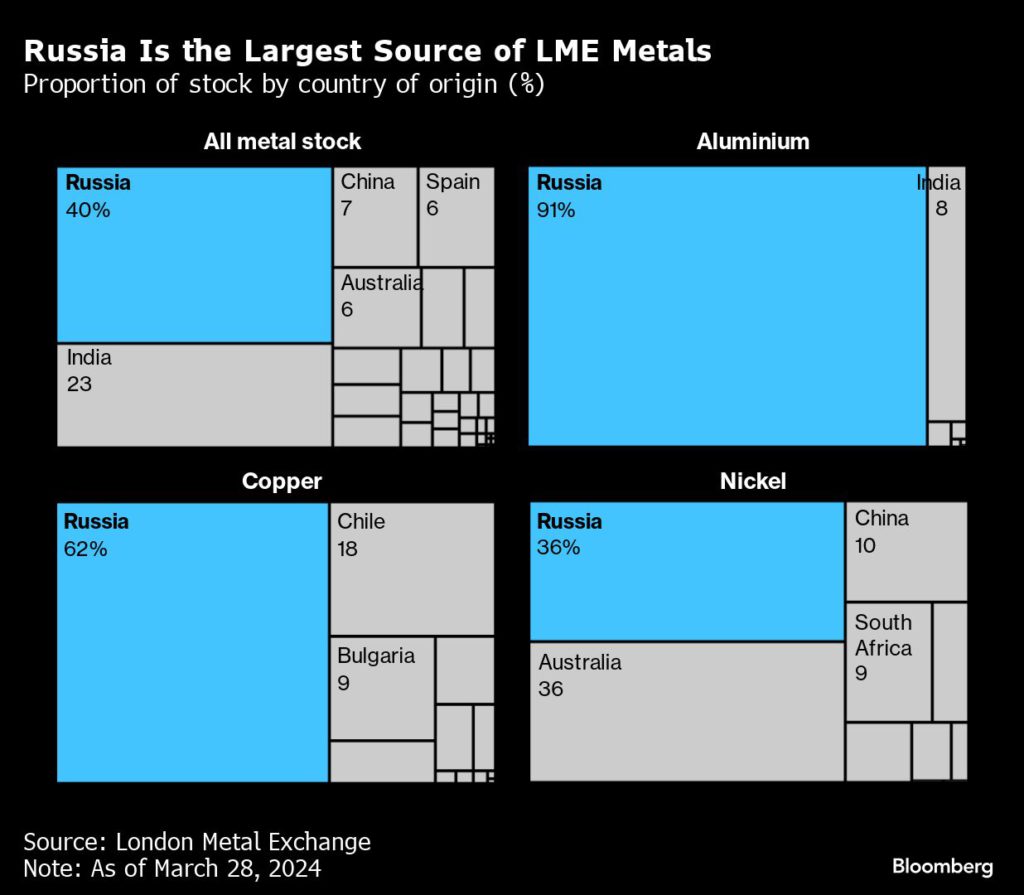

The US and UK last Friday announced a ban on deliveries to the LME and Chicago Mercantile Exchange of any Russian aluminum, copper and nickel produced after April 12. The restrictions are aimed at driving down demand and prices for Russian supplies, while seeking to avoid wider disruptions by allowing its miners to keep selling to non-US and -UK buyers outside of the LME.

Still, LME prices for all three metals have risen sharply this week, with aluminum up 7% and copper closing in on $9,900 a ton for the first time since mid-2022.

Gaming warehousing rules has long been a central part of many traders’ strategy, especially in the aluminum market, and the past week’s moves are unlikely to have a meaningful impact on the wider question of whether the sanctions will be successful at reducing Russia’s revenue from selling metals.

The key for the trade being pursued by Glencore and Trafigura is that the UK has allowed existing stocks of Russian metal to continue to be traded on the LME. However, this “old” Russian metal will be treated differently if it was already stored in LME warehouses when the sanctions came into effect.

By withdrawing and re-registering the metal under a different category, the traders would reduce the pool of potential owners and make it more likely that it remains sitting in the same LME warehouse for an extended period of time — all the while generating profit for them thanks to the practice of “rent sharing.”

Spokespeople for Glencore and Trafigura declined to comment.

The growing percentage of Russian stocks on the LME has already been a controversial subject since the invasion of Ukraine, and the share had increased further in recent months — to more than 90% for aluminum.

One significant risk to the trade is that either the LME or the UK government move to change the rules and so to undercut it. The UK Treasury is keeping the trade license — which created the dual categories of Russian metal — under review as it monitors trade flows and trade practices, according to a person familiar with its thinking.

The LME has said since the sanctions were announced that it is prepared to take further action on Russian metal if there are developments that threaten market orderliness.

“The LME continues to monitor the market closely and remains ready to take further action should that be required, including in relation to adverse market behaviors as a result of the introduction of the recent sanctions,” a spokesperson said.

For the exchange and the broader aluminum market, the immediate consequence of the withdrawals is that the volume of stock that’s readily available to other buyers has fallen to critically low levels.

Live aluminum inventories stand at 171,200 tons, nearing a record low struck in 2022, and traders expect that there will be further requests to withdraw metal in the coming days.

With spot prices trading at steep premiums to futures this week, there’s a growing focus on how long it will take for the metal that Glencore and Trafigura are withdrawing to re-enter the LME system, given that the LME will need to manually approve the applications and confirm that they are compliant with the new rules.

(By Mark Burton and Jack Farchy)

No comments:

Post a Comment