Metals whipsawed as sanctions on new Russian supplies rattle LME

RENAME IT THE LENINGRAD METALS EXCHANGE

Bloomberg News | April 15, 2024 |

Credit: LME

Metals swung sharply, with aluminum surging by a record before later erasing most of its gains, as traders digest US and UK sanctions that banned delivery of new Russian supplies onto the London Metal Exchange.

The curbs on aluminum, nickel and copper announced late Friday don’t prevent Russia from selling its metals to buyers outside the US or UK, and don’t restrict the vast majority of the global trade in metals — which takes place directly between miners, traders and manufacturers rather than through the exchange.

But the sanctions will still reverberate through metals markets because of the LME’s central position at the heart of the industry. Its prices are used as a benchmark and referenced in a huge number of contracts around the world, and many buyers view the ability to deliver on the LME as essential.

“While the new restrictions do not stop the trade of Russian metal, we could see some temporary upside support for prices of copper, aluminium and nickel,” Amy Gower, metals strategist at Morgan Stanley, said in an emailed note. That will be particularly true “if the ban on delivery into LME and CME warehouses makes traders and users less willing to handle Russian material and disrupts broader trade flows.”

Aluminum jumped as much as 9.4% as the market opened, the most since the current form of the contract was launched in 1987, while nickel rose as much as 8.8%. However, both metals were only up by around 2% as trading got under way in Europe, and copper was little changed. On the Shanghai Futures Exchange — where some brands of Russian metal can still be delivered — aluminum closed marginally lower, while nickel was up 0.7%.

Russia is an important metals producer, accounting for 6% of global nickel supply, 5% of aluminum and 4% of copper. The sanctions are aimed at curbing President Vladimir Putin’s ability to fund his war machine by choking off Russian producers’ access to western exchanges, while still allowing metal to flow to manufacturers in allied nations that depend on them.

The restrictions bar new Russian supplies of all three metals to the LME as well as to the Chicago Mercantile Exchange, while allowing delivery of metal produced prior to April 13.

The immediate price action was fueled by “worries that the sanctions will reduce Russian flows to Western markets,” said Jia Zheng, head of trading and research at Shanghai Dongwu Jiuying Investment Management Co. “Any stimulation will be amplified amid an existing bullish backdrop.”

Metals traders are hardened to wild market swings after a period marked by a nickel short squeeze that almost destroyed the LME in March 2022, and sanctions on Rusal that caused havoc in 2018. However, many traders and executives interviewed by Bloomberg since Friday have argued that new restrictions are ultimately unlikely to have as dramatic an impact as those two events.

Russia’s two metal giants, Rusal and MMC Norilsk Nickel PJSC, are much less entangled in the western financial system than they were before the war, and the industry has spent the past two years preparing for the prospect of sanctions.

Read More: New metals sanctions push Russia further into China’s embrace

But the measures look set to cement China’s status as Moscow’s buyer of last resort, potentially leaving Russian supplies trading at deepening discounts to benchmark LME prices.

Both companies have already been selling increasing volumes to China as many western buyers backed away, and aluminum giant United Co. Rusal International PJSC said on Monday that the measures will have no impact on its ability to supply customers.

The LME’s approach is effectively just enforcing the restrictions imposed by the US and UK on Friday. It said on Saturday that “old” Russian metal can continue to be delivered, though the exchange said it would require evidence that the metal was not in breach of sanctions and would approve deliveries on a case-by-case basis.

The decision is likely to reignite a debate over whether Russian metal should be banned altogether to protect the exchange’s role as the home of global benchmark prices.

By continuing to allow Russian supplies, the LME left open the possibility of a short-term surge in deliveries of that “old” Russian metal into its warehouses, which in turn could create further pricing dislocations.

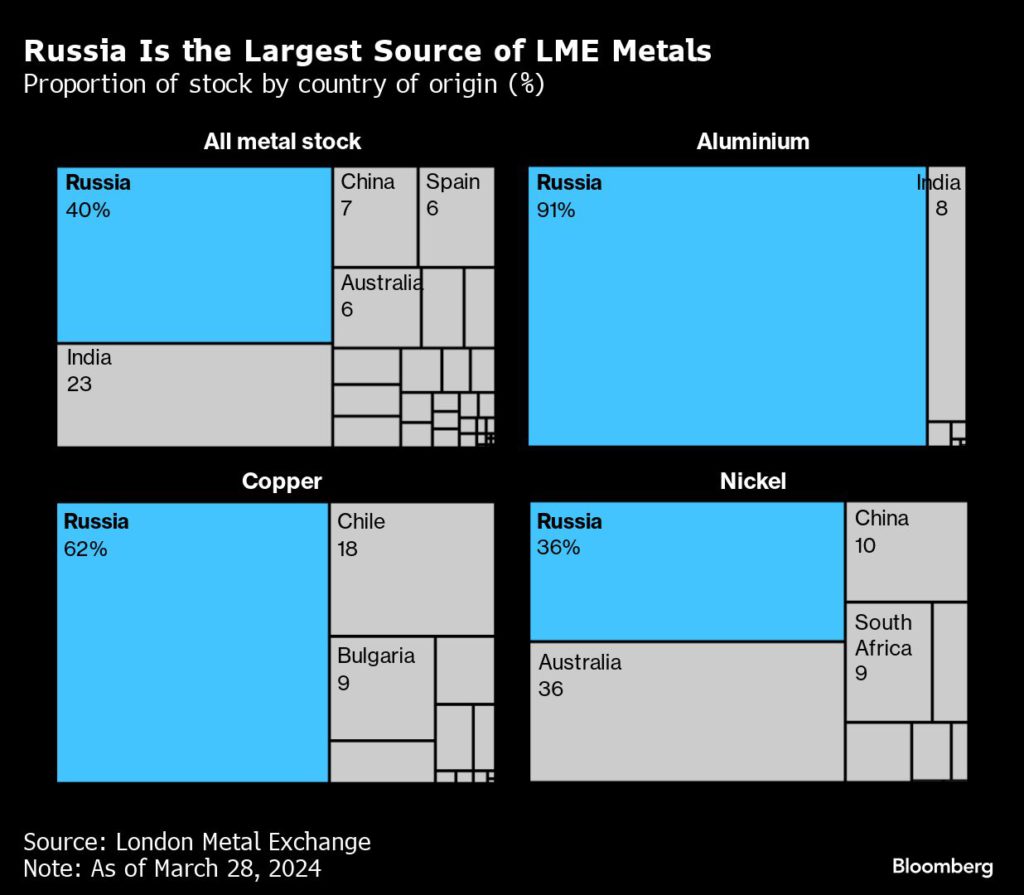

Russia already accounted for 91% of LME aluminum stockpiles at the end of March, 62% of copper and 36% of nickel. In its notice on Saturday, the LME acknowledged the possibility that the uncertainty caused by the sanctions means “a relatively large supply” of Russian metal could flood onto the exchange.

Estimates of the amount of Russian aluminum being held outside of the LME system range from a couple of hundred thousand tons to as much as one million tons.

Aluminum was up 2% at $2,544.50 a ton by 11:34 a.m. London time, while nickel was 1.7% higher.

No comments:

Post a Comment