Martin Baccardax

Wed, May 15, 2024,

U.S. stocks hit a fresh all-time high on May 15, powered in part by a softer-than-expected April inflation report that has reignited bets on a fall Federal Reserve rate cut and triggered some big changes in Wall Street forecasts.

The S&P 500 has clawed back all of its April decline, while powering to a year-to-date gain of around 12%, despite a host of warnings from Fed officials, including Chairman Jerome Powell, that interest rates are likely to remain elevated until inflation is seen moving definitively toward the central bank's 2% target.

The Commerce Department's April CPI report provided the first real piece of evidence that price pressures in the world's biggest economy could see their final leg of easing into the summer months and beyond.

Headline inflation fell for the first time this year, easing to a year-on-year rate of 3.4%, while so-called core prices slowed to 3.8%, the lowest in nearly three years.

"Looking ahead, the case for expecting a further slowdown in core CPI inflation remains compelling," said Ian Shepherdson of Pantheon Macroeconomics. "Supply chains have normalized, wage growth is weakening, and corporate margins are flat but still hugely elevated, indicating clear scope to fall ahead."

Rate-cut foundations 'are in place'

"The foundations, therefore, are in place for a further deceleration in the core CPI this summer, enabling the Fed to start easing in September," he added.

Following the data report, rate traders immediately repriced bets on a September Fed rate cut, while still expecting no change in the current rate of 5.25% and 5.5% over the next two policy meetings, in June and July.

CME Group's FedWatch now pegs the odds of a quarter point cut in September at 52.1%, with the overall chance of any move now trading at 68.8%.

Related: S&P 500 aims for biggest gain in Fed interest rate pause history

In between, of course, comes the Fed's June policy meeting, which will include fresh growth and inflation projections — and a new set of dot plots, the Fed officials' rate projections — for the back half of the year.

That said, the prospect of lower Fed rates, alongside better-than-expected corporate profits and a resilient domestic economy, has not only lifted stocks to the recent all-time peaks. It has also compelled some Wall Street analysts to overhaul their end-of-year price targets for the broadest benchmark of U.S. stocks.

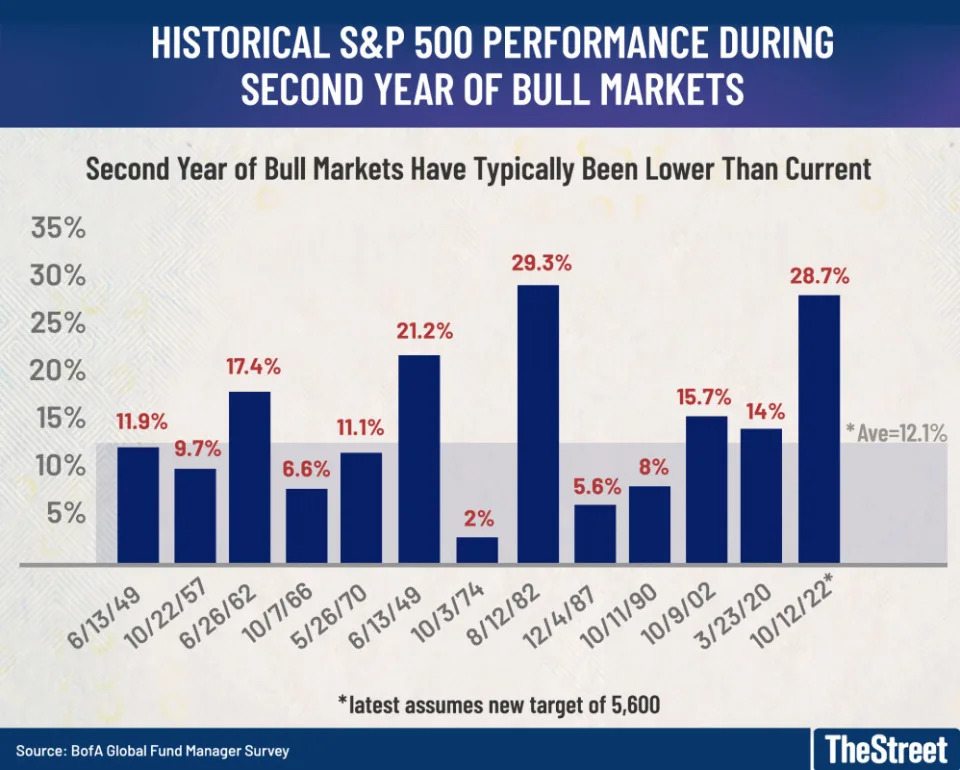

“It has become clear to us that we underestimated the strength of the market momentum," said BMO Capital Markets' chief investment strategist, Brian Belski, in a note that lifted the bank's S&P 500 price target by 500 points, to 5,600 points, the highest on Wall Street.

Market momentum is strong

"The market is behaving in a similar fashion to 2021 and 2023, years where we did not give enough credit to the strength of market momentum, something we are trying to avoid this time around," Belski and his team said.

Earlier this week, data from two closely tracked Wall Street surveys also suggested investors are seeing a clear path to new all-time highs, even if the Fed keeps to its word and holds rates steady until year-end.

S&P Global's Investment Manager Index, published May 14, showed equity-risk appetite surged to a two-and-a-half-year high this month, citing S&P 500 earnings potential over rate cut optimism.

Related: Stocks on inflation watch as S&P 500 tests record

The Atlanta Fed's GDPNow forecasting tool, a real-time tracker of the U.S. economy, suggests a current-quarter GDP growth rate of 3.8%, more than twice the 1.6% pace the Commerce Department published for its recent first-quarter estimate.

LSEG data, meanwhile, estimate collective first-quarter profits for the S&P 500 rose 7.4% from a year earlier to $467.9 billion, a $5 billion improvement since the start of the reporting season.

Looking into the three months ending in June, LSEG sees that year-on-year growth rate improving to 10.6%, with profits rising to a share-weighted $495 billion.

Big fund managers are bullish

Bank of America's monthly survey of global fund managers, meanwhile, suggests investors are the most bullish they've been since November 2021. But it notes that 80% of respondents expect at least two rate cuts in order to support that optimism.

Source: Bank of America's monthly Fund Managers' Survey

Bret Kenwell, U.S. investment analyst at eToro, also notes that the Commerce Department's April retail sales report, which showed a marked slowdown in spending, also aligns with the modest downtick in inflation pressures.

"April’s retail sales and CPI reports may have just threaded the needle for what stock market bulls and the Fed needed to see," Kenwell said. "Consumer spending is the lifeblood of the U.S. economy, so no one wants to see it fall off a cliff.

"However, some weakness on the economic front could nudge the Fed toward its first rate cut, especially if it comes alongside progress on inflation."

No comments:

Post a Comment