CNN Says Wages Are Skyrocketing – OpEd

By Dean Baker

Actually, CNN wouldn’t say that, or at least not directly. What it said, in yet another major piece on how the economy is awful, is that prices are skyrocketing:

The mix of local residents visiting the Enfield Food Shelf in Connecticut has changed a lot in the last few years.

“Prior to the Covid-19 pandemic, many were elderly or disabled people on fixed incomes, said Kathleen Souvigney, the food pantry’s executive director for the past decade.

“But now, more of the folks seeking assistance are working families who are struggling to make ends meet as their cost of living skyrockets. Paying for child care, housing, cars, heating and other basic needs doesn’t leave enough money these days for food, which has also risen sharply in price, Souvigney hears time and time again.”

The key piece of data that CNN apparently was unable to obtain for this article was wage growth. Wages have actually outpaced inflation in many of the items that have seen “skyrocketing” prices according to CNN. And, according to advanced economic theory, if wages are rising more rapidly than a price that is “skyrocketing,” then that wages must also be “skyrocketing.”

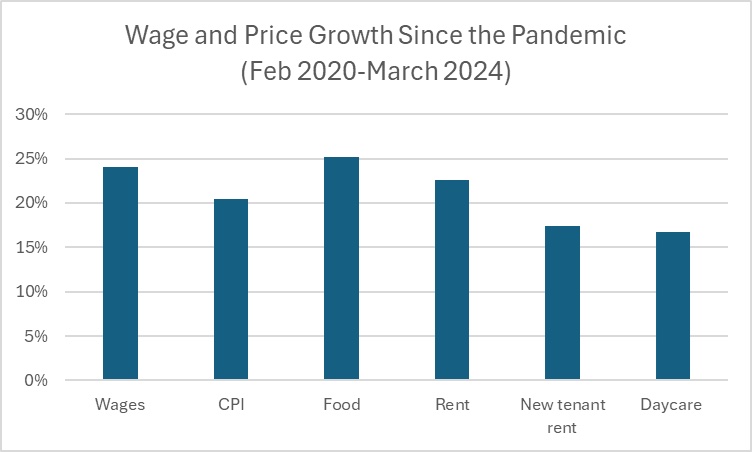

Here’s the picture.

For wages, I have used the Bureau of Labor Statistics (BLS) average hourly wagefor production and non-supervisory workers. This group covers roughly 80 percent of employees. It is useful because it excludes most high-end workers, so that the average is not skewed by high pay for CEOs and professionals.

As can be seen, this wage has risen by 24.0 percent since the pandemic began in February of 2020. This is 3.6 percentage points faster than the overall CPI. It is worth noting that, in contrast to prior decades, the fastest wage growth has been at the bottom end of the wage distribution.

That is not great, but there have been many periods, including the Reagan presidency, when wages have not kept pace with inflation. Furthermore, we have been hit with a worldwide pandemic that led to a huge burst of inflation everywhere. The fact that U.S. workers are actually doing better than before the pandemic is remarkable, and their real wages are on or slightly above the pre-pandemic growth path.

We can also compare the rate of wage growth to the inflation in some of the items highlighted in the CNN piece. Starting with food, inflation at the grocery store has slightly outpaced wage growth over this period, rising 25.2 percent compared to the 24.0 percent increase in wages. This puts a crimp in people’s budgets, but we have seen many periods in which food prices have outpaced wages by larger amounts.

Next, we have rent. As can be seen, the overall rent index has risen faster than the overall CPI, but less rapidly than wages. So workers are still coming out ahead here. But there is an interesting twist in this story.

In addition to its overall rent index, which follows the rents in all units, the BLS also has a “new tenant” rent index which tracks the rent in units that change hands. This index has risen just 17.4 percent since the start of the pandemic.

This is a big deal for this story for two reasons. First, low- and moderate-income people tend to move more frequently than higher-income people. This means the new tenant rent index might be a better approximation of the rents that the people discussed in this piece are facing.

The other reason the new tenant rent index is important is that it leads the overall rent index. At the start of 2021, the new tenant rent index began to show a large jump in rental inflation, as people looked for more space to accommodate working from home. This later showed up in more rapid rental inflation in the overall index.

In the last year and half, the picture has turned around with the new tenant index being flat or even falling. There is enough error in these measurements that it is hard to be very confident about where rental inflation will end up in the rest of 2024 and into 2025, but we can be quite certain that it will be considerably lower going forward than it is now. This should be a big help to low- and moderate-income households.

The last item is childcare. The index for childcare has risen just 16.7 percent, far less than the rise in wages.

There are two important qualifications that need to be added. There are undoubtedly huge differences in the costs faced by parents, depending on the specific childcare available. Most care is subsidized by the government. Where governments have cut back on support, parents have seen far larger increases in tuition.

The other issue is simply one of availability. Many childcare providers closed in the pandemic, and some did not reopen. As a result, the shortage of affordable childcare slots, which was already a big problem before the pandemic, is worse today.

CNN Highlights the Negative in the Biden Economy

To be clear, there are always bad stories in our economy, even in the best of time. Our system of social supports is far weaker than in other wealthy countries. As a result, even in boom times, there will be tens of millions of people struggling to pay for food, rent, healthcare, and other necessities. It is important that the public be made aware of this suffering.

However, it is also important that the media give a clear picture of the state of the economy. And, by most measures, the current economy is among the strongest in the last half-century, and that is in spite of having to shake off the effects of a worldwide pandemic.

We are doing far better than every other wealthy country right now. It is understandable that people care about their own situation, not the situation of workers in Germany and France, but they should recognize that the impact of a massive pandemic that cannot just be wished away by politicians. CNN and the rest of the media have done almost nothing to educate the public on this point.

This first appeared on Dean Baker’s Beat the Press blog.

Dean Baker is the co-director of the Center for Economic and Policy Research (CEPR). He is the author of Plunder and Blunder: The Rise and Fall of the Bubble Economy.

No comments:

Post a Comment