Frik Els | May 20, 2024 |

Copper glow

Another day another copper price high.

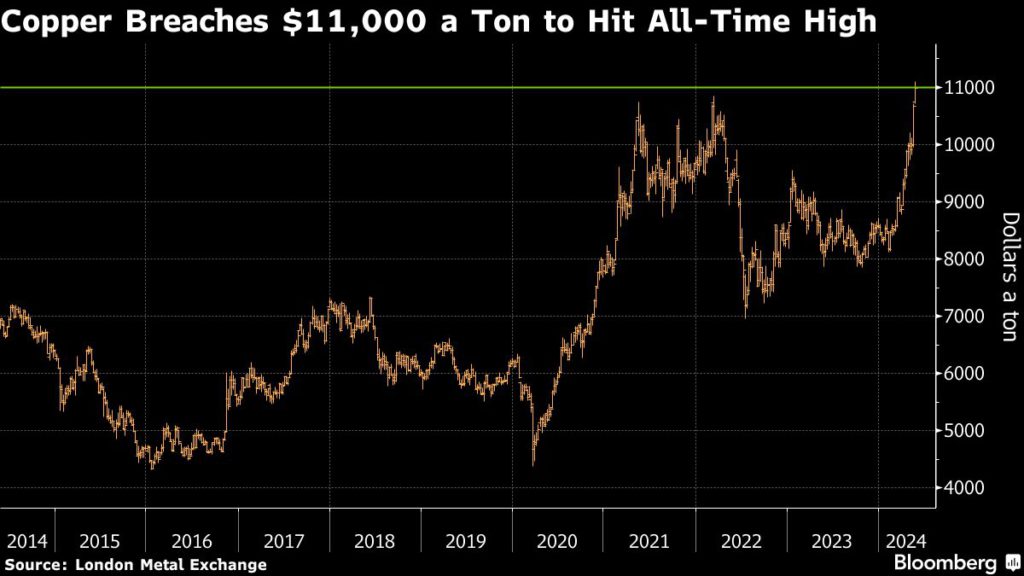

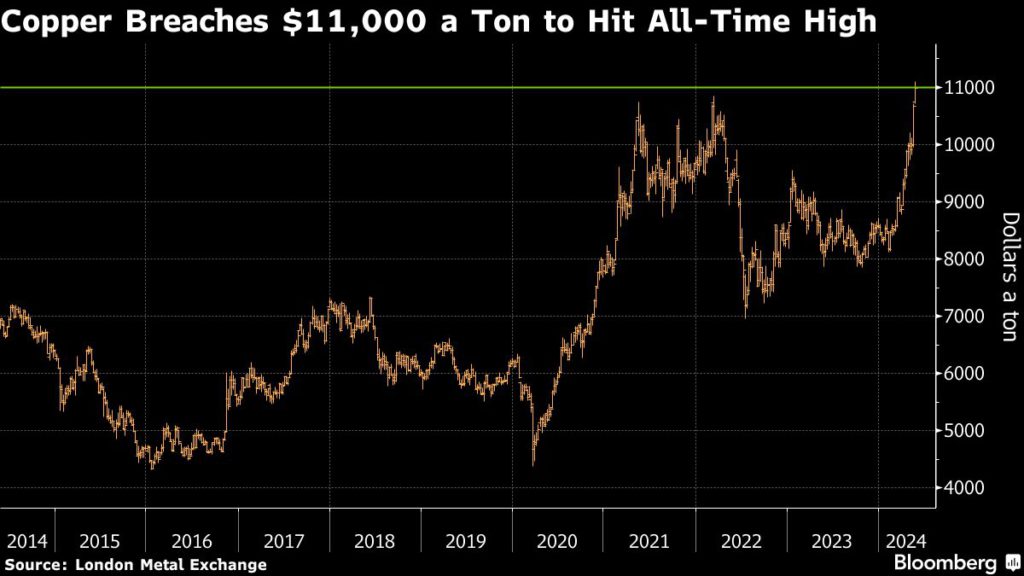

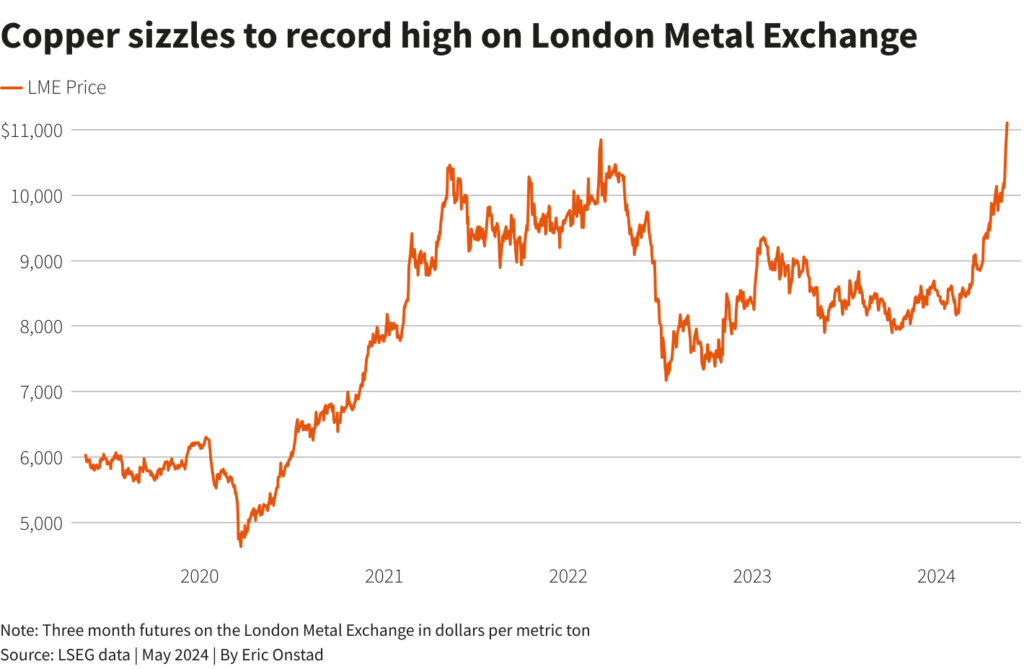

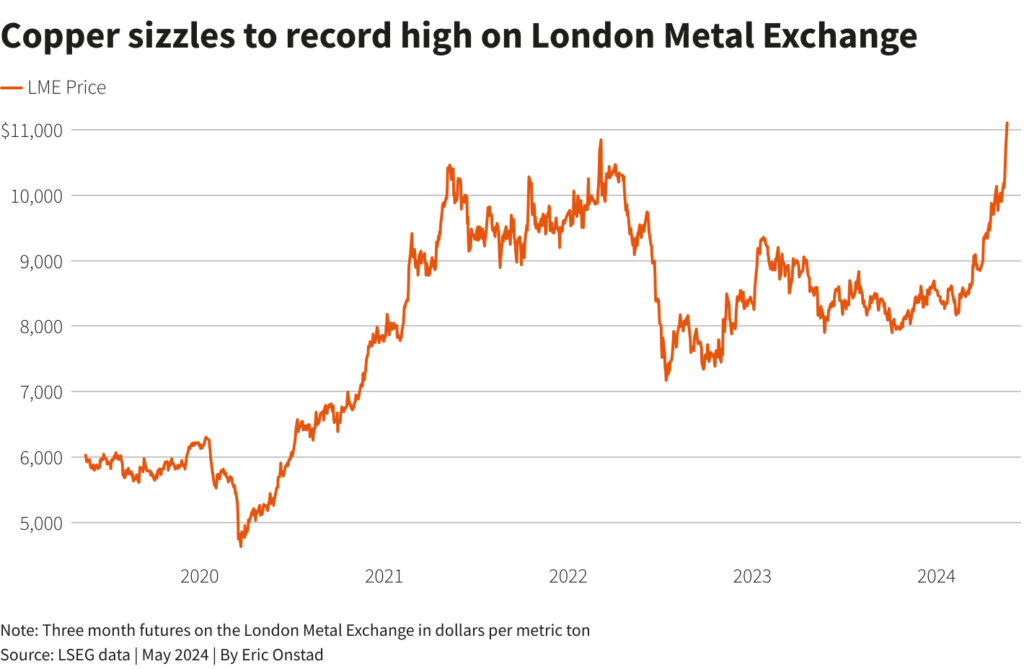

In heavy volume on Monday copper for delivery in July hit a record intra-day level of $5.1990 a pound or $11,460 a tonne.

After the equivalent of $68 billion worth of copper lots exchanged hands in 24 hours, the brown metal is up 35% so far in 2024 with most of the gains in the last few weeks.

Jeff Currie, ex Goldman Sachs and more recently Chief Strategy Officer of Energy Pathways at asset manager Carlyle, told Bloomberg in an interview headlined Copper is the New Oil (not it’s not) that copper “is the highest conviction trade I have ever seen”.

Goldman had been calling copper at today’s prices for at least three years, but Currie’s reading of the energy pathways now sees copper going to $15,000 ($6.80 a pound).

MINING.COM has been banging the same copper drum based on the metal’s position at the nexus of the green energy transition but Currie adds two other tailwinds to green capex demand to get copper to $15k: Green energy transition

AI data centers

Military demand.

Add the long lead times to build new mines (just ask Rio Tinto), tight inventories and Currie says the 2021 call is finally paying off:

“You can’t come up with a better story [..] I’m confident that this time it is liftoff.”

Currie also points out that only at $15,000 would copper match its inflation adjusted all-time peak reached in 1968 which came on the back of a housing boom in the US.

Copper peaked at $0.72 in February of 1968 and as it happens, during that tumultuous year McDonald’s first introduced the Big Mac to America.

The Big Mac, everyone’s favourite deflator, was priced at $0.49 in 1968. Today the Big Mac is a cool $5.99.

Says Currie: “If you go back to the 2000s and I was as bullish on oil then as I am copper today. You know oil ended up going up from $20 to $140 seven times. The upside on copper here is very significant.”

Not sure exactly where on the 20-140 spectrum copper is trading today but if this is the argument that copper is the new oil, MINING.COM will take it.

Copper price hits record above $11,000 on bets that shortage looms

Bloomberg News | May 20, 2024 |

Stock image.

Copper surged to its highest-ever level, extending a months-long rally driven by financial investors who’ve piled into the market in anticipation of deepening supply shortages.

Futures on the London Metal Exchange jumped more than 4%, taking copper past $11,000 a ton for the first time, before paring some gains in afternoon trading.

Banks, miners and investment funds have been touting copper’s bright long-term prospects for months, and a flood of investment into the market over the past few weeks has piled pressure on bearish traders who’ve taken a more cautious stance owing to weak spot demand, particularly in China.

Several developments in 2024 have emboldened copper bulls and drawn in a rising tide of speculative money. Tight supply of copper ore fueled talk of output cuts by smelters, and investors are betting that surging usage in fast-growing sectors including EVs, renewable energy and artificial intelligence will offset the drag from traditional sectors like construction.

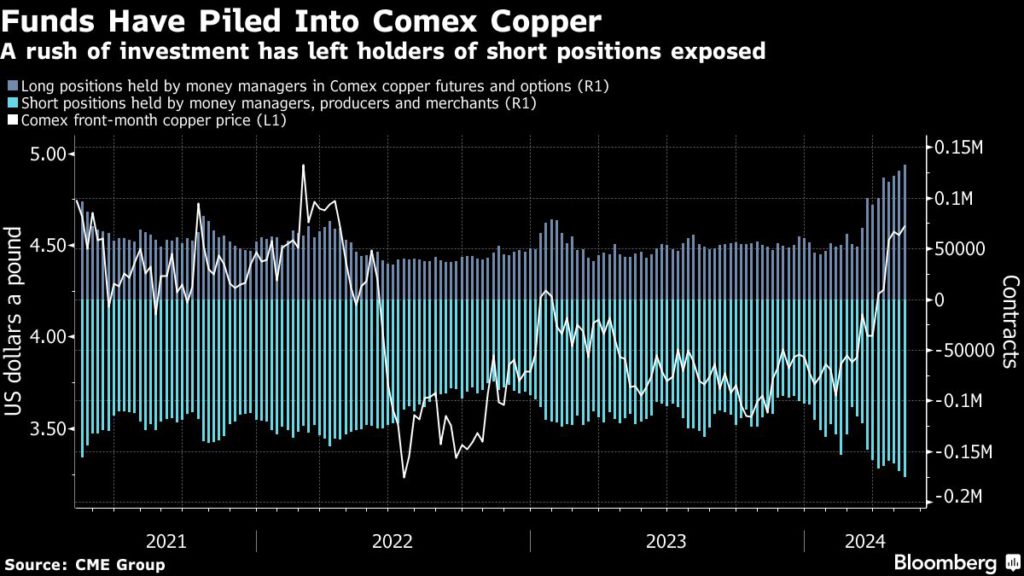

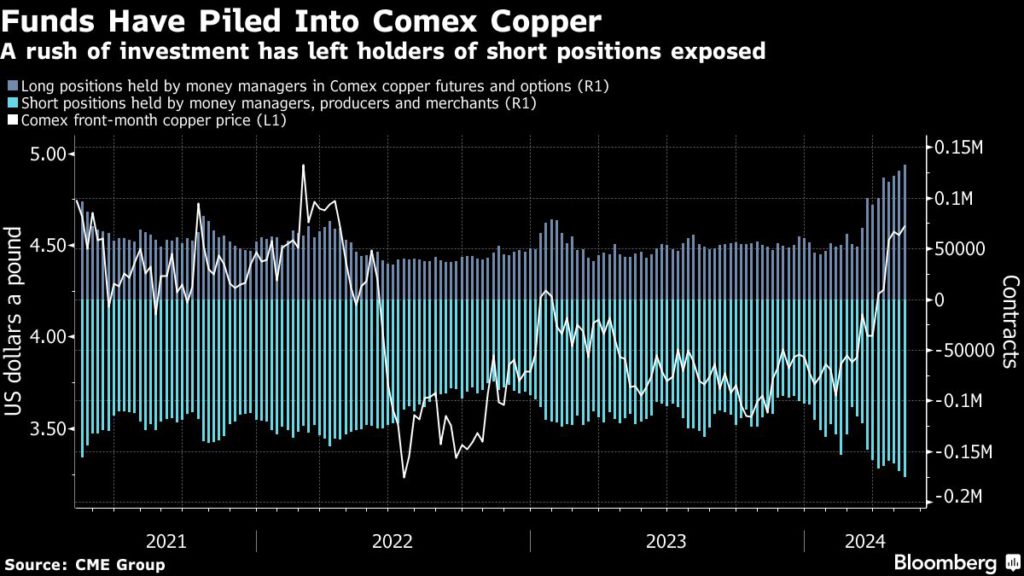

Prices started to take off in early April, and last week the rally went into overdrive as a short squeeze on the New York futures market triggered a global rush to secure the metal.

“That has taken prices to another level and it’s very difficult to call a top in this environment,” Craig Lang, principal analyst at researcher CRU Group, said by phone from Singapore. “Commodities markets do tend to overshoot.”

Investors, traders and mining executives have warned for years that the world faced a critical shortfall of copper amid ballooning demand in green industries. Jeff Currie, commodities veteran and the chief strategy officer of the energy pathways team at Carlyle Group Inc., said last week that copper was the best long trade he has ever seen.

However, many participants in the physical trade have warned that copper prices were running ahead of reality. Demand remains relatively tepid — especially in top buyer China, where inventory levels remain high and suppliers of copper wires and bars have been cutting output. Chinese demand is so subdued that smelters have been racing to export copper as prices in New York and London have shot ahead of prevailing prices in the domestic market.

But the disconnect has continued to grow as investors flocked to western exchanges and bearish traders rushed to buy back short positions.

Copper’s rapid ascent to $11,000 has also brought significant volumes of bullish options into the money, in a trend that could add fuel to the rally as dealers who’ve sold the contracts move to cover their exposure by buying futures.

LME copper was up 2.2% to $10,904 a ton by 3:15 p.m. in London, after earlier hitting an all-time peak of $11,104.50 a ton.

Prices have gained more than a quarter since the start of this year, spearheading across-the-board gains for major industrial metals. Like copper, gold has also rallied to a record, with both metals getting support from optimism that the US Federal Reserve will start cutting interest rates this year.

Diverted metal

A series of setbacks at major copper mines are fueling fears that a much-anticipated production shortfall will arrive earlier than expected. Smelter treatment fees — a gauge of tightness in the ore market — plunged below zero in April, raising the prospect that plants will be forced to cut production to stem losses.

And the short squeeze on the Comex exchange in New York drove prices there to an unprecedented premium over the LME. That triggered a rush to reroute copper to the US, meaning less metal available elsewhere.

“The Comex short squeeze is rediverting copper to the US and tightening supplies in other regions,” Gong Ming, an analyst with Jinrui Futures Co., said by phone. “The Chinese market is expected to see inventories withdrawal soon with exports rising.”

Bloomberg News | May 20, 2024 |

Stock image.

Copper surged to its highest-ever level, extending a months-long rally driven by financial investors who’ve piled into the market in anticipation of deepening supply shortages.

Futures on the London Metal Exchange jumped more than 4%, taking copper past $11,000 a ton for the first time, before paring some gains in afternoon trading.

Banks, miners and investment funds have been touting copper’s bright long-term prospects for months, and a flood of investment into the market over the past few weeks has piled pressure on bearish traders who’ve taken a more cautious stance owing to weak spot demand, particularly in China.

Several developments in 2024 have emboldened copper bulls and drawn in a rising tide of speculative money. Tight supply of copper ore fueled talk of output cuts by smelters, and investors are betting that surging usage in fast-growing sectors including EVs, renewable energy and artificial intelligence will offset the drag from traditional sectors like construction.

Prices started to take off in early April, and last week the rally went into overdrive as a short squeeze on the New York futures market triggered a global rush to secure the metal.

“That has taken prices to another level and it’s very difficult to call a top in this environment,” Craig Lang, principal analyst at researcher CRU Group, said by phone from Singapore. “Commodities markets do tend to overshoot.”

Investors, traders and mining executives have warned for years that the world faced a critical shortfall of copper amid ballooning demand in green industries. Jeff Currie, commodities veteran and the chief strategy officer of the energy pathways team at Carlyle Group Inc., said last week that copper was the best long trade he has ever seen.

However, many participants in the physical trade have warned that copper prices were running ahead of reality. Demand remains relatively tepid — especially in top buyer China, where inventory levels remain high and suppliers of copper wires and bars have been cutting output. Chinese demand is so subdued that smelters have been racing to export copper as prices in New York and London have shot ahead of prevailing prices in the domestic market.

But the disconnect has continued to grow as investors flocked to western exchanges and bearish traders rushed to buy back short positions.

Copper’s rapid ascent to $11,000 has also brought significant volumes of bullish options into the money, in a trend that could add fuel to the rally as dealers who’ve sold the contracts move to cover their exposure by buying futures.

LME copper was up 2.2% to $10,904 a ton by 3:15 p.m. in London, after earlier hitting an all-time peak of $11,104.50 a ton.

Prices have gained more than a quarter since the start of this year, spearheading across-the-board gains for major industrial metals. Like copper, gold has also rallied to a record, with both metals getting support from optimism that the US Federal Reserve will start cutting interest rates this year.

Diverted metal

A series of setbacks at major copper mines are fueling fears that a much-anticipated production shortfall will arrive earlier than expected. Smelter treatment fees — a gauge of tightness in the ore market — plunged below zero in April, raising the prospect that plants will be forced to cut production to stem losses.

And the short squeeze on the Comex exchange in New York drove prices there to an unprecedented premium over the LME. That triggered a rush to reroute copper to the US, meaning less metal available elsewhere.

“The Comex short squeeze is rediverting copper to the US and tightening supplies in other regions,” Gong Ming, an analyst with Jinrui Futures Co., said by phone. “The Chinese market is expected to see inventories withdrawal soon with exports rising.”

Copper’s record run at risk as US shipments calm speculator frenzy

Reuters | May 20, 2024 |

Stock image.

Copper’s lightning rally to record highs may not be sustainable in the coming weeks, with action concentrated on the shipment of material to cover exposed short positions in the US Comex futures market rather than tepid demand in top consumer China.

Prices on the CME Group’s Comex hit a record last week, while benchmark copper on the London Metal Exchange (LME) rocketed on Monday to an all-time peak of $11,104.50 a metric ton, having surged 28% so far this year.

Analysts say copper’s long-term fundamentals are strong, with a bullish outlook attached to firm demand in coming years for applications including the global clean energy transition and greater use of artificial intelligence (AI).

That is set against constrained supply, prompting a race among miners for high quality projects.

The current run higher appears to be on shaky ground, motivated by heavy speculative activity and a dash to cover large short positions – which can be bets on lower prices, or producers hedging their output – taken by traders.

At least 100,000 metric tons of copper are en route to the US CME exchange, two sources with direct knowledge told Reuters on Monday, which will go a good way to allow parties to deliver against bearish positions and take the heat out of the market.

“At the moment, it’s pure speculative rather than real demand,” said Robert Montefusco at broker Sucden Financial.

“It all depends on whether that demand becomes real, because once the specs are out, it’ll just fall away.”

On Comex, there was a total net short position of 7,525 contracts or 85,334 tons, data showed on Friday.

There was a big difference however between the net long position of speculators at 72,785 contracts (825,382 tons) and the net short position by producers of 91,502 contracts (1.04 million tons).

Shipments from South America

Sources have told Reuters that commodity traders including Trafigura and IXM, as well as Chinese copper producers, are among those caught in a short squeeze on Comex.

Many of those shorts have arranged for copper shipments to the US, from producers in Chile and Peru, re-directed vessels that had been headed to China on long-term contracts, and some copper withdrawn from LME warehouses.

More than 20,000 tons from Chile are expected to arrive in the US by the end of May, with bigger volumes lined up to land in June and July, two producer sources said.

The transfer of copper from LME-registered warehouses to Comex however could be limited. Chinese and Russian copper, accounting for 67% of LME stocks, are not eligible for Comex delivery.

There are 17,250 tonnes of copper produced in Chile, Peru and Australia which are US duty-exempt and were in the LME system at the end of April, exchange data showed.

Chinese consumers, smelters hold back

Consumption in China, which accounts for about half of global copper demand, is lacklustre due to a troubled property sector and industrial consumers that are baulking at record prices.

China on Friday announced “historic” steps to stabilise its crisis-hit property sector, but it will take time for a sector that is usually a big consumer of industrial metals to rebound.

For the time being, signals are gloomy, with the Yangshan copper premium, which reflects demand for copper imported into China, hovering at zero after sinking to negative $5 a ton last week, compared with $60 in March.

“Given significant financial length in copper and persisting slack Chinese fundamentals for the time being, we think there remains the risk that investors lose some patience with the story,” JPMorgan analysts said in a note on Monday.

“In our view, this could ultimately be a very healthy correction that acts to kick start Chinese demand out of its stupor.”

Much potential Chinese demand is on hold and could kick in at lower prices, JPMorgan added.

Investors and analysts are still bullish for the medium and long term due to rising global demand and disruptions to mine supply.

(By Eric Onstad, Julian Luk and Pratima Desai, Editing by Veronica Brown and Jan Harvey)

Reuters | May 20, 2024 |

Stock image.

Copper’s lightning rally to record highs may not be sustainable in the coming weeks, with action concentrated on the shipment of material to cover exposed short positions in the US Comex futures market rather than tepid demand in top consumer China.

Prices on the CME Group’s Comex hit a record last week, while benchmark copper on the London Metal Exchange (LME) rocketed on Monday to an all-time peak of $11,104.50 a metric ton, having surged 28% so far this year.

Analysts say copper’s long-term fundamentals are strong, with a bullish outlook attached to firm demand in coming years for applications including the global clean energy transition and greater use of artificial intelligence (AI).

That is set against constrained supply, prompting a race among miners for high quality projects.

The current run higher appears to be on shaky ground, motivated by heavy speculative activity and a dash to cover large short positions – which can be bets on lower prices, or producers hedging their output – taken by traders.

At least 100,000 metric tons of copper are en route to the US CME exchange, two sources with direct knowledge told Reuters on Monday, which will go a good way to allow parties to deliver against bearish positions and take the heat out of the market.

“At the moment, it’s pure speculative rather than real demand,” said Robert Montefusco at broker Sucden Financial.

“It all depends on whether that demand becomes real, because once the specs are out, it’ll just fall away.”

On Comex, there was a total net short position of 7,525 contracts or 85,334 tons, data showed on Friday.

There was a big difference however between the net long position of speculators at 72,785 contracts (825,382 tons) and the net short position by producers of 91,502 contracts (1.04 million tons).

Shipments from South America

Sources have told Reuters that commodity traders including Trafigura and IXM, as well as Chinese copper producers, are among those caught in a short squeeze on Comex.

Many of those shorts have arranged for copper shipments to the US, from producers in Chile and Peru, re-directed vessels that had been headed to China on long-term contracts, and some copper withdrawn from LME warehouses.

More than 20,000 tons from Chile are expected to arrive in the US by the end of May, with bigger volumes lined up to land in June and July, two producer sources said.

The transfer of copper from LME-registered warehouses to Comex however could be limited. Chinese and Russian copper, accounting for 67% of LME stocks, are not eligible for Comex delivery.

There are 17,250 tonnes of copper produced in Chile, Peru and Australia which are US duty-exempt and were in the LME system at the end of April, exchange data showed.

Chinese consumers, smelters hold back

Consumption in China, which accounts for about half of global copper demand, is lacklustre due to a troubled property sector and industrial consumers that are baulking at record prices.

China on Friday announced “historic” steps to stabilise its crisis-hit property sector, but it will take time for a sector that is usually a big consumer of industrial metals to rebound.

For the time being, signals are gloomy, with the Yangshan copper premium, which reflects demand for copper imported into China, hovering at zero after sinking to negative $5 a ton last week, compared with $60 in March.

“Given significant financial length in copper and persisting slack Chinese fundamentals for the time being, we think there remains the risk that investors lose some patience with the story,” JPMorgan analysts said in a note on Monday.

“In our view, this could ultimately be a very healthy correction that acts to kick start Chinese demand out of its stupor.”

Much potential Chinese demand is on hold and could kick in at lower prices, JPMorgan added.

Investors and analysts are still bullish for the medium and long term due to rising global demand and disruptions to mine supply.

(By Eric Onstad, Julian Luk and Pratima Desai, Editing by Veronica Brown and Jan Harvey)

No comments:

Post a Comment