Intel has entered into a definitive agreement under which Apollo-managed funds and affiliates will lead an investment of USD 11 billion to acquire from Intel a 49% equity interest in a joint venture entity related to Intel’s Fab 34.

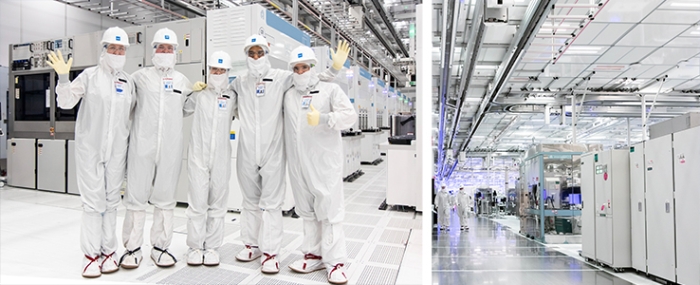

Located in Leixlip, Ireland, Fab 34 is Intel’s leading-edge high-volume manufacturing (HVM) facility designed for wafers using the Intel 4 and Intel 3 process technologies.

To date, Intel has invested USD 18.4 billion in Fab 34. Through this deal, Intel says it can continue the build-out of Fab 34 while also unlocking and reallocating a portion of the investment to other areas of the company.

Intel has committed billions of dollars to reclaim process leadership and expand its worldwide capabilities in leading-edge wafer fabrication and advanced packaging capacity globally as part of its transformation plan.

Under the agreement, the joint venture will have rights to manufacture wafers at Fab 34 to support long-term demand for Intel’s products and provide capacity for Intel Foundry customers.

In the joint company, Intel will own a 51% controlling stake. Fab 34 and its assets will remain fully owned and operated by Intel. The goal of the deal is to provide cash to the business at a lower rate than Intel's equity, strengthening its already robust balance sheet. From a ratings standpoint, the joint venture investment is anticipated to be seen as equity-like.

Under the agreement, the joint venture will have the rights to manufacture wafers at Fab 34 to support long-term demand for Intel’s products and provide capacity for Intel Foundry customers. Intel will have a 51% controlling interest in the joint venture. Intel will however retain full ownership and operational control of Fab 34 and its assets.

“Intel’s agreement with Apollo gives us additional flexibility to execute our strategy as we invest to create the world’s most resilient and sustainable semiconductor supply chain. Our investments in leading-edge capacity in the U.S. and Europe will be critical to meet the growing demand for silicon, with the global semiconductor market poised to double over the next five years,” said David Zinsner, Intel CFO in a press release.

No comments:

Post a Comment