Saudi Aramco Courts Foreign Investors With Roadshows in US and London

Matthew Martin

Mon, Jun 3, 2024

(Bloomberg) -- Saudi Aramco’s top executives are set to hold a series of events in London and the US to drum up demand for the oil giant’s $12 billion share sale, five years after it scrapped an international roadshow for its initial public offering.

Aramco Chief Executive Officer Amin Nasser will be among officials attending at least one of the events in London this week, according to people familiar with the matter. Chief Financial Officer Ziad Al Murshed is also slated to be at a roadshow in the city over the next few days, they said.

The firm is planning a separate event in the US, the people said, declining to be identified as the information is private. Institutional investors can submit orders until June 6 for the share sale that kicked off Sunday.

The $1.8 trillion oil giant’s offer was covered in just a few hours after the deal opened. It wasn’t immediately clear how much demand came from overseas, though the order book reflected a mix of local and foreign investors, Bloomberg News reported.

The extent of foreign participation will be closely watched. During Aramco’s 2019 initial public offering, overseas investors had largely balked at valuation expectations and left the government reliant on local buyers.

The kingdom had planned a series of international events for that $29.4 billion deal, including one in London, which it later scrapped. The company also decided not to market the sale in the US, Canada or Japan, and instead held a roadshow in front of a home audience that had already made their minds up about investing.

The IPO eventually drew orders worth $106 billion, and about 23% of shares were allocated to foreign buyers.

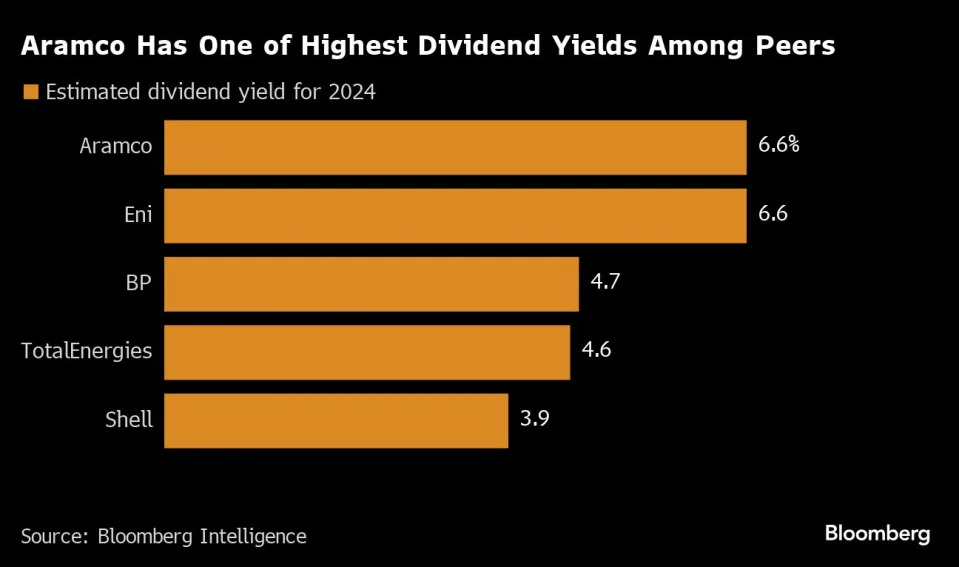

A top selling point this time around is the chance to reap one of the world’s biggest dividends. Investors willing to look past a steep valuation and the lack of buybacks would cash in on a $124 billion annual payout that Bloomberg Intelligence estimates will give the company a dividend yield of 6.6%.

Read More: Investors Pile Into Saudi IPOs With $176 Billion in Orders

The Saudi government owns about 82% of Aramco, while the Public Investment Fund holds a further 16% stake. The kingdom will continue to be the main shareholder after the offering, which adds to Riyadh’s efforts to raise cash and fill a budget deficit.

Most Read from Bloomberg Businessweek

Matthew Martin

Mon, Jun 3, 2024

(Bloomberg) -- Saudi Aramco’s top executives are set to hold a series of events in London and the US to drum up demand for the oil giant’s $12 billion share sale, five years after it scrapped an international roadshow for its initial public offering.

Aramco Chief Executive Officer Amin Nasser will be among officials attending at least one of the events in London this week, according to people familiar with the matter. Chief Financial Officer Ziad Al Murshed is also slated to be at a roadshow in the city over the next few days, they said.

The firm is planning a separate event in the US, the people said, declining to be identified as the information is private. Institutional investors can submit orders until June 6 for the share sale that kicked off Sunday.

The $1.8 trillion oil giant’s offer was covered in just a few hours after the deal opened. It wasn’t immediately clear how much demand came from overseas, though the order book reflected a mix of local and foreign investors, Bloomberg News reported.

The extent of foreign participation will be closely watched. During Aramco’s 2019 initial public offering, overseas investors had largely balked at valuation expectations and left the government reliant on local buyers.

The kingdom had planned a series of international events for that $29.4 billion deal, including one in London, which it later scrapped. The company also decided not to market the sale in the US, Canada or Japan, and instead held a roadshow in front of a home audience that had already made their minds up about investing.

The IPO eventually drew orders worth $106 billion, and about 23% of shares were allocated to foreign buyers.

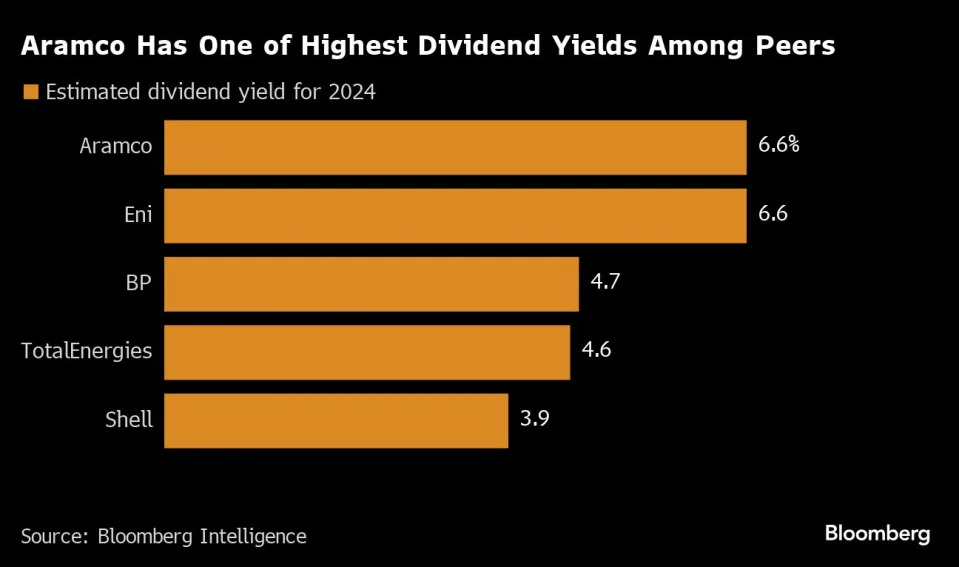

A top selling point this time around is the chance to reap one of the world’s biggest dividends. Investors willing to look past a steep valuation and the lack of buybacks would cash in on a $124 billion annual payout that Bloomberg Intelligence estimates will give the company a dividend yield of 6.6%.

Read More: Investors Pile Into Saudi IPOs With $176 Billion in Orders

The Saudi government owns about 82% of Aramco, while the Public Investment Fund holds a further 16% stake. The kingdom will continue to be the main shareholder after the offering, which adds to Riyadh’s efforts to raise cash and fill a budget deficit.

Most Read from Bloomberg Businessweek

Can Saudi Aramco thread that needle?

Fortune· Courtesy of Saudi Aramco

Vivienne Walt

Thu, May 23, 2024

On Saudi Aramco’s campus at the edge of the Arabian Gulf, the vast scale of the world’s biggest oil producer is on stark display. In one building, a curved monitor 140 feet long wraps around a room, tracking the crude flowing through 25,000 miles of pipelines.

A short distance away, in the company’s “advanced exploration and petroleum engineering research center,” or EXPECArc, scientists fine-tune seismic drones that can analyze underground rock formations and transmit the data back to engineers within seconds—sparing Aramco the expense and risk of dispatching teams into the desert to drill for oil. Meanwhile, others test fast-curing cement injected with carbon and experiment with compounds built to suck carbon directly from the air—trying to build technology that could reduce the polluting effects of burning that oil.

During a rare two-day visit by Fortune in early May, Aramco lifted the curtain on dozens of research projects underway at its headquarters in Dhahran, in eastern Saudi Arabia, where about 20 engineers, specialists, and executives detailed their home-grown inventions. Some of these, the company believes, could someday be hugely lucrative exports, with significant impact on the oil-and-gas industry.

Aramco’s purpose in revealing its work to a few hand-picked journalists was hardly subtle. With environmentalists pushing oil giants to phase out fossil fuels, the company was keen to present itself as a climate friend, not foe—deeply concerned about global warming, but intent on producing oil for generations to come. Projecting a green image is increasingly seen by oil producers as essential in quelling shareholder activism and appeasing regulators.

But Aramco execs stress that they see their climate commitments as in their own interest. “This is our environment. This is our country,” says Ashraf Al-Ghazzawi, executive vice president for strategy and corporate development, in a long interview. “This was not dictated on us.”

'We don't see any contradiction'

The message was simple: Aramco can tackle climate change, even while pumping a mammoth 9 million barrels or so of oil a day. (ExxonMobil, the second-biggest oil company, pumps less than one-third that amount.) “We don’t see any contradiction,” Ghazzawi says. “Combating emissions from these conventional energy sources is a very viable option.”

For the Saudi royals, conventional energy is also essential. Revenues from the country’s vast oil reserves comprise 50% of the Saudi economy. Profits from that oil—which costs Aramco less than $4 a barrel to produce—are crucial to supporting the government’s other economic-development endeavors. In May, the company reported free cash flow of nearly $23 billion for the first quarter of this year, and last year it brought in $440.8 in revenues.

The goal is to make that oil business last far into the future, regardless of the world’s green transition. Aramco claims its tech breakthroughs will cut carbon emissions from each barrel of oil it produces by 15% by 2035, a sum that engineers calculate to be equivalent to 51.1 million tons of carbon a year. The company aims to zero out its emissions by 2050 (its so-called net-zero target). That target excludes joint ventures, as well as Scope 3, or end-user, emissions. But Aramco predicts that even in 2050, millions of people will still be driving fuel-burning cars, flying on jet-fuel planes, and sending cargo on marine-fuel ships.

“We need all sources of energy to meet the growth in demand, which is just tremendous in the developing world,” says Ahmad Al-Khowaiter, executive vice president for technology and innovation. “The main pillar of our strategy and technology is efficiency and optimization of our existing production.”

The emphasis on efficiency, rather than reining in production, is pushed in every corner of the Dhahran headquarters, or “camp,” as the staff calls their American-style suburban complex. (There’s Starbucks and Tex-Mex food on offer, and Little League baseball.)

But to many climate scientists and environmentalists, squaring the circle—being an oil giant and a climate champion—seems impossible. The London-based financial NGO Carbon Tracker Initiative, which monitors companies’ environmental performance, last September ranked Aramco’s climate goals the weakest among 25 publicly traded oil and gas companies, and the only one that restricts its climate targets to wholly owned and operated facilities. In general, the NGO says, the industry “continues to put investors at risk by failing to plan for production cuts.”

The carbon-capture debate

Aramco is determined to far outlast that transition. Khowaiter, head of technology and innovation, says the company has tripled its research-and-development staff since 2010, and in 2023 it listed 1,033 patents with the U.S. patent office. To support those efforts, Aramco recruits staff straight from Saudi high schools, then sponsors their specialized studies, often in the U.S. One engineer Fortune met was about to begin her doctoral studies at Stanford, while another will be leaving this summer for Cornell.

Aramco now spends about $800 million a year on R&D, 60% of which is focused on “sustainability,” Khowaiter says. “Ultimately, the market will value low-carbon products.” That investment is reflected in the sheer amount of activity at headquarters, especially in its effort to capture and reuse carbon.

Carbon capture is a technology that oil producers have embraced. Many climate scientists and officials have regarded it skeptically, however, accusing the industry of promoting the technology in order to forestall implementing meaningful curbs on emissions. U.N. Secretary General António Gutteres has referred to industry plans that emphasize carbon capture over clean energy as “proposals to become more efficient planet wreckers.”

Aramco execs reject that notion. At the company’s Hawiyah gas plant, two hours south of Dhahran, it captures carbon emitted during oil and gas production, then transports it 50 miles away, where it is injected it into an oil well to boost the recovery of crude, as well as to store the carbon. It's a modest pilot project to reuse carbon, rather than emit particles into the atmosphere. Khowaiter says Aramco is aiming to halve the cost of carbon capture, making it commercially viable. Beginning in 2028, it will capture and store about 9 million tons a year of carbon in Jubail, north of Aramco’s headquarters.

Pricey hydrogen

But much of Aramco’s other whizzbang technology is still too expensive to market. That includes developing hydrogen as a source of fuel, which engineers at EXPECArc have researched for years. In 2020, Aramco made the world’s first shipment, to Japan, of blue ammonia—liquified hydrogen created from hydrocarbons. But blue ammonia remains difficult to transport, and vastly more costly than oil or gas.

Aramco predicts blue and green hydrogen (the kind made from renewables) will become a $700 million industry by 2050—admittedly small change for a company this size. It is developing ways to use blue hydrogen locally. One idea under consideration is using blue hydrogen to power a factory which Aramco operates with Saudi Arabia’s Baosteel: The plan would be to use the cleaner power to make steel plates, and then sell the low-carbon product for far higher prices than regular, higher-polluting steel.

Figuring out which among the many lines of R&D will finally work could take years for Aramco to determine—time that many fear the world does not have. “For me, a big litmus test is how rapidly they are actually going to be able to decarbonize their oil and gas,” says James Ingram, senior editor for the Middle East Economic Survey, “or whether it is just talk.”

Ghazzawi, Aramco’s strategy chief, rejects any notion that the company should cut fossil fuel output. “We were never an either-or company,” he says. “Aramco provides a great example where emissions can be dealt with, it can be managed.”

Editor's note: An earlier version of this story included a misspelling of the name of Ashraf Al-Ghazzawi, Saudi Aramco's executive vice president for strategy and corporate development

This story was originally featured on Fortune.com

No comments:

Post a Comment