UK

Raspberry Pi Hands London a Starry Share Market Debut at Last

\

British PC Maker Raspberry Pi Soars in London Trading Debut

Swetha Gopinath

Tue, Jun 11, 2024

(Bloomberg) -- London’s lament over a shrinking equity market has been drowned out — for the moment at least — by the stellar trading debut of personal computer maker Raspberry Pi.

Shares in the British creator of low-cost computers popular among hobbyists and educators soared by as much as 43% Tuesday after a £166 million ($211 million) initial public offering. It’s on track to be the strongest first-day performance in about three years for a company raising at least $100 million in a London listing, according to data compiled by Bloomberg.

The pleasing start for Cambridge, England-based Raspberry Pi brings relief to a market struggling to stop local firms from chasing richer valuations abroad. Activists and foreign suitors alike are trying to lure companies stateside, citing deeper markets in New York, where investors have an established and strong appetite for tech names.

In a painful snub for London, home-grown Arm Holdings Plc, whose chips are used in Raspberry Pi’s products, opted to go public in the US last year. Arm’s investment division took up shares in the listing of Raspberry Pi, founded about 16 years ago.

Investors, meanwhile, are entitled to be wary of new UK listings. CAB Payments Holdings Plc, the last meaningful debut in London has tumbled 62% since its IPO last June.

Some are hopeful that today’s positive performance is early evidence of a turnaround.

“It shows the UK is open for business to technology flotations and that investors are hungry for companies of any size if they tick the right boxes,” Dan Coatsworth, investment analyst at AJ Bell, said in emailed comments. “There is a widely held view that tech companies only float in the US where they can potentially get a higher valuation. Raspberry Pi is proof that the UK can still compete against the likes of the Nasdaq and attract home-grown champions.”

Any news on the London listings front is attracting out-sized attention from banks and the UK government alike, after the City’s share of the broader European IPO market plunged to the lowest level in decades.

Walgreens Boots Alliance Inc. has shelved plans for a potential first-time share sale of its British drugstore chain Boots, dashing hopes for a blockbuster London listing, Bloomberg News reported last week.

More optimistically, online fashion retailer Shein is planning a mega London listing with an estimated valuation of £50 billion, which would be big enough to soothe worries over the UK IPO market for a while.

Most Read from Bloomberg Businessweek

British PC Maker Raspberry Pi Soars in London Trading Debut

Henry Ren

Tue, Jun 11, 2024

(Bloomberg) -- British personal computer maker Raspberry Pi shares jumped on its first day as a public company, offering a boost to London’s struggling market for new stock listings.

Shares of the Cambridge-based company closed Tuesday’s session at 385 pence each, a 38% surge from its initial public offering price of 280 pence. The stock gained as much as 43% during intraday trading from the pricing of its £166 million ($211 million) IPO.

The brisk first-day performance offers a glimmer of hope for the London market, which has struggled in recent years to attract technology companies to list. Raspberry Pi is the first tech firm that raised $100 million or more in London since video-game maker Devolver Digital Inc. went public in 2021, according to data compiled by Bloomberg.

The Raspberry Pi IPO provided “a much needed quality injection into the UK capital markets, and hopefully this proves to be a catalyst for future listings of innovative British businesses domestically,” said Adam Montanaro, a fund manager at Montanaro Asset Management who bought into the offering.

The company, which makes low-cost computers popular among hobbyists and educators, had a market capitalization of about £542 million. Its IPO was oversubscribed by multiple times and the pricing came at the top end of a marketed range, suggesting strong demand for its shares.

The new listing is the biggest in London since cross-border payments firm Cab Payments Holdings Plc floated in July 2023. The city has fallen behind in this year’s IPO revival, with the UK exchange accounting for about 2% of about $13 billion raised in IPOs in Europe this year.

The London Stock Exchange was dealt a blow last year when British chip designer Arm Holdings Plc decided to sell shares in New York. It’s also losing tech listings at a faster pace, with cybersecurity firm Darktrace Plc agreeing to be sold to private equity firm Thoma Bravo.

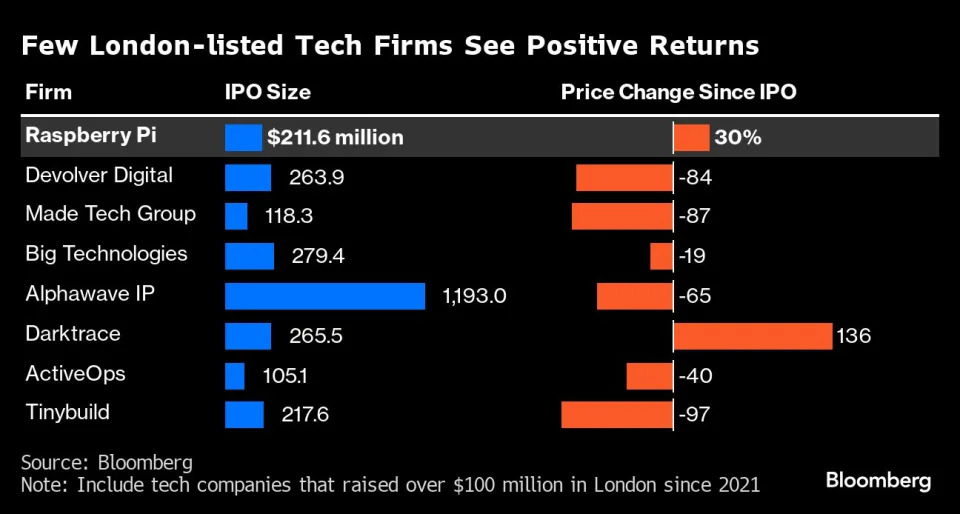

Among the technology-focused companies that went public in London since 2021, few have seen positive returns. Shares of video-game company TinyBuild Inc. slumped by 97% since its 2021 IPO, while semiconductor specialist Alphawave IP Group Plc fell by almost two thirds.

Raspberry Pi could offer a boost to sentiment toward the UK tech scene, but given the small IPO size and limited free float, “it unfortunately does not leave too much room for excitement,” said Ben Barringer, an analyst at Quilter Cheviot.

“There is a long way to go before the UK can be seen to be recovering, but hopefully this IPO helps to encourage other tech founders to consider this route to market,” he said in an email.

Raspberry Pi was previously reported to be considering a listing in early 2022. Since then, it raised money from British chipmaker Arm and Sony Group Corp.’s semiconductor division.

Arm was committed to buying $35 million worth of shares in the IPO, while UK asset manager Lansdowne Partners agreed to purchase as much as $20 million, according to the prospectus.

Raspberry Pi is known for its cheap single-board computers that can be programmed to run different tasks. It sold 7.4 million devices last year and is expecting to sell 8.4 million this year.

Jefferies Financial Group Inc. and Peel Hunt LLP led the offering, according to a statement. The company trades under the symbol RPI.

--With assistance from Thyagu Adinarayan.

Bloomberg Businessweek

Henry Ren

Tue, Jun 11, 2024

(Bloomberg) -- British personal computer maker Raspberry Pi shares jumped on its first day as a public company, offering a boost to London’s struggling market for new stock listings.

Shares of the Cambridge-based company closed Tuesday’s session at 385 pence each, a 38% surge from its initial public offering price of 280 pence. The stock gained as much as 43% during intraday trading from the pricing of its £166 million ($211 million) IPO.

The brisk first-day performance offers a glimmer of hope for the London market, which has struggled in recent years to attract technology companies to list. Raspberry Pi is the first tech firm that raised $100 million or more in London since video-game maker Devolver Digital Inc. went public in 2021, according to data compiled by Bloomberg.

The Raspberry Pi IPO provided “a much needed quality injection into the UK capital markets, and hopefully this proves to be a catalyst for future listings of innovative British businesses domestically,” said Adam Montanaro, a fund manager at Montanaro Asset Management who bought into the offering.

The company, which makes low-cost computers popular among hobbyists and educators, had a market capitalization of about £542 million. Its IPO was oversubscribed by multiple times and the pricing came at the top end of a marketed range, suggesting strong demand for its shares.

The new listing is the biggest in London since cross-border payments firm Cab Payments Holdings Plc floated in July 2023. The city has fallen behind in this year’s IPO revival, with the UK exchange accounting for about 2% of about $13 billion raised in IPOs in Europe this year.

The London Stock Exchange was dealt a blow last year when British chip designer Arm Holdings Plc decided to sell shares in New York. It’s also losing tech listings at a faster pace, with cybersecurity firm Darktrace Plc agreeing to be sold to private equity firm Thoma Bravo.

Among the technology-focused companies that went public in London since 2021, few have seen positive returns. Shares of video-game company TinyBuild Inc. slumped by 97% since its 2021 IPO, while semiconductor specialist Alphawave IP Group Plc fell by almost two thirds.

Raspberry Pi could offer a boost to sentiment toward the UK tech scene, but given the small IPO size and limited free float, “it unfortunately does not leave too much room for excitement,” said Ben Barringer, an analyst at Quilter Cheviot.

“There is a long way to go before the UK can be seen to be recovering, but hopefully this IPO helps to encourage other tech founders to consider this route to market,” he said in an email.

Raspberry Pi was previously reported to be considering a listing in early 2022. Since then, it raised money from British chipmaker Arm and Sony Group Corp.’s semiconductor division.

Arm was committed to buying $35 million worth of shares in the IPO, while UK asset manager Lansdowne Partners agreed to purchase as much as $20 million, according to the prospectus.

Raspberry Pi is known for its cheap single-board computers that can be programmed to run different tasks. It sold 7.4 million devices last year and is expecting to sell 8.4 million this year.

Jefferies Financial Group Inc. and Peel Hunt LLP led the offering, according to a statement. The company trades under the symbol RPI.

--With assistance from Thyagu Adinarayan.

Bloomberg Businessweek

No comments:

Post a Comment