‘Labour must rethink the Bank of England’s role to fulfil its growth mission’

We have an economy which is not delivering. Occasional flashes of better news, such as the 0.6% quarter on quarter increase in GDP during the first three months of 2024, do not fundamentally change the picture.

There is no consensus as to why we are doing so badly, and there is no agreement on what we should do to remedy the dire state of affairs which confronts us.

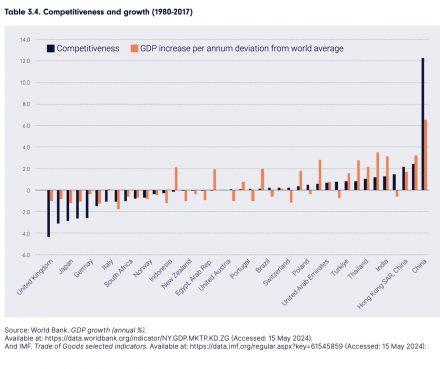

My new report argues that there is a viable way ahead, but that for this to be adopted there has to be a radical change in strategy. Instead of having inflation at two per cent as our principal economic goal, competitiveness should be our primary objective.

High interest rates push up the exchange rate, making the economy uncompetitive

Chasing inflation down to 2% per annum requires deflationary policies which push up the exchange rate, making the economy uncompetitive. Interest rates today stand at 5.25%. The result is a dearth of profitable investment opportunities.

Having recognised just how deeply uncompetitive we currently are, the only remedy is much greater export competitiveness. We have to use export and investment-led growth to prevent us from continuing to haemorrhage share of world trade. The only way to do this is by having a much more competitive pound. In its absence, nothing else will work.

This will require a one-off devaluation of around 25%, providing us with a growth rate strong and consistent enough to keep the performance of the UK economy up with the rest of the world for the foreseeable future.

Why we should change the BoE’s mandate

We should change the principal remit of the Bank of England away from keeping inflation close to 2%. Instead, it should be to keep the pound trading on the international markets at a level which generates growth at an agreed rate – probably 2.5 to 3% per annum.

It would also send a strong political signal about Labour’s commitment to its growth mission, much as the last Labour government sought to send political signals by handing the Bank independence.

Adopting this strategy is crucially important but it is, of course, not the only thing which needs to be done. We need better education and training, infrastructure modernisation, more patient capital, appropriate tax incentives – especially those designed to encourage investment – and a planning system that strikes a reasonable balance between industry and other priorities.

Restoring manufacturing to perhaps 15% of GDP will need to be an important part of the mix. This is a policy whose popularity with the public may help to make more acceptable the devaluation needed to make it occur.

We need to look beyond conventional wisdom

Is any of this going to happen? Maybe not. It is, however, surely possible that these dismal prospects in front of us may trigger a willingness to look beyond the conventional wisdom to new solutions to old problems.

If this does not happen, however, and there is no change in strategy thus leaving the UK uncompetitive and continuing to lose share of world trade, we can be sure that investment, especially of the kind which contributes most to economic growth, will languish.

We will continue to have large current account deficits. And, of course, our economy will continue to stagnate. Is this really what we want?

READ MORE: Sign up to our must-read daily briefing email on all things Labour

SHARE: If you have anything to share that we should be looking into or publishing about this story – or any other topic involving Labour or the election – contact us (strictly anonymously if you wish) at mail@labourlist.org.

SUBSCRIBE: Sign up to LabourList’s morning email here for the best briefing on everything Labour, every weekday morning.

DONATE: If you value our work, please donate to become one of our supporters here and help sustain and expand our coverage.

PARTNER: If you or your organisation might be interested in partnering with us on sponsored events or content, email mail@labourlist.org.

No comments:

Post a Comment