From social housing to funding the environmental plans of half a dozen major nations, here's just a few ways to spend the money that would be generated by Brazil's billionaire tax

Emily Chudy

13 Aug 2024

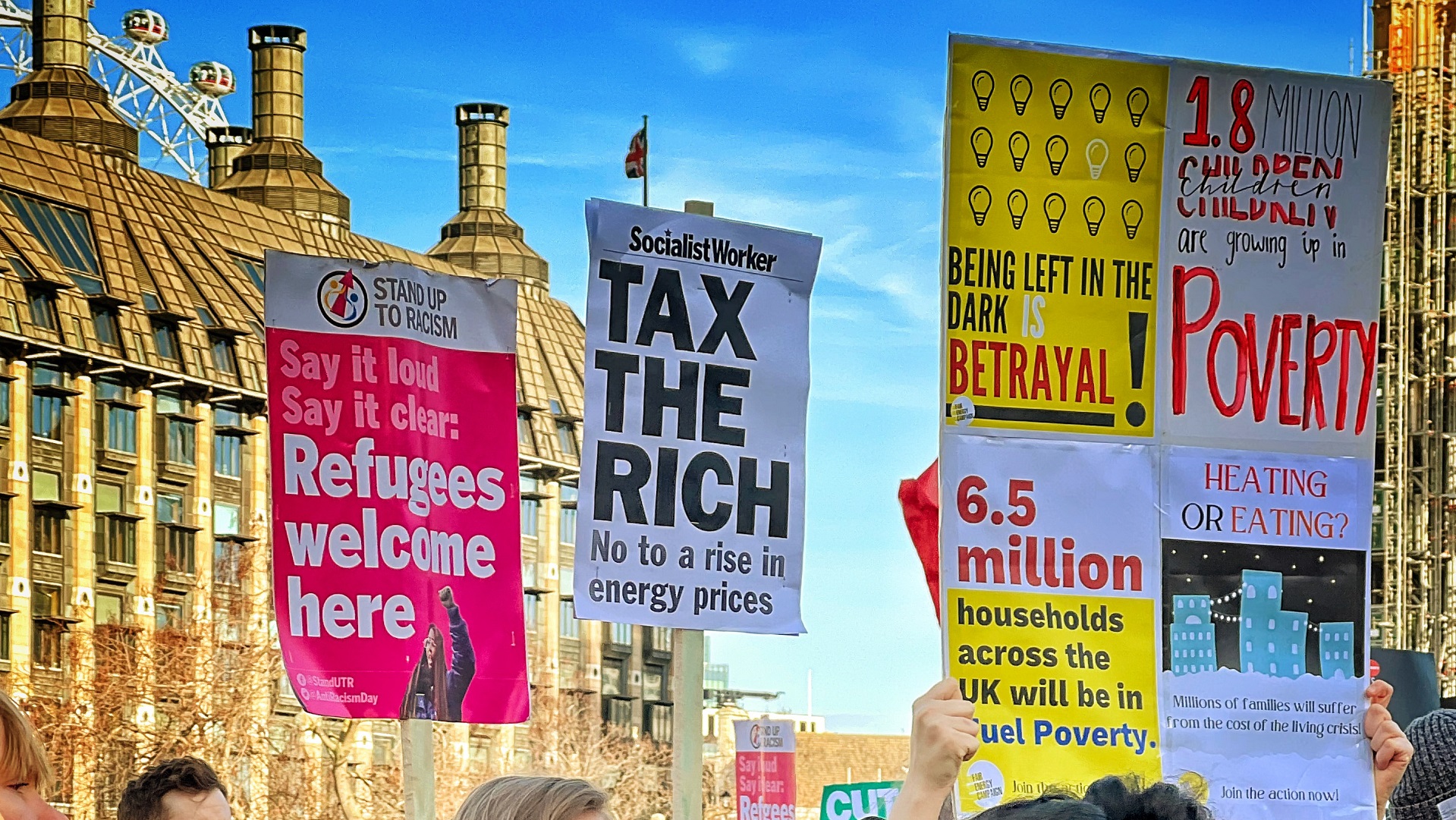

People protesting against the cost of living crisis in London.

Flickr/ Garry Knight

The Brazilian government has put forward a radical proposal to impose a 2% global wealth tax, which would impact the 3,000 wealthiest people in the world.

The idea was put forward during a recent G20 meeting and, according to NPR, could unlock an extra $250bn per year (around £196bn). The 2% proposal is a result of estimates suggesting that billionaires are currently only paying about 0.3% of their wealth in tax.

Several nations – including France, Spain and South Africa – reportedly voiced support for the idea during the G20 meeting. However US treasury secretary Janet Yellen has said she is against it.

The proposed “billionaire tax” is still up in the air, therefore. But if it was put through, how could that extra £190bn help alleviate poverty or climate change?

Here’s how a global “billionaire tax” could help change the world for the better. Wealth of world’s five richest men doubles as five billion people get poorer: ‘It’s not democratic’

Tax secrets the wealthy don’t want you to know, like how to get richer by buying a yacht!

Provide social homes for almost the entire UK waiting list

A June study by consultancy firm JLL estimates that the cost of providing social housing for all 1.284 million people on a waiting list in the UK would run to £205bn.

With £196bn on the cards from a proposed billionaire tax, around 1.19 million social houses could be provided, meaning the waiting list for social homes would be reduced to just 94,000 people.

The current waiting list for social housing is so long that some are facing delays of more than half a century; the longest in the country is in London borough Greenwich, where people could face a 55-year wait for social housing.

The Brazilian government has put forward a radical proposal to impose a 2% global wealth tax, which would impact the 3,000 wealthiest people in the world.

The idea was put forward during a recent G20 meeting and, according to NPR, could unlock an extra $250bn per year (around £196bn). The 2% proposal is a result of estimates suggesting that billionaires are currently only paying about 0.3% of their wealth in tax.

Several nations – including France, Spain and South Africa – reportedly voiced support for the idea during the G20 meeting. However US treasury secretary Janet Yellen has said she is against it.

The proposed “billionaire tax” is still up in the air, therefore. But if it was put through, how could that extra £190bn help alleviate poverty or climate change?

Here’s how a global “billionaire tax” could help change the world for the better. Wealth of world’s five richest men doubles as five billion people get poorer: ‘It’s not democratic’

Tax secrets the wealthy don’t want you to know, like how to get richer by buying a yacht!

Provide social homes for almost the entire UK waiting list

A June study by consultancy firm JLL estimates that the cost of providing social housing for all 1.284 million people on a waiting list in the UK would run to £205bn.

With £196bn on the cards from a proposed billionaire tax, around 1.19 million social houses could be provided, meaning the waiting list for social homes would be reduced to just 94,000 people.

The current waiting list for social housing is so long that some are facing delays of more than half a century; the longest in the country is in London borough Greenwich, where people could face a 55-year wait for social housing.

Fund Keir Starmer’s abandoned climate policy

In a major U-turn in February, ahead of the general election, Labour scrapped its climate policy of spending £28bn every year on its green investment plan.

Announced in 2021, the 28bn per year climate pledge would reportedly have been spent on hydrogen power, offshore wind, tree planting, flood defences and home insulation. Instead Labour has said it will spend £23.7bn across five years on green initiatives.

A £196bn wealth tax would fund Labour’s initial promise on the climate with plenty of room to spare.

In fact, the money raised annually by Brazil’s proposed “billionaire tax” would foot the bill for environmental spending promised by France (€20bn/£17bn), Germany (€57bn/£49bn), the Netherlands (€28bn/£24bn) and Italy (€76bn/£65bn) combined, on top of the UK.

There would even be a £7bn leftover, which is around what Europe spends annually to protect one million hectares of land in the Brazilian Amazon.

Eliminate child poverty in the UK

One of the issues that experts have claimed is fuelling a rise in child poverty in the UK is the two-child benefit limit, which figures state could be scrapped with just a fraction of the proposed “billionaire tax” at £3.4bn a year. Charities estimate that scrapping the two-child benefit cap would lift 300,000 children out of poverty.

And with £186.6bn leftover to spend, the proposed wealth tax could fund:Increasing child benefit by £20 a week, pulling 500,000 children out of poverty across the UK (£10bn)

Expanding universal free school meals to all pupils from reception to year 11 (£2.9m)

Bringing back the educational maintenance allowance for students, which was scrapped in 2011 (£596m)

Implementing former prime minister Gordon Brown’s plan to fight poverty in the UK, including an extended Household Support Fund (£3bn)

Funding a thousand brand new council playgrounds for children across the country (£55m)

All of these policies could be funded with tens and tens of billions of pounds to spare.

See universal credit more than triple

The UK is forecast to spend £90bn on universal credit in 2024-25. With an extra £190bn cash injection, this amount would rise to £280bn if all of the money was solely spent on uplifting universal credit.

With a 211% increase in funding to universal credit, then, families across the country could see a few hundred extra pounds in their wallets if the money was directly allocated to recipients.

With those single and under 25 receiving £311.68 per month currently, according to the government’s website, an uplift from the “billionaire tax” would see them receiving £969.32 per month.

For those single and 25 or over, currently receiving £393.45 per month, monthly universal credit would increase to £1,223.63.

The amount a person would receive for a first child born on or after 6 April 2017 would also increase from £287.92 per month to £895.43 per month.

Scrap tuition fees for university students

In its 2024 manifesto, the Green Party promised to scrap tuition fees and bring back maintenance grants for universities, which had a predicted annual cost of £7.8bn.

With the £190bn in proposed “billionaire tax”, not only could university students get their studies paid for, but the estimated 1.7 million undergraduates in the UK could be given £107,176 each as a one-off payment with the money left over.

With the average deposit for a first-time home buyer costing around £53,414 in 2023, the cash injection for young Brits would probably be very welcome.

Pay for thousands of tourist trips to outer space

A billionaire tax also could buy tourist tickets into space for around half a million people (533,707). That’s almost the entire population of Edinburgh.

According to Virgin Galactic, a 90-minute trip into space would set you back $450,000 (£356,000), so around half a million people could go on the trip of a lifetime with the money raised from a billionaire tax.

Buy the entire world’s Disney parks

The 12 global Disney parks, with locations including California, Florida, Hong Kong, Tokyo, Shanghai and Paris, are worth an estimated total of $125bn (£97bn). With the money generated by the “billionaire tax” you could comfortably buy every single one of Disney’s theme parks around the globe.

That’s a lot of roller coasters.

No comments:

Post a Comment