BHP and workers reach deal to end strike at Escondida

Staff Writer | August 16, 2024 |

Escondida is forecast to produce about 1.1 million tonnes of copper in the 12 months to June 30, or 5% of the world’s total copper production. (Image courtesy of Rio Tinto, which has a 30% interest in the mine, run by BHP.)

BHP (ASX, LON, NYSE: BHP) and union leaders in Chile reached a preliminary wage agreement on Friday to end a strike at Escondida, the world’s largest copper mine.

The union, representing about 2,400 workers, initiated the strike on Tuesday after failing to reach a pay deal.

A central point in the negotiations was the union’s demand for 1% of shareholder dividends from the mine, or about $35,000 per worker. The company had offered a bonus of $28,900 before the strike.

“BHP and Union No. 1 have come to an agreement for a collective contract proposal. Along with that, it was agreed to suspend the strike underway as of this Friday, Aug. 16, at 8 a.m.,” BHP said in a statement.

The new deal could be signed on Sunday after union leadership meets with members.

Escondida accounts for about 5% of the world’s mined copper, producing more than 1 million metric tonnes of the metal a year.

Based on data from the state-run Chilean Copper Commission (Cochilco), Escondida accounted for 23.7% of the country’s copper production during the first half of the year. This is almost the same amount produced by Chile’s Codelco, the world’s largest copper producer, during the same period.

The mine produced 614,400 tonnes of copper in the first six months of 2024, according to Cochilco. Chile’s total production of the red metal during this period amounted to 2.6 million tonnes.

Copper for delivery in September fell 1.2% from Thursday’s settlement after the news, touching $4.10 per pound ($9,020 per tonne) on Friday morning on the Comex market in New York.

“Strikes usually don’t tend to be long-lasting in Chile, and so the market may have been reluctant to react to it too much in the early stages,” Michael Widmer, head of metals research at Bank of America, told Bloomberg.

“The bigger issue right now is how we’re doing on the demand side, and that’s probably why the market hasn’t focused on it so much.”

The last significant strike at Escondida occurred in 2017, lasting 44 days. The stoppage hurt production, drove global copper prices up, and became the longest private-sector mining strike in Chile’s history. It is estimated that Escondida failed to produce more than 120,000 tonnes of the red metal due to that strike.

Miners down tools at two Chilean copper mines, as majors struggle to maintain production levels

August 16, 2024 (Investorideas.com Newswire)

The copper market continues to be challenged by supply issues, with two large mines in Chile hit by strikes.

The copper market continues to be challenged by supply issues, with two large mines in Chile hit by strikes.

On Monday, Lundin Mining (TSX:LUN) said it will gradually cut down activities at the Caserones copper mine after a small part of its workforce in Chile took action over a failed collective bargaining agreement.

The Canadian miner had tried to reach an agreement with one of three unions representing approximately 30% of Caserones employees, or 5% of the total workforce at the Caserones, prior to the strike…

The company recently upped its stake in Caserones to 70% after exercising an option with Japan's JX Nippon Mining & Metals. The mine represents one of Lundin's trio of key assets in or around northern Chile, the other two being the 80%-owned Candelaria mine in the Atacama region and the Josemaría project in Argentina. (via Mining.com)

No word yet on how the strike could impact production.

Chile is the largest producer of mined copper in the world, followed by the Democratic Republic of Congo and Peru.

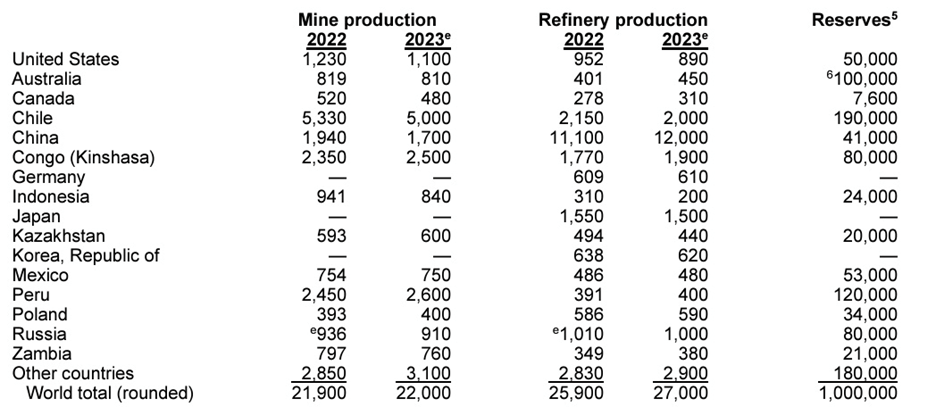

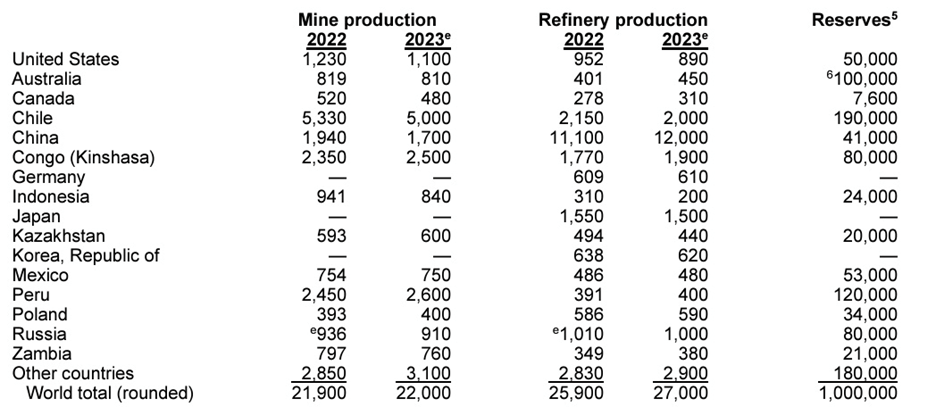

Source: US Geological Survey

Labor strife is also evident at BHP's huge Escondida mine, with a strike starting on Tuesday. Reuters reported "a powerful workers union… is looking to snarl production at the site as it pushes for a bigger share of profits."

Readers may recall a 44-day strike at Escondida in 2017 which caused copper prices to spike when the mega-miner declared "force majeure".

The same thing happened in 2016 after a 26-day strike, and in 2011 the union halted operations for two weeks.

In Africa, the export of copper has been interrupted for a different reason. On Aug. 11, Zambia temporarily sealed its border with Congo after the DRC government banned certain beverage imports, including beer, from Zambia, local media said.

Landlocked Congo only has one way to access ports, and that is through Zambia. The latter resumed trade with the DRC on Tuesday.

Copper market

Benchmark Mineral Intelligence (BMI) forecasts global copper consumption to grow 3.5% to 28 million tonnes in 2024, and for demand to increase from 27 million tonnes in 2023 to 38 million tonnes in 2032, averaging 3.9% yearly growth.

Yet the US Geological Survey reports supply from copper mines in 2023 amounted to only 22 million tonnes. If the copper supply doesn't grow this year, we are possibly looking at a 6Mt deficit.

August 16, 2024 (Investorideas.com Newswire)

The copper market continues to be challenged by supply issues, with two large mines in Chile hit by strikes.

The copper market continues to be challenged by supply issues, with two large mines in Chile hit by strikes.

On Monday, Lundin Mining (TSX:LUN) said it will gradually cut down activities at the Caserones copper mine after a small part of its workforce in Chile took action over a failed collective bargaining agreement.

The Canadian miner had tried to reach an agreement with one of three unions representing approximately 30% of Caserones employees, or 5% of the total workforce at the Caserones, prior to the strike…

The company recently upped its stake in Caserones to 70% after exercising an option with Japan's JX Nippon Mining & Metals. The mine represents one of Lundin's trio of key assets in or around northern Chile, the other two being the 80%-owned Candelaria mine in the Atacama region and the Josemaría project in Argentina. (via Mining.com)

No word yet on how the strike could impact production.

Chile is the largest producer of mined copper in the world, followed by the Democratic Republic of Congo and Peru.

Source: US Geological Survey

Labor strife is also evident at BHP's huge Escondida mine, with a strike starting on Tuesday. Reuters reported "a powerful workers union… is looking to snarl production at the site as it pushes for a bigger share of profits."

Readers may recall a 44-day strike at Escondida in 2017 which caused copper prices to spike when the mega-miner declared "force majeure".

The same thing happened in 2016 after a 26-day strike, and in 2011 the union halted operations for two weeks.

In Africa, the export of copper has been interrupted for a different reason. On Aug. 11, Zambia temporarily sealed its border with Congo after the DRC government banned certain beverage imports, including beer, from Zambia, local media said.

Landlocked Congo only has one way to access ports, and that is through Zambia. The latter resumed trade with the DRC on Tuesday.

Copper market

Benchmark Mineral Intelligence (BMI) forecasts global copper consumption to grow 3.5% to 28 million tonnes in 2024, and for demand to increase from 27 million tonnes in 2023 to 38 million tonnes in 2032, averaging 3.9% yearly growth.

Yet the US Geological Survey reports supply from copper mines in 2023 amounted to only 22 million tonnes. If the copper supply doesn't grow this year, we are possibly looking at a 6Mt deficit.

BHP strike in Chile enters third day, buoying global copper price

Reuters | August 15, 2024 |

BHP’s Escondida copper mine in Chile. (Image: Wikimedia Commons)

A strike at mining giant BHP’s huge Escondida mine in Chile entered its third day on Thursday, bolstering global copper prices as an ongoing standoff between the company and workers starts to spread worries about supply of the red metal.

BHP and the worker union held an initial meeting on Wednesday in a bid to defuse the strike but failed to make a breakthrough that would allow the restart of formal talks, with miners digging in as they seek a larger share of profits.

Benchmark three-month copper on the London Metal Exchange was up over 2.2% to $9,169 per metric ton on Thursday, and various mining shares like Rio Tinto, Southern Copper and Freeport-McMoRan rose as well.

Escondida is the world’s largest copper mine, accounting for nearly 5% of global supply in 2023, and the union on strike has in past years forced the firm to halt operations and declare force majeure, meaning it can’t fulfill its contracts.

On Wednesday, BHP said operations were continuing under a contingency plan while the union said the strike was keeping the Los Colorados concentration and electrowinning plants offline.

The two sides have both signaled a willingness to returning to formal talks but remain at loggerheads over the conditions. BHP had asked the union to pause its strike to resume negotiations, a demand the union refused.

Hundreds of workers have also set up camp at Puerto Coloso, BHP’s exclusive port, which also houses its desalination plants.

(By Fabian Cambero and Alexander Villegas; Editing by Jonathan Oatis)

No comments:

Post a Comment