2024.05.29

North American graphite producers got a boost earlier this month, with President Biden announcing that US tariffs on imports of Chinese electric vehicles and battery parts will increase significantly.

The tariff on EVs from China will quadruple from 25% to 100%, while for Chinese EV batteries and battery parts, including graphite used in the battery anode, it will rise to 25%.

The move is the result of a review of tariffs first put in place by President Trump in 2018. Industries in the government’s crosshairs include electric vehicles, batteries and solar cells. It also follows Biden’s call last month to hike tariffs on Chinese steel and aluminum.

In total, the new levies are expected to affect $18 billion worth of Chinese imports.

Bloomberg notes that President Xi Jinping’s strategy of ramping up manufacturing to arrest an economic slowdown at home has triggered alarm abroad. US and European Union leaders have scolded Beijing over state support that they say has fueled a deluge of cheap exports that threaten jobs in their markets.

The Inflation Reduction Act aims to grant incentives to companies that source their battery materials within the US and outside of China.

Passed by the Biden administration in 2022, the IRA provides US consumers tax credits of up to $7,500 per electric vehicle, provided the parts or materials are sourced from the United States, or from countries with which the US has a free trade agreement. This includes graphite, lithium, cobalt and other critical minerals.

As well as offering consumer incentives, the IRA subsidizes up to 30% of manufacturing costs related to battery cell assembly and battery pack production, helping to encourage carmakers and battery suppliers to invest in US-based supply chains.

The dilemma facing the US government is it wants to create a US-centered electric vehicle supply, but by imposing restrictions on China, which dominates the mining and processing of most metals needed for vehicle electrification, it is making things a lot tougher for EV- and battery-makers to source the raw materials, because the rest of the world doesn’t mine enough of them, process them into usable materials, and manufacture the necessary components.

On April 26, the Biden administration gave electric-vehicle makers a two-year extension to shore up sources of graphite and other critical minerals considered difficult to trace to their origin.

Starting in 2025, plug-in cars containing critical minerals from companies controlled by US foes, including China, will be ineligible for up to $7,500 in tax credits.

But automakers will have until 2027 to curb the use of materials from so-called “foreign entities of concern” (FEOCs), provided they submit plans to comply with the rules after the two-year transition.

Critics of the tariff increases say that while they will protect US jobs, they will do nothing to alleviate the obstacle to higher rates of EV adoption in the United States (and Canada): high sticker prices.

According to Reuters, automakers say that without access to low-cost batteries and battery materials made in China, EVs will be too expensive for consumers.

(According to the Kelley Blue Book, the average price of a new EV is more than $65,000, compared to $48,000 for gas-powered cars. Restricting foreign mineral inputs like graphite, and assembling cars in North America, could make them even more costly.)

This in turn may imperil the Biden administration’s clean energy agenda. The government wants half of all new vehicles sold in the US in 2030 zero emissions. It has also set a goal of 500,000 charging stations.

Moreover, the cost of Biden’s plan to keep Chinese electric vehicles out of the States is being borne by US taxpayers.

“Electric vehicles (EVs) may be the most subsidized product in America. Federal taxpayers shell out $7,500 every time a new eligible electric vehicle is purchased (usually by wealthy buyers). State and local taxpayers chip in an additional $1,500 for each EV purchase,” writes

David Williams, president of the Taxpayers Protection Alliance. He argues, “It’s time for President Biden and lawmakers to ditch protectionism and finally end EV subsidies.”

Still, there is an argument to be made that without government help, US automakers and battery manufacturers will be pushed out by China, which owns both the EV market and the battery supply chain.

China’s dominance

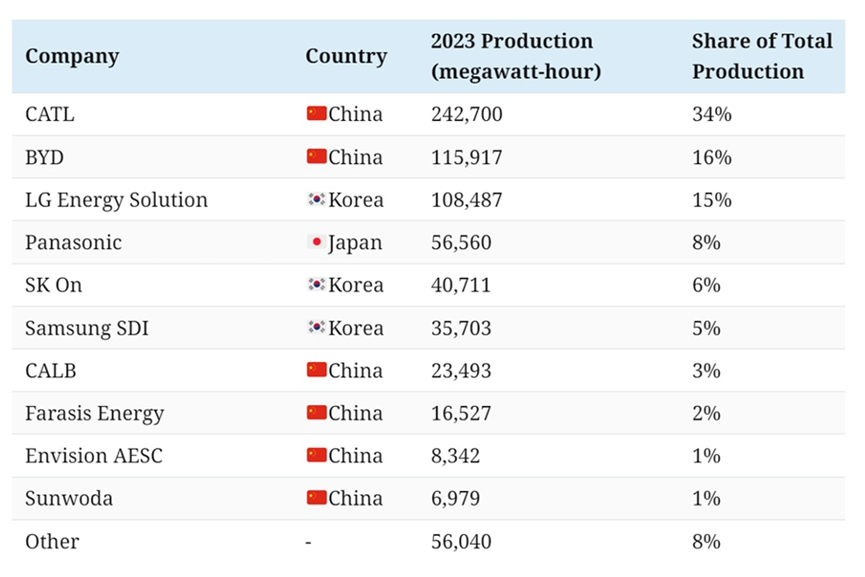

The International Energy Agency (IEA) estimates that two-thirds of global battery cell production is in China, while the United States accounts for only about 10%.

A BBVA Research report suggests China’s dominance is in part due to a national strategy that prioritizes the development and adoption of EVs. The Chinese government has implemented policy initiatives to support the production and purchase of EVs, such as tax exemptions, subsidies, and investments in charging infrastructure. Additionally, foreign automakers, such as Tesla, have been allowed to build up their factories in China. (BBVA Research)

In line with BBVA’s report, China Briefing reports the country has more than 600,000 NEV (“new energy vehicle”)-related enterprises, with major industry players including BYD Auto, Tesla China, SAIC-GM-Wuling, Aion, and Changan Automobile.

Source: Visual Capitalist

The briefing also says China holds a dominant position in the EV supply chain, with over three-quarters of the world’s battery production capacity. The country houses more than half the world’s processing and refining capacity for graphite, lithium and cobalt. It boasts 70% of the global production capacity for cathodes and 85% for anodes.

Moreover, China’s EV manufacturing industry has a 20% cost advantage over US and European markets. This is due to government policies that support the EV industry, including subsidies and tax incentives, at the national and regional levels.

Graphite

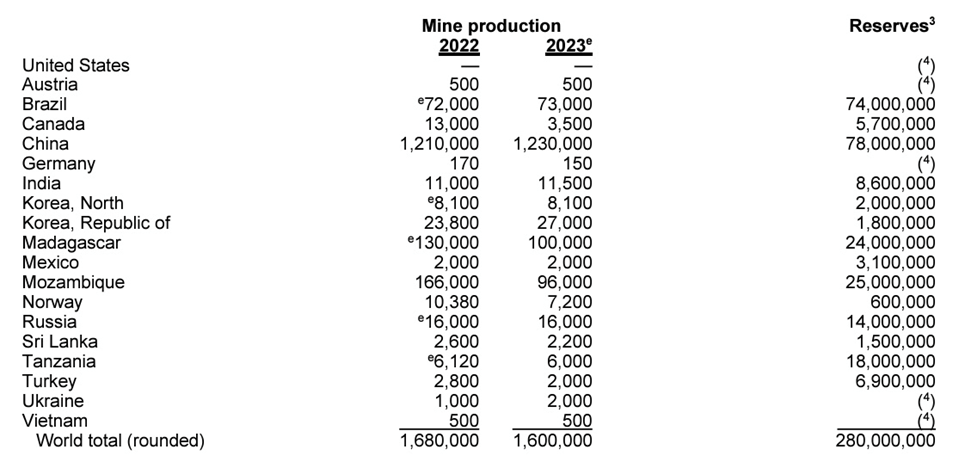

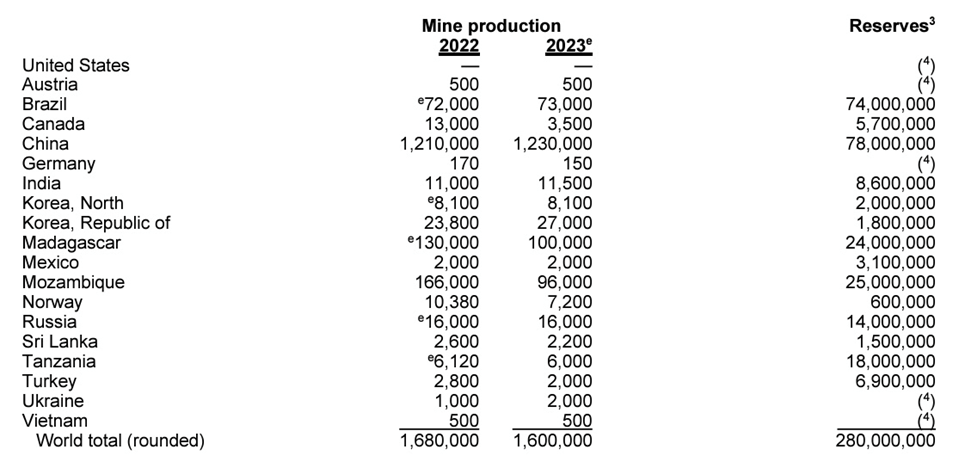

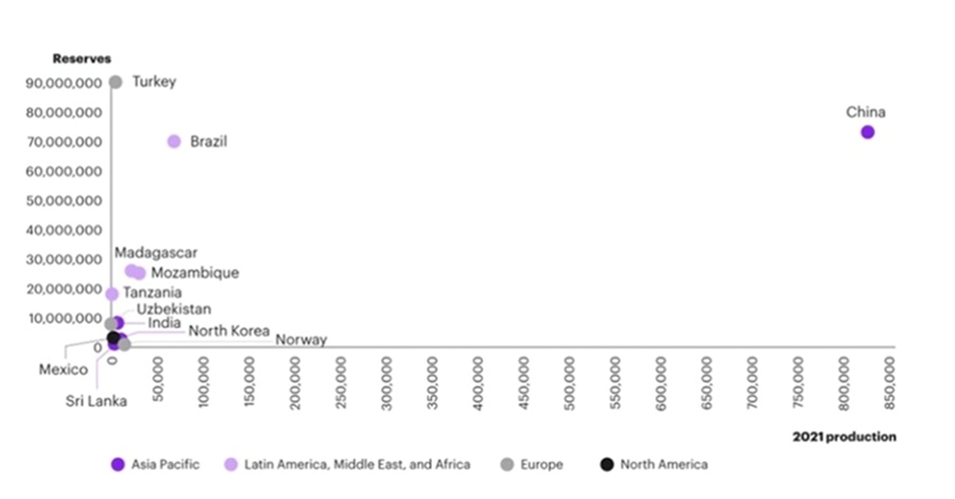

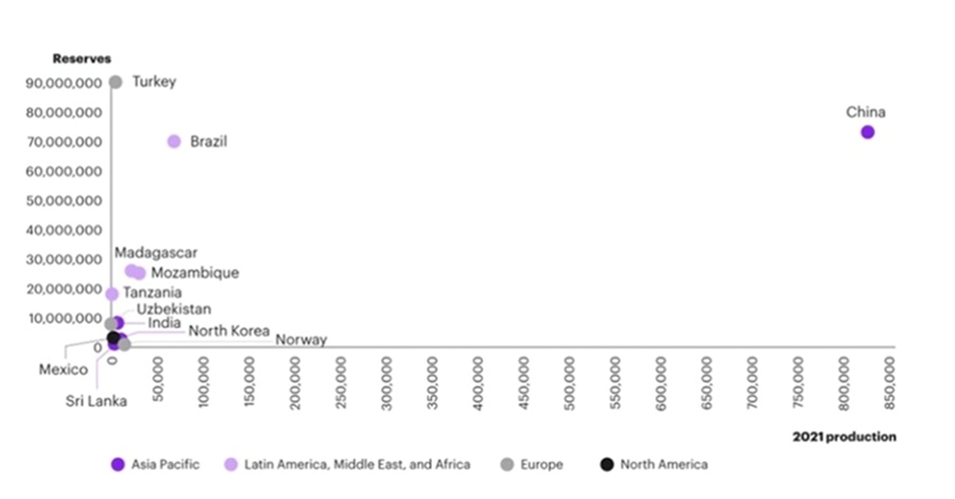

China is by far the biggest graphite producer at about 80% of global production. It also controls almost all graphite processing, establishing itself as a dominant player in every stage of the supply chain.

After China, the next leading graphite producers are Mozambique, Brazil, Madagascar, Canada and India. The US currently produces no graphite, and therefore must rely solely on imports to satisfy domestic demand.

The briefing also says China holds a dominant position in the EV supply chain, with over three-quarters of the world’s battery production capacity. The country houses more than half the world’s processing and refining capacity for graphite, lithium and cobalt. It boasts 70% of the global production capacity for cathodes and 85% for anodes.

Moreover, China’s EV manufacturing industry has a 20% cost advantage over US and European markets. This is due to government policies that support the EV industry, including subsidies and tax incentives, at the national and regional levels.

Graphite

China is by far the biggest graphite producer at about 80% of global production. It also controls almost all graphite processing, establishing itself as a dominant player in every stage of the supply chain.

After China, the next leading graphite producers are Mozambique, Brazil, Madagascar, Canada and India. The US currently produces no graphite, and therefore must rely solely on imports to satisfy domestic demand.

Source: USGS

Heavy reliance on Chinese graphite mine supply. Source: Kearney

In October, Beijing said it will require export permits for some graphite products — retaliation against the United States and the European Union for widened curbs on Chinese companies’ access to semiconductors.

China initially imposed export controls on gallium and germanium, two critical inputs for semiconductors and renewable energy, then moved on to graphite.

Under the new graphite restrictions, which took effect December 1, 2023, exporters must apply for permits to ship two types of graphite: synthetic graphite, and natural flake graphite and its products.

A recent article in Barron’s notes that the relaxed sourcing rules (the above-mentioned two-year extension) will allow US automakers to keep sourcing Chinese graphite until 2027, and their vehicles will continue to be eligible for tax credits, as long as they can explain how they plan to comply with the Inflation Reduction Act rules after 2027.

But author Cullen Hendrix, a senior fellow at the Peterson Institute for International Economics, and fellow at the Payne Institute for Public Policy at the Colorado School of Mines, says the rules will make developing a long-term strategy for diversifying supply chains more difficult. That’s because the IRA incentivizes companies to source from the US or from countries that have a US free-trade agreement.

The problem is that there are few countries outside China that produce graphite, pushing companies to deal with “fringe producers” such as Mozambique.

Hendrix notes there is currently only one non-Chinese, IRA-compliant producer, Australia’s Syrah Resources, which has an off-take agreement with Tesla to ship graphite from its mine in Mozambique to a processing facility in Louisiana.

The African mine has its own set of challenges, though. As Hendrix states,

The Balama mine is located in Cabo Delgado, where troops from Mozambique, Rwanda, and a coalition of regional states are fighting a vicious insurgency being waged by the local Islamic State franchise. In June 2022, roadside attacks by those militants led Syrah to temporarily suspend logistics and personnel movements at the mine, though mining and processing activities were unaffected, according to Reuters.

Operations were temporarily suspended again, and staff evacuated in November due to nearby violence. Though the insurgency is on its heels, this state of affairs doesn’t exactly scream security of supply.

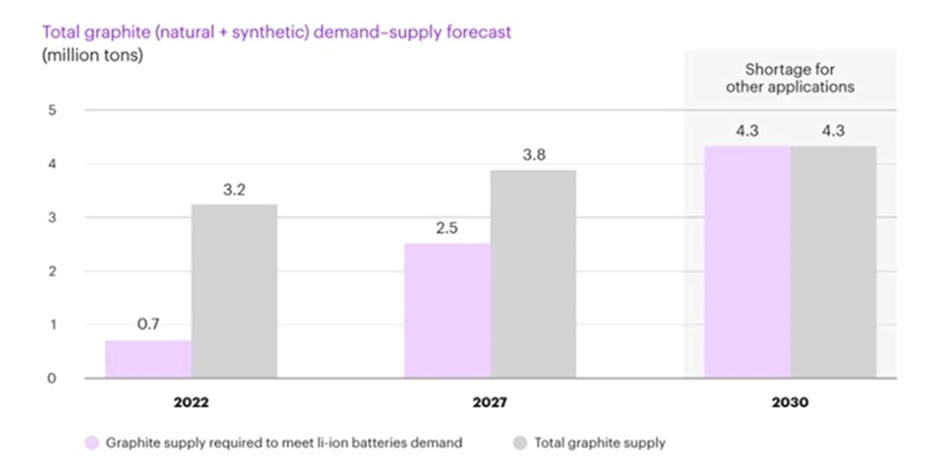

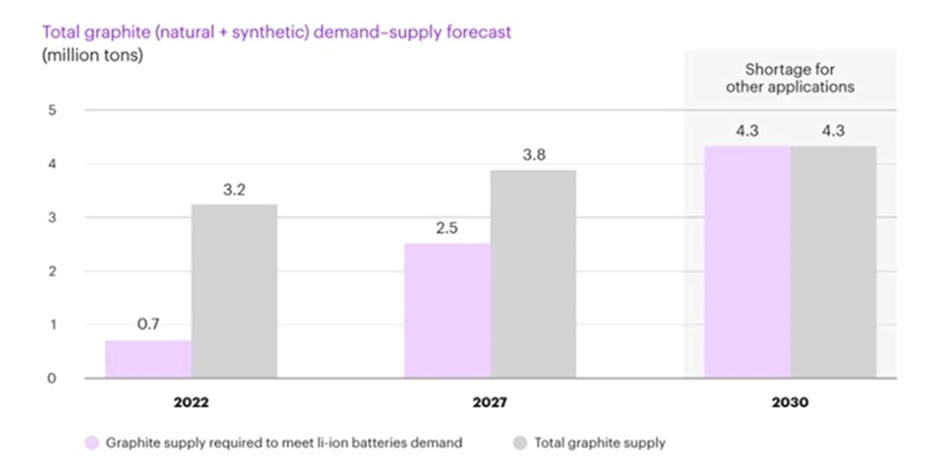

Speaking of supply, deficits are expected to kick in by 2025 as new graphite mines fail to keep up with surging demand from automakers.

According to a Benchmark Mineral Intelligence (BMI) analysis, graphite demand is likely to grow by a factor of eight by 2030 over 2020 levels (4.2 metric tons over a supply of 3.0), and 25 times by 2040. That translates into a predicted supply shortfall of 30% for graphite, compared to 11% for lithium (2.4 over 2.1), 26% for nickel (1.5 over 1.1), and 6% for cobalt (0.32 over 0.30).

In October, Beijing said it will require export permits for some graphite products — retaliation against the United States and the European Union for widened curbs on Chinese companies’ access to semiconductors.

China initially imposed export controls on gallium and germanium, two critical inputs for semiconductors and renewable energy, then moved on to graphite.

Under the new graphite restrictions, which took effect December 1, 2023, exporters must apply for permits to ship two types of graphite: synthetic graphite, and natural flake graphite and its products.

A recent article in Barron’s notes that the relaxed sourcing rules (the above-mentioned two-year extension) will allow US automakers to keep sourcing Chinese graphite until 2027, and their vehicles will continue to be eligible for tax credits, as long as they can explain how they plan to comply with the Inflation Reduction Act rules after 2027.

But author Cullen Hendrix, a senior fellow at the Peterson Institute for International Economics, and fellow at the Payne Institute for Public Policy at the Colorado School of Mines, says the rules will make developing a long-term strategy for diversifying supply chains more difficult. That’s because the IRA incentivizes companies to source from the US or from countries that have a US free-trade agreement.

The problem is that there are few countries outside China that produce graphite, pushing companies to deal with “fringe producers” such as Mozambique.

Hendrix notes there is currently only one non-Chinese, IRA-compliant producer, Australia’s Syrah Resources, which has an off-take agreement with Tesla to ship graphite from its mine in Mozambique to a processing facility in Louisiana.

The African mine has its own set of challenges, though. As Hendrix states,

The Balama mine is located in Cabo Delgado, where troops from Mozambique, Rwanda, and a coalition of regional states are fighting a vicious insurgency being waged by the local Islamic State franchise. In June 2022, roadside attacks by those militants led Syrah to temporarily suspend logistics and personnel movements at the mine, though mining and processing activities were unaffected, according to Reuters.

Operations were temporarily suspended again, and staff evacuated in November due to nearby violence. Though the insurgency is on its heels, this state of affairs doesn’t exactly scream security of supply.

Speaking of supply, deficits are expected to kick in by 2025 as new graphite mines fail to keep up with surging demand from automakers.

According to a Benchmark Mineral Intelligence (BMI) analysis, graphite demand is likely to grow by a factor of eight by 2030 over 2020 levels (4.2 metric tons over a supply of 3.0), and 25 times by 2040. That translates into a predicted supply shortfall of 30% for graphite, compared to 11% for lithium (2.4 over 2.1), 26% for nickel (1.5 over 1.1), and 6% for cobalt (0.32 over 0.30).

EV demand will absorb all graphite output at this rate. Source: Kearney

By then, the world’s graphite supplies will not even be able to cover demand for EVs, let alone all end-use sectors, BMI projections showed.

BMI has said as many as 97 average-sized graphite mines need to come online by 2035 to meet global demand. That’s about eight new mines a year — a daunting challenge considering the time it takes to develop graphite deposits into mines.

Fortunately, the current US government has recognized the problem and is making funds available to US graphite producers. Stockhouse recently reported that mining projects focused on extracting critical minerals like graphite, lithium, and cobalt are eligible for federal loan guarantees worth $72 billion.

Also, a 25% tariff will be applied to Chinese natural graphite imports starting in 2026. The fact that the $7,500 Clean Vehicle Credit is not available to “foreign entities of concern” including Iran, Russia, North Korea, and China, which produces 70% of the world’s graphite, while only 2% of global mine production of EV battery minerals like graphite, cobalt and nickel came from the US and its free-trade-agreement partners in 2023, shows the urgency of the need to develop more home-grown graphite.

Graphite One (TSXV:GPH, OTCQX:GPHOF)

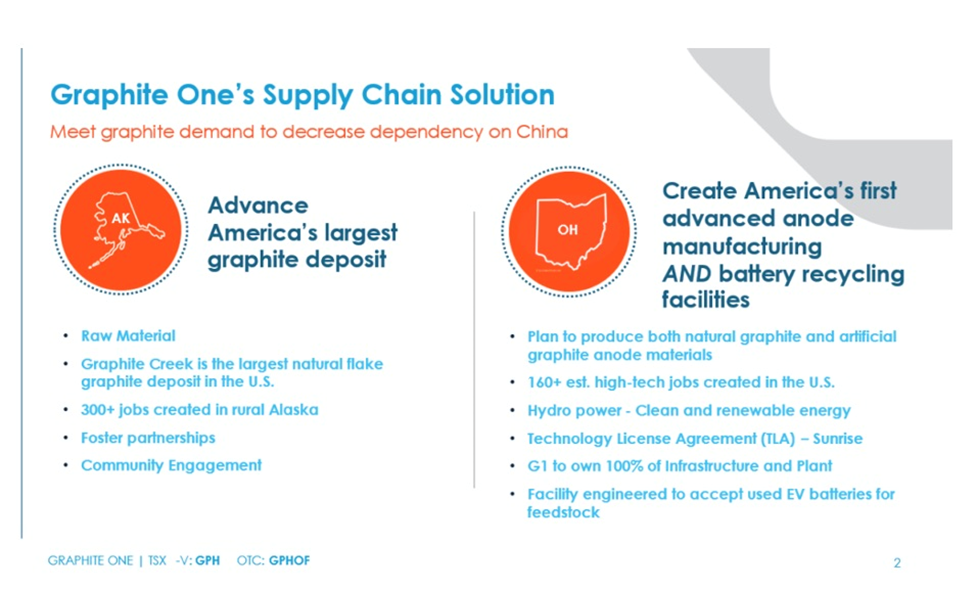

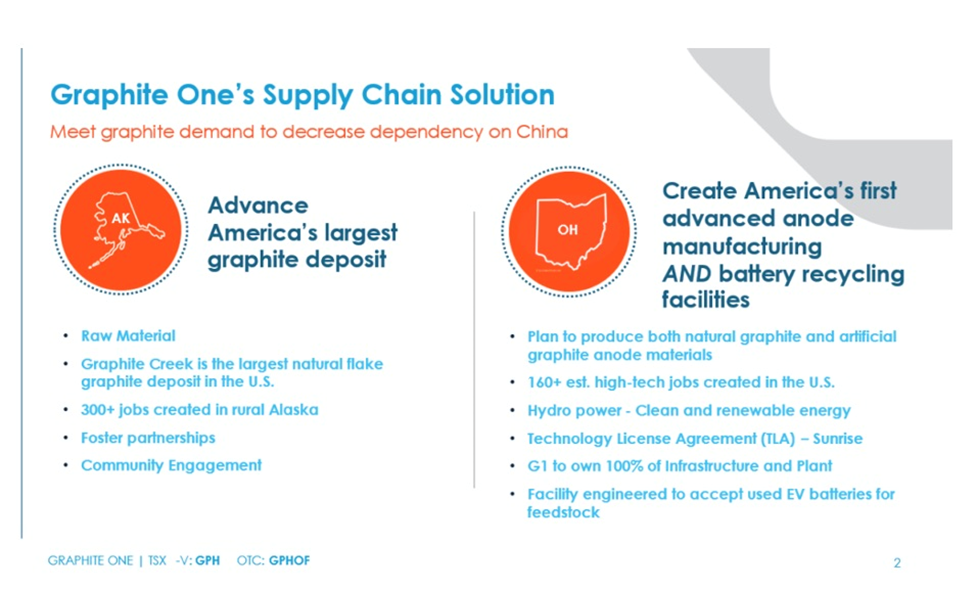

This is good news for companies like Graphite One (TSXV:GPH, OTCQX:GPHOF), which is addressing the domestic graphite shortfall by not only developing a graphite mine in Alaska, but building the first links of a domestic (North American) graphite supply chain.

To be eligible for the loan guarantee, a project must be energy-related and located within the United States. Graphite One ticks all the boxes for this kind of support. The company has already received two major grants from the US Department of Defense.

Last July, the DoD awarded GPH with a technology investment grant of up to $37.5 million under Title III of the Defense Production Act.

Graphite One Awarded $37.5 Million Department of Defense Grant Under the Defense Production Act

The company subsequently entered into a one-year $5 million loan agreement with Taiga Mining Company, its largest shareholder. On December 27, 2023, the company settled the loan and accrued interest when Taiga exercised its option to acquire a 1% NSR. The settlement of the loan leaves the company debt-free.

Graphite is included on a list of 23 critical metals the US Geological Survey has deemed critical to the economy and national security.

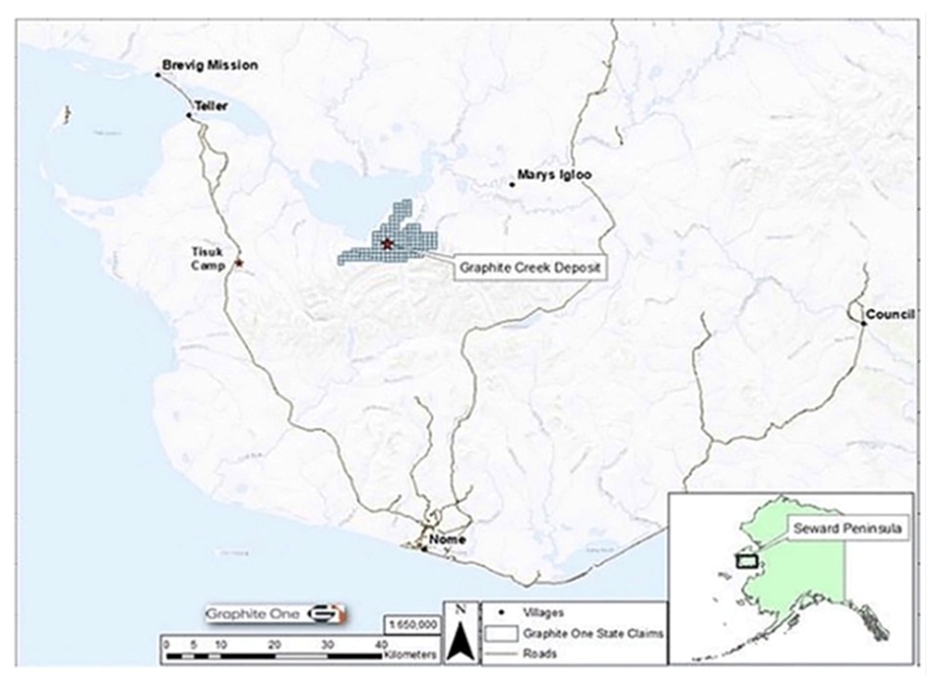

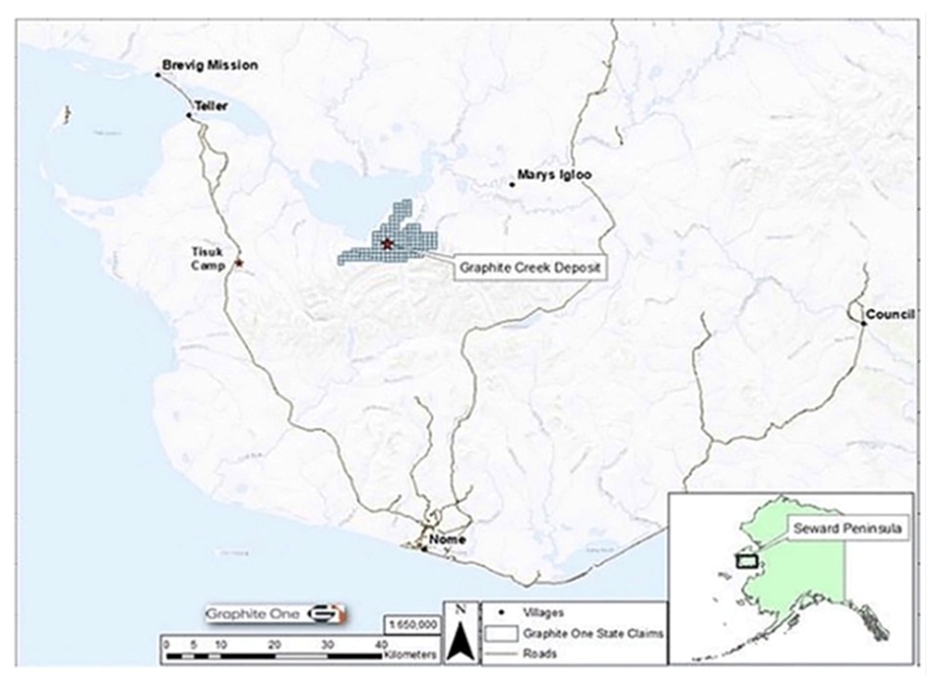

Graphite One’s Graphite Creek mine is situated along the northern flank of the Kigluaik Mountains, Alaska, spanning 18 kilometers.

Graphite Creek in early 2021 was given High-Priority Infrastructure Project (HPIP) status by the Federal Permitting Improvement Steering Committee (FPISC). The HPIP designation allows Graphite One to list on the US government’s Federal Permitting Dashboard, which ensures that the various federal permitting agencies coordinate their reviews of projects as a means of streamlining the approval process.

In other words, having HPIP means that Graphite Creek will likely be fast-tracked to production.

The USGS has cited Graphite Creek as the country’s largest known graphite deposit, and “among the largest in the world.”

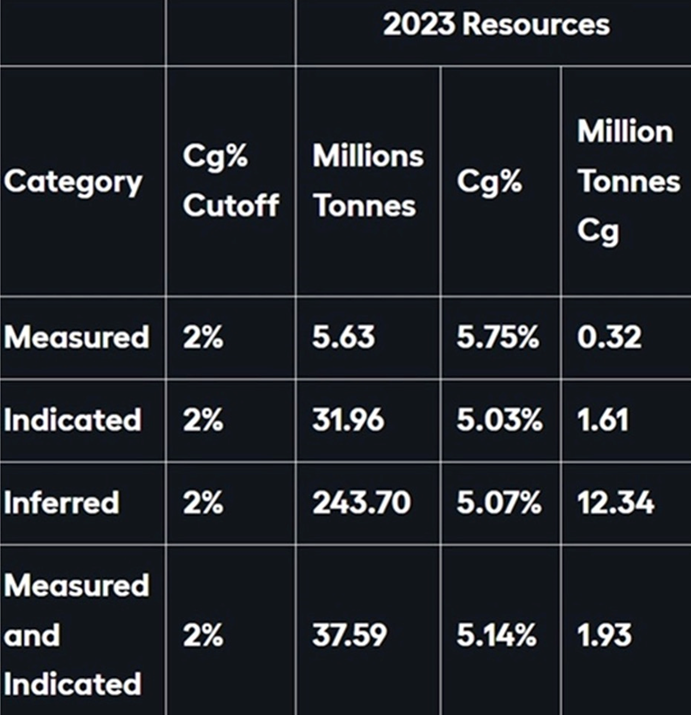

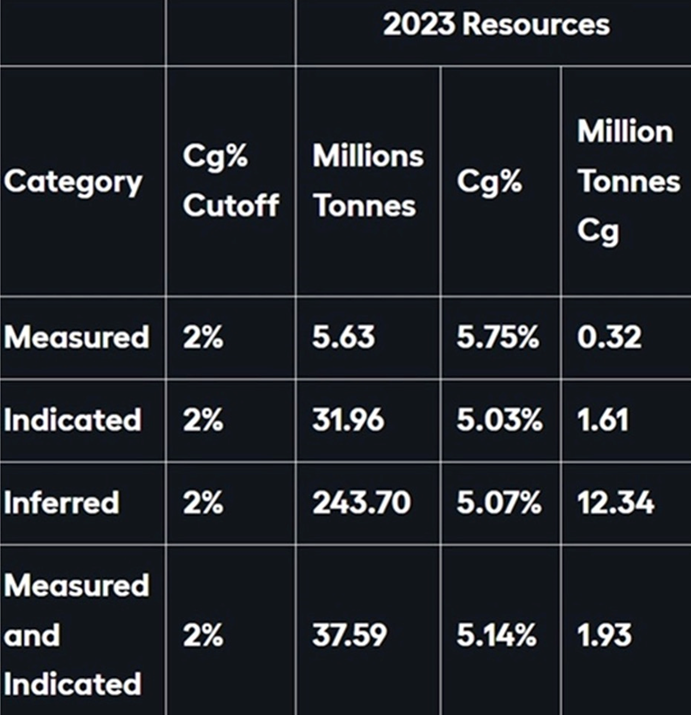

On March 13, 2023, Graphite One updated its resource estimate, which showed an increase of 15.5% in measured and indicated tonnage with a corresponding increase of 13.1% in contained tonnes of graphite.

Measured and indicated resources now stand at 37.6 million tonnes at 5.14% graphite, with an inferred resource of 243.7 million tonnes at 5.07% graphite.

According to the PFS, the mine is expected to produce, on average, 51,813 tonnes of graphite concentrate per year during its projected 23-year mine life.

The company itself is anticipated to produce about 75,000 tonnes of products a year, of which 49,600 tonnes would be anode materials, 7,400 tonnes purified graphite products and 18,000 tonnes unpurified graphite products.

In October, Graphite One announced the completion of the 2023 drill program along with a selection of assay results. With the infusion of DoD funds, G1’s program quadrupled the scope of 2022’s, with 57 holes completed for a total of 8,736 meters — the largest drill program in Graphite One’s history. Of the 57 holes, five were geotechnical and the remaining 52 all intersected visual graphite mineralization and continued to demonstrate exceptional consistency of a shallow, high-grade graphite deposit that remains open both to the east and west of the existing mineral resource estimate.

Subject to financing, Graphite One plans to invest $435 million to build a graphite anode manufacturing plant in Trumbull County, Ohio, between Cleveland and Pittsburgh.

Through its subsidiary, Graphite One Alaska, the Vancouver-based company has selected Ohio’s Voltage Valley as the site for a graphite anode manufacturing plant by entering into a 50-year land-lease agreement on 85 acres. The deal also contains a right to terminate the lease and an option to purchase the property once known as the Warren Depot, part of the National Defense Stockpile infrastructure, until the brownfield site was processed through the Ohio EPA Voluntary Action program a decade ago, certifying that the land does not need further cleanup.

Graphite One plans to start construction within the next three years, as part of the company’s strategy to become the first vertically integrated producer to serve the US EV battery market. Its supply chain strategy involves mining, manufacturing and recycling, all done domestically.

The Ohio facility represents the second link in Graphite One’s advanced graphite materials supply chain; the first link is Graphite One’s Graphite Creek mine in Alaska, which is currently working toward completion of its feasibility study in the fourth quarter of 2024, on an accelerated timetable, with the $37.5 million Defense Production Act grant provided in July 2023.

Subject to financing and other contingent events, the plant will manufacture synthetic graphite until a source of natural graphite becomes available from the company’s Graphite Creek mine, located near Nome, Alaska, according to the March 20 news release.

Graphite One’s activities should be considered a bolt-on to what is already happening in northwestern Alaska with respect to the building of the first deepwater port in the US Arctic region.

The U.S. Army Corps of Engineers and Alaska’s Department of Transportation have chosen two sites for a deepwater port facility: Nome and Port Clarence. Nome has received $600 million in government grants and appears to be well on its way to doubling the size of its existing port to accommodate the world’s largest commercial and military vessels. Work is expected to start this year.

Developing America’s largest graphite deposit coincides with major port expansion at critical juncture of the Bering Strait – Richard Mills

CEO Anthony Huston recently traveled to Washington, DC to meet with President Joe Biden. The meeting was between the President and a select group of executives invited to the White House to discuss investment and job creation.

Hours before the event, Biden signed an executive order establishing a 25% tariff on Chinese imports, including graphite.

The White House tariff statement noted that “Concentration of critical minerals mining and refining capacity in China leaves our supply chains vulnerable and our national security and clean energy goals at risk.”

“I was honored to represent everyone at Graphite One in the meeting with President Biden,” Huston said in the May 15 news release. “We appreciate his support for the renewable energy transition and G1 is excited to continue pushing forward to create a secure 100% U.S.-based supply chain for natural and synthetic graphite. The White House meeting underscores that projects like Graphite One’s are important in so many ways — from industrial investment and job creation to the renewable energy transition, technology development and national security.”

Graphite and Critical Mineral Mining Boosted by $72B Fund

Click here for a link to the public broadcast, and here for the White House tariff statement.

Graphite One CEO and President, Anthony Huston, Invited by President Biden to White House Investment and Job Creation Session; White House Sets 25% Tariff on Chinese Graphite

In other Graphite One news, the company said it completed the initial planning sessions earlier this month at the Ohio site chosen for its battery anode active material production plant, and continues to progress its two Department of Defense grant projects.

A week prior to Huston’s participation in the White House jobs and investment forum, Graphite One senior management took part in a Defense Logistics Agency (DLA) visit to G1 project partner Vorbeck Materials’ facilities in Maryland. The DLA site visit took place at the half-way point in the $4.7 million DLA-funded project to develop a graphite and graphene-based foam fire suppressant as an alternative to Perfluoroalkyl and Perfluoroalkyl Substances (PFAS) fire-suppressant materials, as required by US law.

In its May 2024 project review session with the DoD project team overseeing Graphite One’s $37.5 million Defense Production Act Title III grant to accelerate completion of G1’s anticipated National Instrument 43-101 feasibility study (FS), Graphite One senior management outlined plan for the 2024 field season at Graphite Creek. Work remains on schedule to complete the FS as planned by December 2024 subject to financing. “As we near completion of the FS, we can now say that DoD’s support has cut about two years off of our initial feasibility study timeline,” said Huston.

The Slowdown in US Electric Vehicle Sales Looks More Like a Blip

“For every sign of an EV slowdown, another suggests an adolescent industry on the verge of its next growth spurt. In fact, for most automakers, even the first quarter was a blockbuster. Six of the 10 biggest EV makers in the US saw sales grow at a scorching pace compared to a year ago — up anywhere from 56% at Hyundai-Kia to 86% at Ford. A sampling of April sales similarly came in hot.” Tom Randall, Bloomberg

Conclusion

Graphite One has received strong support from the US government for developing its “made in America” graphite supply chain anchored by Graphite Creek, the largest graphite deposit in the country and one of the biggest in the world. Two DoD grants have been awarded, one for $37.5 million, the other for $4.7 million.

In addition, G1 qualifies for federal loan guarantees worth $72 billion.

The company has already received and settled a $5m loan from its largest shareholder, Taiga Mining. The Bering Straits Native Corporation has pledged its support for the project including a $2 million investment with an option to increase that to $10.4 million.

The project isn’t near a salmon fishery and it has the backing of local communities such as Nome, which has a long history of resource extraction.

The company has help from the highest political offices in Alaska — the governor, both senators and Alaska’s single House member. They clearly see an investment to increase domestic capabilities for graphite as money well spent.

Graphite One could supply a significant portion of the amount of graphite demanded by the United States, currently.

Consider: In 2023, the US imported 83,000 tonnes of natural graphite, of which 89% was flake and high-purity, suitable for electric vehicles.

Based on the prefeasibility study, the Graphite Creek mine is anticipated to produce, on average, 51,813 tonnes of graphite concentrate per year during its projected 23-year mine life.

We see Graphite One taking a leading role in loosening China’s tight grip on the US graphite market by mining feedstock from its Graphite Creek project in Alaska and shipping it, either through Nome or Port Clarence, to its planned graphite anode manufacturing plant in Voltage Valley, Ohio.

The new 25% tariff on Chinese graphite imports will help G1 to develop a home-grown graphite supply chain. Automakers have until 2027 to figure out how they will source graphite outside of China. After that, EVs with graphite and other battery components originating in China or other foreign entities of concern will no longer be eligible for subsidies, making them more expensive.

Graphite is essential to an electric car; it is the largest component in batteries by weight, with no known substitutes. While EV sales have recently slowed, that is expected to be temporary.

The International Energy Agency estimates that US sales of fully electric vehicles will soar to 2.5 million in 2025, from 1.1 million last year, Bloomberg reported on Tuesday.

Graphite One Inc.

TSXV:GPH, OTCQX:GPHOF

2024.05.28 share price: Cdn$0.89

Shares Outstanding: 129.0m

Market cap: Cdn$122.4M

GPH website

Richard (Rick) Mills

aheadoftheherd.com

By then, the world’s graphite supplies will not even be able to cover demand for EVs, let alone all end-use sectors, BMI projections showed.

BMI has said as many as 97 average-sized graphite mines need to come online by 2035 to meet global demand. That’s about eight new mines a year — a daunting challenge considering the time it takes to develop graphite deposits into mines.

Fortunately, the current US government has recognized the problem and is making funds available to US graphite producers. Stockhouse recently reported that mining projects focused on extracting critical minerals like graphite, lithium, and cobalt are eligible for federal loan guarantees worth $72 billion.

Also, a 25% tariff will be applied to Chinese natural graphite imports starting in 2026. The fact that the $7,500 Clean Vehicle Credit is not available to “foreign entities of concern” including Iran, Russia, North Korea, and China, which produces 70% of the world’s graphite, while only 2% of global mine production of EV battery minerals like graphite, cobalt and nickel came from the US and its free-trade-agreement partners in 2023, shows the urgency of the need to develop more home-grown graphite.

Graphite One (TSXV:GPH, OTCQX:GPHOF)

This is good news for companies like Graphite One (TSXV:GPH, OTCQX:GPHOF), which is addressing the domestic graphite shortfall by not only developing a graphite mine in Alaska, but building the first links of a domestic (North American) graphite supply chain.

To be eligible for the loan guarantee, a project must be energy-related and located within the United States. Graphite One ticks all the boxes for this kind of support. The company has already received two major grants from the US Department of Defense.

Last July, the DoD awarded GPH with a technology investment grant of up to $37.5 million under Title III of the Defense Production Act.

Graphite One Awarded $37.5 Million Department of Defense Grant Under the Defense Production Act

The company subsequently entered into a one-year $5 million loan agreement with Taiga Mining Company, its largest shareholder. On December 27, 2023, the company settled the loan and accrued interest when Taiga exercised its option to acquire a 1% NSR. The settlement of the loan leaves the company debt-free.

Graphite is included on a list of 23 critical metals the US Geological Survey has deemed critical to the economy and national security.

Graphite One’s Graphite Creek mine is situated along the northern flank of the Kigluaik Mountains, Alaska, spanning 18 kilometers.

Graphite Creek in early 2021 was given High-Priority Infrastructure Project (HPIP) status by the Federal Permitting Improvement Steering Committee (FPISC). The HPIP designation allows Graphite One to list on the US government’s Federal Permitting Dashboard, which ensures that the various federal permitting agencies coordinate their reviews of projects as a means of streamlining the approval process.

In other words, having HPIP means that Graphite Creek will likely be fast-tracked to production.

The USGS has cited Graphite Creek as the country’s largest known graphite deposit, and “among the largest in the world.”

On March 13, 2023, Graphite One updated its resource estimate, which showed an increase of 15.5% in measured and indicated tonnage with a corresponding increase of 13.1% in contained tonnes of graphite.

Measured and indicated resources now stand at 37.6 million tonnes at 5.14% graphite, with an inferred resource of 243.7 million tonnes at 5.07% graphite.

According to the PFS, the mine is expected to produce, on average, 51,813 tonnes of graphite concentrate per year during its projected 23-year mine life.

The company itself is anticipated to produce about 75,000 tonnes of products a year, of which 49,600 tonnes would be anode materials, 7,400 tonnes purified graphite products and 18,000 tonnes unpurified graphite products.

In October, Graphite One announced the completion of the 2023 drill program along with a selection of assay results. With the infusion of DoD funds, G1’s program quadrupled the scope of 2022’s, with 57 holes completed for a total of 8,736 meters — the largest drill program in Graphite One’s history. Of the 57 holes, five were geotechnical and the remaining 52 all intersected visual graphite mineralization and continued to demonstrate exceptional consistency of a shallow, high-grade graphite deposit that remains open both to the east and west of the existing mineral resource estimate.

Subject to financing, Graphite One plans to invest $435 million to build a graphite anode manufacturing plant in Trumbull County, Ohio, between Cleveland and Pittsburgh.

Through its subsidiary, Graphite One Alaska, the Vancouver-based company has selected Ohio’s Voltage Valley as the site for a graphite anode manufacturing plant by entering into a 50-year land-lease agreement on 85 acres. The deal also contains a right to terminate the lease and an option to purchase the property once known as the Warren Depot, part of the National Defense Stockpile infrastructure, until the brownfield site was processed through the Ohio EPA Voluntary Action program a decade ago, certifying that the land does not need further cleanup.

Graphite One plans to start construction within the next three years, as part of the company’s strategy to become the first vertically integrated producer to serve the US EV battery market. Its supply chain strategy involves mining, manufacturing and recycling, all done domestically.

The Ohio facility represents the second link in Graphite One’s advanced graphite materials supply chain; the first link is Graphite One’s Graphite Creek mine in Alaska, which is currently working toward completion of its feasibility study in the fourth quarter of 2024, on an accelerated timetable, with the $37.5 million Defense Production Act grant provided in July 2023.

Subject to financing and other contingent events, the plant will manufacture synthetic graphite until a source of natural graphite becomes available from the company’s Graphite Creek mine, located near Nome, Alaska, according to the March 20 news release.

Graphite One’s activities should be considered a bolt-on to what is already happening in northwestern Alaska with respect to the building of the first deepwater port in the US Arctic region.

The U.S. Army Corps of Engineers and Alaska’s Department of Transportation have chosen two sites for a deepwater port facility: Nome and Port Clarence. Nome has received $600 million in government grants and appears to be well on its way to doubling the size of its existing port to accommodate the world’s largest commercial and military vessels. Work is expected to start this year.

Developing America’s largest graphite deposit coincides with major port expansion at critical juncture of the Bering Strait – Richard Mills

CEO Anthony Huston recently traveled to Washington, DC to meet with President Joe Biden. The meeting was between the President and a select group of executives invited to the White House to discuss investment and job creation.

Hours before the event, Biden signed an executive order establishing a 25% tariff on Chinese imports, including graphite.

The White House tariff statement noted that “Concentration of critical minerals mining and refining capacity in China leaves our supply chains vulnerable and our national security and clean energy goals at risk.”

“I was honored to represent everyone at Graphite One in the meeting with President Biden,” Huston said in the May 15 news release. “We appreciate his support for the renewable energy transition and G1 is excited to continue pushing forward to create a secure 100% U.S.-based supply chain for natural and synthetic graphite. The White House meeting underscores that projects like Graphite One’s are important in so many ways — from industrial investment and job creation to the renewable energy transition, technology development and national security.”

Graphite and Critical Mineral Mining Boosted by $72B Fund

Click here for a link to the public broadcast, and here for the White House tariff statement.

Graphite One CEO and President, Anthony Huston, Invited by President Biden to White House Investment and Job Creation Session; White House Sets 25% Tariff on Chinese Graphite

In other Graphite One news, the company said it completed the initial planning sessions earlier this month at the Ohio site chosen for its battery anode active material production plant, and continues to progress its two Department of Defense grant projects.

A week prior to Huston’s participation in the White House jobs and investment forum, Graphite One senior management took part in a Defense Logistics Agency (DLA) visit to G1 project partner Vorbeck Materials’ facilities in Maryland. The DLA site visit took place at the half-way point in the $4.7 million DLA-funded project to develop a graphite and graphene-based foam fire suppressant as an alternative to Perfluoroalkyl and Perfluoroalkyl Substances (PFAS) fire-suppressant materials, as required by US law.

In its May 2024 project review session with the DoD project team overseeing Graphite One’s $37.5 million Defense Production Act Title III grant to accelerate completion of G1’s anticipated National Instrument 43-101 feasibility study (FS), Graphite One senior management outlined plan for the 2024 field season at Graphite Creek. Work remains on schedule to complete the FS as planned by December 2024 subject to financing. “As we near completion of the FS, we can now say that DoD’s support has cut about two years off of our initial feasibility study timeline,” said Huston.

The Slowdown in US Electric Vehicle Sales Looks More Like a Blip

“For every sign of an EV slowdown, another suggests an adolescent industry on the verge of its next growth spurt. In fact, for most automakers, even the first quarter was a blockbuster. Six of the 10 biggest EV makers in the US saw sales grow at a scorching pace compared to a year ago — up anywhere from 56% at Hyundai-Kia to 86% at Ford. A sampling of April sales similarly came in hot.” Tom Randall, Bloomberg

Conclusion

Graphite One has received strong support from the US government for developing its “made in America” graphite supply chain anchored by Graphite Creek, the largest graphite deposit in the country and one of the biggest in the world. Two DoD grants have been awarded, one for $37.5 million, the other for $4.7 million.

In addition, G1 qualifies for federal loan guarantees worth $72 billion.

The company has already received and settled a $5m loan from its largest shareholder, Taiga Mining. The Bering Straits Native Corporation has pledged its support for the project including a $2 million investment with an option to increase that to $10.4 million.

The project isn’t near a salmon fishery and it has the backing of local communities such as Nome, which has a long history of resource extraction.

The company has help from the highest political offices in Alaska — the governor, both senators and Alaska’s single House member. They clearly see an investment to increase domestic capabilities for graphite as money well spent.

Graphite One could supply a significant portion of the amount of graphite demanded by the United States, currently.

Consider: In 2023, the US imported 83,000 tonnes of natural graphite, of which 89% was flake and high-purity, suitable for electric vehicles.

Based on the prefeasibility study, the Graphite Creek mine is anticipated to produce, on average, 51,813 tonnes of graphite concentrate per year during its projected 23-year mine life.

We see Graphite One taking a leading role in loosening China’s tight grip on the US graphite market by mining feedstock from its Graphite Creek project in Alaska and shipping it, either through Nome or Port Clarence, to its planned graphite anode manufacturing plant in Voltage Valley, Ohio.

The new 25% tariff on Chinese graphite imports will help G1 to develop a home-grown graphite supply chain. Automakers have until 2027 to figure out how they will source graphite outside of China. After that, EVs with graphite and other battery components originating in China or other foreign entities of concern will no longer be eligible for subsidies, making them more expensive.

Graphite is essential to an electric car; it is the largest component in batteries by weight, with no known substitutes. While EV sales have recently slowed, that is expected to be temporary.

The International Energy Agency estimates that US sales of fully electric vehicles will soar to 2.5 million in 2025, from 1.1 million last year, Bloomberg reported on Tuesday.

Graphite One Inc.

TSXV:GPH, OTCQX:GPHOF

2024.05.28 share price: Cdn$0.89

Shares Outstanding: 129.0m

Market cap: Cdn$122.4M

GPH website

Richard (Rick) Mills

aheadoftheherd.com

No comments:

Post a Comment