By Irina Slav - Oct 28, 2024

Both India and China have stated quite plainly that they will not be following the example of the UK and shutting down any coal power plants in the observable future.

Coal power provides the cheap energy that Chinese and other Asian manufacturers of wind and solar components and equipment—not to mention EVs—use to keep their products cheap.

These two countries will be driving coal demand growth over the near to medium term.

Report upon report sings praises to energy transition efforts that are leading to record wind and solar electricity generation. Outside the spotlight, however, things look very different. There, coal remains king—and this is not about to change anytime soon.

Reuters recently reported that India’s coal power generation had fallen for the second month in a row in September thanks to higher solar output and lower electricity demand. Time for some solar praise, perhaps? Not really, because at the same time, India’s coking coal imports surged to a six-year high over the first half of the country’s latest fiscal year.

Meanwhile, in neighboring China, coal remains the largest contributor to the country’s power supply despite China being the largest developer of wind and solar capacity in the world—and by a wide margin. The latest domestic production figures point to an increase. The latest demand figures point to an increase in coal in response to growing demand. Coal accounts for 60% of China’s power generation, and this is not about to change soon.

Both India and China have stated quite plainly that they will not be following the example of the UK and shutting down any coal power plants in the observable future. Both India and China have officially prioritized energy supply security and affordability over emissions, even as they both pursue a more diverse grid.

Ironically, it is coal power that is essentially fueling the energy transition. Coal power provides the cheap energy that Chinese and other Asian manufacturers of wind and solar components and equipment—not to mention EVs—use to keep their products cheap. Also ironically, the surge in demand for electricity from data centers will quite likely add a boost to coal demand in some parts of the world where natural gas is not as cheap as it is—for now—in the United States.

In its latest World Energy Outlook, the International Energy Agency expended a lot of words in praise of the energy transition and how future energy demand growth was going to be met entirely by wind and solar capacity that will be added.

Citing recent ramp-ups in wind and solar investment in the past couple of years, the IEA wrote in the executive summary that the combined capacity of the two would “rise from 4 250 GW today to nearly 10 000 GW in 2030 in the STEPS, short of the tripling target set at COP28 but more than enough, in aggregate, to cover the growth in global electricity demand, and to push coal-fired generation into decline.”

What the IEA did not write in the executive summary but kept for the full report was that at least until 2030, coal demand is not about to start going down—despite its own projections that demand for all hydrocarbons would be in decline before 2030, stifled by wind and solar growth.

“In the STEPS, the outlook for coal has been revised upwards particularly for the coming decade, principally as a result of updated electricity demand projections, notably from China and India. Total coal demand is 300 million tonnes of coal equivalent (Mtce) or 6% higher in 2030 than in the WEO-2023. Even with this revision, coal demand declines by an average of 2% each year through to 2050.”

This is what the IEA wrote in its report, where STEPS is the stated-policies scenario that the agency uses for its forecasts. In other words, the IEA is admitting that it was wrong last year to project the demise of coal. In this year’s edition of the WEO, it is correcting that incorrect assumption. To be fair, it ends that correction on a transition-positive note, but chances are it will have to revise its projections yet again next year. Because no one outside Europe and the Anglosphere is giving up coal—not least in order to keep supplying Europe and the Anglosphere with the components of their top-priority electrification of everything. As Bloomberg’s Javier Blas put it, the energy transition is powered by coal.

It wasn’t hard to see where that urge to electrify everything would end. The visions were that the electrification of everything would be covered by surging wind and solar capacity that would have the decency to deliver the supply when there is demand for it. China, however, quickly realized this was not going to happen, and as it built huge solar installations after a huge wind park, it also built coal power plants. This is what India is doing right now, too. These two countries will be driving coal demand growth over the near to medium term. That’s because they know that supplying the power that their economies and voters demand is more important than counting CO2 molecules.

Meanwhile, the UK is preparing scenarios for blackouts because its baseload capacity just got decimated with the shutdown of the country’s last coal power plant. Billions are being slated for investment in things like batteries and flywheels to store energy from wind and solar installations, but the realization that this cannot work without baseload capacity is yet to dawn on the Starmer government—as it is on the European authorities that are still pushing for an end to coal. If there is a perfect time to learn something important from China and India, that time is right now.

By Irina Slav for Oilprice.com

China Ramps Up Coal Power as Energy Demand Surges

Coal still accounts for about 60% of China’s power generation, despite a surge in hydropower earlier this year.

Hydropower in China saw a sharp decline in September, which boosted the use of thermal coal for power generation.

Power consumption in data centers, big data, and cloud computing jumped by 33% between January and June compared to the same period in 2023.

Although the share of coal in China’s electricity generation has been declining in recent years with the renewables boom, Chinese coal power generation and demand remains strong.

Coal still accounts for about 60% of China’s power generation, despite a surge in hydropower earlier this year after abundant rainfall, which reduced the share of coal in the country’s energy mix during the summer.

But hydropower saw a sharp decline in September, which boosted the use of thermal coal for power generation amid surging power demand in the world’s second-largest economy.

China’s thermal power generation, which is overwhelmingly coal-fired, jumped by 8.9% last month, per official data cited by Reuters’s columnist Clyde Russell.

Total power generation rose by 6% in September from a year earlier as electricity demand has started to outpace China’s economic growth in recent years.

Power demand jumped by 8.5% in September from the same month last year, while year to date, Chinese power consumption also rose by a similar percentage, 7.9% year-over-year, per the data quoted by Reuters’s Russell.

The surge in Chinese power consumption has led to high coal demand, too, as the power sector continues to rely on thermal generation for a stable supply of electricity amid soaring demand.

This demand is not only the result of a growing economy. China’s economy has expanded by less than 5% so far this year, and analysts fear the country could miss its own 2024 growth target of “about 5%.”

The surge in power demand has also been attributed to the increased use of household appliances amid rising numbers of middle-class residents, as well as the surge in power use for data centers and electric vehicle charging.

Chinese electricity consumption in the data services industry and for charging and battery services soared in the first half of 2024, driven by technology and electric vehicles, data from the China Electricity Council has shown.

Power consumption in data centers, big data, and cloud computing jumped by 33% between January and June compared to the same period in 2023.

In addition, China’s EV sales have already topped conventional car registrations for three consecutive months. EV and plug-in hybrid sales surged by 50.9% in September from a year earlier, grabbing a 52.8% share of total sales, the latest Chinese data showed earlier this month.

Electricity consumption per capita in China already exceeded that of the European Union at the end of 2022 and is set to rise further, the International Energy Agency (IEA) said in its Electricity Mid-Year Update report in July.

“The rapidly expanding production of solar PV modules and electric vehicles, and the processing of related materials, will support ongoing electricity demand growth in China while the structure of its economy evolves,” the IEA noted.

Despite continued growth in coal-fired power generation, China reached a momentous milestone in clean energy in the first half of the year, as rising hydropower, solar, and wind output pushed down the share of coal in power generation to below 60% for the first time ever.

Solar and wind power contributed to this achievement, but it was mostly the result of a rebound in hydropower generation, which squeezed coal in the late spring and summer, thanks to heavy rainfalls.

Come September, however, hydropower generation crashed by 14.6% from a year earlier. And rising coal power generation filled in the gap.

Coal-fired generation will be a pillar of China’s electricity generation system for many years to come, as the country’s electricity demand growth is set to continue outpacing economic growth in the coming years and as electrification is booming with the energy transition and expansion of data centers.

By Tsvetana Paraskova for Oilprice.com

By Tsvetana Paraskova - Oct 27, 2024, 4:00 PM CDT

Coal still accounts for about 60% of China’s power generation, despite a surge in hydropower earlier this year.

Hydropower in China saw a sharp decline in September, which boosted the use of thermal coal for power generation.

Power consumption in data centers, big data, and cloud computing jumped by 33% between January and June compared to the same period in 2023.

Although the share of coal in China’s electricity generation has been declining in recent years with the renewables boom, Chinese coal power generation and demand remains strong.

Coal still accounts for about 60% of China’s power generation, despite a surge in hydropower earlier this year after abundant rainfall, which reduced the share of coal in the country’s energy mix during the summer.

But hydropower saw a sharp decline in September, which boosted the use of thermal coal for power generation amid surging power demand in the world’s second-largest economy.

China’s thermal power generation, which is overwhelmingly coal-fired, jumped by 8.9% last month, per official data cited by Reuters’s columnist Clyde Russell.

Total power generation rose by 6% in September from a year earlier as electricity demand has started to outpace China’s economic growth in recent years.

Power demand jumped by 8.5% in September from the same month last year, while year to date, Chinese power consumption also rose by a similar percentage, 7.9% year-over-year, per the data quoted by Reuters’s Russell.

The surge in Chinese power consumption has led to high coal demand, too, as the power sector continues to rely on thermal generation for a stable supply of electricity amid soaring demand.

This demand is not only the result of a growing economy. China’s economy has expanded by less than 5% so far this year, and analysts fear the country could miss its own 2024 growth target of “about 5%.”

The surge in power demand has also been attributed to the increased use of household appliances amid rising numbers of middle-class residents, as well as the surge in power use for data centers and electric vehicle charging.

Chinese electricity consumption in the data services industry and for charging and battery services soared in the first half of 2024, driven by technology and electric vehicles, data from the China Electricity Council has shown.

Power consumption in data centers, big data, and cloud computing jumped by 33% between January and June compared to the same period in 2023.

In addition, China’s EV sales have already topped conventional car registrations for three consecutive months. EV and plug-in hybrid sales surged by 50.9% in September from a year earlier, grabbing a 52.8% share of total sales, the latest Chinese data showed earlier this month.

Electricity consumption per capita in China already exceeded that of the European Union at the end of 2022 and is set to rise further, the International Energy Agency (IEA) said in its Electricity Mid-Year Update report in July.

“The rapidly expanding production of solar PV modules and electric vehicles, and the processing of related materials, will support ongoing electricity demand growth in China while the structure of its economy evolves,” the IEA noted.

Despite continued growth in coal-fired power generation, China reached a momentous milestone in clean energy in the first half of the year, as rising hydropower, solar, and wind output pushed down the share of coal in power generation to below 60% for the first time ever.

Solar and wind power contributed to this achievement, but it was mostly the result of a rebound in hydropower generation, which squeezed coal in the late spring and summer, thanks to heavy rainfalls.

Come September, however, hydropower generation crashed by 14.6% from a year earlier. And rising coal power generation filled in the gap.

Coal-fired generation will be a pillar of China’s electricity generation system for many years to come, as the country’s electricity demand growth is set to continue outpacing economic growth in the coming years and as electrification is booming with the energy transition and expansion of data centers.

By Tsvetana Paraskova for Oilprice.com

Coal Continues to Dominate India's Power Mix Despite Gas Growth

By Rystad Energy - Oct 24, 2024

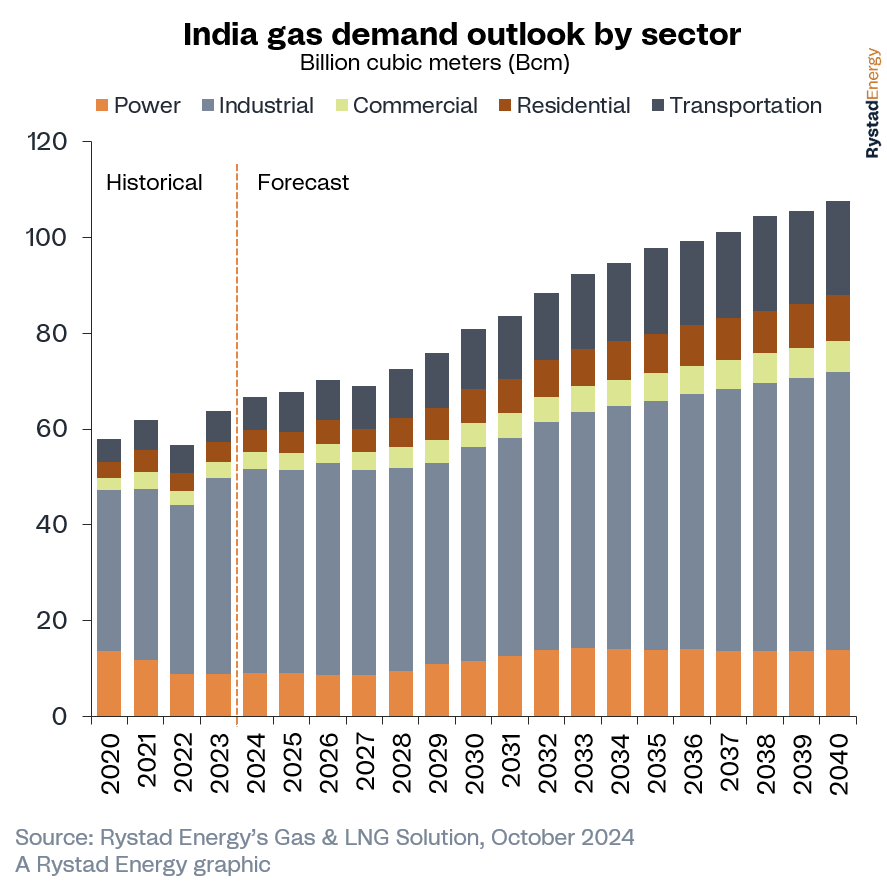

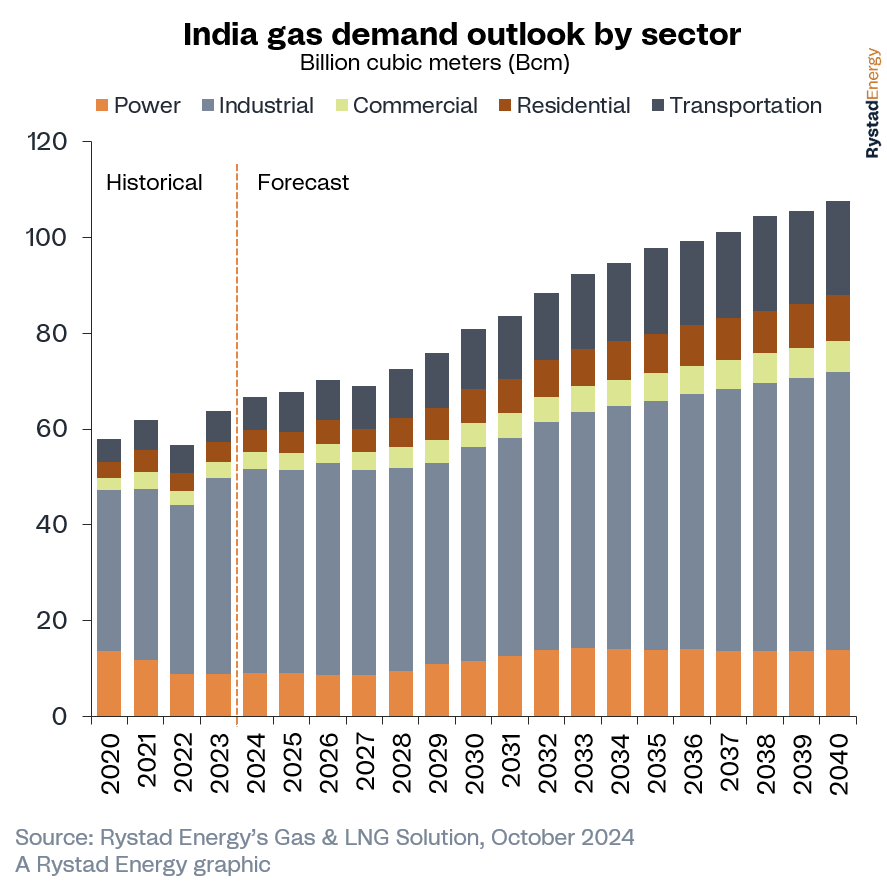

India's gas demand is projected to double by 2040, fueled by economic growth, urbanization, and a shift towards cleaner energy sources.

Domestic gas production is increasing but will not be sufficient to meet the rising demand, necessitating continued reliance on imports.

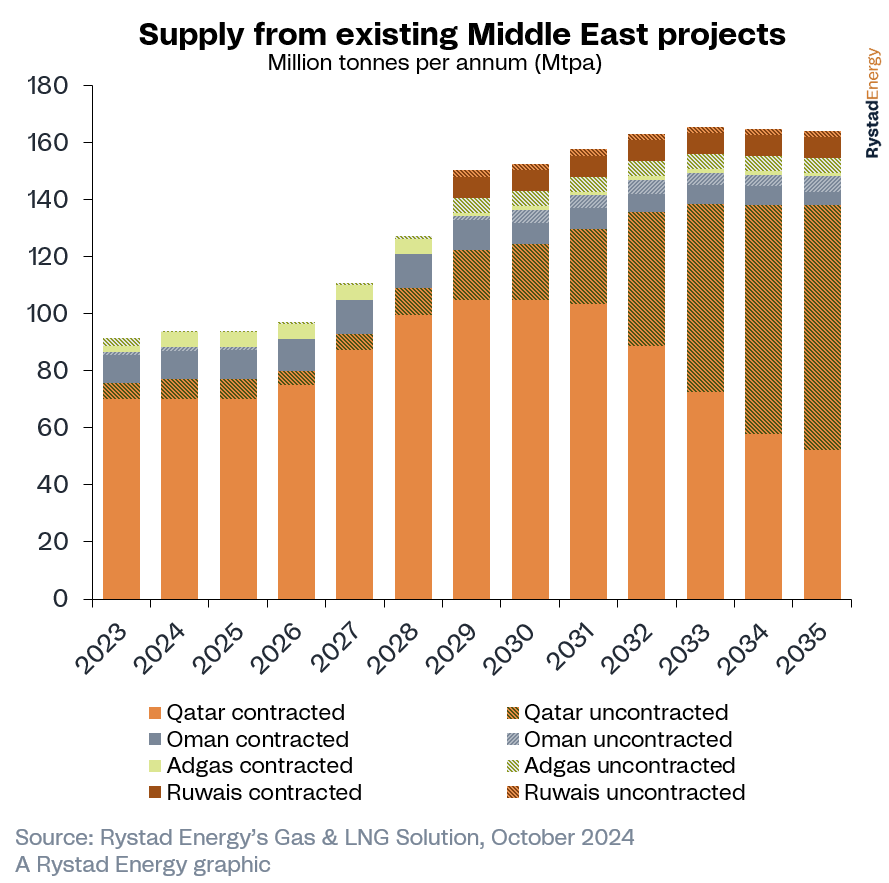

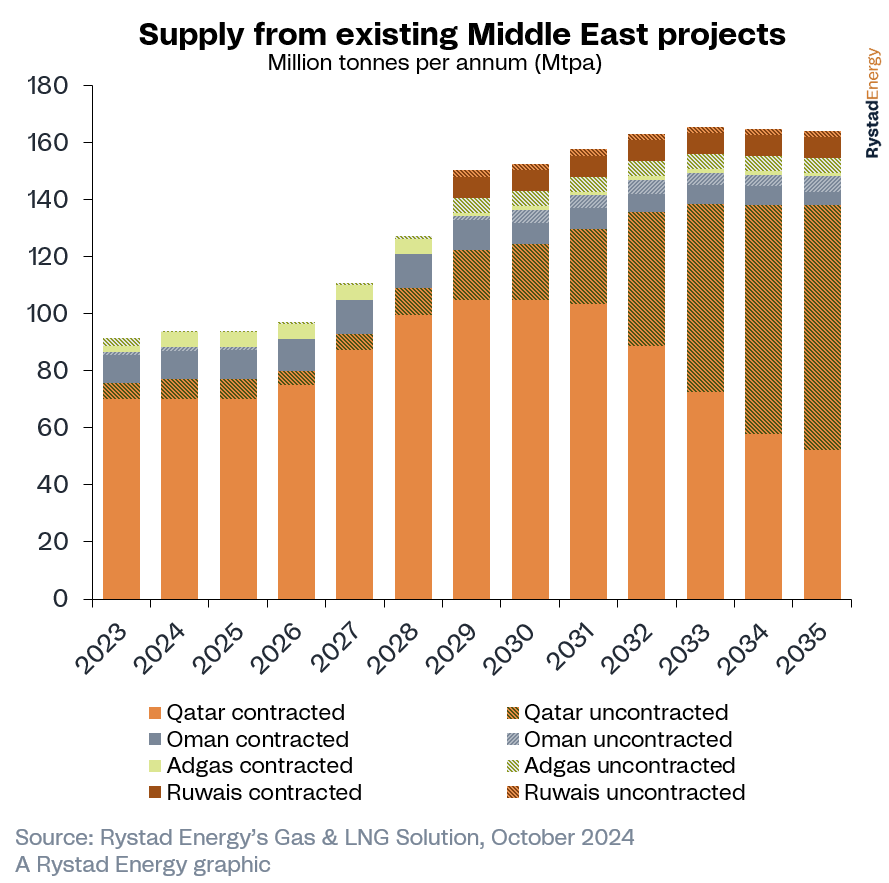

India is securing long-term LNG contracts, particularly with Middle Eastern suppliers, to ensure energy security and mitigate price volatility.

Fueled by population growth, economic development and a shift towards cleaner energy, India’s gas consumption is expected to nearly double to 113.7 billion cubic meters (Bcm) by 2040 from 65 billion cubic meters (Bcm) in 2023, according to Rystad Energy's research. Near-term demand is supported by a 51% jump in domestic gas production since 2020 to 36.7 Bcm by 2025, but this will not be enough to meet the country’s growing demand for natural gas. The result is that India will continue to rely heavily on imports to satisfy its future energy needs.

Recognizing this uptick in gas demand, India has bolstered its trade security by signing long-term contracts extending into 2030 and beyond. These agreements help shield India from global price fluctuations and supply chain disruptions, ensuring a steady flow of gas to support its growing economy. By securing these agreements, the country not only enhances its energy security but also strengthens its position in the global liquified natural gas (LNG) market, advancing its shift toward a cleaner energy mix.

The nation’s heavy reliance on coal is clear, particularly during recent heatwaves which have temporarily driven up coal usage alongside LNG for power generation. Gas, on the other hand, currently accounts for just 2% of the country’s power mix, as the focus remains on more cost-effective options like coal and renewables – in fact, coal-generated power is not projected to start falling this side of 2040. While gas-for-power isn’t expected to be a major driver for gas demand, the sector could still see growth, however, depending on future policies to promote coal-to-gas switching or introduce carbon pricing.

India’s LNG sector is experiencing significant growth. Looking ahead, a strategic next step could involve continued dealings with the Middle East. The geographical proximity of the two regions, combined with the substantial volume of uncontracted LNG production in the Middle East, presents an excellent opportunity for India to secure favorable terms – it’s an ideal buyer-seller relationship that could help fuel India’s needs. The nation is well-positioned to attract aggressive targeting from Middle Eastern producers and offtakers, with nearly 100 million tonnes per annum of Middle East LNG remaining uncontracted by 2035,

Kaushal Ramesh, Vice President, Gas & LNG Research, Rystad Energy

Learn more with Rystad Energy's Gas & LNG Solution.

Demand drivers: Food security comes first

Looking ahead, India’s gas demand will come from several sectors, including the country’s expanding city gas distribution (CGD) network as well as the fertilizer, refining and petrochemicals industries. Urea production in India heavily depends on natural gas as a key input, with limited alternatives available in the short term. As the government aims for complete food security, it continues to provide substantial subsidies for urea production, resulting in steady demand for gas in this sector, regardless of price fluctuations.

Following the successful restart of four gas-based fertilizer plants in 2021 and 2022, Indian urea production reached 30 million tonnes in 2023. This was still short of that year’s urea demand of 35 million tonnes, suggesting further growth potential in the near term. Meanwhile, rising demand for oil products and petrochemicals could increase India’s refining capacity to around 335 million tonnes per annum (Mtpa) by 2030, with many expansions expected to occur near LNG terminals.

The CGD sector also supports gas use across transportation, industrial, commercial and domestic applications through the development of compressed natural gas (CNG) stations and piped natural gas (PNG) networks. India’s CGD network has expanded rapidly in recent years, with the number of CNG stations rising more than fivefold since 2015 to 5,710 by April of last year and the number of PNG connections more than quadrupling to 12 million over the same period. After the latest CGD bidding rounds, nearly 100% of India’s geographical area is expected to be covered by the CGD network, reaching a population of over 1.4 billion.

Potential pitfalls

While there are positive signs for the Indian gas sector, several challenges could hinder its growth. A key issue is Indian buyers’ history of renegotiating or even abandoning near-complete deals, which creates uncertainty for suppliers. This preference for flexibility and cost-effectiveness over long-term commitments highlights India's focus on securing the best prices for its consumers in a volatile global market – but it could limit LNG growth prospects.

Additionally, slow infrastructure development has hampered the growth of India’s gas sector. Regasification terminals remain concentrated in the western part of the country, and efforts to expand the gas pipeline network to other regions have been inconsistent. This slow progress is due to regulatory hurdles, challenges in securing investments, difficult terrain, and competing priorities as India channels significant resources into renewable energy development alongside its gas infrastructure.

By Rystad Energy

India's gas demand is projected to double by 2040, fueled by economic growth, urbanization, and a shift towards cleaner energy sources.

Domestic gas production is increasing but will not be sufficient to meet the rising demand, necessitating continued reliance on imports.

India is securing long-term LNG contracts, particularly with Middle Eastern suppliers, to ensure energy security and mitigate price volatility.

Fueled by population growth, economic development and a shift towards cleaner energy, India’s gas consumption is expected to nearly double to 113.7 billion cubic meters (Bcm) by 2040 from 65 billion cubic meters (Bcm) in 2023, according to Rystad Energy's research. Near-term demand is supported by a 51% jump in domestic gas production since 2020 to 36.7 Bcm by 2025, but this will not be enough to meet the country’s growing demand for natural gas. The result is that India will continue to rely heavily on imports to satisfy its future energy needs.

Recognizing this uptick in gas demand, India has bolstered its trade security by signing long-term contracts extending into 2030 and beyond. These agreements help shield India from global price fluctuations and supply chain disruptions, ensuring a steady flow of gas to support its growing economy. By securing these agreements, the country not only enhances its energy security but also strengthens its position in the global liquified natural gas (LNG) market, advancing its shift toward a cleaner energy mix.

The nation’s heavy reliance on coal is clear, particularly during recent heatwaves which have temporarily driven up coal usage alongside LNG for power generation. Gas, on the other hand, currently accounts for just 2% of the country’s power mix, as the focus remains on more cost-effective options like coal and renewables – in fact, coal-generated power is not projected to start falling this side of 2040. While gas-for-power isn’t expected to be a major driver for gas demand, the sector could still see growth, however, depending on future policies to promote coal-to-gas switching or introduce carbon pricing.

India’s LNG sector is experiencing significant growth. Looking ahead, a strategic next step could involve continued dealings with the Middle East. The geographical proximity of the two regions, combined with the substantial volume of uncontracted LNG production in the Middle East, presents an excellent opportunity for India to secure favorable terms – it’s an ideal buyer-seller relationship that could help fuel India’s needs. The nation is well-positioned to attract aggressive targeting from Middle Eastern producers and offtakers, with nearly 100 million tonnes per annum of Middle East LNG remaining uncontracted by 2035,

Kaushal Ramesh, Vice President, Gas & LNG Research, Rystad Energy

Learn more with Rystad Energy's Gas & LNG Solution.

Demand drivers: Food security comes first

Looking ahead, India’s gas demand will come from several sectors, including the country’s expanding city gas distribution (CGD) network as well as the fertilizer, refining and petrochemicals industries. Urea production in India heavily depends on natural gas as a key input, with limited alternatives available in the short term. As the government aims for complete food security, it continues to provide substantial subsidies for urea production, resulting in steady demand for gas in this sector, regardless of price fluctuations.

Following the successful restart of four gas-based fertilizer plants in 2021 and 2022, Indian urea production reached 30 million tonnes in 2023. This was still short of that year’s urea demand of 35 million tonnes, suggesting further growth potential in the near term. Meanwhile, rising demand for oil products and petrochemicals could increase India’s refining capacity to around 335 million tonnes per annum (Mtpa) by 2030, with many expansions expected to occur near LNG terminals.

The CGD sector also supports gas use across transportation, industrial, commercial and domestic applications through the development of compressed natural gas (CNG) stations and piped natural gas (PNG) networks. India’s CGD network has expanded rapidly in recent years, with the number of CNG stations rising more than fivefold since 2015 to 5,710 by April of last year and the number of PNG connections more than quadrupling to 12 million over the same period. After the latest CGD bidding rounds, nearly 100% of India’s geographical area is expected to be covered by the CGD network, reaching a population of over 1.4 billion.

Potential pitfalls

While there are positive signs for the Indian gas sector, several challenges could hinder its growth. A key issue is Indian buyers’ history of renegotiating or even abandoning near-complete deals, which creates uncertainty for suppliers. This preference for flexibility and cost-effectiveness over long-term commitments highlights India's focus on securing the best prices for its consumers in a volatile global market – but it could limit LNG growth prospects.

Additionally, slow infrastructure development has hampered the growth of India’s gas sector. Regasification terminals remain concentrated in the western part of the country, and efforts to expand the gas pipeline network to other regions have been inconsistent. This slow progress is due to regulatory hurdles, challenges in securing investments, difficult terrain, and competing priorities as India channels significant resources into renewable energy development alongside its gas infrastructure.

By Rystad Energy

No comments:

Post a Comment