ExxonMobil Signs Largest U.S. Lease for Offshore Carbon Storage

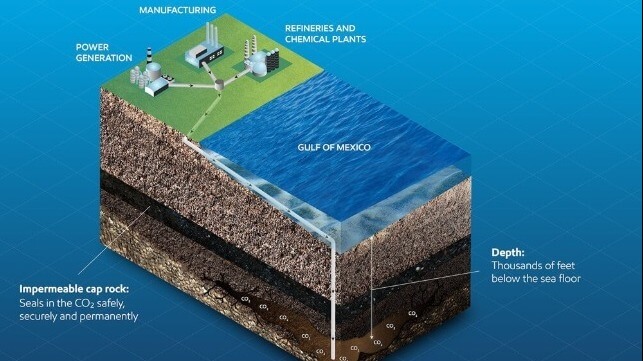

ExxonMobil has doubled down on its plans for subsea carbon storage, signing the largest ever seabed lease for carbon sequestration in the United States.

Exxon announced Thursday that it has purchased 271,000 acres worth of lease rights from the Texas General Land Office. The areas are located in shallow water just off the coast of Texas in Chambers, Jefferson and Galveston counties, near the Galveston Bay and Beaumont petrochemical hubs.

Exxon is advancing a longtime plan to add CO2 capture and storage to its service portfolio along the Gulf Coast, where there are a large number of oil and gas stakeholders with an interest in mitigating their emissions. Exxon already operates the largest CO2 pipeline network in the United States, and it also holds 69 offshore lease blocks in federal waters for CO2 sequestration.

Exxon did not disclose the terms, but it said that the lease payments will benefit the Texas Permanent School Fund. In a statement, Texas GLO Commissioner Dawn Buckingham emphasized the importance of funding childhood education as part of the deal.

"This is yet another sign of our commitment to CCS and the strides we’ve been able to make," said Dan Ammann, president of ExxonMobil Low Carbon Solutions. "With our growing roster of customers ready to deploy CCS, we’ll be driving substantial emissions reductions along the Gulf Coast through a comprehensive solution that includes capture, transportation, and storage—capabilities that make us a clear leader."

Study Highlights Potential and Challenges of Onboard Carbon Capture

An engineering study exploring the potential for the use of carbon capture aboard vessels highlights the feasibility of the technology both for retrofits and newbuilds demonstrating that it can be a key step in the efforts to reach the IMO’s decarbonization goals. The results showed despite the high current costs of the technology it could significantly extend the economic life of a vessel while also achieving meaningful reductions in CO2 emissions with a small fuel penalty.

The study was launched 18 months ago as a cooperation between the Oil and Gas Climate Initiative (OGCI), the Global Centre for Maritime Decarbonisation (GCMD), and Stena Bulk together with a consortium of the world’s leading maritime organizations. The goal was to identify the potential for using carbon capture as well as practical barriers, such as port readiness, which need to be addressed before OCCS can be widely adopted across the maritime industry.

“OCCS has gained traction in recent years as a feasible approach to meet the 2023 IMO revised GHG emissions reduction targets,” said Professor Lynn Loo, CEO of GCMD. “However, its adoption faces numerous hurdles, including the need to balance the tension between maximizing CO2 capture rates while maintaining commercially acceptable CapEx and OpEx.”

For the engineering study, they selected a medium range tanker highlighting that it is a common class of vessel with 1,700 in operation in the 40,000 to 50,000 dwt range. However, they note that it is not the most efficient segment but if successful with the technology it could lead to broader adoption in the industry.

Working with Stena Bulk they studied the Stena Impero (49,683 dwt), a modern product tanker built in 2018. The vessel uses a common two-stroke MAN diesel engine for propulsion and is currently fitted with an exhaust scrubber.

The engineering project analyzed the design and cost implications of retrofitting a carbon capture system on the vessel. It found that the technology could reduce the vessel’s carbon dioxide (CO2) emissions by as much as 20 percent per year, with a fuel consumption penalty of just under 10 percent.?

The cost of building and installing the full system on the Stena Impero was estimated at $13.6 million, with an abatement cost of avoided CO2 for the first-of-a-kind prototype evaluated at $769/ton CO2. However, the consortium believes that further research and development will drive down costs, making OCCS increasingly viable for the shipping industry.

With the use of OCCS technology, the report concludes that the Stena Impero could maintain its CII rating of “C and better” for an additional nine years. The vessel would be able to remain in compliance until the end of its economic life, assuming a CII reduction factor of two percent from 2027 onwards.

Dr. Michael Traver, head of OGCI’s Transport Workstream called the study a “major milestone in understanding the potential of using carbon capture technology.” The technical feasibility demonstrated in the project he said “is highly encouraging.”

The study also looked at incorporating OCCS on newbuild vessels, with the findings that improvements to capture rate and fuel penalty may be achieved using more efficient engines, heat pumps, and alternative solvents.

“For OCCS systems to be practical, the industry needs to manage captured CO2 effectively. To this end, GCMD has previously completed a study to define the operational envelope for offloading onboard captured CO2, contributing to the whole-of-system approach to emissions reduction via carbon capture,” commented Professor Loo.

The study provides quantitative insights on managing the trade-offs between the actual cost of operating OCCS and its emissions reduction potential. It also highlights that many challenges remain to be addressed. This includes the lack of a defined regulatory framework and operational challenges include recurring additional costs due to fuel penalty, amine solvent replenishment, manpower, maintenance, and offloading services.

The study points out that offloading captured CO2 is in its nascency, with a lack of national and port policies for accounting for captured CO2 and its final deposition. There is also a lack of infrastructure at ports to support offloading and storage. The results are detailed in a 139-page report released by GCMD.

They are calling for collaboration and support from stakeholders across the value chain needed to develop offloading infrastructure and onshore storage. Logistical and policy support for permanent sequestration or utilization of the offloaded CO2 they conclude will also be necessary to encourage the adoption of OCCS solutions.

No comments:

Post a Comment