Staff Writer | October 10, 2024 |

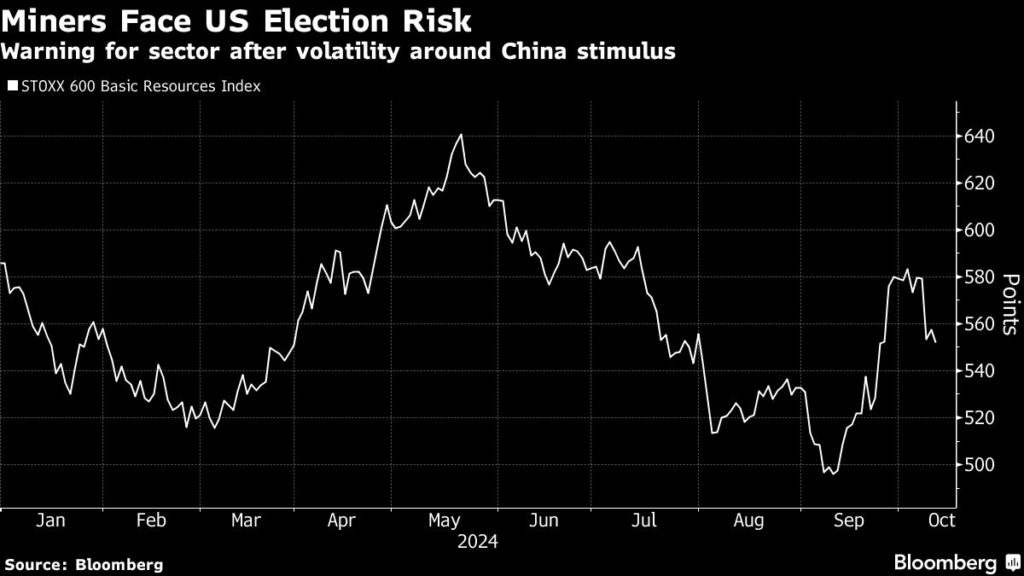

Mining stocks could face a valuation drop of up to 20% if US tariffs are imposed after next November’s presidential election, according to JPMorgan Chase & Co. analysts.

“Metals markets aren’t pricing in significant risk premiums for trade-related outcomes, like higher tariffs, despite this being a concern raised by clients,” analysts Dominic O’Kane and his team wrote in a note.

JPMorgan’s analysis shows potential downside of 10% to 20% in the fair value of major mining stocks in a scenario where base metal and iron ore prices decline by more than 10%.

The bank cited tariffs as a key factor behind the sector’s more than 10% drop in 2017-2018 during the Trump administration.

JPMorgan downgraded Anglo American Plc from overweight to neutral and Sweden’s Boliden AB from neutral to underweight. Shares of both companies fell, with Anglo American down 2.1% and Boliden down 2.8%.

Regardless of the election outcome, tariffs will remain central to US minerals policy.

Gregory Wischer, a non-resident fellow at the Payne Institute for Public Policy at the Colorado School of Mines, stated that a future Harris administration would likely maintain the Biden administration’s tariffs on Chinese mineral imports, while a Trump administration could significantly increase tariffs, including a potential 60% levy on Chinese imports and a 10% baseline on all imports.

(With files from Bloomberg)

No comments:

Post a Comment