Ubitus K.K., an Nvidia-backed company, plans to build a new data center near nuclear power plants in Japan due to the energy's cost-effectiveness and reliability for AI applications.

NextEra Energy is evaluating the potential restart of Iowa's only nuclear power plant, the Duane Arnold Energy Center, to meet the increasing energy demands of the AI industry.

The growing interest of tech companies in nuclear energy highlights a shift in the energy landscape, driven by the need for abundant and reliable power sources for AI and data centers.

Another day, another data center cozying up to nuclear power.

This time its an Nvidia-backed company called Ubitus K.K., based in Tokyo. The company is looking to "acquire land in Kyoto, Shimane or a prefecture in Japan’s southern island of Kyushu, primarily because of the availability of nuclear power in the region", according to a new report from Bloomberg.

Chief Executive Officer Wesley Kuo announced the plans in an interview on Thursday last week. The company already has two data centers used for gaming and is planning a third for AI.

Kuo commented: “Unless we have other, better, efficient and cheap energy, nuclear is still the most competitive option in terms of cost and the scale of supply. For industrial use — especially AI — they need a constant, high-capacity supply.”

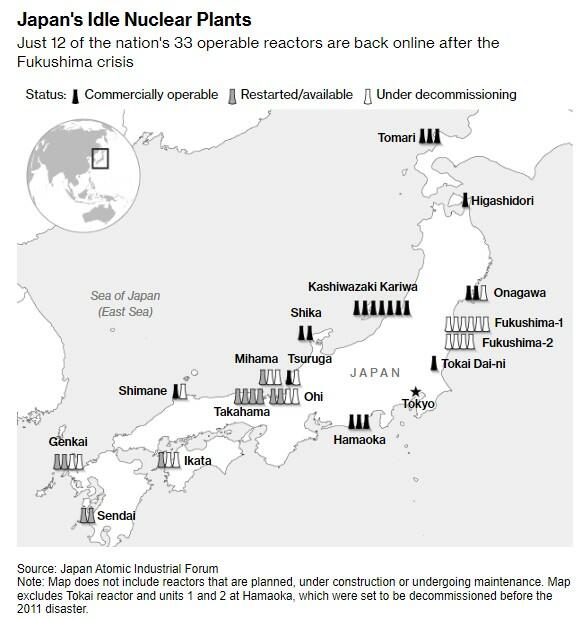

The Bloomberg report says that in Japan, nuclear power remains controversial due to the 2011 Fukushima disaster and strict post-disaster regulations, with only 33 reactors available, many still inactive.

Recall, following the news of the Three Mile Island nuclear plant restart near Harrisburg, Pennsylvania, and the Biden administration supplying a $1.5 billion loan to resurrect Holtec's Palisades nuclear plant in Michigan, along with Amazon, Microsoft, and Google all jumping on the nuclear trade via the "next AI trade," the atomic era continued gaining steam last week with news that another dormant nuclear plant, this time in Iowa, is slated for a possible restart.

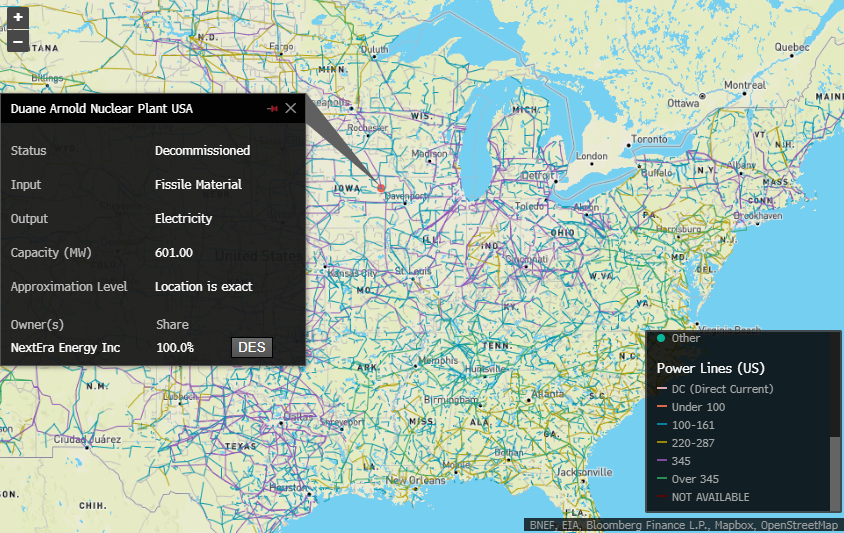

On a Wednesday earnings call, NextEra Energy CEO John Ketchum told investors that the company may restart the shuttered 600-megawatt Duane Arnold Energy Center (DAEC), Iowa's only nuclear power plant. It's located on the west bank of the Cedar River, about eight miles northwest of Cedar Rapids.

The company said on its earnings call:

"As a top operator of all forms of power generation, we often get asked about nuclear and gas," Ketchum told investors.

He explained, "Let me start with nuclear. Nuclear will play a role, but there are some practical limitations. Remember, on a national level, we expect we are going to need to add 900 gigawatts of new generation to the grid by 2040," adding, "There are only a few nuclear plants that can be recommissioned in an economic way. We are currently evaluating the recommissioning of our Duane Arnold nuclear plant in Iowa as one example."

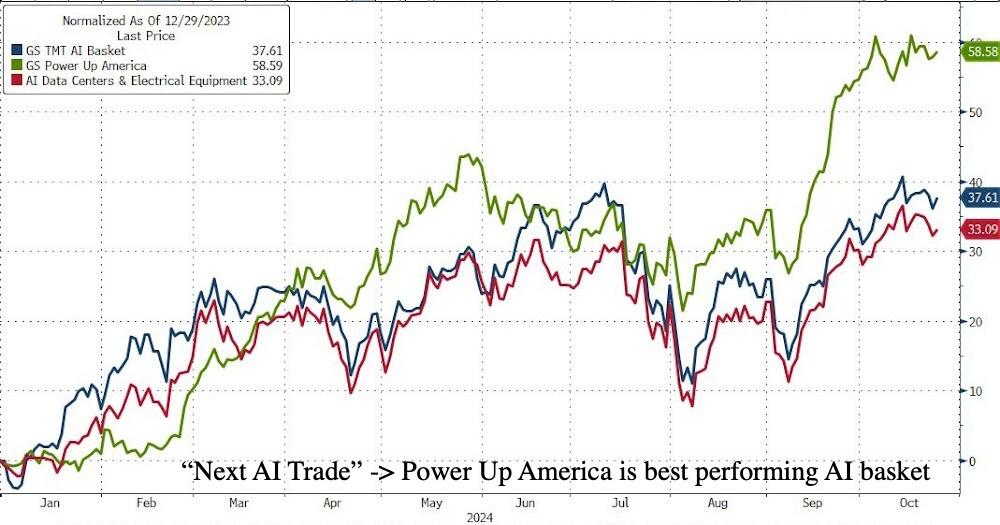

The latest news from big tech firms diving into nuclear and reviving the industry provides a substantial tailwind for our "Next AI Trade" which we laid out in April as our long-term favorite trade, and where we outlined various investment opportunities for powering up America, playing out.

And for a trip down memory lane: take a step back to December 2020, nearly four years ago, when we first introduced the nuclear theme to readers with the headline: "Buy Uranium: Is This The Beginning Of The Next ESG Craze."

Big tech realizes that clean power is not enough for their business ends, and they need power that is both clean and available around the clock.

Big Tech’s big bet on nuclear will take a while to take shape.

Big Tech has deep pockets and massive electricity needs that are only going to get even more massive in the coming years as the AI race heats up and data centers multiply.

Microsoft recently struck a deal to restart of the Three Mile Island nuclear power plant. Google partnered with small modular reactor developer Kairos to build 500MW of generation capacity. Amazon bought stock in another SMR developer, X-energy. Big Oil loves nuclear. This could change the course of the energy transition.

Until quite recently, Big Tech was fully dedicated to the energy transition in its original form, envisaging a massive buildout of wind and solar capacity to replace gas and coal as sources of electricity. Then the AI race began, and Big Tech discovered something it should have known all along: it needed a lot of electricity that was available around the clock. Wind and solar couldn’t cut it. So Big Tech turned to nuclear.

“Nuclear plants are the only energy sources that can consistently deliver on that promise,” Constellation Energy’s chief executive Joe Dominguez said in comments on the Microsoft news, referring to the promise of abundant electricity supply with a low emissions footprint.

“This agreement is a key part of our effort to commercialise and scale the advanced energy technologies we need to reach our net zero and 24/7 carbon-free energy goals and ensure that more communities benefit from clean and affordable power in the future,” Google’s senior director for energy and climate Michael Terell said in comments on the deal with Kairos Power.

The tech industry appears to have taken its time in realizing that clean power is not enough for their business ends, and they need power that is both clean and available around the clock—and batteries cannot make wind and solar round-the-clock power sources.

“These large investments show the tech industry does not feel renewables and batteries can provide enough stable or cost-effective power and nuclear will be needed,” the chair of the American Nuclear Society’s International Council and chief executive of nuclear fuel producer Lightbridge Corporation told the FT last week. Indeed, it was high time someone acknowledged the shortcomings of the default energy sources of transition advocates who have not yet felt directly the need for reliable, in addition to non-hydrocarbon, electricity.

In fairness, Big Tech’s big bet on nuclear will take a while to take shape. For example, Microsoft may have agreed with Constellation Energy to restart Three Mile Island, but the restart depends on permits yet to be granted by the relevant authorities—and it is not a done deal in light of anti-nuclear sentiments among the public, Reuters reports.

Small modular reaction technology has not been tested at a commercial scale yet, and the one project that tried to test it ultimately failed, with developer NuScale losing its deal with a Utah utility after it turned out the electricity its reactors would be generating was going to be a lot more expensive than original planned.

Yet, Big Tech has deep pockets and massive electricity needs that are only going to get even more massive in the coming years as the AI race heats up and data centers multiply. Indeed, various forecasts are naming data center proliferation as the top reason for a considerable future increase in U.S. electricity consumption after more than a decade of flat demand. Per Barclays, data centers alone will come to account for 9% of total U.S. demand for electricity by 2030. That would be up from just 3.5%. Per Wood Mac, total electricity demand in the U.S. could swell by up to 15% in the next five years. And it won’t be wind and solar covering this demand if Big Tech is any judge.

The nuclear bet could be a disaster for wind and solar, and not just because nuclear is a direct rival for the love of some huge consumers of energy. That bet could mortally wound wind and solar because of carbon credits.

Right now, Big Tech majors are the biggest clients of companies engaged in the generation of electricity from wind and solar installations, for which generation these companies also receive so-called carbon credits. They are free to sell these credits to companies that want to reduce their emission footprint accumulated from their use of hydrocarbon sources of electricity for lack of comparable non-hydrocarbon alternatives. Microsoft, Amazon, and Google are big consumers of carbon credits. But if those reactors get built, demand for carbon credits will take a plunge—and it will never return.

This is a problem for wind and solar generators because those carbon credits are an important source of income. That source of income could become even more important as negative prices due to overproduction become more frequent. Yet Big Tech with its nuclear plans could put an end to this lucrative carbon credit trade because nuclear generation is zero-emission generation.

Granted, this will take years to happen. There will be challenges as small modular reactor technology proves itself in the field. There will be failures and delays. But with Big GTech’s money and its very urgent need for energy, chances are that nuclear will be making a major comeback. In the meantime, gas and even coal are guaranteed some stable demand growth from the data center world.

By Irina Slav for Oilprice.com

Deep Atomic launches SMR for data centres

The MK60 small modular reactor design, developed specifically to provide power and cooling to data centres, has been unveiled by Deep Atomic.

_92619.jpg)

The MK60 is a light water small modular reactor (SMR) incorporating multiple passive safety systems. Deep Atomic says it is "compact, scalable, and built on a foundation of proven technology". Each unit generates up to 60 MWe and provides an additional 60 MW of cooling capacity through its "integrated data centre-centric design approach".

The company - headquartered in Zurich, Switzerland - says the reactor is well-suited to various types of data centres, including those supporting traditional cloud services, cryptocurrency operations, and AI applications.

"Data centres are the backbone of digital innovation, but their massive energy needs have become the critical bottleneck blocking growth," said Deep Atomic founder and CEO William Theron.

The MK60 is said to offer data centre operators a scalable power solution that can be deployed in various locations, including areas with limited grid access, and can be sited closer to urban areas due to its advanced safety features.

"It's designed to be installed on-site at data centres, delivering reliable zero-carbon electricity and energy-efficient cooling, thereby significantly reducing carbon footprints, and helping data centres meet their increasingly stringent sustainability goals," Theron said.

Deep Atomic's Head of Engineering Freddy Mondale noted that many regions were struggling to provide the amounts of power that new data centres require. "Our on-site reactors bypass these grid limitations, allowing DCs (data centres) to be built in optimal locations without straining existing infrastructure."

Mondale says that a 60 MWe reactor with additional 60 MW of cooling capacity "hits a sweet spot for data centres. It's large enough to power significant compute infrastructure, yet small enough to allow for modular deployment and scaling".

He added: "The MK60 can be deployed in multiples, allowing scalability from 60 MW up to over 1 GW to meet growing energy demands."

Deep Atomic says it has already begun to engage with regulators and potential customers as it moves forward with development. The company is seeking partnerships with data centre operators and other investors "looking towards the future of sustainable digital infrastructure".

Deep Atomic's announcement of the MK60 comes on the heels of several announcements by global tech giants related to nuclear energy.

Microsoft announced in September it had signed a 20-year power purchase agreement with Constellation that will see Three Mile Island unit 1 restarted. Google announced last week it had agreed to purchase energy from Kairos Power under a deal that would support the first commercial deployment of its fluoride salt-cooled high-temperature advanced small modular reactors by 2030 and aim for a fleet totalling 500 MW of capacity by 2035. The following day, Amazon announced a series of agreements that will see it taking a stake in advanced nuclear reactor developer X-energy and rolling out its Xe-100 advanced SMR initially at a project in Washington State.

Meanwhile, the head of Japanese cloud-based gaming services provider Ubitus KK has said it is planning to construct a new data centre and is specifically looking at areas with nearby nuclear power plants to provide the required power.

Google and Kairos Power team up for SMR deployments

Google has agreed to purchase energy from small modular reactors under a deal that will support the first commercial deployment of Kairos Power's reactor by 2030 and a fleet totalling 500 MW of capacity by 2035.

_22592.jpg)

The Master Plant Development Agreement signed by the two companies will see Kairos Power develop, construct, and operate a series of advanced reactor plants and sell energy, ancillary services, and environmental attributes to Google under power purchase agreements (PPAs). Plants will be sited in "relevant service territories to supply clean electricity to Google data centres", with the first deployment by 2030 to support Google’s 24/7 carbon-free energy and net zero goals.

This the first corporate agreement for multiple deployments of a single advanced reactor design in the USA, the companies said.

Kairos has adopted a rapid iterative development approach and vertical integration strategy to bring its fluoride salt-cooled high-temperature reactor technology to market. Site work and excavation for a low-power demonstration reactor version, Hermes, began at Oak Ridge, Tennessee, earlier this year after the US Nuclear Regulatory Commission (NRC) issued a construction permit in 2023, targeted to be operational by 2027. The NRC has also completed the final environmental assessment for the construction of the next iteration - the two-unit power-producing Hermes 2 plant - which is also planned to be built at Oak Ridge.

Kairos said the innovative, multi-plant agreement with Google will support technology development by extending Kairos Power’s iterative demonstration strategy through its first commercial deployments: "Building on progress from the early iterations, each new plant will enable continued learning and optimisation to support accelerated commercialisation. Along the way, milestone-based accountability baked into the agreement will establish confidence in Kairos Power's ability to deliver throughout the long-term partnership."

"Our partnership with Google will enable Kairos Power to quickly advance down the learning curve as we drive toward cost and schedule certainty for our commercial product," Mike Laufer, Kairos Power CEO and co-founder, said. "By coming alongside in the development phase, Google is more than just a customer. They are a partner who deeply understands our innovative approach and the potential it can deliver."

Google is aiming to achieve net-zero emissions across all of its operations and value chain by 2030. Earlier this year, Google - together with Microsoft and steel manufacturer Nucor - announced plans to develop new business models and aggregate their demand for advanced clean electricity technologies, including advanced nuclear, and issued a Request for Information to identify specific projects to engage with.

The additional generation that will be developed under the multi-plant agreement with Kairos will complement its existing use of variable renewables while helping it to reach its 24/7 carbon-free energy and net zero goals, the company said.

"This landmark announcement will accelerate the transition to clean energy as Google and Kairos Power look to add 500 MW of new 24/7 carbon-free power to US electricity grids," Google Senior Director of Energy and Climate Michael Terrell said. "This agreement is a key part of our effort to commercialise and scale the advanced energy technologies we need to reach our net zero and 24/7 carbon-free energy goals and ensure that more communities benefit from clean and affordable power in the future."

Google pioneered the first corporate purchase agreements for renewable electricity more than a decade ago, and since then has played a pivotal role in accelerating clean energy solutions, Terrell said in a blog post. The agreement with Kairos is important because the grid needs new sources of electricity to support AI technologies, and nuclear can help meet those demands reliably with carbon-free energy every hour of every day, he added.

"By procuring electricity from multiple reactors … we will help accelerate the repeated reactor deployments that are needed to lower costs and bring Kairos Power’s technology to market more quickly. This is an important part of our approach to scale the benefits of advanced technologies to more people and communities, and builds on our previous efforts," he said.

"We'll continue working to accelerate a diverse portfolio of advanced clean electricity technologies and bring new 24/7 clean, affordable energy onto every grid where we operate."

Molten salt reactors

Molten salt reactors - or MSRs - use molten fluoride salts as primary coolant, at low pressure. Some designs - like Kairos Power's KP-FHR - use solid fuel, while others use fuel salts, in which the nuclear fuel is dissolved in the coolant.

The KP-FHR will use fully ceramic TRISO (tri-structural isotropic) pebble-type fuel. The Hermes and Hermes 2 demonstration plants will feature units with a thermal capacity of 35 MW each. The two 35 MWt units at Hermes 2 are intended to a power a common turbine generator set to produce about 20 MW electric (MWe).

Kairos envisages its commercial KP-FHR offering as dual unit plants, with two 75 MWe units for a total of 150 MWe of power output.

MSRs are one of the four main types of SMR that are currently being developed. SMRs are broadly defined as nuclear reactors with a capacity of up to 300 MWe equivalent, designed with modular technology using module factory fabrication, pursuing economies of series production and short construction times

Amazon invests in X-energy, unveils SMR project plans

Amazon has announced it has taken a stake in advanced nuclear reactor developer X-energy, with the goal of deploying up to 5 GW of its small modular reactors in the USA by 2039.

Online shopping and web services giant Amazon's Climate Change Pledge Fund was described as the anchor investor in a USD500 million financing round for X-energy, alongside Ken Griffin, founder and CEO of Citadel, Ares Management Corporation, private equity firm NGP and University of Michigan.

The funding is designed to pave the way to completion of the reactor design and licensing, and the first phase of its TRISO-X fuel fabrication facility at Oak Ridge, Tennessee.

The first project

The first project looks set to be in Washington State, with Amazon announcing it had signed an agreement with Energy Northwest, a consortium of state public utilities, for an initial four advanced small modular reactors (SMRs) generating about 320 MWe, with an option to treble that number to 960 MWe, which would be the amount needed to power about 770,000 homes.

Amazon will fund the initial feasibility phase for the SMR project which is planned for a site near the energy company's Columbia Generating Station nuclear energy facility in Richland. Under the agreement Amazon would have the right to purchase electricity from the first phase, while Energy Northwest will have the option to build the eight extra modules, with the additional power being available to Amazon and utilities in the area.

Matt Garman, CEO of Amazon Web Services, said: "One of the fastest ways to address climate change is by transitioning our society to carbon-free energy sources, and nuclear energy is both carbon-free and able to scale - which is why it’s an important area of investment for Amazon. Our agreements will encourage the construction of new nuclear technologies that will generate energy for decades to come."

Greg Cullen, Vice President for Energy Services & Development at Energy Northwest, said: "We've been working for years to develop this project at the urging of our members, and have found that taking this first, bold step is difficult for utilities, especially those that provide electricity to ratepayers at the cost of production. We applaud Amazon for being willing to use their financial strength, need for power and know-how to lead the way to a reliable, carbon-free power future for the region."

The advanced reactors

The Xe-100 is a Generation IV advanced reactor design which X-energy says is based on decades of high temperature gas-cooled reactor operation, research, and development. Designed to operate as a standard 320 MWe four-pack power plant or scaled in units of 80 MWe. At 200 MWt of 565°C steam, the Xe-100 is also suitable for other power applications including mining and heavy industry. The Xe-100 uses tri-structural isotropic (TRISO) particle fuel, which has additional safety benefits because it can withstand very high temperatures without melting,

X-energy says its design makes it road-shippable with accelerated construction timelines and more predictable and manageable construction costs, and is well suited to meet the requirements of energy-intensive data centres.

Clay Sell, X-energy CEO, said: "Amazon and X-energy are poised to define the future of advanced nuclear energy in the commercial marketplace. To fully realise the opportunities available through artificial intelligence, we must bring clean, safe, and reliable electrons onto the grid with proven technologies that can scale and grow with demand. We deeply appreciate our earliest funders and collaborators, notably the US Department of Energy and Dow Inc. With Amazon, Ken Griffin, and our other strategic investors, we are now uniquely suited to deliver on this transformative vision for the future of energy and tech."

The initial Xe-100 plant is being developed at Dow Inc's UCC Seadrift Operations site on the Texas Gulf Coast, which would be the first nuclear reactor deployed to serve an industrial site in the USA.

What else has been announced?

A memorandum of understanding has also been signed with utility company Dominion Energy to look into the development of an SMR project near the company's existing North Anna nuclear power station. It is not the first move into nuclear energy from Amazon, which is co-locating a data centre facility next to Talen Energy's nuclear power plant in Pennsylvania.

Robert Blue, Chairman and CEO of Dominion Energy, said: "This agreement builds on our longstanding partnership with Amazon and other leading tech companies to accelerate the development of carbon-free power generation in Virginia. It's an important step forward in serving our customers' growing needs with reliable, affordable and increasingly clean energy. This collaboration gives us a potential path to advance SMRs with minimal rate impacts for our residential customers and substantially reduced development risk."

In July, Dominion Energy announced a Request for Proposals from leading SMR nuclear technology companies to evaluate the feasibility of developing an SMR at the company's North Anna plant - while it is not a commitment to build an SMR, it is an important first step in evaluating the technology and the feasibility of developing it at North Anna the company says.

Data centres and nuclear

Amazon's series of announcements confirms a recent trend of data centre operators looking at nuclear energy as a way to get reliable energy that is carbon free. Amazon noted that it is not just their data centres and web services which are going to see increasing electricity demand, but also wider developments such as electrifying its vehicle fleet.

On Tuesday, a fellow online giant, Google, signed a Master Plant Development Agreement with Kairos Power for the development and construction of a series of advanced reactor plants.

And last month Microsoft announced it had signed a 20-year power purchase agreement with Constellation which would see Three Mile Island unit 1 restarted, five years after it was shut down.

No comments:

Post a Comment