HIGH SEAS CRIMINAL CAPITALISM

Italy Launches Antitrust Investigation into MSC Investment in Moby

Italy’s Competition and Market Authority revealed today that it has launched an investigation into the investment by MSC Mediterranean Shipping Company into Italian ferry operator Moby. The investigation is looking at the potential of “restrictions of competition,” after MSC made a series of actions in 2022 and 2023 to save the financially troubled ferry operator.

The authority reports with the assistance of the Special Antitrust Unit of the Guardia di Finanza, they carried out inspections on November 13. They visited the offices of Moby and Grandi Navi Veloci (GNV), as well as the parent company Onorato Armatori and MSC’s Marinvest which carried out the investments through Shipping Agencies Services (SAS, another MSC company.

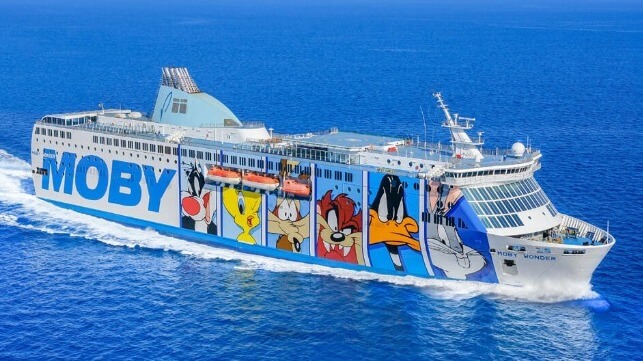

Moby operates a fleet of ferries between the Italian mainland and destinations including Sardinia, Corsica, Sicily, and Elba. Parent company Onorato Group reports it operates a total of 38 ships, with about 41,000 departures for 33 ports annually. In addition to Moby, the group acquired Toremar, Compagnia Regionale Toscana in July 2012, and Tirrenia in 2015.

Moby group however was facing financial difficulties unable to repay debts from the mergers and in 2022 was faced with bankruptcy. The Aponte family working with the Ororato family devised a plan by which SAS would acquire 49 percent of Moby for approximately €150 million while providing a loan for an additional €243 million. In January this year, MSC also acquired two Moby RoPax ferries, Moby Vinci and Moby Sharden, for a further €109 million.

The regulators are highlighting that it is a highly concentrated market that already has high barriers to entry. They note the services transporting passengers and cargo in some cases are only offered by Moby and GNV while on some routes there is a third operator. GNV, which was started by the Grimaldi group in 1992, has been owned by MSC since 2010.

Moby and GNV confirmed that the investigation was underway. They said in prepared statements that they were fully cooperating with the organizations providing requested information.

This investigation is proceeding as MSC continues to be very aggressive with acquisitions across the group. Among the other deals the company recently acquired car carrier operator Gram Car Carriers. Last week, it was reported that MSC has received all the required approvals for its 49 percent investment in Hamburg’s port operator HHLA to proceed. The company is also expanding its logistics operations both with port investments and shoreside logistic operators.

Trafigura Charged for Alleged Bribery Scheme in Angola

Swiss commodity trading giant Trafigura has been charged with failing to prevent a $5 million bribery scheme in its chartering and oil trading operations in Angola, the latest public corruption case involving the commodity-trading industry in the developing world. It is the first such case in Switzerland to result in charges against a top executive - Mike Wainwright, the firm's former CEO, who retired earlier this year.

According to Swiss prosecutors, Trafigura paid off an Angolan oil official, Paulo Gouveia Junior, in exchange for his signature on eight ship charter contracts and one bunkering contract in 2009-10. These allegedly corrupt agreements netted Trafigura $144 million in profits.

Over the course of 2009-11, prosecutors said, Trafigura paid $4.3 million into a shell company in the Virgin Islands and designated Gouveia as the beneficiary of the fund. Gouveia also allegedly received an additional cash bribe of $600,000 delivered in Angola. The transactions were highly structured and were routed through an intermediary - a consultant who previously worked for Trafigura and whose sole client was Trafigura. This fixer was given the nickname "Mr. Non-Compliant" by Trafigura founder Claude Dauphin, prosecutors asserted.

Wainwright was personally involved, according to the indictment, and allegedly signed some of the documents for these transactions. He has maintained his innocence, and his legal counsel told the FT that he will be mounting a robust defense.

Trafigura is also a defendant in the case. If convicted, the company would have to forfeit its earnings from the alleged scheme, totaling about $150 million - equal to about two percent of its total profit in 2023.

The trading company is a pivotal player in Angola's development plans, with a leading role in the deepwater Port of Lobito.

No comments:

Post a Comment