Trump's Win Boosts Oil Stocks, But Offshore Wind and Ocean Freight Tumble

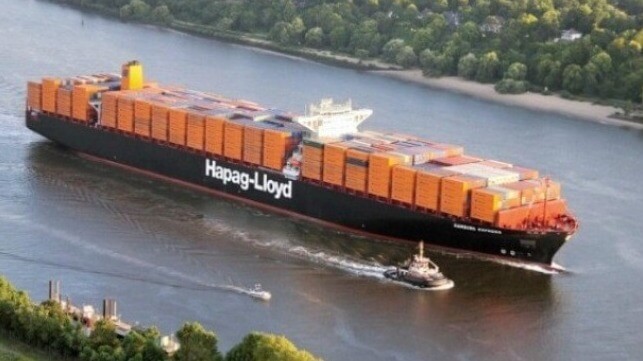

The decisive electoral victory of future President Donald Trump has sent energy stocks soaring, while the initial investor reaction for the rest of the industry appears mixed. Ocean carriers might face headwinds ahead, based on early trading for Maersk, Zim and Hapag-Lloyd, among others.

Trump has promised to open the floodgates for oil and gas companies, pledging a "drill, baby, drill" orientation towards regulation. U.S. petroleum production is currently at an all-time high, and the market showed expectations that it could go even higher if producers faced fewer restrictions. At the same time, the possibility of tighter sanctions on Venezuela and Iran could reduce net global oil exports under a new Trump administration, noted analysts at Goldman Sachs.

In early trading Wednesday, U.S. energy, drilling and tanker firms showed strong performance. Offshore drilling leader Transocean jumped nearly three percent; inland barge operator Kirby rose more than six percent; Chevron rose three percent; and Exxon was up by 1.5 percent.

Shell, BP and Equinor - all active players in the U.S. Gulf of Mexico's oil patch - fell in early trading, including a four percent drop for Equinor. The global Brent benchmark oil price remained stable.

Trump has also promised to radically increase tariffs on imported goods, particularly from China. If carried out, that campaign pledge could hamper containerized freight volumes, especially on transpacific trade lanes. Publicly-listed container carriers' stocks fell in early trading, led by Maersk (down eight percent), NYK (nine percent) and Hapag-Lloyd (10 percent).

The president-elect has pledged to end the U.S. offshore wind industry by executive order "on day one," and investors in the sector have responded to the changing regulatory environment. Market leader Orsted shed 15 percent of its value on Wednesday, followed by turbine builder Vestas, which dropped 13 percent. Siemens Energy, owner of turbine manufacturer Siemens Gamesa, fell by two percent.

American Retailers: Tariff Hikes Would Raise Prices, Reduce Import Volume

The tariffs that President-elect Donald Trump has proposed to enact on imports could raise retail costs on basics like apparel and furniture by up to $78 billion a year, enough to prompt some U.S. consumers to stop buying as much as they do today, according to the National Retail Federation.

Current effective tariff rates on everyday items run in the range of 0-17 percent. Trump has proposed to increase these rates by 10-20 percent - plus at least 60 percent more for all goods from China, America's number-three trading partner after Canada and Mexico. Average tariff rates in this range have not been seen in the U.S. since the 1800s, and would have a substantial effect on trade flows.

Importers pay tariffs (also known as duties, in trade parlance) to U.S. Customs and Border Protection during the customs process. Some or all of this additional cost is typically passed on to the consumer in the form of higher retail prices, and the NRF estimates that this will raise expenses for the average American household by about $7,000 per year. Some consumers will be able to accept this cost and will pay it, either by purchasing imported goods at higher prices or by buying domestically-made substitutes. Others will not be able to afford the increase and will buy less, NRF suggested, reducing retail demand.

The NRF commissioned a study to examine the effects of tariffs on six common categories of imported products: apparel, footwear, furniture, household appliances, toys and travel goods. Assuming that some amount of import sourcing shifts out of China to other nations - for example, Vietnam - then average tariff rates for these categories would run between 33-98 percent, with toys being affected most. About $46-78 billion a year in extra costs would be passed on to the customer for these goods alone, according to NRF.

"Consumers would pay $13.9-24 billion more for apparel, $8.8-14.2 billion more for toys, $8.5-13.1 billion more for furniture, $6.4-$10.9 billion more for household appliances, $6.4-10.7 billion more for footwear, and $2.2-3.9 billion more for travel goods. Cost increases come at the expense of purchases of other goods and services and represent lost household spending power," NRF concluded.

Reduced retail spending would mean less cargo across the pier, and shipping investors responded accordingly: on Monday, publicly-listed container carriers' stocks fell sharply, led by Maersk (down eight percent), NYK (nine percent) and Hapag-Lloyd (10 percent).

Share prices for major retailers were also down, reflecting expectations of lower sales volumes. Walmart dipped slightly, Target fell by 2.5 percent, and Best Buy fell by nearly four percent. Shares in leading apparel retailers were also down slightly.

In a statement, the American Association of Port Authorities - whose members will be affected by any changes in trade volume - said that it was looking forward to working with the next administration.

"America’s ports wish to congratulate the newly elected Trump – Vance Presidential Administration," said Cary S. Davis, AAPA President and CEO. "AAPA looks forward to working closely with our Federal Government partners to get shovels in the ground faster, continue rebuilding our critical infrastructure, and strengthen the resiliency of our nation’s ports over the next four years."

Over the next few months, freight volumes and rates may spike as retailers rush to get ahead of any changes in tariff policy, according to consultancy Xeneta. The presidential inauguration will occur on January 20, and the new administration may take time to enact its trade plans, so retailers may take advantage of a narrow window in which to stock up early, Xeneta predicted. During the last Trump administration, in 2018, freight rates jumped by 70 percent before the implementation of a tariff hike on Chinese goods.

"The knee-jerk reaction from US shippers will be to frontload imports before Trump is able to impose his new tariffs. Back in 2018, the tariff on Chinese imports was 25%, now it is increasing up to 100% so the incentive to frontload is even greater. If you have warehouse space and the goods to ship, frontloading imports is the simplest way to manage this risk in the short term," said Xeneta chief analyst Peter Sand.

No comments:

Post a Comment