By ZeroHedge - Dec 26, 2024

The US is already the largest LNG supplier to Europe, and could theoretically replace Russian LNG imports.

Replacing Russian LNG with US LNG could increase shipping costs and European prices.

Europe's decarbonization goals may limit its willingness to make long-term commitments to US LNG.

Samantha Dart, co-head of global commodities research at Goldman, published a note to clients outlining five key questions and answers about the US-EU liquefied natural gas trade. This comes just days after President-elect Donald Trump threatened the EU with a barrage of tariffs unless Brussels ramped up purchases of American LNG.

For context, last Friday, Trump wrote on Truth Social:

"I told the European Union that they must make up their tremendous deficit with the United States by the large-scale purchase of our oil and gas. Otherwise, it is TARIFFS all the way!!!"

Dart told clients that the US is already Europe's largest LNG supplier and a key source of supply growth. She said replacing Russian LNG with US LNG imports could raise shipping costs and European prices to incentivize re-routing cargoes

Europe’s Natural Gas Prices Jump to 2024 High

She said such a shift would have minimal impact on US LNG export revenues, as total export capacity remains fixed, adding exporters with long-term contracts with proposed US LNG projects would benefit. However, Europe's decarbonization strategy may limit the willingness of European companies to make long-term NatGas commitments with US exporters.

Dart laid out key questions and answers about the US-EU LNG trade that help clients understand that US LNG Gulf exports can "theoretically" replace Russian NatGas flowing into the EU. How much US LNG is exported to Europe?

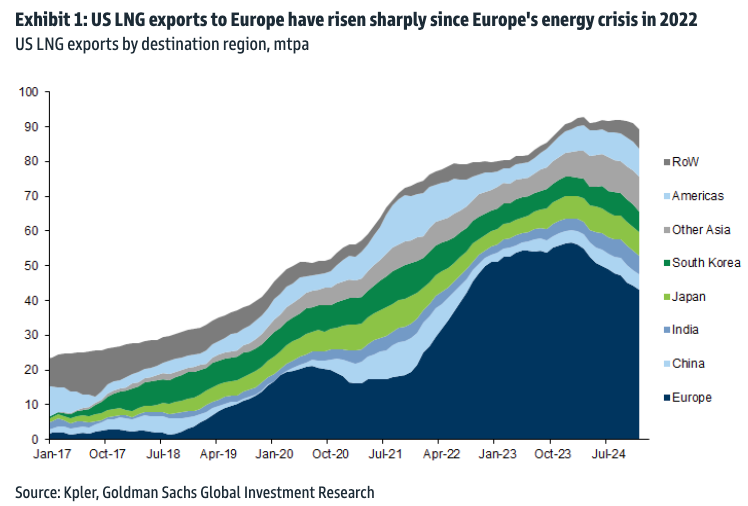

US LNG exports averaged 91 mt over the past year (Dec23-Nov24), of which 47 mt or 51% were delivered to Europe. US LNG exports to Europe have grown significantly in levels and as a share of total US LNG exports since the European energy crisis in 2022, peaking in 2023 (Exhibit 1).

Are US LNG volumes sold in the spot market or are they contracted?

The vast majority of US LNG sales are under contract. That said, US contracts typically have flexible destination ports, in that the buyer is not obligated to deliver to a particular location. This allows buyers of US LNG to re-sell or re-direct cargoes to higher-paying destinations. This was evident during the European energy crisis, when European gas prices increased sharply relative to the rest of the world. Even as total US LNG exports grew, this worked as an effective incentive for US LNG deliveries to non-European destinations to contract by 41%, while European deliveries increased by 197%[1], as seen in Exhibit 1.What portion of European LNG imports come from the US?

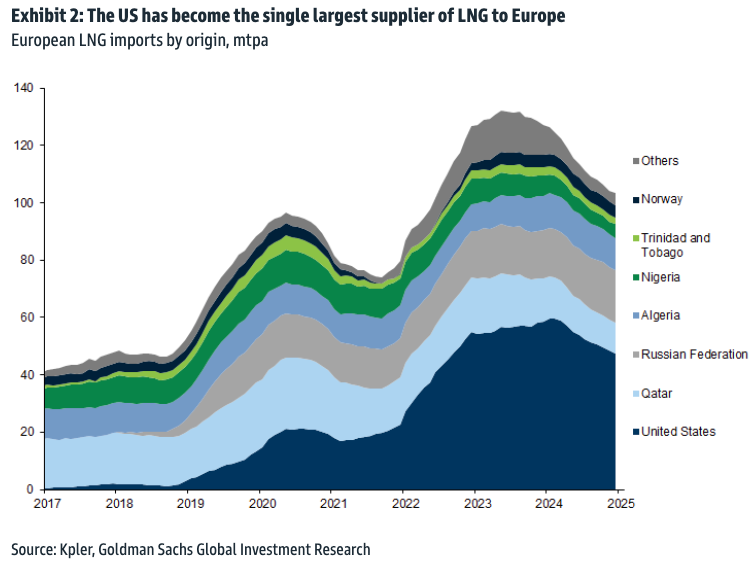

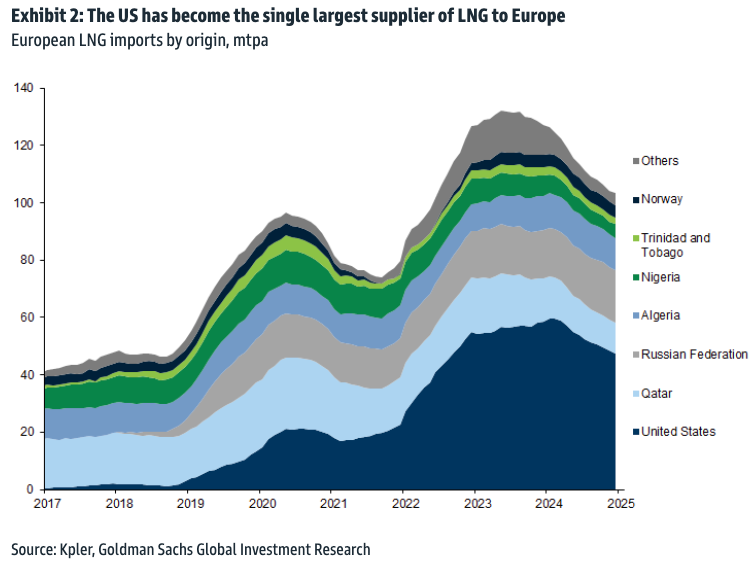

The US has become the single largest source of LNG to Europe, averaging 46% of imports into the region over the past 12 months (Exhibit 2). Most European LNG imports are sourced from Atlantic Basin suppliers to minimize shipping costs. Importantly, the US is also the primary source of likely European LNG import growth, based on long-term LNG contracts signed by European buyers since the start of the Ukraine war. US volumes contracted by European buyers in the period add to just under 16 mtpa, which is more than with any other single supplier globally (Exhibit 3).

The vast majority of US LNG sales are under contract. That said, US contracts typically have flexible destination ports, in that the buyer is not obligated to deliver to a particular location. This allows buyers of US LNG to re-sell or re-direct cargoes to higher-paying destinations. This was evident during the European energy crisis, when European gas prices increased sharply relative to the rest of the world. Even as total US LNG exports grew, this worked as an effective incentive for US LNG deliveries to non-European destinations to contract by 41%, while European deliveries increased by 197%[1], as seen in Exhibit 1.What portion of European LNG imports come from the US?

The US has become the single largest source of LNG to Europe, averaging 46% of imports into the region over the past 12 months (Exhibit 2). Most European LNG imports are sourced from Atlantic Basin suppliers to minimize shipping costs. Importantly, the US is also the primary source of likely European LNG import growth, based on long-term LNG contracts signed by European buyers since the start of the Ukraine war. US volumes contracted by European buyers in the period add to just under 16 mtpa, which is more than with any other single supplier globally (Exhibit 3).

Can US LNG replace Russian LNG imports into the EU?

Theoretically, yes. US LNG deliveries to non-EU countries are currently approximately 18 mtpa above the levels observed during the peak of the European energy crisis, suggesting there is enough flexibility in the market to replace Russia's current 17 mtpa of LNG exports to the region. However, such a reallocation of flows might offer little benefit, if any, to Europe or the US. Less optimal routes for LNG deliveries (for example, longer routes for Russian cargoes) would likely lead to higher freight costs. In addition, European import costs might go up in order to motivate the re-route of US cargoes that would have otherwise opted to deliver elsewhere.

Total US LNG exports would also not increase as a result of this reallocation, given that US LNG export capacity would not be impacted in the process.How could Europe support growing US LNG exports?

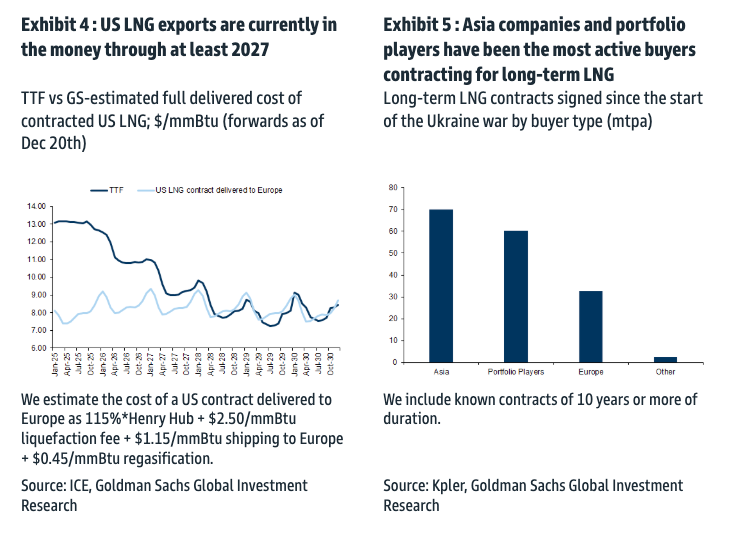

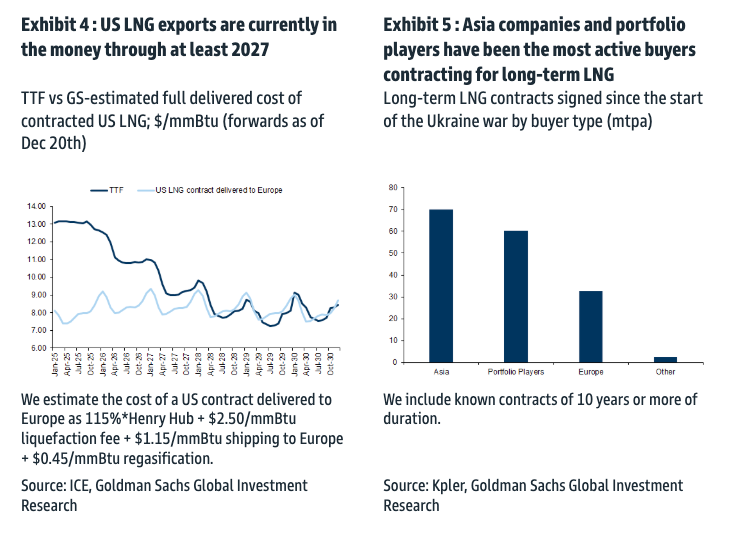

Additional long-term contracting by European buyers with proposed US LNG projects would be the most impactful measure the EU could take to support higher future US LNG exports, as this would increase the likelihood such contracted liquefaction projects reach a final investment decision (FID). As of now, the forward curve for European gas prices suggests new long-term US LNG export contracts are in the money through at least 2027 (Exhibit 4). That said, Europe's decarbonization goals might limit European companies' appetite for long-term commitments to grow natural gas use. In fact, when we look across all long-term LNG contracts signed since the start of the Ukraine war, European companies are far behind Portfolio player companies and Asia importers (Exhibit 5).

It appears that Goldman believes Trump's 'America First' policy of replacing Russian LNG to Europe with American LNG is "theoretically" possible.

By Zerohedge.com

Theoretically, yes. US LNG deliveries to non-EU countries are currently approximately 18 mtpa above the levels observed during the peak of the European energy crisis, suggesting there is enough flexibility in the market to replace Russia's current 17 mtpa of LNG exports to the region. However, such a reallocation of flows might offer little benefit, if any, to Europe or the US. Less optimal routes for LNG deliveries (for example, longer routes for Russian cargoes) would likely lead to higher freight costs. In addition, European import costs might go up in order to motivate the re-route of US cargoes that would have otherwise opted to deliver elsewhere.

Total US LNG exports would also not increase as a result of this reallocation, given that US LNG export capacity would not be impacted in the process.How could Europe support growing US LNG exports?

Additional long-term contracting by European buyers with proposed US LNG projects would be the most impactful measure the EU could take to support higher future US LNG exports, as this would increase the likelihood such contracted liquefaction projects reach a final investment decision (FID). As of now, the forward curve for European gas prices suggests new long-term US LNG export contracts are in the money through at least 2027 (Exhibit 4). That said, Europe's decarbonization goals might limit European companies' appetite for long-term commitments to grow natural gas use. In fact, when we look across all long-term LNG contracts signed since the start of the Ukraine war, European companies are far behind Portfolio player companies and Asia importers (Exhibit 5).

It appears that Goldman believes Trump's 'America First' policy of replacing Russian LNG to Europe with American LNG is "theoretically" possible.

By Zerohedge.com

No comments:

Post a Comment