Cecilia Jamasmie | December 5, 2024 |

Cobre Panama copper mine contributed almost 5% of Panama’s GDP.

(Image courtesy of Franco-Nevada assets handbook.)

A recent nationwide survey in Panama has shed light on what locals think about the potential reopening of First Quantum’s (TSX: FM) $6.5 billion Cobre Panamá copper mine, which has been shut down for over a year following a Presidential decree.

The findings reveal a nation deeply divided, with people balancing concerns about environmental impacts and governance against the mine’s critical economic role.

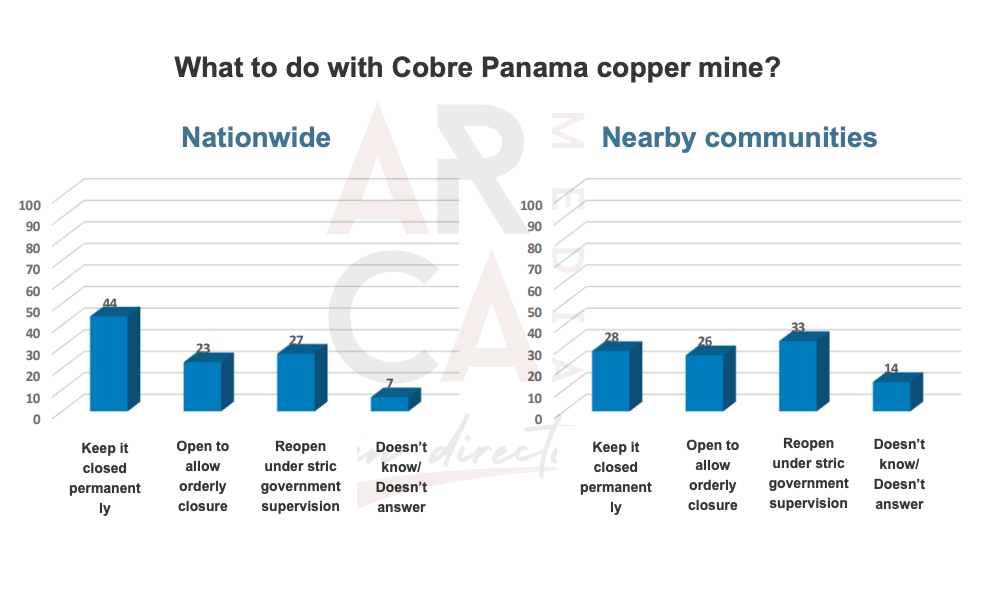

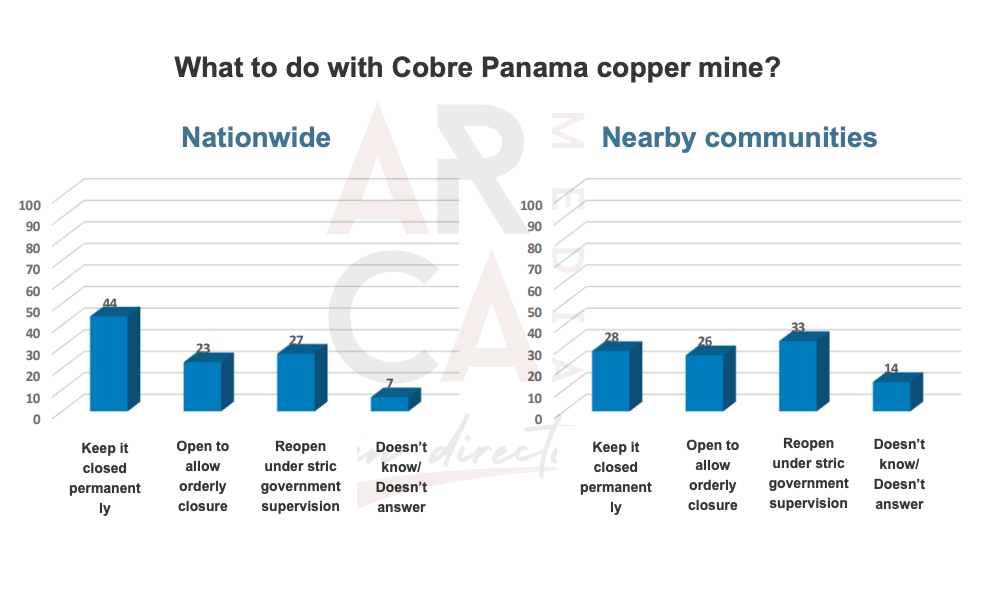

The survey, commissioned by ARCA Media en Direct and conducted by research firm DOXA, involved 1,600 face-to-face interviews nationwide and included 400 participants from communities near the mine.

The results of the survey come at a time when Panama is grappling with the economic and social ramifications of the mine’s closure ordered by then-President Laurentino Cortizo after the Supreme Court ruled the mine contract unconstitutional.

In mining-adjacent communities, a greater proportion of respondents would support to reopen the mine either to keep it operating under government supervision (33%) or to facilitate and orderly closure (26%).

The shutdown of Cobre Panama marked a turning point for a mine that once contributed nearly 5% of Panama’s GDP and accounted for 75% of its exports.

Nationally, 44% of respondents believe the mine should remain closed indefinitely. A 27% of participants support reopening it under strict government supervision, while 23% advocate for reopening the mine just to enable its orderly closure.

In mining-adjacent communities, a greater proportion of respondents would support to reopen the mine either to keep it operating under government supervision (33%) or to facilitate and orderly closure (26%).

A recent nationwide survey in Panama has shed light on what locals think about the potential reopening of First Quantum’s (TSX: FM) $6.5 billion Cobre Panamá copper mine, which has been shut down for over a year following a Presidential decree.

The findings reveal a nation deeply divided, with people balancing concerns about environmental impacts and governance against the mine’s critical economic role.

The survey, commissioned by ARCA Media en Direct and conducted by research firm DOXA, involved 1,600 face-to-face interviews nationwide and included 400 participants from communities near the mine.

The results of the survey come at a time when Panama is grappling with the economic and social ramifications of the mine’s closure ordered by then-President Laurentino Cortizo after the Supreme Court ruled the mine contract unconstitutional.

In mining-adjacent communities, a greater proportion of respondents would support to reopen the mine either to keep it operating under government supervision (33%) or to facilitate and orderly closure (26%).

The shutdown of Cobre Panama marked a turning point for a mine that once contributed nearly 5% of Panama’s GDP and accounted for 75% of its exports.

Nationally, 44% of respondents believe the mine should remain closed indefinitely. A 27% of participants support reopening it under strict government supervision, while 23% advocate for reopening the mine just to enable its orderly closure.

In mining-adjacent communities, a greater proportion of respondents would support to reopen the mine either to keep it operating under government supervision (33%) or to facilitate and orderly closure (26%).

Taken from: Doxa post election survey.

Panamanians acknowledge Cobre Panama’s economic significance. When survey participants opposed to reopening were presented with the potential consequences of a prolonged closure — including the loss of $4 billion annually and 40,000 jobs — 52% nationwide expressed support for reopening. However, in communities near the mine, economic arguments appear to hold less sway, with support for reopening, among those generally opposed, remaining low.

As operations at Cobre Panama remain suspended, the mine has transitioned into a preservation phase, incurring significant monthly costs. First Quantum reported spending between $11 million and $13 million per month on labour, maintenance, and environmental stability measures. By the end of October, nearly 121,000 tonnes of copper concentrate remained on-site, as First Quantum continued negotiating a permit to export the stockpiled metal.

Panamanians acknowledge Cobre Panama’s economic significance. When survey participants opposed to reopening were presented with the potential consequences of a prolonged closure — including the loss of $4 billion annually and 40,000 jobs — 52% nationwide expressed support for reopening. However, in communities near the mine, economic arguments appear to hold less sway, with support for reopening, among those generally opposed, remaining low.

As operations at Cobre Panama remain suspended, the mine has transitioned into a preservation phase, incurring significant monthly costs. First Quantum reported spending between $11 million and $13 million per month on labour, maintenance, and environmental stability measures. By the end of October, nearly 121,000 tonnes of copper concentrate remained on-site, as First Quantum continued negotiating a permit to export the stockpiled metal.

Financial shock

The survey showed Panamanians are concerned about how the situation may affect the flow of foreign direct investment (FDI) if the mine remains closed. At a national level, 57% of respondents believe a continued shutdown would deter FDI, with 54% of those near the mine sharing this belief.

Respondents also expressed a strong desire for greater governmental oversight. Nationwide, 57% support reviewing the contract with First Quantum, rising to 65% among residents near the mine.

Trust in current President José Raúl Mulino’s administration to resolve the crisis was relatively high, with 44% of respondents expressing confidence in his leadership, compared to 18% for the construction workers’ union and 15% for the chamber of commerce.

President Mulino has criticized his predecessor for leaving the issue unresolved, pledging to address it with what he calls “credibility and national acceptance.”

As the government weighs its options, the survey highlights a critical tension: while a large segment of the population values the mine’s economic contributions, particularly for jobs and revenue, deep-seated concerns about its social and environmental impact persist.

Any decision about the mine’s future will need to address public opposition, economic imperatives, and the trust gap between communities and mining stakeholders.

No comments:

Post a Comment