Who is Paying for Cambodia's Massive New Canal?

[By Grace Stanhope and Hannah Buckley]

Speculation swirls around Cambodia’s newest megaproject, the Funan Techo Canal. It’s a US$1.7 billion project (at least) – but where’s the money coming from?

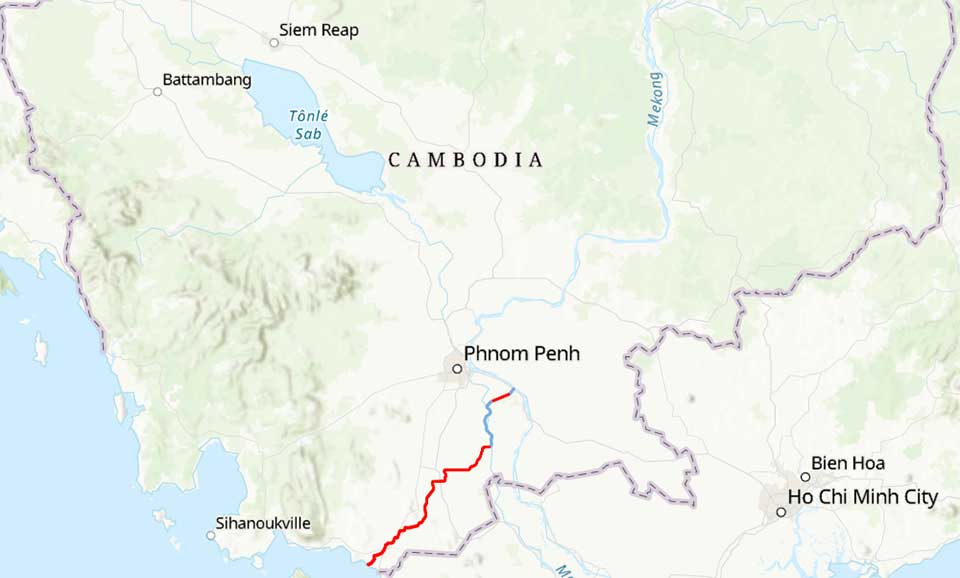

The 180-kilometer waterway will link two major rivers in the south of the country, the Mekong and Bassac, with the Gulf of Thailand. It will enable Cambodia to export directly to world markets, reducing reliance on Vietnamese ports which currently transport one-third of Cambodia’s exports. That dependence, and the associated costs, are a source of great frustration for Cambodia.

Funan Techo Canal (Cambodia National Mekong Committee)

A groundbreaking ceremony was held on 5 August, coinciding auspiciously with the birthday of former leader Hun Sen. Completion is scheduled (quite ambitiously, given normal infrastructure project slippages) for 2028. The state media coverage was frenzied with every capital, provincial and private television station “requested” to broadcast the ceremony, and there is a clear sense that this project is a personal legacy for Hun Sen – it even shares his honorific title. Techo is a Khmer word meaning powerful or strong, bestowed by the Cambodian king on army commanders, and Hun Sen insists Cambodian media use it in his title or risk unspecified “legal action”.

But despite the robust demonstrations of state support, it has not been smooth sailing. The United States and Vietnam were alarmed by claims that the canal may be used for military access, invoking parallel fears related to China’s funding of Cambodia’s mysterious Ream naval base upgrade.

Cambodia’s Prime Minister Hun Manet waves to a crowd with images of his himself and his father, former prime minister Hun Sen, on wide display during the groundbreaking ceremony of the Funan Techo Canal in Kandal province (Tang Chhin Sothy/AFP via Getty Images)

The regional politics of any intervention in the flow of the Mekong are also deeply vexed. In its mandatory submission to the Mekong River Commission, Cambodia chose not to undertake a Prior Consultation, claiming that the canal does not constitute a diversion of the river system, to the chagrin of its neighbors. The lower level of detail and clarity required for a notification rather than a consultation at the Mekong River Commission leaves the canal project even more exposed to claims of environmental and social degradation.

Adding to the confusion is a shadowy money trail. A US$1.7 billion bill would squeeze the budget of Cambodia, a UN-designated “Least Developed Country” with a tax-to-GDP ratio less than half that of the OECD average. But the government staunchly denies taking on any loan to pay for the project. What gives?

Plenty of international media reporting around the canal has asserted that it is “Chinese-funded.” It’s worth interrogating that claim. Certainly, the contractor undertaking the works is a Chinese state-owned enterprise, the China Road and Bridge Corporation or CRBC. And in the past China has provided financing from its state policy banks for dozens of major infrastructure projects in Cambodia, including road and airport upgrades, expressways and energy transmission lines. In fact, China is Cambodia’s largest bilateral creditor, with debt amounting to US$4.11 billion in 2023, mostly for infrastructure projects.

In late 2023, the Cambodian government described the arrangement as a build-operate-transfer scheme (BOT), but by June 2024, the details (or at least the narrative) had evolved. It now appears that 51% of the project will be financed by Cambodian companies, including two state-owned firms and a third co-investor, unnamed at this stage. That slim majority allows the government to claim Cambodian “ownership” of the megaproject, even though it’s unclear where the Cambodian companies are sourcing their finance. It wouldn’t be unheard of for Chinese loans to be diverted through the Cambodian entities.

The remaining 49% will be delivered under a BOT scheme by CRBC, whereby CRBC build and operate the canal for 50 years and then transfer ownership to the Cambodian government once costs have been recouped.

Economic modelling for the canal has not been made public, so its financial viability is up for debate. Government estimates expect US$88 million in canal freight earnings in the first year of operation. Other numbers are also floating around, including an improbable US$8 billion in first year revenue. That would be equivalent to a quarter of Cambodia’s yearly GDP. BOT schemes are nominally “debt-free”, but they nonetheless rely on the project being profitable enough that the private entity (in this case CRBC) can recover its costs.

Unless a state policy bank (China Export-Import Bank or China Development Bank) is lending the money to CRBC, this project wouldn’t qualify as official development finance. That hasn’t been confirmed, but it also hasn’t been ruled out. If it were true, it would substantially alter the current trajectory of the China-Cambodia bilateral development relationship. If earlier reports were accurate and the project is entirely funded by China, that commitment alone would equal a roughly four-fold increase on 2021 and 2022 levels (correspondingly, a commitment to fund 49% of the project would imply a doubling).

The financing details are not the only aspect rife with conjecture. A few extra spanners in the proverbial works include speculation that the project will spur controversial sand mining and exports; suspicions that the cost is vastly underestimated, given a shorter canal in Thailand is projected to take 10 years and cost $28 billion; and its official designation as an “unsolicited” project, suggesting that the concept was brought to the Cambodian government by CRBC, rather than originating with Cambodian officials.

Progress on this megaproject will be watched very closely. Here’s hoping the information starts flowing before the water does.

Grace Stanhope is a Research Associate in the Lowy Institute’s Indo-Pacific Development Centre working on the Southeast Asia Aid Map, a tool that tracks and analyses foreign aid and development finance flows to Southeast Asia from 2015 onwards.

Hannah Buckley is a Research Assistant at the Lowy Institute, contributing to the Southeast Asia Aid Map project. She is completing a Master of International Relations at UNSW.

This article appears courtesy of The Lowy Interpreter and may be found in its original form here.

The opinions expressed herein are the author's and not necessarily those of The Maritime Executive.

No comments:

Post a Comment