U.S. cuts China tariffs to 30 percent, China slashes levies on imports from U.S. to 10 percent.

May 12, 2025

By Ali Walker and Elena Giordano

Top U.S. officials said Monday that America and China will both substantially cut reciprocal tariffs targeting each other.

The announcement goes some way toward deescalating U.S. President Donald Trump’s huge tariff war that has upended global trade and caused economic aftershocks around the world.

The U.S. will cut tariffs on Chinese imports from 145 percent to 30 percent, while the Chinese side will drop measures from 125 percent to 10 percent.

“We have a mechanism for continued talks,” U.S. Treasury Secretary Scott Bessent said at a press conference after U.S.-China talks in Geneva over the weekend.

Full text: Joint Statement on China-U.S. Economic and Trade Meeting in Geneva

GENEVA, May 12 (Xinhua) -- China and the United States on Monday released a joint statement on China-U.S. Economic and Trade Meeting in Geneva.

The following is the English translation of the full text of the joint statement:

Joint Statement on China-U.S. Economic and Trade Meeting in Geneva

The Government of the People's Republic of China ("China") and the Government of the United States of America (the "United States"),

Recognizing the importance of their bilateral economic and trade relationship to both countries and the global economy;

Recognizing the importance of a sustainable, long-term, and mutually beneficial economic and trade relationship;

Reflecting on their recent discussions and believing that continued discussions have the potential to address the concerns of each side in their economic and trade relationship; and

Moving forward in the spirit of mutual opening, continued communication, cooperation, and mutual respect;

The Parties commit to take the following actions by May 14, 2025:

The United States will (i) modify the application of the additional ad valorem rate of duty on articles of China (including articles of the Hong Kong Special Administrative Region and the Macau Special Administrative Region) set forth in Executive Order 14257 of April 2, 2025, by suspending 24 percentage points of that rate for an initial period of 90 days, while retaining the remaining ad valorem rate of 10 percent on those articles pursuant to the terms of said Order; and (ii) removing the modified additional ad valorem rates of duty on those articles imposed by Executive Order 14259 of April 8, 2025 and Executive Order 14266 of April 9, 2025.

China will (i) modify accordingly the application of the additional ad valorem rate of duty on articles of the United States set forth in Announcement of the Customs Tariff Commission of the State Council No. 4 of 2025, by suspending 24 percentage points of that rate for an initial period of 90 days, while retaining the remaining additional ad valorem rate of 10 percent on those articles, and removing the modified additional ad valorem rates of duty on those articles imposed by Announcement of the Customs Tariff Commission of the State Council No. 5 of 2025 and Announcement of the Customs Tariff Commission of the State Council No. 6 of 2025; and (ii) adopt all necessary administrative measures to suspend or remove the non-tariff countermeasures taken against the United States since April 2, 2025.

After taking the aforementioned actions, the Parties will establish a mechanism to continue discussions about economic and trade relations. The representative from the Chinese side for these discussions will be He Lifeng, Vice Premier of the State Council, and the representatives from the U.S. side will be Scott Bessent, Secretary of the Treasury, and Jamieson Greer, United States Trade Representative. These discussions may be conducted alternately in China and the United States, or a third country upon agreement of the Parties. As required, the two sides may conduct working-level consultations on relevant economic and trade issues.

The two-day China-U.S. high-level meeting on economic and trade affairs concluded in Geneva, Switzerland.

Chinese Vice Premier He Lifeng, who also serves as the Chinese lead on China-U.S. economic and trade affairs, met with U.S. lead person Treasury Secretary Scott Bessent and U.S. Trade Representative Jamieson Greer, over the weekend.

Focusing on the implementation of the important consensus reached by the two heads of state during their phone call on January 17, the two sides held candid, in-depth and constructive discussions. They reached a series of major consensus and made substantial progress during the talks.

They also agreed to establish an economic and trade consultation mechanism to maintain communication on their respective concerns in the economic and trade fields.

This marks the first round of talks since the U.S. imposed heavy tariffs on Chinese goods.

In-depth, candid and constructive

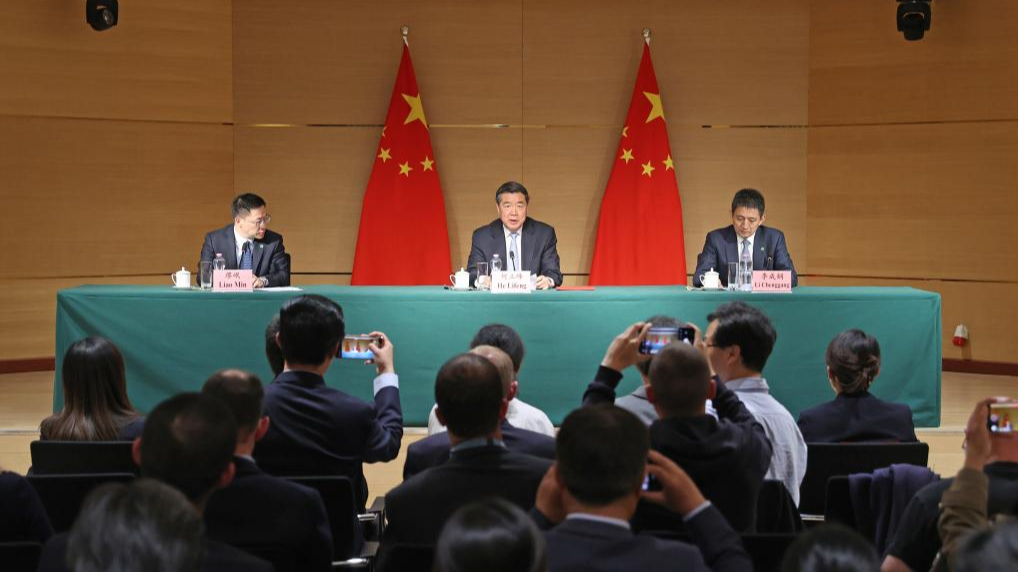

The Chinese delegation held a press conference following the high-level meeting with the U.S. side.

The meeting was candid, in-depth and constructive, said He, adding that China and the United States have also agreed to establish an economic and trade consultation mechanism.

The two countries, He said, will finalize the relevant details as soon as possible and release a joint statement on Monday summarizing the outcomes of the talks.

Through the joint efforts of both sides, the talks were fruitful, he said, adding that this marks an important step towards resolving differences through equal dialogue and consultation. It has laid the foundation and created conditions for further narrowing differences and deepening cooperation.

Economic and trade relations between China and the United States are not only of great significance to both countries but also have a major impact on the stability and development of the global economy, said He.

Speaking at the press conference, Li Chenggang, the international trade representative with the Chinese Ministry of Commerce and vice commerce minister, said the two countries conducted the talks based on mutual respect, equality and mutual benefit, in a professional and efficient manner.

Both sides, he said, have accommodated each other's concerns and development interests, creating favorable conditions for the stable, sound and sustainable development of China-U.S. economic and trade relations.

Finding solutions, extending list of cooperation

As two major countries at different stages of development and with different economic systems, it is natural for China and the United States to have differences and frictions in economic and trade cooperation, He said during the meeting, stressing that the key is to find proper solutions to these issues based on the principles of mutual respect, peaceful coexistence and win-win cooperation.

There are no winners in a trade war, He said, adding that China does not want a trade war but is not afraid of one. If the U.S. side insists on infringing upon China's rights and interests, China will resolutely retaliate and respond accordingly.

He urged both sides to explore more potential areas for cooperation, extend the list of cooperative initiatives, expand the scope of mutual benefits, promote the continuous and new development of China-U.S. economic and trade relations, and inject greater stability and certainty into the development of the world economy.

During a meeting with World Trade Organization (WTO) Director-General Ngozi Okonjo-Iweala on Sunday, He called on all parties to resolve differences and disputes through equal dialogue within the WTO framework, to jointly uphold multilateralism and free trade, and to push for the stable and smooth functioning of global industrial and supply chains.

Okonjo-Iweala said WTO members should work together to defend an open and rules-based multilateral trading system, strengthen dialogue and cooperation on international trade issues, and enhance the WTO's role in promoting trade liberalization, improving trade efficiency, and achieving global sustainable development.

A file photo of WTO Director-General Ngozi Okonjo-Iweala. /VCG

World Trade Organization (WTO) Director-General Ngozi Okonjo-Iweala on Sunday said she was pleased to see positive outcomes achieved during the high-level meeting on economic and trade affairs between China and the United States.

In a statement, Okonjo-Iweala said the talks marked an important step forward, adding that amid the current global situation, such progress is critical not only for both countries, but also for the rest of the world, including the most vulnerable economies.

Instant View: US-China agree to cut tariffs,

90-day pause

U.S. Secretary of the Treasury Scott Bessent and U.S. Trade Representative Jamieson Greer attend a news conference after trade talks with China, in Geneva, Switzerland, May 12, 2025. REUTERS/Emma Farge

UPDATED May 12, 2025

LONDON/SHANGHAI - Stocks and the dollar surged on Monday after the United States and China said they had agreed on a 90-day pause on tariffs and reciprocal duties would drop sharply, giving investors some confidence that a full-scale trade war may have been averted.

U.S. Treasury Secretary Scott Bessent, speaking after talks with Chinese officials in Geneva, told reporters the two sides had reached the deal that was outlined in a joint statement and that reciprocal rates would drop by 115 percentage points.

This weekend's meetings were the first face-to-face interactions between U.S. and Chinese officials since U.S. President Donald Trump returned to power and launched a global tariff blitz, imposing particularly hefty duties on China.

MARKET REACTION:

STOCKS: Futures on the S&P 500 and Nasdaq jumped to trade up 2.8% and 3.5%, respectively, from gains of 1.5-2% previously, while in Europe, the STOXX 600 rose 0.7% in early trading.

FOREX: The dollar extended gains, with the euro down 1.2% at $1.1164, having traded down 0.2% on the day earlier, while the yen weakened, leaving the U.S. currency up 1.6% at 147.715, from a 0.5% gain earlier.

BONDS: Benchmark 10-year U.S. Treasury yields rose 7 basis points on the day to 4.44%, having traded up 5 bps before the joint statement.

COMMENTS:

JAN VON GERICH, CHIEF MARKET ANALYST, NORDEA, HELSINKI:

"Markets have taken it at face value, I personally am a bit sceptical, if you want to end up with low tariffs then why do it like this? It’s still bouncy, and uncertainty is elevated.

"I’m still worried that there will be a last word, that now they’ve come to an initial conclusion the details won’t satisfy both sides, and there will be something else but, of course, time will tell. I would not take everything we hear at the moment at face value, that’s what we saw on ‘Liberation Day’ (April 2 tariff announcement), and now, and it still bounces both ways."

JANE FOLEY, HEAD OF FX STRATEGY, RABOBANK, LONDON:

"The market reacted already overnight in anticipation of this, and we’ve got a bit more details now, and it's continuing the tone it set overnight, where it’s buying back the dollar. We have this scenario where the dollar is now being treated as a risky asset and is making gains.

"We’ve had reassurance from the U.S. that negotiations will continue and that the tone of the negotiations have been positive and US and China don’t want to decouple, so there is a lot more optimism that the tariffs won’t have the devastating impact that perhaps they could have done, and there is a collective sigh of relief in markets.

"That doesn’t mean that we’re back to where we were before the Trump inauguration, the 10% baseline tariff still exists everywhere, the 90 pause is there and the clock is starting to tick. The overall scenario is not as bad as it could have been, but we still have a fair amount of uncertainty about where these tariffs will settle, their impact on world growth and central bank policy."

KENNETH BROUX, SENIOR STRATEGIST FX AND RATES, SOCIETE GENERALE, LONDON

"There is a de-escalation between China and U.S. resulting in a reduction of tariff on Chinese goods to 30% and Chinese tariffs on US goods to 10%. It's a clear vote by the market in favour of riskier assets. It's a step in the right direction and a positive of U.S. assets and U.S. economy."

"The dollar was lagging other markets in the recovery from the April lows. We had equities up back to April 2nd levels, we had bond yields up to those levels and the dollar was actually lagging that move. Now the conditions are falling into place for a deeper adjustment and a bigger recovery of the dollar to catch up with equities and bond yields."

ZHIWEI ZHANG, CHIEF ECONOMIST, PINPOINT ASSET MANAGEMENT, HONG KONG:

"This is better than I expected. I thought tariffs would be cut to somewhere around 50% and this is much lower. Obviously, this is very positive news for economies in both countries and for the global economy, and makes investors much less concerned about the damage to global supply chains in the short term.

"But we also need to keep in mind this is only a three-month temporary reduction of tariffs. So this is the beginning of a long process. The two sides will spend months probably, to come up with a resolution, or reach a final trade deal, but this is a very good starting point."

ARNE PETIMEZAS, DIRECTOR RESEARCH, AFS GROUP, AMSTERDAM:

"Such a sharp U-turn by the US on tariffs on a Monday morning is quite the surprise. It seems that tariffs on China will fall to manageable levels, albeit temporary. Markets should rally on this. How can Trump credibly raise tariffs when the 90-day pause ends? He has toned down his tariffs faster than anyone thought he could, and April 2 will soon be forgotten. Granted, he told you to buy the dip."

WILLIAM XIN,CHAIRMAN OF HEDGE FUND SPRING MOUNTAIN PU JIANG INVESTMENT MANAGEMENT, SHANGHAI:

"The result far exceeds market expectations. Previously, the hope was just that the two sides can sit down to talk, and the market had been very fragile. Now, there's more certainty. Both China stocks and the yuan will be in an upswing for a while." REUTERS

China firmly supports multilateralism, free trade and WTO's greater role: vice premier

GENEVA, May 12 (Xinhua) -- China will continue its support for the World Trade Organization (WTO) to work as a stabilizer of global trade and to make greater contributions in addressing global challenges, Chinese Vice Premier He Lifeng said here on Sunday.

During his meeting with WTO Director-General Ngozi Okonjo-Iweala, He said that the multilateral trading system, with the WTO at its core, is the cornerstone of international trade and plays an important role in global economic governance.

He urged all parties to resolve differences and disputes through dialogues on an equal footing within the WTO's framework, to jointly uphold multilateralism and free trade, and push for the stable and smooth functioning of global industrial and supply chains.

China will continue to participate comprehensively and deeply in the reform of the global trade body, safeguarding the legitimate rights and interests of developing members, said the Chinese vice premier.

He, the Chinese lead person for China-U.S. economic and trade affairs, also briefed the WTO chief on the high-level China-U.S. economic and trade meeting held over the weekend in Geneva.

Okonjo-Iweala said that the current global economic and trade growth faces severe challenges, noting that WTO members should work together to defend an open and rule-based multilateral trading system, strengthen dialogue and cooperation on international trade issues, and push for a greater WTO role in facilitating trade liberalization, improving trade efficiency, and achieving global sustainable development.

No comments:

Post a Comment