Cyclic Materials to open $25M rare earths plant in Canada

Cyclic Materials, a Canadian startup backed by Amazon and Microsoft, is investing $25 million to build a rare-earths recycling plant and research centre in Kingston, Ontario.

The company has developed proprietary technology that recovers rare earth elements from discarded products such as wind turbines and data-centre hard drives. In 2023, it launched a commercial demonstration facility using this process to extract rare earth magnets. By 2024, it had opened a second facility in Kingston to produce Mixed Rare Earth Oxide (MREO).

Last year, the federal government awarded Cyclic Materials $4.9 million to build a demonstration facility in Kingston. That project is now complete.

The new 140,000-square-foot Kingston Centre of Excellence will mark the company’s first commercial-scale “Hub” processing unit. It will begin operations in the first quarter of 2026 and is designed to process 500 tonnes of magnet-rich feedstock annually, converting it into rMREO. This recycled product contains critical components such as neodymium, praseodymium, terbium, and dysprosium. These elements are key to manufacturing permanent magnets used in electric vehicle motors, wind turbines and consumer electronics.

“With this Centre of Excellence, we’re advancing our core mission: to secure the most critical elements of the energy transition through circular innovation,” chief executive Ahmad Ghahreman said. “Kingston is where Cyclic began—and now it’s where we’re anchoring our commercial future.”

Cyclic is also expanding internationally, with a recycling plant under construction in Mesa, Arizona, slated to open in early 2026.

Global demand for rare earths is climbing rapidly, driven by the surge in clean energy and digital technologies. China, the dominant player in the rare earth supply chain, has used its control of exports as leverage in geopolitical disputes, including in response to US tariffs.

While President Donald Trump announced on Wednesday a rare earth supply deal with Beijing, the search for secure and independent sources continues.

Rare earth startups eye slice of $1 billion bounty from Brazil

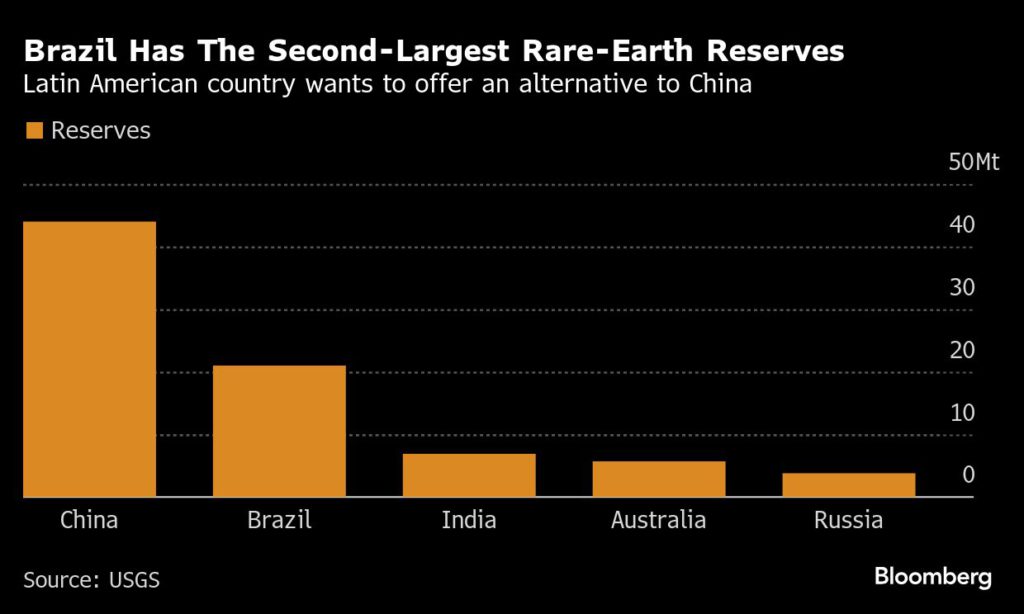

Mineral explorers hoping to tap into surging demand for rare earths are vying for a slice of nearly $1 billion in Brazilian funding to help make their projects a reality in a nation with the biggest reserves after China.

Brazil is set to unveil on Thursday a shortlist of strategic minerals projects eligible for financial support from its development bank BNDES and government funding agency Finep. The state-owned entities have spent weeks sifting through 124 pitches for initiatives totaling $15 billion, including many by firms seeking to churn out rare earths used in magnets, batteries and high-tech gear.

The South American nation is looking to turn years of rare earth promise into reality when China is using its dominance in the industry as leverage in trade relations, prompting the US and other governments to seek stable supplies elsewhere as a matter of national security. Trade tensions over these obscure elements have created opportunities for startups.

Firms with early-stage projects in Brazil include Aclara Resources Inc., Viridis Mining and Minerals Ltd. and Meteoric Resources NL.

While a slice of the state funding may not be enough to get projects over the line, BNDES is also open to bringing in international institutions such as the Japan International Cooperation Agency — as long as projects offer a refining component. It could also mobilize private partners as well as Brazil’s climate change fund.

“The world has realized it can’t rely on just one country,” said Jose Luis Gordon, director of development, foreign trade and innovation at BNDES.

Brazil has 23% of global reserves, second only to China, according to the US Geological Survey. The country’s production is limited to Serra Verde Group — a company backed by US investors that has signed up mostly Chinese buyers.

“Brazil is copy-paste geologically to what the Chinese have,” Aclara Chief Executive Officer Ramon Barua said in an interview. “The difference is we’re doing it in a super environmentally friendly way.”

Rare earths are in the spotlight after China rolled out export restrictions while the US pushes for resource deals in Ukraine, Greenland and the Democratic Republic of the Congo. US President Donald Trump said Wednesday that a trade framework with Beijing has been completed, with China supplying rare earths and magnets.

It’s not the first time rare earths have captured global attention. In the early 2010s, companies including Molycorp Inc. and Lynas Rare Earths Ltd. rode a wave of investor interest on the obscure elements, until the market crashed as more supply came on stream and consumers switched to cheaper alternatives.

The global industry still faces plenty of hurdles beyond pulling elements out of the ground. One is competing with China in processing. Another is creating a price benchmark outside China’s opaque market. Consulting firm Wood Mackenzie estimates prices would have to double to encourage ex-China guaranteed supply.

“Investors are not willing to run all that risk, so there is a need for incentives, most likely from governments, that help them de-risk,” said Johann Schimd, head of metals consulting at Wood Mackenzie.

Prospective producers in Brazil are looking to engage with buyers in the US and other Western nations in a bet they’ll be able to tap low-cost funding. Aclara, for example, wants to mine and process in Brazil to supply a magnets plant in South Carolina.

Viridis has held talks with state banks in the US, Canada, Germany, France, Japan, Korea and Australia. The Perth-based firm is looking to diversify its pool of financiers and customers for more flexibility.

“The entire industrial chain still needs to be structured,” said Klaus Petersen, Viridis’ country manager in Brazil. “We’re only talking to development banks.”

(By Mariana Durao)

Resolution stakes claim in US critical minerals market

Australia’s Resolution Minerals (ASX: RML) is entering the critical minerals market in the United States with the acquisition of the Horse Heaven antimony-gold-tungsten project in central Idaho.

Located in the historic Stibnite mining district, the brownfield project borders Perpetua Resources’ (NASDAQ, TSX: PPTA) $2 billion Stibnite redevelopment, which is the only known antimony reserve in the US.

Resolution will acquire Horse Heaven for $1 million in cash, along with 444.8 million shares and 222.4 million options exercisable at $0.018 each, expiring in July 2028. The project was previously held by Stallion Uranium (TSX-V: STUD).

The planned acquisition gives Resolution control of two highly prospective mineralized corridors — the Antimony Ridge Fault Zone (ARFZ) and Golden Gate Fault Zone (GGFZ). Both of these corridors host known gold, silver, antimony and tungsten mineralization associated with sheared and hydrothermally altered granodiorite.

The move is part of Resolution’s broader push into critical minerals, with a strategic focus on antimony and tungsten, both of which have reached record highs prices amid tightening export controls by China.

According to the US Geological Survey, China accounted for 60% of global antimony production in 2024. The US currently imports all of its antimony, which is vital for manufacturing solar panels, flame retardants and defence materials.

“As many governments around the world look to onshore their supply of critical minerals, such as antimony and tungsten, we have secured a commanding ground position with known antimony occurrences and next to what is likely to become the largest antimony producer in the US,” executive director Aharon Zaetz said. “The board considers that the acquisition of the Horse Heaven project has the potential to be a transformative event for RML,” he noted.

Shares in Resolution jumped on the news, closing nearly 6% higher in Sydney at A$0.019 apiece. This leaves the company’s market capitalization at about A$9 million ($5.9 million).

Resolution, which intends to start drilling this year, described Horse Heaven as a strategic complement to its existing Australian portfolio of antimony, gold and copper assets.

Horse Heaven’s neighbouring Stibnite project is one of 20 US government-prioritized assets to be fast tracked under an executive order signed by President Donald Trump, aimed at boosting domestic critical mineral production.

With an estimated 148 million pounds of antimony, Perpetua’s Stibnite project holds one of the largest reserves of the metal outside Chinese control.

No comments:

Post a Comment