Column: Copper market pays the price for forgetting its TACO hedge

The copper market got the tariff right but the products wrong.

US President Donald Trump’s proclamation “to address the effects of copper imports on America’s national security” was not what traders were expecting.

There will be 50% tariffs on copper imports effective Friday but only on semi-manufactured products such as wire and tube. Refined copper is excluded, at least until January 2027, when a tariff may be phased in if warranted.

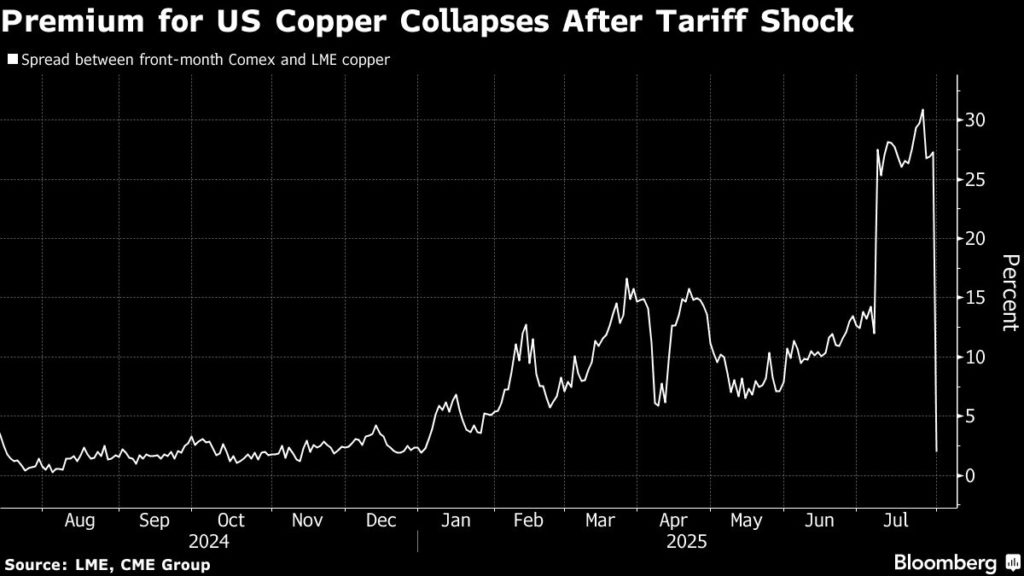

The tariff trade, which has defined the copper market since February, has imploded. The CME’s US contract plummeted by more than 20% on the news, wiping out the previous high premium over the London Metal Exchange (LME) price.

The United States is now awash with metal it doesn’t need after traders shipped huge tonnages through the yawning arbitrage gap.

The copper market forgot Trump’s tendency to back down on his most extreme tariff threats. It has, to borrow a current investor meme, just been TACO’d, which stands for Trump Always Chickens Out.

Copper products targeted

The tariffs on semi-finished copper products cover between 400,000 and 500,000 metric tons of annual US imports.

America imports considerably more copper as refined metal. Imports last year were just over 900,000 tons.

Canada is the largest single supplier of copper products to the US, but the supplier base is highly diverse. Last year’s imports of copper tubes, for example, came from 32 different countries.

The tariffs will also be extended down the product chain to copper-intensive derivative products such as cables, connectors and electrical components, likely ensnaring more supplier countries.

The new tariff wall should be a boost for domestic processors, but only if they have the capacity to cover the range and quality of what is currently being imported.

The number of product-specific exemptions granted in the coming months will provide an answer.

Scrap wars heat up

The tariff wall on products will be complemented by restrictions on exports of US mined concentrates and recyclable copper.

A quarter of domestically-produced “copper input materials” will be required to be sold in the United States from 2027. That rate will rise to 30% in 2028 and 40% in 2029.

That may need more capacity than exists at the current three domestic smelters, even assuming Grupo Mexico reactivates its idle Hayden plant in Arizona.

“High-quality copper scrap” will also be subject to a 25% minimum domestic sales requirement to stimulate domestic recycling.

It’s not clear what types of scrap qualify or how such a measure is going to work in practice, but the move marks an escalation in the simmering scrap wars.

The European Union is also considering export quotas on recyclable copper to stop what it calls “scrap leakage.”

The prime target is China, which is the world’s largest buyer of secondary raw material.

The country imported 2.25 million tons of copper scrap in 2024, the highest annual total since 2018, the year before authorities tightened up the purity specifications on imported material.

Imports have already slowed this year thanks to a 42% drop in shipments from the United States due to the high CME price premium.

Growing resource nationalism in the global scrap market promises profound structural changes in the flow of recyclable materials.

Can we have our copper back now?

But not for refined copper, which is what everyone was expecting.

Big trade houses have shipped over half a million tons of copper to the United States for a trade that is now redundant, even if it was a bonanza for those involved.

CME warehouses currently hold 232,195 tons of copper, which is the highest tonnage since 2004. Metal is still arriving daily thanks to the last-minute dash to beat what traders thought was the August 1 deadline.

The supply chain in the rest of the world is still compensating for the huge suction effect created by the prospect of tariffs.

China exported almost 260,000 tons of refined copper between March and June, compared with 78,000 tons in the prior four-month period.

Some of it was delivered against a short squeeze on the London market created by the raid on LME stocks for US-deliverable brands of copper.

Some of it was non-Chinese metal stripped from bonded warehouses and shipped directly to the United States.

China’s surging export flows have depleted Shanghai Futures Exchange stocks, which have fallen to 73,423 tons, the lowest level since December.

While the futures tariff trade has collapsed overnight, the physical supply chain will take longer to readjust.

Analysts are already running the numbers to gauge whether it makes sense for copper to reverse flow back out of the United States.

Same time next year?

Is that it for the copper tariff trade?

Probably not, given the explicit reference to the option of a phased tariff on imports of refined copper, starting at 15% in 2027 and rising to 30% in 2028.

It will depend on an update on the state of the domestic market by Commerce Secretary Howard Lutnick scheduled for the end of June next year.

It also depends, of course, on whether Trump changes his mind again before then.

You never know with Tariff Man.

(The opinions expressed here are those of the author, Andy Home, a columnist for Reuters.)

(Editing by Elaine Hardcastle)

Codelco sees ‘good news’ in exclusion of cathodes from US copper tariffs

The chairman of the world’s biggest copper producer, Chile’s state-run Codelco, said on Wednesday it was positive that cathodes were not subject to US tariffs on copper.

“A preliminary reading suggests that tariffs will not be applied to copper cathodes, allowing us as a country to continue supplying that market,” Maximo Pacheco, chairman of Codelco, told Reuters. “It’s good news for Chile and for Codelco.”

Chile, the world’s biggest supplier of the red metal, is also the top importer of copper cathodes to the United States.

(By Daina Beth Solomon)

Traders brace for wave of copper to hit LME after tariff shock

Copper traders are rushing to book up storage space in a bet that US President Donald Trump’s shock decision not to tariff the main traded form of the metal will prompt a wave of copper into warehouses on the London Metal Exchange.

For months, traders had fallen over one another to ship copper to the US to capture sharply higher prices. They rapidly built up a stockpile worth more than $5 billion spread across US ports — particularly New Orleans, which has improbably become host to the world’s largest exchange copper inventory.

Now the same traders are looking for new homes for some of that metal, while the aftermath of the frenzied race has left them with stashes in awkward locations from California to Hawaii.

The race for LME storage space underscores how the announcement from the White House has marked a dramatic end to an arbitrage trade that copper industry veterans said was the most profitable of their careers. It’s also the latest example of how Trump’s tariff drive has upended the $250 billion market for a metal crucial to the energy transition and viewed as increasingly strategic for governments around the world.

On Wednesday, Trump sent shockwaves through the industry with the announcement that import tariffs of 50% would apply only to processed forms of copper, not to refined metal. As New York prices collapsed in a matter of minutes, warehousing companies were already fielding calls from traders looking to redirect copper that had been destined for the US market to LME warehouses instead. (While they are located in ports like New Orleans, LME facilities sit outside of US customs.)

And, once again, the birthplace of jazz has become the center of activity of the global copper world, according to many of the two dozen traders, producers and logistics executives who spoke to Bloomberg News for this story, most on condition of anonymity.

One trading house executive said that by Thursday afternoon there was no available LME warehouse capacity left in New Orleans that hadn’t been earmarked for a trader, while a warehousing executive said his company had no more capacity to bring copper into New Orleans warehouses for the next three months at least.

As the US price premium collapsed, some traders have sought to divert shipments of metal from South American producers that had been due to be sold in the US, to buyers in Europe and Asia instead. Others are continuing with plans to ship to the US, but keeping open the option of delivering either against US copper futures on Comex or against the LME.

A flood of copper onto the LME would represent a dramatic reversal from just one month ago, when the world’s benchmark copper contract was gripped for weeks by a mounting supply squeeze.

Futures on exchanges like the LME and the Comex are physically deliverable, meaning traders can place metal into an exchange warehouse and deliver it against a futures contract. That ensures that futures prices retain a connection to the real world, while also serving as a market of last resort to physical metals traders — effectively providing a guaranteed buyer if no consumers want to buy their metal. An inflow of inventory into exchange warehouses increases the quantity of immediately-available metal and so generally puts a downward pressure on prices and timespreads.

The shifts have prompted a reassessment of the outlook for the copper price, at least in the short term. While US prices tumbled over 20% in a day as the threat of hefty import tariffs was removed, prices on the LME were also 0.9% lower on Thursday, with traders saying they expected prices to retreat further.

To be sure, whether large volumes of copper ultimately are delivered to LME warehouses in the US will depend on movements in prices, with traders constantly calibrating the relative profitability of delivering their metal to one warehouse or to another, or to an end user.

“I think you will see deliveries onto both the LME and CME. It’s all a function of what is cheaper – letting the cargo reach the US or re-routing back to the LME,” said Anant Jatia, chief investment officer at Greenland Investment Management, a hedge fund specializing in commodity arbitrage trading.

For physical traders, the tariff decision means the end of what has been the most profitable trading opportunity in a generation. Trump’s announcement three weeks ago that he would impose tariffs on copper from Aug. 1 set off a race to get copper through US customs before that date — a race that is now irrelevant.

The key question is whether they locked in the profit on the trade by selling US copper futures at the elevated prices that prevailed until Wednesday evening: several executives at trading houses said they had, precisely because they feared that Trump could change policy at the last moment.

Many still face headaches, however. Of an estimated 500,000 to 600,000 tons of excess copper inventory that has been shipped to the US so far this year, only some of it is from producers whose output is deliverable against the Comex or LME contracts. Traders including Mercuria Energy Group Ltd., IXM and Trafigura Group have shipped non-exchange-deliverable African copper to the US in recent months, according to customs data.

And a lot of the metal that has been shipped is in the wrong place. In their haste to get copper to the US, traders have delivered it to locations like Long Beach in California – where there are few real-world buyers and no exchange warehouses. One trader even rushed to deliver a shipment into Hawaii in recent days. Now, those traders face a headache over whether to pay hefty logistics costs to move that metal within the US, or similarly large expenses to re-export it.

While Comex prices dropped below LME prices for parts of Thursday, they remained within a few dollars a ton of one another — not enough to spur re-exports, said traders. The mere cost of taking metal from a Comex warehouse to an LME warehouse in the same US city is around $50 a ton, traders said. Comex prices edged higher on Friday, while the LME was little changed.

For the copper market, the abrupt removal of the threat of tariffs means that the US is no longer exerting a magnetic force on the market, drawing every spare ton of copper to its shores.

Traders said they expected prices to retreat as a result: alongside the drop in prices, the LME copper market moved into a deeper contango on Thursday, with nearby prices trading at a widening discount to later dated price — a sign of ample supplies.

While most traders still believe copper has a bright long-term future, the collapse on Comex has stung financial investors who had been buying US copper futures — either as a bet that Trump would indeed impose 50% import tariffs, or as an outright bet on higher copper prices. Investor positioning in Comex copper had risen to the most bullish level since October 2024 in recent weeks — raising the prospect of hefty selling pressure as those positions unwind.

“The fallout from the chaos in copper markets is likely to result in forced sales resulting from epic mark-to-market losses,” Daniel Ghali of TD Securities Inc. said in a note. “We estimate that the resulting flows could be in line with or even surpass the largest outflows on record.”

Copper traders are beginning to turn their attention away from Trump — even if he has left open the possibility of imposing an import tariff in 2027 — and are once again focusing on the metal’s main consumer, China.

It’s a return to something approaching normality for the copper market. Greenland’s Jatia, who specializes in trading commodity arbitrages, says he hasn’t touched the spread between Comex and the LME since March because of the difficulty of predicting what Trump would do about tariffs.

Now, though, he is returning to the market, he says: “The binary risk on the spread – tariff / no tariff – is now gone.”

(By Jack Farchy, Julian Luk and Archie Hunter)

No comments:

Post a Comment