By AFP

August 12, 2025

On April 2, US President Donald Trump, with Commerce Secretary Howard Lutnick beside him, unveiled sweeping tariffs on almost all trading partners

- Copyright AFP/File Brendan SMIALOWSKI

Beiyi SEOW

When US President Donald Trump announced tariffs on almost all trading partners in April, Ben Knepler contacted the factory in Cambodia producing his company’s outdoor furniture. “Stop production,” he ordered.

The announcement involved a 10-percent levy on imports from most partners, set to rise further for many of them. For Cambodia, the planned duty was a staggering 49 percent.

“That night, we spoke to our factory,” Knepler told AFP. “We literally cannot afford to bring our own product into the US with that kind of tariff.”

The decision was even more painful for Knepler and his Pennsylvania-based company, True Places, given that he had previously shifted production of his outdoor chairs to Cambodia from China, following tariffs on Chinese imports imposed by Trump during his first presidency.

“We were facing 25-percent tariffs in China, and there were zero-percent tariffs in Cambodia,” Knepler recalled.

It took him a year to move the massive equipment and molds to Cambodia only to see another steep levy.

With Trump’s “reciprocal” tariff hikes taking effect last Thursday, these Cambodia-made chairs face a lower — though still significant — 19 percent duty.

– ‘Wheel of misfortune’ –

Knepler’s experience echoes that of many US companies producing everything from yo-yos to clothing abroad, after years of offshoring American manufacturing.

To cope, businesses use various strategies.

Some pass on the new costs as a surcharge to customers. Others halted imports when duties reached prohibitive levels, hoping Trump would strike bilateral trade deals that would make their businesses viable again.

Trump frames his tariffs as paid for by other countries, touting tens of billions in revenue this year — but firms contest this description.

“We make the tariff payments when the product comes into the US,” Knepler stressed. “Before we sell it, we’re the ones who pay that tariff.”

Now saddled with hundreds of thousands of dollars in debt he took on to relocate the company’s production to Cambodia, Knepler worries if his business will survive.

He likens the rapid policy changes to spinning a “wheel of misfortune,” resulting in a new tariff each time. Over four months this year, the planned tariff rate on Cambodian exports has gone from 0 to 49 percent, to 10 percent, to 36 percent, to 19 percent, he said.

“No one knows what it’s going to be tomorrow,” he added. “It’s impossible to have any kind of confidence in what the rate will be in three- or four-months’ time.”

Economists warn that tariffs could fuel inflation and drag on growth.

EY chief economist Gregory Daco noted that the duties effective Thursday raise the average tariff rate to 17.6 percent from 2.8 percent at the start of the year -— the highest level since the early 1930s.

While Trump lauds the limited effects his duties have had on US prices so far, experts say tariffs take time to filter through to consumers.

Many of Trump’s sweeping levies also face legal challenges over his use of emergency economic powers.

– Price hikes –

The global tariffs are especially hard to avoid.

Barton O’Brien said he accelerated production and borrowed money to bring in as much inventory as possible before Trump took office.

On the election campaign trail, the Republican leader had floated a 60-percent tariff on imports from China, where O’Brien makes most of his products.

The Maryland-based veteran selling dog harnesses and other accessories rented a container to ship as many products as he could before Trump’s new tariffs would take effect. “I had dog life jackets in the bathroom,” he told AFP.

There is “no way” to produce domestically, he said, adding that comparable American-made products sell for nearly six times his retail prices.

He makes some items too in India and Vietnam.

But Chinese products face an additional 30-percent duty this year, even under an extended truce now expiring in November. The rates for India and Vietnam are 25 percent and 20 percent respectively.

“If you look at the brands I compete with, we’re all made in the same countries. We’re all going to have to raise prices together,” said O’Brien.

India reels from US tariff hike threat

By AFP

August 12, 2025

Jewelry is on display at a store in the ‘Little India’ neighborhood of New York City

Anuj SRIVAS

Indian exporters are scrambling for options to mitigate the fallout of US President Donald Trump’s threatened tariff salvo against the world’s most populous nation.

Many warn of dire job losses after Trump said he would double new import tariffs from 25 percent to 50 percent if India continues to buy Russian oil, in a bid to strip Moscow of revenue for its military offensive in Ukraine.

“At 50 percent tariff, no product from India can stand any competitive edge,” said economist Garima Kapoor from Elara Securities.

India, one of the world’s largest crude oil importers, has until August 27 to find alternatives to replace around a third of its current oil supply from abroad.

While New Delhi is not an export powerhouse, it shipped goods worth about $87 billion to the United States in 2024.

That 50 percent levy now threatens to upend low-margin, labour-intensive industries ranging from gems and jewellery to textiles and seafood.

The Global Trade Research Initiative estimates a potential 60 percent drop in US sales in 2025 in sectors such as garments.

Exporters say they are racing to fulfil orders before the deadline.

“Whatever we can ship before August 27, we are shipping,” said Vijay Kumar Agarwal, chairman of Creative Group. The Mumbai-based textile and garment exporter has a nearly 80 percent exposure to the US market.

But Agarwal warned that is merely triage.

Shipping goods before the deadline “doesn’t solve” the problem, he said.

“If it doesn’t get resolved, there will be chaos,” he said, adding that he’s worried for the future of his 15,000 to 16,000 employees.

“It is a very gloomy situation… it will be an immense loss of business.”

– Shifting production abroad –

Talks to resolve the matter hinge on geopolitics, far from the reach of business.

Trump is set to meet Vladimir Putin on Friday, the first face-to-face meeting between the two countries’ presidents since Russia launched its full-scale invasion of Ukraine in February 2022.

New Delhi, with longstanding ties with Moscow, is in a delicate situation.

Since Trump’s tariff threats, Prime Minister Narendra Modi has spoken to both Putin and Ukrainian President Volodymyr Zelensky, urging a “peaceful resolution” to the conflict.

Meanwhile, the US tariff impact is already being felt in India.

Businesses say fresh orders from some US buyers have begun drying up — threatening millions of dollars in future business and the livelihoods of hundreds of thousands in the world’s fifth biggest economy.

Among India’s biggest apparel makers with global manufacturing operations, some are looking to move their US orders elsewhere.

Top exporter Pearl Global Industries has told Indian media that some of its US customers asked that orders be produced in lower-duty countries such as Vietnam or Bangladesh, where the company also has manufacturing facilities.

Major apparel maker Gokaldas Exports told Bloomberg it may boost production in Ethiopia and Kenya, which have a 10 percent tariff.

– ‘Standstill’ –

Moody’s recently warned that for India, the “much wider tariff gap” may “even reverse some of the gains made in recent years in attracting related investments”.

India’s gems and jewellery industry exported goods worth more than $10 billion last year and employs hundreds of thousands of people.

“Nothing is happening now, everything is at a standstill, new orders have been put on hold,” Ajesh Mehta from D. Navinchandra Exports told AFP.

“We expect up to 150,000 to 200,000 workers to be impacted.”

Gems, and other expensive non-essential items, are vulnerable.

“A 10 percent tariff was absorbable — 25 percent is not, let alone this 50 percent,” Mehta added.

“At the end of the day, we deal in luxury products. When the cost goes up beyond a point, customers will cut back.”

Seafood exporters, who have been told by some US buyers to hold shipments, are hoping for new customers.

“We are looking to diversify our markets,” says Alex Ninan, who is a partner at the Baby Marine Group.

“The United States is totally out right now. We will have to push our products to alternative markets, such as China, Japan… Russia is another market we are really looking into.”

Ninan, however, warns that is far from simple.

“You can’t create a market all of a sudden,” he said

S.Africa to offer US new deal to avoid 30% tariff

By AFP

August 12, 2025

Copyright AFP/File Jim WATSON

Julie BOURDIN

South Africa will offer a “generous” new trade deal to the United States on Tuesday to avoid 30-percent tariffs, government ministers said.

Washington on Friday slapped the huge tariff on some South African exports, the highest in sub-Saharan Africa, despite efforts by Pretoria to negotiate a better arrangement to avoid massive job losses.

The ministers did not release details of the new offer but said previously discussed measures to increase imports of US poultry, blueberries and pork had been finalised.

“When the document is eventually made public, I think you would see it as a very broad, generous and ambitious offer to the United States on trade,” Agriculture Minister John Steenhuisen said at a press briefing.

Officials have said the 30-percent tariff could cost the economy around 30,000 jobs, with unemployment already at 33.2 percent according to statistics released Tuesday.

“Our goal is to demonstrate that South African exports do not pose a threat to US industries and that our trade relationship is, in fact, complementary,” Trade Minister Parks Tau said.

The United States is South Africa’s third-largest trading partner after the European Union and China.

However South African exports account for only 0.25 percent of total US imports and are “therefore not a threat to US production”, Tau said.

Steenhuisen said US diplomats raised issues related to South African domestic policies, which was a “surprise given the fact we thought we were in a trade negotiation”.

The two nations are at odds over a range of domestic and international policies.

US President Donald Trump has criticised land and employment laws meant to redress racial inequalities that linger 30 years after the end of apartheid.

Steenhuisen is from the pro-business Democratic Alliance (DA) party, the second-largest group in the coalition government, that objects to the same laws.

“Things like expropriation without compensation, things like some of the race laws in the country, are issues that they regard as barriers now to doing trade with South Africa,” he told AFP on the sidelines of the briefing.

“I think we’re seeing some form of a new era now where trade and tariffs are being used to deal with other issues, outside of what would generally be trade concerns,” Steenhuisen said.

– ‘New normal’ –

Other countries, including Brazil and India, have been slapped with “far more punitive tariffs” because of ideological disagreements with the Trump administration, he said.

“This is obviously a new normal to which we’re going to all have to adapt,” Steenhuisen said.

Although US diplomatic ties with several countries have plummeted since Trump took office in January, Pretoria has so far said that political disagreements had not come up in the trade negotiations.

Tau said the negotiations with the United States were “unprecedented” as they did not follow the World Trade Organization rule book.

“That book has been put on the side for now and all of us are grappling with the reality of what we are dealing with,” Tau said, adding it still remained “important that we reaffirm our own commitments to our own sovereignty as a country”.

Beiyi SEOW

When US President Donald Trump announced tariffs on almost all trading partners in April, Ben Knepler contacted the factory in Cambodia producing his company’s outdoor furniture. “Stop production,” he ordered.

The announcement involved a 10-percent levy on imports from most partners, set to rise further for many of them. For Cambodia, the planned duty was a staggering 49 percent.

“That night, we spoke to our factory,” Knepler told AFP. “We literally cannot afford to bring our own product into the US with that kind of tariff.”

The decision was even more painful for Knepler and his Pennsylvania-based company, True Places, given that he had previously shifted production of his outdoor chairs to Cambodia from China, following tariffs on Chinese imports imposed by Trump during his first presidency.

“We were facing 25-percent tariffs in China, and there were zero-percent tariffs in Cambodia,” Knepler recalled.

It took him a year to move the massive equipment and molds to Cambodia only to see another steep levy.

With Trump’s “reciprocal” tariff hikes taking effect last Thursday, these Cambodia-made chairs face a lower — though still significant — 19 percent duty.

– ‘Wheel of misfortune’ –

Knepler’s experience echoes that of many US companies producing everything from yo-yos to clothing abroad, after years of offshoring American manufacturing.

To cope, businesses use various strategies.

Some pass on the new costs as a surcharge to customers. Others halted imports when duties reached prohibitive levels, hoping Trump would strike bilateral trade deals that would make their businesses viable again.

Trump frames his tariffs as paid for by other countries, touting tens of billions in revenue this year — but firms contest this description.

“We make the tariff payments when the product comes into the US,” Knepler stressed. “Before we sell it, we’re the ones who pay that tariff.”

Now saddled with hundreds of thousands of dollars in debt he took on to relocate the company’s production to Cambodia, Knepler worries if his business will survive.

He likens the rapid policy changes to spinning a “wheel of misfortune,” resulting in a new tariff each time. Over four months this year, the planned tariff rate on Cambodian exports has gone from 0 to 49 percent, to 10 percent, to 36 percent, to 19 percent, he said.

“No one knows what it’s going to be tomorrow,” he added. “It’s impossible to have any kind of confidence in what the rate will be in three- or four-months’ time.”

Economists warn that tariffs could fuel inflation and drag on growth.

EY chief economist Gregory Daco noted that the duties effective Thursday raise the average tariff rate to 17.6 percent from 2.8 percent at the start of the year -— the highest level since the early 1930s.

While Trump lauds the limited effects his duties have had on US prices so far, experts say tariffs take time to filter through to consumers.

Many of Trump’s sweeping levies also face legal challenges over his use of emergency economic powers.

– Price hikes –

The global tariffs are especially hard to avoid.

Barton O’Brien said he accelerated production and borrowed money to bring in as much inventory as possible before Trump took office.

On the election campaign trail, the Republican leader had floated a 60-percent tariff on imports from China, where O’Brien makes most of his products.

The Maryland-based veteran selling dog harnesses and other accessories rented a container to ship as many products as he could before Trump’s new tariffs would take effect. “I had dog life jackets in the bathroom,” he told AFP.

There is “no way” to produce domestically, he said, adding that comparable American-made products sell for nearly six times his retail prices.

He makes some items too in India and Vietnam.

But Chinese products face an additional 30-percent duty this year, even under an extended truce now expiring in November. The rates for India and Vietnam are 25 percent and 20 percent respectively.

“If you look at the brands I compete with, we’re all made in the same countries. We’re all going to have to raise prices together,” said O’Brien.

India reels from US tariff hike threat

By AFP

August 12, 2025

Jewelry is on display at a store in the ‘Little India’ neighborhood of New York City

- Copyright AFP ANGELA WEISS

Anuj SRIVAS

Indian exporters are scrambling for options to mitigate the fallout of US President Donald Trump’s threatened tariff salvo against the world’s most populous nation.

Many warn of dire job losses after Trump said he would double new import tariffs from 25 percent to 50 percent if India continues to buy Russian oil, in a bid to strip Moscow of revenue for its military offensive in Ukraine.

“At 50 percent tariff, no product from India can stand any competitive edge,” said economist Garima Kapoor from Elara Securities.

India, one of the world’s largest crude oil importers, has until August 27 to find alternatives to replace around a third of its current oil supply from abroad.

While New Delhi is not an export powerhouse, it shipped goods worth about $87 billion to the United States in 2024.

That 50 percent levy now threatens to upend low-margin, labour-intensive industries ranging from gems and jewellery to textiles and seafood.

The Global Trade Research Initiative estimates a potential 60 percent drop in US sales in 2025 in sectors such as garments.

Exporters say they are racing to fulfil orders before the deadline.

“Whatever we can ship before August 27, we are shipping,” said Vijay Kumar Agarwal, chairman of Creative Group. The Mumbai-based textile and garment exporter has a nearly 80 percent exposure to the US market.

But Agarwal warned that is merely triage.

Shipping goods before the deadline “doesn’t solve” the problem, he said.

“If it doesn’t get resolved, there will be chaos,” he said, adding that he’s worried for the future of his 15,000 to 16,000 employees.

“It is a very gloomy situation… it will be an immense loss of business.”

– Shifting production abroad –

Talks to resolve the matter hinge on geopolitics, far from the reach of business.

Trump is set to meet Vladimir Putin on Friday, the first face-to-face meeting between the two countries’ presidents since Russia launched its full-scale invasion of Ukraine in February 2022.

New Delhi, with longstanding ties with Moscow, is in a delicate situation.

Since Trump’s tariff threats, Prime Minister Narendra Modi has spoken to both Putin and Ukrainian President Volodymyr Zelensky, urging a “peaceful resolution” to the conflict.

Meanwhile, the US tariff impact is already being felt in India.

Businesses say fresh orders from some US buyers have begun drying up — threatening millions of dollars in future business and the livelihoods of hundreds of thousands in the world’s fifth biggest economy.

Among India’s biggest apparel makers with global manufacturing operations, some are looking to move their US orders elsewhere.

Top exporter Pearl Global Industries has told Indian media that some of its US customers asked that orders be produced in lower-duty countries such as Vietnam or Bangladesh, where the company also has manufacturing facilities.

Major apparel maker Gokaldas Exports told Bloomberg it may boost production in Ethiopia and Kenya, which have a 10 percent tariff.

– ‘Standstill’ –

Moody’s recently warned that for India, the “much wider tariff gap” may “even reverse some of the gains made in recent years in attracting related investments”.

India’s gems and jewellery industry exported goods worth more than $10 billion last year and employs hundreds of thousands of people.

“Nothing is happening now, everything is at a standstill, new orders have been put on hold,” Ajesh Mehta from D. Navinchandra Exports told AFP.

“We expect up to 150,000 to 200,000 workers to be impacted.”

Gems, and other expensive non-essential items, are vulnerable.

“A 10 percent tariff was absorbable — 25 percent is not, let alone this 50 percent,” Mehta added.

“At the end of the day, we deal in luxury products. When the cost goes up beyond a point, customers will cut back.”

Seafood exporters, who have been told by some US buyers to hold shipments, are hoping for new customers.

“We are looking to diversify our markets,” says Alex Ninan, who is a partner at the Baby Marine Group.

“The United States is totally out right now. We will have to push our products to alternative markets, such as China, Japan… Russia is another market we are really looking into.”

Ninan, however, warns that is far from simple.

“You can’t create a market all of a sudden,” he said

S.Africa to offer US new deal to avoid 30% tariff

By AFP

August 12, 2025

Copyright AFP/File Jim WATSON

Julie BOURDIN

South Africa will offer a “generous” new trade deal to the United States on Tuesday to avoid 30-percent tariffs, government ministers said.

Washington on Friday slapped the huge tariff on some South African exports, the highest in sub-Saharan Africa, despite efforts by Pretoria to negotiate a better arrangement to avoid massive job losses.

The ministers did not release details of the new offer but said previously discussed measures to increase imports of US poultry, blueberries and pork had been finalised.

“When the document is eventually made public, I think you would see it as a very broad, generous and ambitious offer to the United States on trade,” Agriculture Minister John Steenhuisen said at a press briefing.

Officials have said the 30-percent tariff could cost the economy around 30,000 jobs, with unemployment already at 33.2 percent according to statistics released Tuesday.

“Our goal is to demonstrate that South African exports do not pose a threat to US industries and that our trade relationship is, in fact, complementary,” Trade Minister Parks Tau said.

The United States is South Africa’s third-largest trading partner after the European Union and China.

However South African exports account for only 0.25 percent of total US imports and are “therefore not a threat to US production”, Tau said.

Steenhuisen said US diplomats raised issues related to South African domestic policies, which was a “surprise given the fact we thought we were in a trade negotiation”.

The two nations are at odds over a range of domestic and international policies.

US President Donald Trump has criticised land and employment laws meant to redress racial inequalities that linger 30 years after the end of apartheid.

Steenhuisen is from the pro-business Democratic Alliance (DA) party, the second-largest group in the coalition government, that objects to the same laws.

“Things like expropriation without compensation, things like some of the race laws in the country, are issues that they regard as barriers now to doing trade with South Africa,” he told AFP on the sidelines of the briefing.

“I think we’re seeing some form of a new era now where trade and tariffs are being used to deal with other issues, outside of what would generally be trade concerns,” Steenhuisen said.

– ‘New normal’ –

Other countries, including Brazil and India, have been slapped with “far more punitive tariffs” because of ideological disagreements with the Trump administration, he said.

“This is obviously a new normal to which we’re going to all have to adapt,” Steenhuisen said.

Although US diplomatic ties with several countries have plummeted since Trump took office in January, Pretoria has so far said that political disagreements had not come up in the trade negotiations.

Tau said the negotiations with the United States were “unprecedented” as they did not follow the World Trade Organization rule book.

“That book has been put on the side for now and all of us are grappling with the reality of what we are dealing with,” Tau said, adding it still remained “important that we reaffirm our own commitments to our own sovereignty as a country”.

Nvidia, AMD agree to pay US 15% of revenue from sales of AI chips to China

Nvidia chief executive Jensen Huang met with US President Donald Trump at the White House last week and agreed to give the US government a 15 percent cut of Nvidia’s revenues from chip sales to China, according to media reports Sunday. The US has been restricting which chips Nvidia and its US rival AMD can export to China on national security grounds.

Issued on: 11/08/2025

By: FRANCE 24

Nvidia hits milestone of $4 trillion market value

Nvidia said last month that Washington had pledged to let the company sell its “H20” chips to China, which are a less powerful version the tech giant specifically developed for the Chinese market.

The Trump administration had not issued licenses to allow Nvidia to sell the chips before the reported White House meeting.

On Friday, however, the Commerce Department started granting the licenses for chip sales, the reports said.

Silicon Valley-based Advanced Micro Devices (AMD) will also pay 15 percent of revenue on Chinese sales of its MI308 chips, which it was previously barred from exporting to the country.

The deal could earn the US government more than $2 billion, according to the New York Times report.

The move comes as the Trump administration has been imposing stiff tariffs, with goals varying from addressing US trade imbalances, wanting to reshore manufacturing and pressuring foreign governments to change policies.

A 100 percent tariff on many semiconductor imports came into effect last week, with exceptions for tech companies that announce major investments in the United States.

(FRANCE 24 with AFP)

Nvidia chief executive Jensen Huang met with US President Donald Trump at the White House last week and agreed to give the US government a 15 percent cut of Nvidia’s revenues from chip sales to China, according to media reports Sunday. The US has been restricting which chips Nvidia and its US rival AMD can export to China on national security grounds.

Issued on: 11/08/2025

By: FRANCE 24

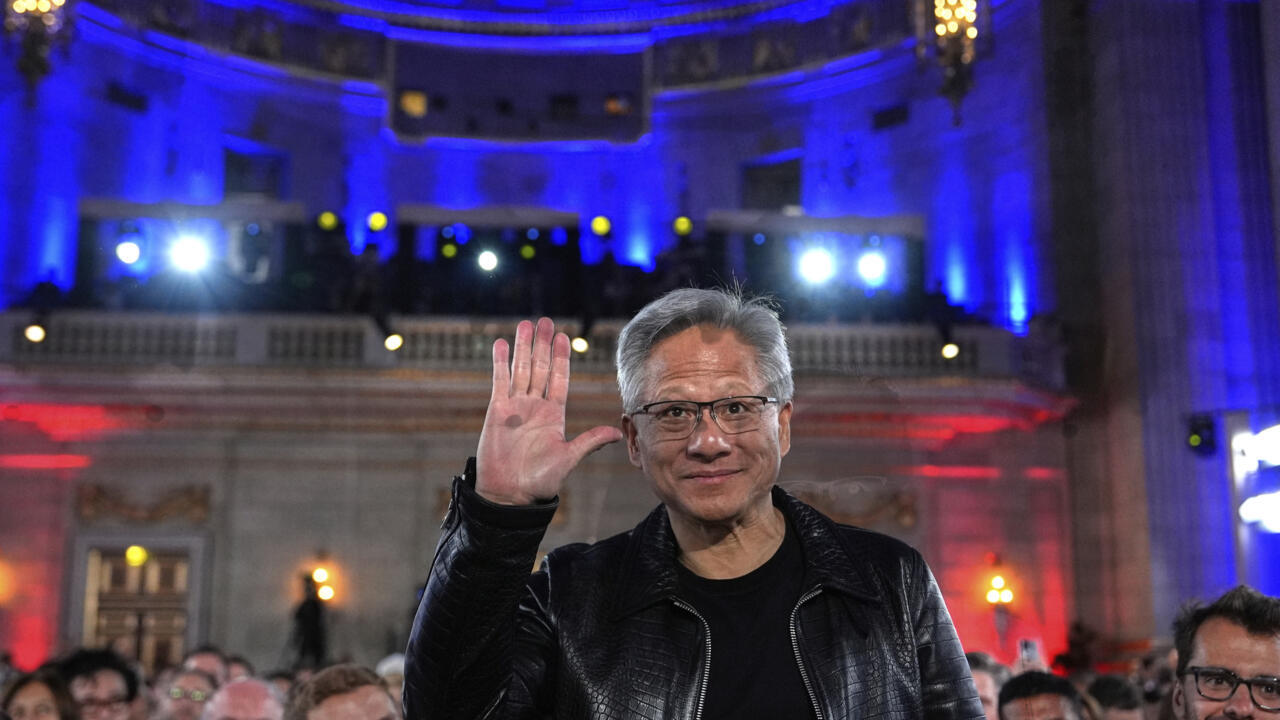

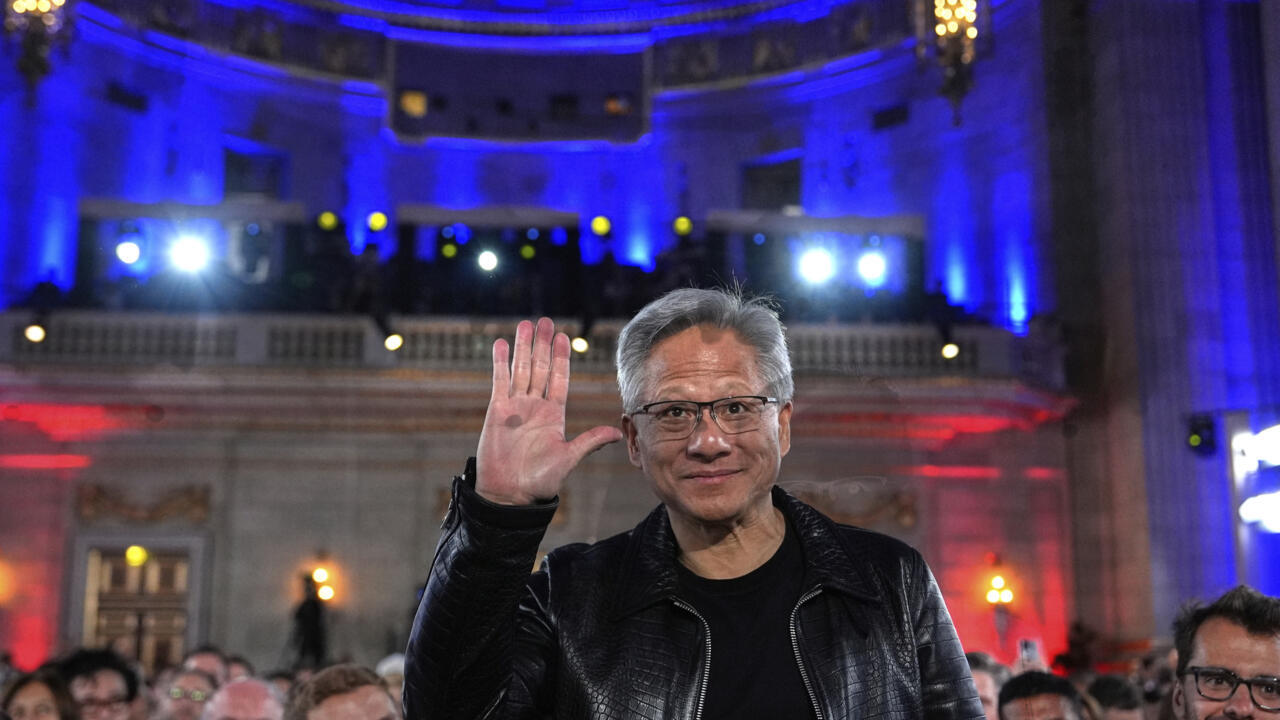

Nvidia CEO Jensen Huang waves as President Donald Trump speaks during an AI summit at the Andrew W. Mellon Auditorium on July 23, 2025, in Washington. © Julia Demaree Nikhinson, AP

US semiconductor giants Nvidia and Advanced Micro Devices have agreed to pay the United States government 15 percent of their revenue from selling artificial intelligence chips to China, according to media reports Sunday.

Nvidia CEO Jensen Huang met with US President Donald Trump at the White House on Wednesday and agreed to give the federal government the cut from its revenues, a highly unusual arrangement in the international tech trade, according to reports in the Financial Times, Bloomberg and New York Times.

AFP was not able to immediately verify the reports.

US semiconductor giants Nvidia and Advanced Micro Devices have agreed to pay the United States government 15 percent of their revenue from selling artificial intelligence chips to China, according to media reports Sunday.

Nvidia CEO Jensen Huang met with US President Donald Trump at the White House on Wednesday and agreed to give the federal government the cut from its revenues, a highly unusual arrangement in the international tech trade, according to reports in the Financial Times, Bloomberg and New York Times.

AFP was not able to immediately verify the reports.

Nvidia hits milestone of $4 trillion market value

© France 24

01:43

Investors are betting that AI will transform the global economy, and last month Nvidia – the world’s leading semiconductor producer – became the first company ever to hit $4 trillion in market value.

The California-based firm has, however, become entangled in trade tensions between China and the United States, which are waging a heated battle for dominance to produce the chips that power AI.

The US has been restricting which chips Nvidia can export to China on national security grounds.

01:43

Investors are betting that AI will transform the global economy, and last month Nvidia – the world’s leading semiconductor producer – became the first company ever to hit $4 trillion in market value.

The California-based firm has, however, become entangled in trade tensions between China and the United States, which are waging a heated battle for dominance to produce the chips that power AI.

The US has been restricting which chips Nvidia can export to China on national security grounds.

Nvidia said last month that Washington had pledged to let the company sell its “H20” chips to China, which are a less powerful version the tech giant specifically developed for the Chinese market.

The Trump administration had not issued licenses to allow Nvidia to sell the chips before the reported White House meeting.

On Friday, however, the Commerce Department started granting the licenses for chip sales, the reports said.

Silicon Valley-based Advanced Micro Devices (AMD) will also pay 15 percent of revenue on Chinese sales of its MI308 chips, which it was previously barred from exporting to the country.

The deal could earn the US government more than $2 billion, according to the New York Times report.

The move comes as the Trump administration has been imposing stiff tariffs, with goals varying from addressing US trade imbalances, wanting to reshore manufacturing and pressuring foreign governments to change policies.

A 100 percent tariff on many semiconductor imports came into effect last week, with exceptions for tech companies that announce major investments in the United States.

(FRANCE 24 with AFP)

No comments:

Post a Comment