Dark Lessons of Prewar Protectionism: From Tariff Wars to Global Fragmentation

With its misguided tariff wars, the second Trump administration is not only fragmenting seven decades of globalization. It is also contributing to a kind of geopolitical climate that set the stage for the rise of fascism in the 1930s.

Times are different today, but like then, globalization is no longer at crossroads. It is unraveling. The White House has opted for an ominous path with a dark historical precedent.

Dark legacies of the 1930 Smoot-Hawley Act

After the “Soaring Twenties,” US economy drifted into the Great Depression. Presumably to protect American jobs and farmers, two Republicans, Reed Smoot and Willis C. Hawley, pushed for a major tariff increase. This led to the enactment of the Smoot-Hawley Tariff Act, despite opposition by over 1,000 leading US economists.

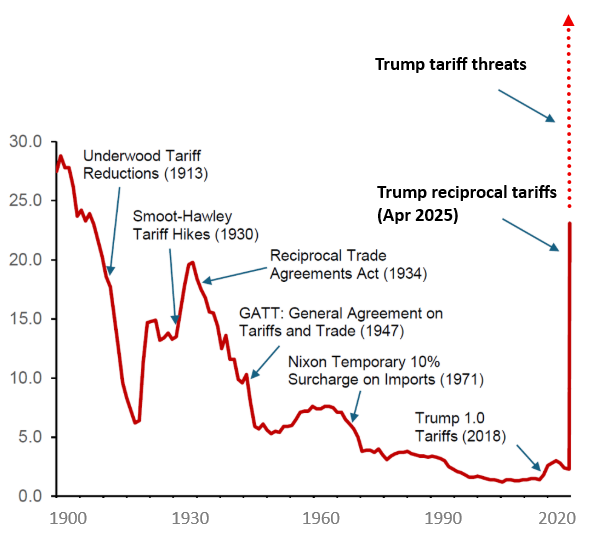

The ensuing tariffs were the second highest in US history. But instead of protecting American jobs and boosting US economy, the effect of the Act turned out to be precisely the opposite.

Following the retaliatory tariffs of America’s major trading partners, it reduced US exports and imports by more than half during the Depression. In Germany, however, international friction paved the way to the rise of the Nazi party.

The US economy recovered only with the war effort serving as a huge fiscal stimulus.

The Act of 1930 was a grossly misguided response to the economic crash. What it gained in the short-term, it lost in the long-term. It delivered neither US stability nor prosperity. Instead, it contributed to instability and worsened the economic malaise.

In brief, the Act made the Great Depression worse, compounding the chaotic international status quo that prolonged the lingering contraction, thus paving the way for World War II.

The Trump tariffs

With the new Trump administration, the first round of tariffs built on traditional trade wars focusing mainly on Canada, Mexico and China. The tariff costs amount to more than $1.3 trillion; that is, over 3.5 times more than the 2017-18 tariffs.

The second round began with President Trump’s “reciprocal tariffs.” It is an odd, Orwellian term for tariffs that are not multilateral, conceptually sound and appropriately estimated. Instead, the Trump tariffs are unilateral, flawed and mistakenly calculated – that is, coercive, illicit and miscalculated.

Subsequently, the Trump White House boasted that “every country in the world wants to make a deal with America.” But that did not happen. Instead, the reciprocal tariffs were followed by a series of retaliations, which heralded the ongoing third round of tariff wars.

Nonetheless, under the US tariff attacks, many economies have been compelled to make deals with the Trump administration. In the short-term, they may contribute tens of billions of dollars to the US. But in the long-term, such intimidation tactics will cost US economy hundreds of billions of dollars, fragment globalization and erode the rules-based international trading regime.

Figure US tariff wars and Smoot-Hawley in history (stylized)

Source: White House, Bloomberg, MUFR GMR, author

Dark parallels

Global economic prospects have been fragile since 2008. A decade later, in 2018, the first Trump administration’s tariffs and deglobalization undermined a promising recovery, with the US imposing punitive tariffs on $400 billion worth of Chinese goods which affected more than 90% of the trade affected.

Instead of building a multilateral front against trade protectionism, Western powers sought to appease the first Trump administration. That emboldened the Trump trade czars and contributed to the Biden administration’s fatal decision not to reverse his predecessor’s tariff decisions.

Devoid of any meaningful economic rationale, the Trump tariffs go hand in hand with major austerity tremors, which are set to erode what is left of Roosevelt’s New Deal and Lyndon B. Johnson’s dream of Great Society. Perversely, the new focus is on massive rearmament, a new Cold War, and destructive geopolitics, including US complicity in the genocide in the Gaza Strip.

Once the tariffs’ full impact is felt, global economic prospects will suffer more shocks. Worse, the Trump administration is doing its best to obfuscate the destructive impact of its tariff stance by firing federal economists dedicated to monitoring economic data, in order to replace them with uber-conservative ideologues and data manipulation.

The result is a darkening economic picture that could cause a “big correction” in US markets, as America’s big investment banks are now alerting their clients.

Global costs of fragmentation

Globalization fosters the flows of trade, investment and people. From 1950 to 2008, it reinforced integration among economies, thanks to technological progress, reduced transport costs, and offshoring of value activities across countries. Thereby, it also enabled the rise of the Asian dragons, China and India and more broadly the Global South.

Conversely, deglobalization reflects the retrenchment of such flows between countries. It fosters de-integration and fragmentation. During the first Trump administration, the Trump administration tried to exploit deglobalization to overcome the longstanding secular stagnation in the West, compounded by the US tariff wars.

With the second Trump administration, the net effect is geoeconomic fragmentation, due to “a policy-driven reversal of global economic integration,” as the International Monetary Fund (IMF) calls it. It is neither automatic nor inevitable, but a US policy choice, with horrible economic and human consequences. With the resulting trade war contributing to the weakest global growth prospects in decades, geoeconomic fragmentation is feeding into another Cold War, which the world cannot afford.

In the late 2010s, deglobalization translated to slowing growth in the Global South. Today, global economic fragmentation is effectively curbing the rise of emerging and developing world.

The original commentary was published by China Daily on August 12, 2025

Americans are afflicted with increasing economic inequality. We should therefore avoid regressive tax increases, which put the highest increase on poor or average Americans. But tariffs are highly regressive.

US President Donald Trump delivers remarks on reciprocal tariffs during an event in the Rose Garden entitled "Make America Wealthy Again" at the White House in Washington, DC, on April 2, 2025.

(Photo by Brendan Smialowski / AFP via Getty Images)

Paul F. Delespinasse

Aug 19, 2025

For some decades most Republican members of Congress have taken the "Norquist Pledge" never to vote for tax increases. Many of them have carried this pledge even further by reducing the Internal Revenue Service budget, impairing the agency's ability to collect taxes that are already in the law books. Lately, however, these Republicans have supported major increases in federal taxes imposed by US President Donald Trump---high tariffs on goods imported into the United States.

Although Mr. Trump repeatedly speaks of "making Brazil pay, " "making China pay," etc., he is actually imposing a tax on goods imported into the US from those countries. This tax will either be passed along to American consumers in the form of higher prices, or it will be absorbed by the importing company, making it a tax on American business owners.

No money is coming in from Brazil or China.

These new taxes have been putting decent amounts of money into the federal treasury, which it certainly can use. But it is all coming in from Americans.

Congress clearly did not specifically authorize the president to impose tariffs on Brazil because it is prosecuting its former president for trying to remain in office after he lost an election.

I have often attacked the Norquist Pledge and accused politicians who take it of political malpractice, since changed circumstances may sometimes require tax increases to support needed spending or reduce out of control deficits. So why am I not happy that Republicans have found a way to weasel out of their pledge never to increase taxes?

Americans are afflicted with increasing economic inequality. We should therefore avoid regressive tax increases, which put the highest increase on poor or average Americans. But tariffs are highly regressive. Poor people must spend all of their meager incomes, mostly on goods. Better-off people save some of their income and spend more on services, which tariffs do not greatly affect.

Of course regressive taxes suit the interests of the wealthy, whose campaign donations politicians covet, and who also benefit from legislation impairing the ability of the IRS to audit them.

Unfortunately for Mr. Trump and his entourage, the claimed legal basis for his power to impose tariffs is extremely weak. Congress has authorized the president to adjust tariffs in unforeseen domestic or international emergencies. But Mr. Trump has pushed this authorization beyond all reasonable limits and has a propensity to declare emergencies that clearly are not emergencies.

In recent years the newly conservative US Supreme Court has invented a new "major questions" doctrine. This doctrine is not unreasonable. It says that when US Congress has authorized a government agency to regulate something, if that agency enacts a regulation that has large scale consequences, the court will strike that regulation down unless Congress has clearly and specifically authorized that kind of regulation.

The tariffs are a presidential action, not that of a government agency, but this is an even more appropriate case for applying the major questions doctrine. Government agencies can only impose new regulations after lengthy deliberations required by the Administrative Procedures Act. Unlike federal administrative agencies, the president—claiming congressional authorization—can just do things without any required procedures or consultation.

Congress clearly did not specifically authorize the president to impose tariffs on Brazil because it is prosecuting its former president for trying to remain in office after he lost an election. And it clearly did not specify that the president could increase tariffs in order to increase federal revenues, or to deal with imaginary emergencies that he himself dreamed up.

Presidentially imposed tariffs are obviously a case where the major questions doctrine would be an appropriate guide to the justices.

No doubt the court's conservative majority invented the major questions doctrine because it supported some decision that they wanted to make. Fair enough. But will they respect this doctrine when it requires a decision they do not want to make?

Our work is licensed under Creative Commons (CC BY-NC-ND 3.0). Feel free to republish and share widely.

Paul F. Delespinasse, who now lives in Oregon, is professor emeritus of political science at Adrian College in Michigan. He can be reached via his website, www.deLespinasse.org.

Full Bio >

Democrats on the Joint Economic Committee said that "continued uncertainty" caused by the president's policies could reduce manufacturing investments by nearly half a trillion dollars by the end of this decade.

US President Donald Trump holds up a chart of "reciprocal tariffs" while speaking during a “Make America Wealthy Again” trade announcement event in the Rose Garden at the White House on April 2, 2025 in Washington, DC

(Photo by Brendan Smialowski/AFP via Getty Images)

Brett Wilkins

Aug 18, 2025

COMMON DREAMS

US President Donald Trump's tariff whiplash has already harmed domestic manufacturing and could continue to do so through at least the end of this decade to the tune of nearly half a trillion dollars, a report published Monday by congressional Democrats on a key economic committee warned.

The Joint Economic Committee (JEC)-Minority said that recent data belied Trump's claim that his global trade war would boost domestic manufacturing, pointing to the 37,000 manufacturing jobs lost since the president announced his so-called "Liberation Day" tariffs in April.

"Hiring in the manufacturing sector has dropped to its lowest level in nearly a decade," the Democrats on the committee wrote. "In addition, many experts have noted that in and of itself, the uncertainty created by the administration so far could significantly damage the broader economy long-term."

"Based on both US business investment projections and economic analyses of the UK in the aftermath of Brexit, the Joint Economic Committee-Minority calculates that a similarly prolonged period of uncertainty in the US could result in an average of 13% less manufacturing investment per year, amounting to approximately $490 billion in foregone investment by 2029," the report states.

"The uncertainty created by the administration so far could significantly damage the broader economy long-term."

"Although businesses have received additional clarity on reciprocal tariff rates in recent days, uncertainty over outstanding negotiations is likely to continue to delay long-term investments and pricing decisions," the publication adds. "Furthermore, even if the uncertainty about the US economy were to end tomorrow, evidence suggests that the uncertainty that businesses have already faced in recent months would still have long-term consequences for the manufacturing sector."

According to the JEC Democrats, the Trump administration has made nearly 100 different tariff policy decisions since April—"including threats, delays, and reversals"—creating uncertainty and insecurity in markets and economies around the world. It's not just manufacturing and markets—economic data released last week by the Bureau of Labor Statistics showed that businesses in some sectors are passing the costs of Trump's tariffs on to consumers.

As the new JEC minority report notes:

As independent research has shown, businesses are less likely to make long-term investments when they face high uncertainty about future policies and economic conditions. For manufacturers, decisions to expand production—which often entail major, irreversible investments in equipment and new facilities that typically take years to complete—require an especially high degree of confidence that these expenses will pay off. This barrier, along with other factors, makes manufacturing the sector most likely to see its growth affected by trade policy uncertainty, as noted recently by analysts at Goldman Sachs.

"Strengthening American manufacturing is critical to the future of our economy and our national security," Joint Economic Committee Ranking Member Maggie Hassan (D-N.H.) said in a statement Monday. "While President Trump promised that he would expand our manufacturing sector, this report shows that, instead, the chaos and uncertainty created by his tariffs has placed a burden on American manufacturers that could weigh our country down for years to come."

No comments:

Post a Comment