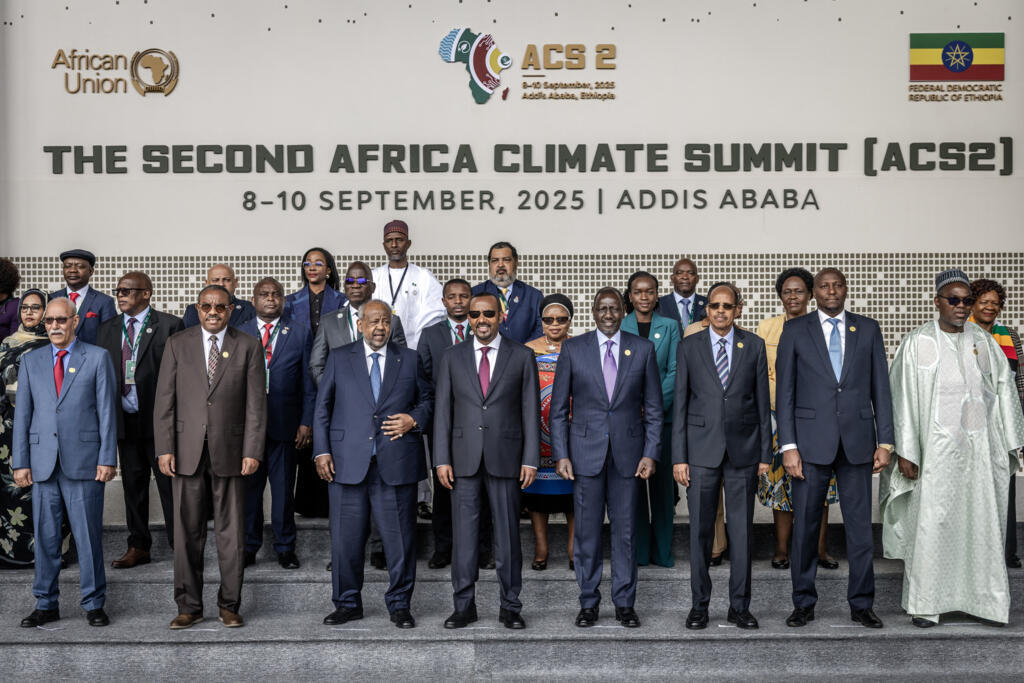

African leaders ended their second continental climate summit on Wednesday in Addis Ababa with a call for more money, fairer financing and a stronger voice in global talks.

Issued on: 11/09/2025 - RFI

By:Melissa Chemam with RFI

The African Union (AU) gathered all 54 member states at its headquarters in Ethiopia’s capital. The aim was to agree a common position ahead of Cop30 in Brazil this November.

The summit closed with the Addis Ababa Declaration – a plan that AU leaders say should reframe Africa not as a victim of climate change, but as a source of solutions.

Three pillars

Ethiopia's President Taye Atske Selassie outlined the three main pillars of the Addis Ababa Declaration – with the first being to accelerate the development of renewable energy to make Africa "a green industrial power".

"First, we will put our future into motion. We are committed to accelerating the development of renewable energy and infrastructure. This will not only make energy accessible, but it will also position Africa as a green industrial power," he said.

The second pillar is the forming of a coalition of countries possessing key minerals, in order to ensure greater transparency and a fair share of the benefits, while the third is the protection of natural heritage.

Debates at the summit focused on reforming global climate finance to better serve African needs. Panelists spoke about the urgency of moving from a system driven by the priorities of donors, to one that addresses the needs of those impacted by climate change.

The AU's Bankoye Adeoye told RFI he felt proud of the outcomes of the summit, saying: "We did not shy away from difficult conversations." According to him, the goal is to open a new chapter in climate negotiations at COP30 in Brazil.

$50 billion a year

Africa emits just 4 percent of greenhouse gases but suffers disproportionately from the impact of global warming, so is calling for more funding towards climate change adaptation – in the name of what Mahmoud Ali Youssouf, chair of the AU Commission, called "climate justice".

According to the Addis Ababa Declaration, Africa is aiming to secure $50 billion a year "to champion climate solutions", with the establishment of the Africa Climate Innovation Compact and the African Climate Facility, sponsored by Ethiopia's Prime Minister Abiy Ahmed.

Abiy said the initiative should aim to deliver 1,000 solutions to tackle climate challenges by 2030.

But according to Professor Carlos Lopes, the African continent's representative at COP30, these plans lack focus.

"In my opinion, it's too broad. It covers too many topics that don't have the same importance, and therefore it loses some of the will to influence and create the opportunity for a unified African voice," he told RFI.

'Rich nations set the planet on fire'

According to a 2024 report by the World Meteorological Organisation, 48 of Africa's 54 countries are at risk of flooding and 40 are at risk of drought, worsened by climate change. These hazards caused a loss of 2 to 5 percent of GDP each year.

Given that industrialised nations have polluted the planet for more than 150 years, the promised funds to help Africa adapt to the effects of this fall far short of the required amount, said AU Commission chair Youssouf in his opening remarks.

"Today, the link between climate and underdevelopment is no longer in doubt," he added. "Climate, rural exodus, migration and instability in all its forms are intertwined. The vulnerability of our member countries caused by climate change... must be redressed through climate justice... by providing financial resources, technology and expertise."

"Rich polluting nations set the planet on fire, then sit back and send water droppers" to the developing world, Oxfam's Africa director Fati N'Zi-Hassane echoed in a statement.

"They must take responsibility for the damage they are causing and adequately fund climate action in countries where climate change is wreaking havoc on communities that are least responsible for the crisis."

(with newswires)

Oil majors face $4.4bn in liabilities under Nigeria's tightened decommissioning rules, says NUPRC chief

Nigeria’s upstream regulator NUPRC has cleared 94 oilfield decommissioning and abandonment plans worth $4.42bn since April 2023, arising from all Field Development Plans (FDPs) submitted within this period, its chief executive told an industry forum in Lagos – underscoring the tightening of rules to safeguard state finances.

According to CEO Gbenga Komolafe, the obligations will be paid gradually over the life of the fields into escrow accounts, in line with the 2021 Petroleum Industry Act (PIA).

About $400mn has already been secured through letters of credit and escrow, he said. A new framework on domiciling escrow accounts has been agreed with international oil companies (IOCs) and is awaiting approval by the Ministry of Justice.

Komolafe – in prepared remarks to the Nigerian Extractive Industries Transparency Initiative (NEITI) Companies Forum, delivered by a deputy and summarised in an NUPRC release – said that the stricter rules for asset transfers also aim to prevent environmental liabilities from falling on the state.

NUPRC is applying lessons from costly global divestment cases, he said, citing overseas examples where costs escalated (including £27bn projected in the North Sea by 2032, more than $9bn in the Gulf of Mexico, CAD30bn–70bn for 97,000 inactive wells in Alberta, and AUD200mn in liabilities left after Northern Oil & Gas Australia’s collapse in 2019).

“Without a robust and enforceable framework for abandonment and decommissioning, divestment transitions can create lasting financial and environmental burdens,” Komolafe said.

“Nigeria is not immune to this challenge, and if we are to avert costly mistakes. It is precisely to avoid this outcome that Nigeria, through the Petroleum Industry Act and subsequent regulatory actions, has taken bold and decisive steps.”

Komolafe cited the biggest recent Nigerian divestments approved under stricter frameworks that require upfront financial guarantees. The specific companies he named include:

TotalEnergies — still operating with partial divestments. In May 2025, TotalEnergies agreed to sell its 12.5% non-operated interest in the Bonga field (OML 118) to Shell for $510mn; the deal is subject to regulatory approvals and expected to close by the end of 2025, according to Reuters and company statements.

Shell Petroleum Development Company of Nigeria Ltd. (SPDC, Shell plc) — exit completed. Shell said in March 2025 that it had closed the $2.8bn sale of its onshore business to Renaissance Africa Energy

Equinor ASA — exit completed. Equinor confirmed in December 2024 that it had sold its entire Nigerian business, including its Agbami field interest (OML 128), to Chappal Energies

ExxonMobil (Mobil Producing Nigeria Unlimited) — exit completed. Seplat Energy announced in December 2024 it had closed its $1.28bn acquisition of ExxonMobil’s shallow-water assets, renaming the unit Seplat Energy Producing Nigeria Unlimited.

Eni (Nigerian Agip Oil Company Ltd.) — exit completed. Eni said in August 2024 that it had closed the sale of NAOC to Oando Plc, though it retained a 5% stake in the Shell-operated SPDC joint venture.

No comments:

Post a Comment