United States Antimony stock jumps after $245M Pentagon contract win

United States Antimony Corporation (NYSE: UAMY) has secured a sole-source, five-year contract worth up to $245 million from the US Defense Logistics Agency (DLA) to supply antimony metal ingots for the national defense stockpile.

The news sent US Antimony’s shares soaring 17.8% in New York trading on Tuesday, pushing the company’s market capitalization to about $975 million.

Securing domestic supply

Antimony, a grey metal listed by the US as critical to national and economic security, is used in defense and high-tech applications including flame-retardant materials, certain semiconductors, ammunition primers, and superhard alloys. The US has not produced antimony commercially since 2016, making domestic supply a priority.

United States Antimony operates the only two smelters in North America with long-standing capacity to process the metal. According to the company, both facilities are already capable of producing ingots that meet stringent military specifications, with first deliveries under the contract expected this week.

US Antimony has been working to expand its feedstock base, sourcing ore globally while advancing domestic projects. Mining recently began on its Alaska acreage, with initial results showing high-grade deposits that the company says will enable efficient processing and contribute to the US supply chain. It is also advancing acreage in Montana.

The company emphasized that competing antimony sources, whether from the US or abroad, are at least three years away from commercial-scale production and may not meet defense standards.

Chairman and CEO Gary C. Evans called the Pentagon contract a “meaningful milestone” for the company and its employees.

“This sole-source award underscores our unique position as the only fully integrated antimony operation outside China,” Evans said, highlighting the significance of winning a government contract worth nearly 17 times the company’s 2024 revenue of $14.9 million.

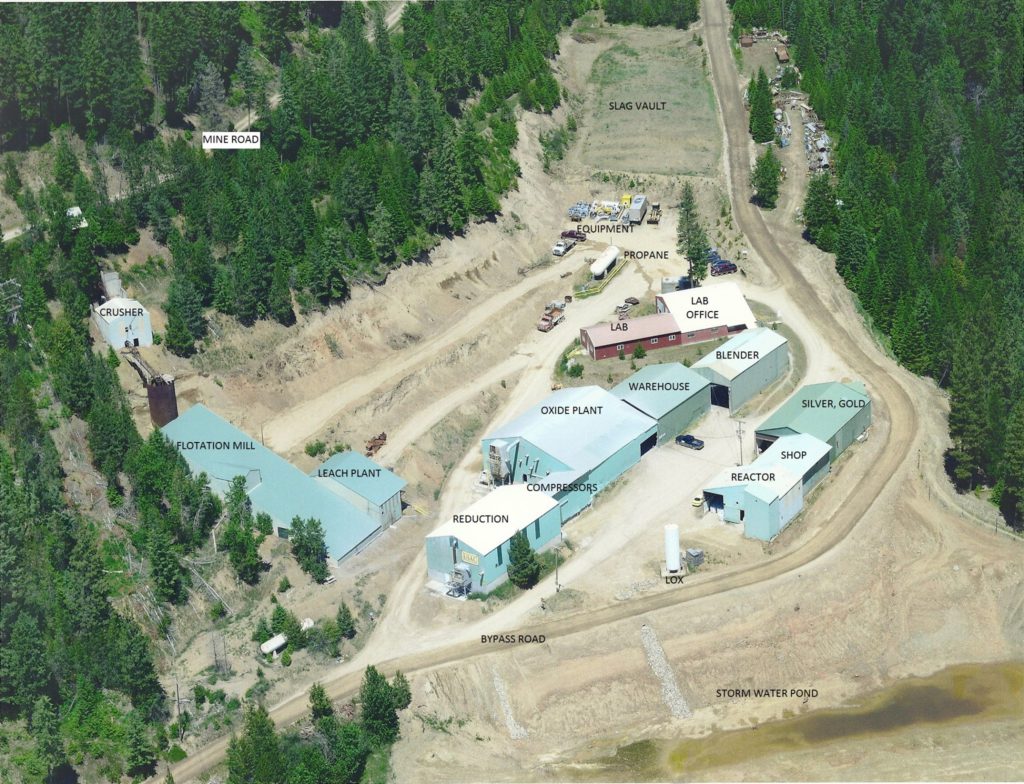

Founded decades ago, US Antimony Corporation produces and markets antimony, zeolite, and precious metals across the US and Canada. Its Montana facility processes ore into antimony oxide, antimony metal, and antimony trisulfide while also recovering gold and silver. Its Bear River Zeolite operation in Idaho supplies materials for water filtration, nuclear waste treatment, agriculture, and other industrial uses.

US agency wants to buy scandium oxide from Rio Tinto for defence stockpile

The US Defense Logistics Agency is seeking to buy scandium oxide worth up to $40 million over the next five years from a unit of mining giant Rio Tinto to secure supplies of the critical material for addition to the national stockpile.

Scandium is one of the rare earth elements, whose importance to the Western defence and technology sectors has been in the spotlight since China, the main producer, imposed export controls.

“Scandium, until recently, was primarily sourced from China. In late 2024, China placed export controls on scandium, which constrained the supply chain and prompted this acquisition for the National Defense Stockpile,” DLA said in a document published last week.

It intends to buy 6.4 metric tons of scandium oxide within five years.

In the first year it will be seeking almost 2 tons, equivalent to about 5% of last year’s global production of scandium oxide, which, according to US Geological Survey, totalled 40 tons with existing capacity of 80 tons.

To increase domestic supply of scandium, the US awarded up to $10 million to Elk Creek Resources, a unit of NioCorp Developments, in August.

However, for now the US government has to seek the product, used in many defence systems, from outside the country.

“Rio Tinto Services Inc. has been identified as the only vendor available capable of fulfilling the government’s required product needs at the capacity required for the contract,” the document said.

Rio Tinto said it would not comment on commercial matters, but added that it was “actively collaborating with the US government to identify opportunities and leverage available support to increase domestic production and strengthen supply chains for the American market.”

In 2020, Rio Tinto’s scientists became the first to develop a process which allows the extraction of high-purity scandium oxide from waste streams of titanium dioxide production, without the need for any additional mining.

“Rio Tinto is uniquely positioned to help secure materials critical to America’s future,” the group said in an emailed reply to a Reuters‘ request for comment.

Rio Tinto’s facility in Quebec, Canada produced the first batch of scandium oxide three years ago and currently has the annual production capacity of 3 metric tons.

(By Polina Devitt; Editing by Ros Russell)

No comments:

Post a Comment