BHP eyes revival of long-closed copper mines in Arizona

BHP (ASX: BHP), the world’s largest miner, is considering reopening four long-closed copper mines in Arizona, the centre of the copper industry in the United States.

Chief executive officer Mike Henry said that policy changes introduced by president Donald Trump encouraged BHP to expand its exploration efforts and review dormant assets in the state.

The potential restart would focus on the Globe–Miami region, where BHP also intends to reprocess tailings from the shuttered operations. Among the sites is the Magma mine, acquired through BHP’s 1996 purchase of Magma Copper. The mine was later shut down, with its surface area converted into the base for the Resolution joint venture with Rio Tinto (ASX: RIO).

Henry credited the renewed push to what he described as a “breathtaking level of ambition and urgency” in the US drive to secure supplies of critical minerals and reduce its reliance on China.

“The more supportive attitude towards mining and the urgency behind getting mining up and going, is a very welcome shift,” Henry told the Financial Times. “The sector has never been more in the spotlight.”

The state’s most significant copper project remains Resolution Copper, held by BHP and Rio Tinto. The $2-billion development has been stalled for more than two decades while awaiting court rulings and final permits. Once operational, it could produce up to 1 billion pounds of copper a year, enough to meet roughly 25% of US demand.

Rio Tinto, which holds a 55% stake in Resolution, remains confident that Trump’s administration will grant the necessary approvals to move the project forward.

Demand to soar

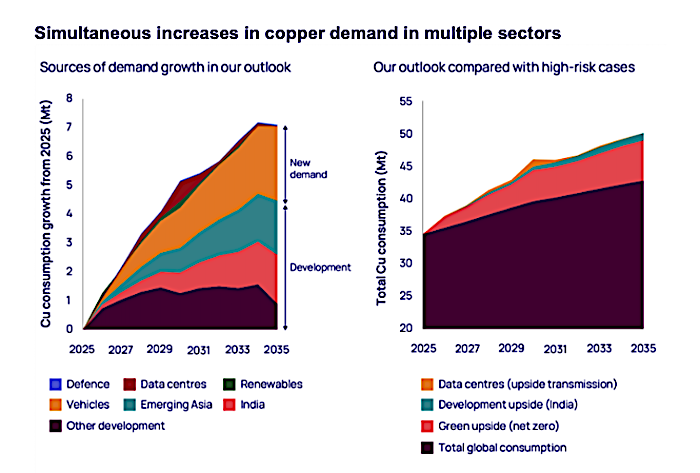

Henry’s comments come as copper demand is forecast to surge 24% by 2035, rising 8.2 million tonnes per annum (Mtpa) to 42.7 Mtpa, according to Wood Mackenzie. The consultancy’s new Horizons report warns that several powerful disruptors could amplify both demand and price volatility beyond expectations.

Among these disruptors, data centres represent the most unpredictable variable in copper demand forecasting. Beyond AI-driven demand, the broader energy transition is fundamentally reshaping copper consumption patterns. India and Southeast Asia are emerging as key growth engines, with their rapid industrialization expected to add 3.3 Mtpa of demand by 2035.

A fourth disruptor lies in shifting geopolitical priorities. Europe’s decision to raise defence spending to 3.5% of gross domestic product (GDP) in response to Russia’s invasion of Ukraine adds a modest direct copper demand of 25,000 to 40,000 tonnes per year over the next decade. However, the broader impact will be felt through infrastructure resilience and modernization.

Together, these factors could add an extra 3 Mtpa, or about 40% of total copper demand growth, by 2035, Wood Mackenzie says.

Japan, Spain and South Korea warn over unsustainable copper processing fees

Japan, Spain and South Korea issued a rare joint statement on Wednesday expressing deep concerns over tumbling copper treatment and refining charges (TC/RCs), warning both smelters and miners cannot develop sustainably under current conditions.

Copper smelters worldwide are grappling with falling processing fees and shrinking margins amid tight concentrate supply and expanding smelting capacity in China. In June, some Chinese smelters agreed to process copper for Chilean miner Antofagasta at no charge.

“We are deeply concerned that this deterioration in TC/RCs is prompting a reassessment of copper smelting operations worldwide, with several companies already indicating intentions to scale down or withdraw from copper concentrate smelting,” the three countries’ industry ministries said after an online meeting.

TC/RCs, a key source of revenue for smelters, are fees paid by miners when they sell concentrate, or semi-processed ore, to be refined into metal. But in some spot deals this year, TC/RCs have turned negative, forcing smelters to pay miners to provide smelting services.

The ministries said the current market environment prevents copper smelting from developing sustainably alongside mining in resource-producing countries and warned that growing dependence on specific countries is undesirable for both resource-producing and smelting countries.

“We hope TC/RCs will return to sustainable levels for copper concentrate trading,” they said, adding they will continue engaging with relevant countries and stakeholders to establish a resilient and sustainable copper supply chain.

Naoki Kobayashi, deputy director of the mineral resources department at Japan’s industry ministry, said the three countries — all importers of copper concentrate with domestic smelting operations — wanted to raise the issue during the metals industry gathering LME Week in London.

Japan’s major copper smelters, JX Advanced Metals and Mitsubishi Materials, have said they plan to scale back copper concentrate processing as declining fees erode margins.

(By Yuka Obayashi; Editing by Sharon Singleton)

Supply problems may force Freeport Indonesia to halt Manyar smelter

Freeport Indonesia may be forced to suspend operations at its Manyar smelter at the end of October due to a lack of copper concentrate following a mud-flow incident at its Grasberg mine, media outlet Kontan reported on Tuesday, citing an energy ministry official.

Freeport Indonesia did not immediately respond to a request for comment.

Tri Winarno, an official at the country’s mining ministry, estimated that copper concentrate supplies from Grasberg would only be sufficient until the end of this month, Kontan reported.

“(Freeport) will face a lack of supply by the end of October. Temporarily halted,” Tri told reporters.

The mud-flow disaster had killed seven workers and operations at the Grasberg mine have been halted for nearly a month.

Grasberg may not return to its pre-accident operating rates until at least 2027, the company had said.

The $3.7 billion Manyar smelter only resumed operations in May after a fire broke out in October last year, damaging the plant.

(By Bernadette Christina and Ananda Teresia; Editing by John Mair and David Stanway)

No comments:

Post a Comment